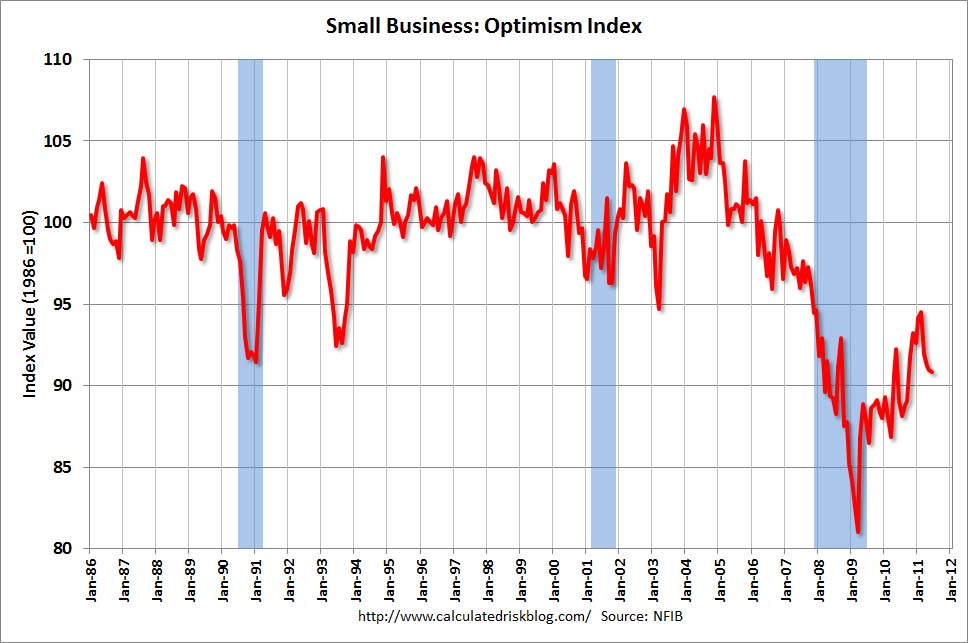

The June NFIB Small Business Optimism was released July 12. The headline of the Press Release is “Small Business Optimism Stagnates: Main Street Desperately in Search of Reasons to be Positive.”

The Index of Small Business Optimism declined .1 points in June, falling to 90.8.

Here are some excerpts from the report that I find particularly notable:

Earnings trends for small businesses remained distressingly negative in June, particularly given that the recovery is now beginning its third year. According to today’s report, 69 percent of the owners view the current period as a poor time to expand and 75 percent of those blame the weak economy for their outlook, while 10 percent cite political uncertainty.

also:

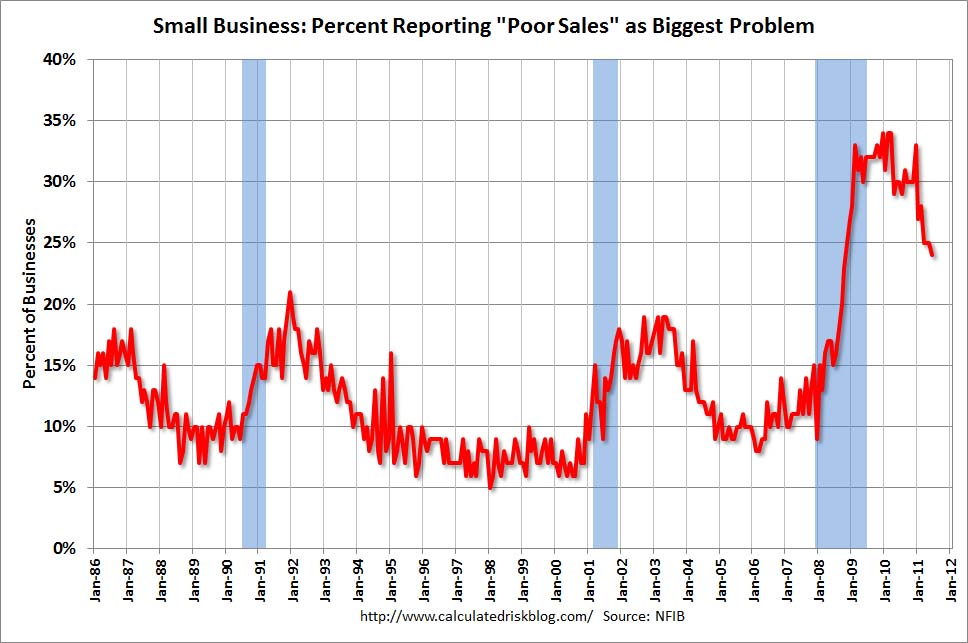

The sales outlook for small firms continues to look grim as expectations have declined for 4 months in a row and “poor sales” continues to be the #1 problem for owners in operating their business. The net percent of owners expecting higher real sales fell 3 points to a net 0 percent of all owners (seasonally adjusted), 13 points below January’s reading. The net percent of all owners (seasonally adjusted) reporting higher nominal sales over the past 3 months improved 2 percentage points, rising to a net negative 7 percent, more firms with sales trending down than up.

also:

Access to credit remains a limited problem as it continues to affect a small percentage of owners. Three percent of owners reported financing as their #1 business problem and 91 percent reported that all their credit needs were met or that they were not interested in borrowing.

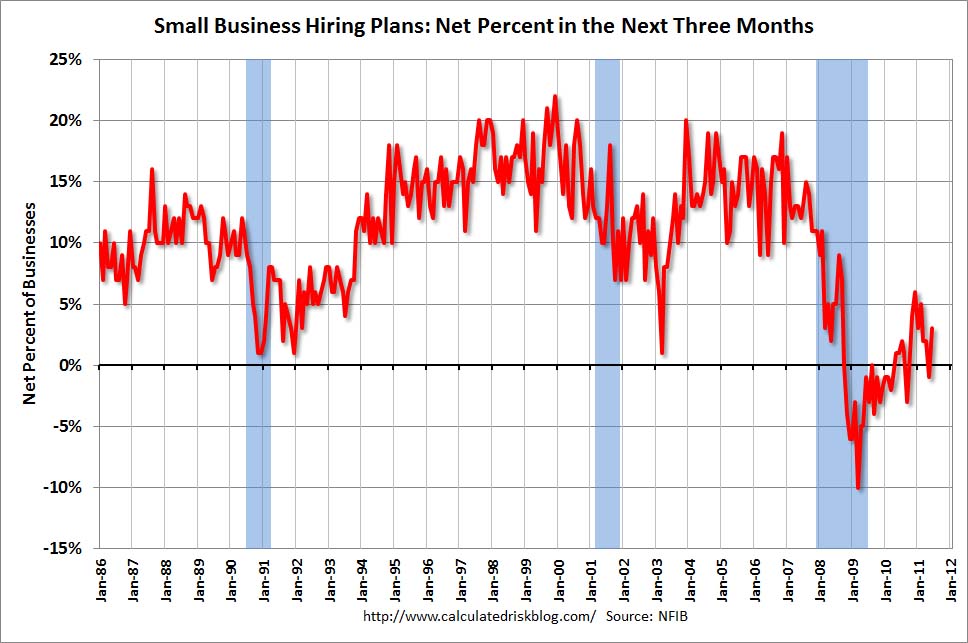

In conjunction with this June NFIB Small Business Optimism Survey, the CalculatedRisk blog on July 12 (in a post titled "NFIB: Small Business Optimism Index 'basically unchanged' in June") had three charts that depicted various facets (the Index itself; Hiring Plans and Poor Sales) of the Survey, as shown below:

(click on charts to enlarge images)

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1316.14 as this post is written

No comments:

Post a Comment