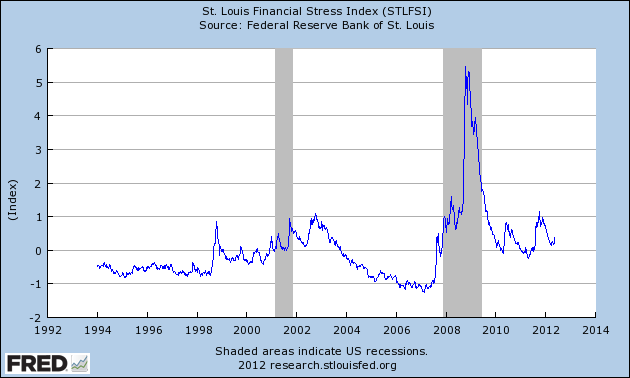

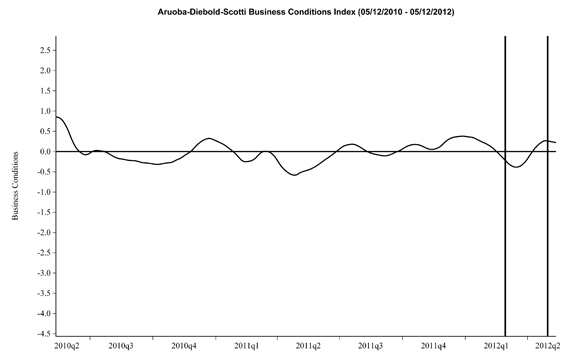

My overall analysis indicates a continuing elevated and growing level of danger which contains many worldwide and U.S.-specific “stresses” of a very complex nature.

I have written numerous posts of some of what I consider both ongoing and recent “negative developments.” These developments, as well as other highly problematic conditions, have presented a highly perilous economic environment that endangers the overall financial system.

My analysis continues to indicate that there are many reasons for tremendous concern, as seen in almost innumerable fundamental economic, financial-market, and proprietary measures. Many prominent parties seem to be fixated on the European financial problems. While I continue to believe that these European problems are gravely serious and disconcertingly intractable, and have broader implications (as explained in the November 17, 2011 post "

Europe And Contagion – Broader Implications"), exceedingly problematical U.S. economic problems also exist. While many would refute this view - as seen in a variety of recent

economic and market forecasts that continue to indicate low probabilities of any type of serious adversity - my analyses indicate this optimism is misplaced, unfortunately.

Among the greatest threats to a quality, sustainable U.S. economic recovery (or expansion) is the existence - and future resolution of - a variety of asset bubbles. While the collective belief appears to be that either such bubbles don't exist - or if they do exist, they are not something to be unduly concerned about - I continue to find these

asset bubbles alarming, and have written extensively about them.

Predicting the timing and extent of a stock market crash is always difficult, and the immense complexity of today’s economic situation makes such a prediction even more challenging. With that being said, my analyses indicate that the danger inherent in the financial system has reached a level at which a stock market crash – that would also involve (as seen in 2008) various other markets as well – has reached a level at which a near-term crash is of tremendous concern.

As reference, below is a one-year daily chart of the S&P500, indicating both the 50dma and 200dma as well as price labels. The current price is 1304.86:

(click on chart to enlarge image)(chart courtesy of StockCharts.com; chart creation and annotation by the author)

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1304.86 as this post is written