On September 9, 2014 the September Duke/CFO Magazine Global Business Outlook Survey (pdf) was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO Survey, I found the following to be the most notable excerpts:

Chief financial officers in the U.S. say a hike in the minimum wage to $10 to $15 an hour (from the current federal standard of $7.25) would result in immediate layoffs and significantly curtail future hiring at firms that would be affected by these wage hikes.

also:

Nearly half of all companies surveyed indicate they have already or soon will implement labor-saving technology, which will allow them to maintain production with fewer employees. Among these companies, the average reduction in the needed number of employees is approximately 10 percent (median 5 percent).

also:

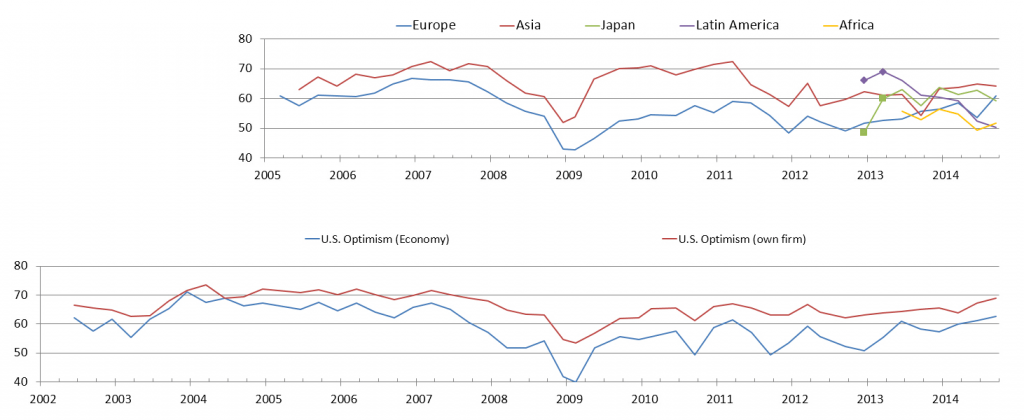

On a scale of 0-100, CFO optimism about the U.S. economy increased to 63 from 61 last quarter, continuing to rise above the long-run average of 59. Capital spending is expected to grow by more than 7 percent and full-time employment by 2 percent. Earnings should increase by more than 10 percent.

also:

U.S. CFOs indicate governmental policies and increased regulation are their top two concerns in terms of risks to the financial performance of their firms. Other top concerns include the cost of benefits, economic uncertainty, difficulty attracting and retaining qualified employees, and data security.

The CFO survey contains two Optimism Index chart, with the bottom chart showing U.S. Optimism (with regard to the economy) at 63, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO Surveys can be found under the “CFO and CEO Confidence” label)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1989.20 as this post is written

No comments:

Post a Comment