From Janet Yellen’s opening comments:

We have seen continued progress toward our objective of maximum employment. The pace of employment growth has remained strong, with job gains averaging nearly 290,000 per month over the past three months. The unemployment rate was 5.5 percent in February; that’s three-tenths lower than the latest reading available at the time of our December meeting. Broader measures of job market conditions—such as those counting individuals who want and are available to work but have not actively searched recently and people who are working part time but would rather work full time—have shown similar improvement. As we noted in our statement, slack in the labor market continues to diminish. Meanwhile, the labor force participation rate—the percentage of working-age Americans either working or seeking work—is lower than most estimates of its trend and wage growth remains sluggish, suggesting that some cyclical weakness persists. So considerable progress clearly has been achieved, but room for further improvement in the labor market continues.

also:

Inflation has declined further below our longer-run objective, largely reflecting the lower energy prices I just mentioned. Declining import prices have also restrained inflation and, in light of the recent appreciation of the dollar, will likely continue to do so in the months ahead. My colleagues and I continue to expect that as the effects of these transitory factors dissipate and as the labor market improves further, inflation will move gradually back toward our 2 percent objective over the medium term. In making this forecast, we are attentive to the low levels of market-based measures of inflation compensation. In contrast, survey-based measures of longer term inflation expectations have remained stable. The Committee will continue to monitor inflation developments carefully.

Janet Yellen’s responses as indicated to the various questions:

HOWARD SCHNEIDER. Howard Schneider with the Reuters. Hi. Thank you. So there's been this pretty consistent reference to expectations of above-trend growth over the last few months. Now, we're seeing growth downgraded in the context of very explicit references to international and external conditions, weak export growth, oil dragging down inflation, and your own comments now on the dollar. So my question is, doesn't this indicate that the Fed’s facing a tougher time, you know, kind of going it along to coupling form the rest of the world then perhaps you expected last fall when this first started to be an issue?

CHAIR YELLEN. Well, it looks like from incoming data pertaining to the first quarter that real GDP growth has declined somewhat below where it was for the last several quarters of last year. And that's really why the Committee indicated that growth has moderated somewhat. There has been a slight downgrading of estimates of growth for this year. You mentioned the dollar. We noted that export growth has weakened, probably the strong dollar is one reason for that.

On the other hand, the strength of the dollar also in part reflects the strength of the US economy. The strength of the dollar is also one factor that is--as I noted is holding down import prices and at least on a transitory basis at this point pushing inflation down. So we are taking account of international developments, including prospects for growth in our trade partners in making the forecast we have here.

Nevertheless, it is important to recognize that this is not a weak forecast. Taking everything into account, we continue to project above trend growth. We continue to project improvement in the labor market by the end of 2015. The central tendency of the participants is they are looking for an unemployment rate that will be down to 5.0 to 5.2 which is consistent with their estimates of its longer-run normal value. So, we do see considerable underlying strength in the US economy. And in spite of what looks like a weaker first quarter, we are projecting good performance for the economy.

also:

MARTIN CRUTSINGER. Marty Crutsinger, Associated Press. The policy statement today talks about one of the prerequisites you'll need to start raising rates is to be reasonably confident that inflation--your inflation target--will be met at 2 percent but that is coming out at a time when you have lowered your forecast on inflation. What--which I would think would make you less confident about it. What is it going to take to make you reasonably confident about inflation?

CHAIR YELLEN. So I don't have a mechanical answer for you. There is no single thing where I would say we must see such-and-such in order to achieve that level of confidence. We will be looking at a wide array of data.

Now, we have said that we also want to see continued improvement in the labor market. And a stronger labor market with less labor market slack is one factor that would tend to certainly for me increase my confidence that as slack diminishes, that inflation will move up over time. Other things I will be looking at, of course, the inflation data. But as we said, we expect inflation to remain quite low because of the depressing influence of energy price declines and the dollar. But we will be looking at the inflation data carefully to see if we can interpret for example low levels of inflation if we see that which we expect, as reflecting those influences.

We will be looking at wage growth. We have not seen wage growth pick up. We may not see wage growth pick up. I wouldn't say either that that is a precondition to raising rates. But if we did see wage growth pick up, that would be at least a symptom that inflation would likely move up over time. We'll be watching inflation expectations. Survey measures have been stable. I expect that to continue. But we will be watching it carefully. And market-based measures of inflation compensation have fallen. They are low. If they were to move up over time, that would probably serve to increase my confidence.

But there are a wide range of things that we will be looking at, including further improvement in the labor market. So there's no simple answer. This is a judgment that the Committee will have to make.

also:

PETER BARNES. Peter Barnes, Fox Business. Chair Yellen, I wanted to check in again with you on whether or not you see or have any concerns about bubbles out there in the economy, particularly the financial markets, debt and equity markets and I want to refer to your most recent Monetary Policy Report to Congress last month in which you said overall equity valuations by some conventional measures are somewhat higher than their historical levels, valuation metrics in some sectors continued to appear stretched relative to historical norms. In the same report last year, in July, the reports specifically mentioned biotech and social media stocks as being substantially. Let's see here, substantially stretched. Do you still feel that way and can you comment on bubbles and particularly these sectors?

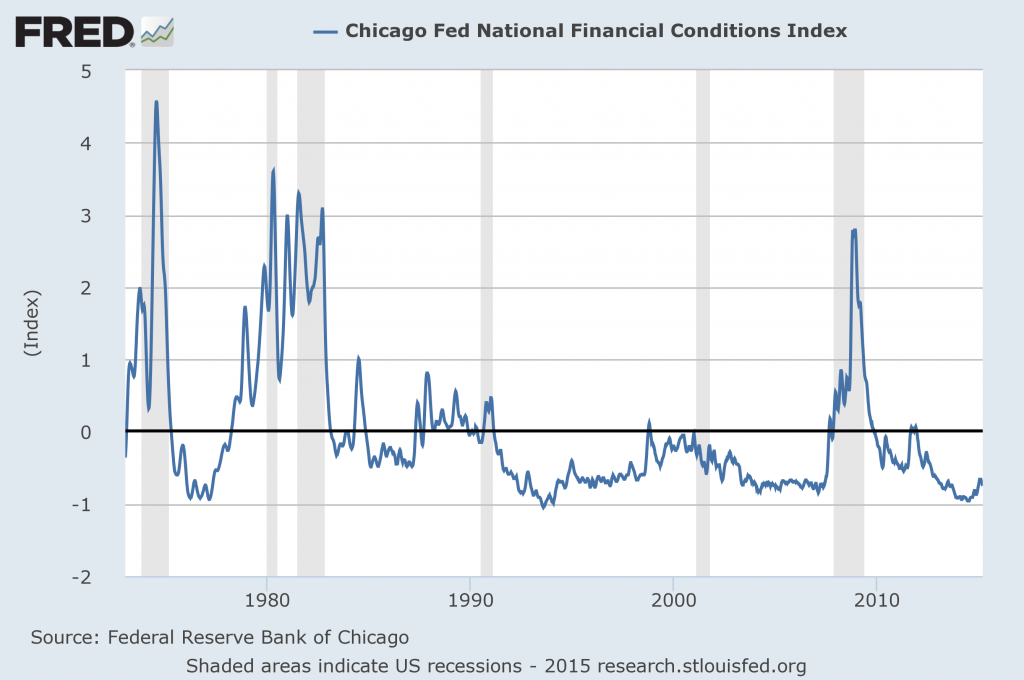

CHAIR YELLEN. Well, I don't want to comment on those particular sectors. You know, as we said in the report, overall measures of equity valuations are on the high side, but not outside of historical ranges. In some corporate debt markets, we do see evidence of unusually low spreads. And that's what we referred to in the report.

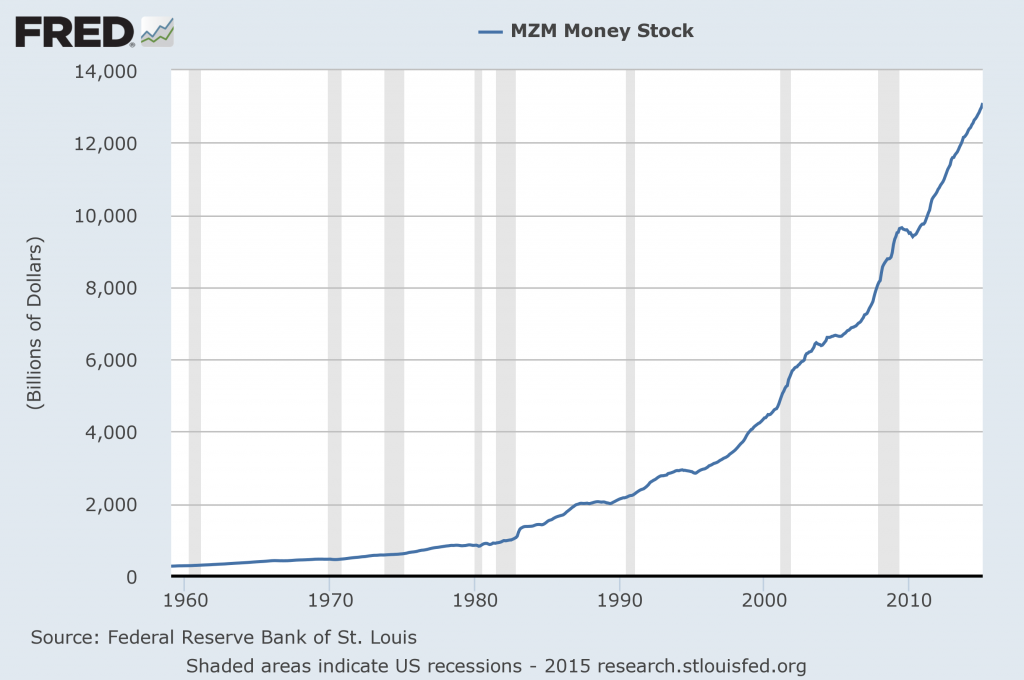

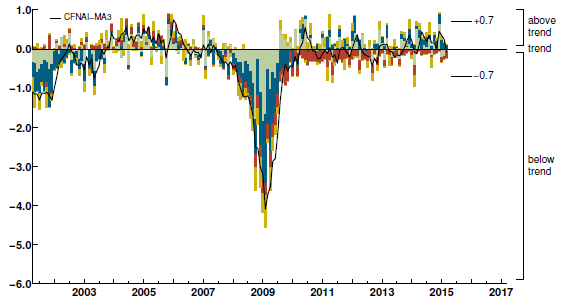

More broadly, we do try to assess potential threats to financial stability. And in addition to looking at asset valuations, we also look at measures of credit growth of the extent of leverage being used in the economy and in the financial sector, and the extent of maturity transformation.

And taking into account a broad range of metrics that bear on financial stability, our overall assessment at this point is the threats are moderate.

also:

JEN LIBERTO. Jen Liberto, Politico. So, I want to switch gears a little bit and ask about some of the tension between the Fed and Congress lately with some lawmakers calling for more transparency and accountability measures. I wanted to ask to what degree that there might be room for the Fed to consider some of these measures, like maybe a rules-based approach, like the

Taylor rule, or some of these measures, that would change up who has a voting seat on the FOMC. To what degree does that make it more difficult to accomplish your mission?

CHAIR YELLEN. So, I believe the Federal Reserve is already one of the most transparent central banks of any around the globe. We provide an immense amount of information both financial about our balance sheet and our monetary policy operations. We have audited financial statements. We published our balance sheet every week. If you want to know exactly what's in the SOMA portfolio, it's listed on the New York Fed Web site on a CUSIP by CUSIP basis. I have press conferences; we issue minutes. We have, you know, statements that we release right after meetings and transcripts within five years. So, if you put all of that together, we are a transparent central bank.

With respect to Congressional changes that are under consideration that would politicize monetary policy by bringing Congress in to make policy judgments about in real-time on our monetary policy decisions. Congress itself decided in 1978 that that was a bad thing to do. That it would lead to poor economic performance. And they carved out this one area of policy reviews of monetary policy decision making from GAO audits. The GAO looks at everything else that goes on within the Fed. And I think that that is a central bank best practice.

The global experience shows that giving central banks independence to make monetary policy decisions that they think are in the best interest of the country and consistent with their mandates leads to lower inflation and more stable macroeconomic outcomes. So, I feel very strongly about that. But we are accountable to Congress. Of course, we are ready to provide information that Congress needs to evaluate the Fed's decision making in monetary policy and elsewhere.

With respect to monetary policy rules, they can be useful and I find them useful and long have as a kind of benchmark for thinking about what might be the appropriate stance of policy. But to chain a central bank to follow a simple mathematical rule that fails to take account of many things that are very important in making monetary policy. For example, I was earlier asked about being against zero lower bound which is an important special consideration, that would be a very foolish thing to do and I oppose it.

With respect to proposals having to do with voting and the structure of the Fed that you mentioned, a lot of ideas have been mentioned. I would say for my part, I think the Federal Reserve works well. The system we have was put into place by Congress decades ago. I don't think it's a system that's broken. Of course, Congress can revisit the decisions it's made about the structure of the Fed. There were good reasons for making the decisions that were about how the structure voting and other things. And I don't think the system is broken. I think it's working well. So I don't see a need for changes. But of course, it's up to Congress to review that.

also:

GREG ROBB. Greg Robb from MarketWatch. We hear that productivity takes a long time before you can understand it, but it’s been very low in this cycle. What that does mean for Fed policy?

CHAIR YELLEN. Well, I agree. It has been very low. It's been disappointingly low. A positive aspect of what is fundamentally a disappointment is that the labor market has improved more rapidly than might have been expected given the pace of economic growth. So the unemployment rate has come down more rapidly than I would have expected, and the labor market has improved more rapidly than I would have expected. We have written down our estimates of potential output. In the long run, it is a disappointing factor about the ultimate prospects for the U.S. economy. If it continues, I would expect it to pick up. And as you can see from the longer-run growth projections, most FOMC participants believe it will pick up above current levels. But it means it's something that would, if it persists, retard living standards and would likely retard real wage growth and improvement in living standards for ordinary households.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2090.19 as this post is written