On Wednesday, March 19, 2025 FOMC Chair Jerome Powell gave his scheduled March 2025 FOMC Press Conference. (link of video and related materials)

Below are Jerome Powell’s comments I found most notable – although I don’t necessarily agree with them – in the order they appear in the transcript. These comments are excerpted from the “Transcript of Chair Powell’s Press Conference“ (preliminary)(pdf) of March 19, 2025, with the accompanying “FOMC Statement” and “Summary of Economic Projections” (pdf) dated March 19, 2025.

Excerpts from Chair Powell’s opening comments:

Inflation has eased significantly over the past two years but remains somewhat elevated relative to our 2 percent longer-run goal. Estimates based on the Consumer Price Index and other data indicate that total PCE prices rose 2.5 percent over the 12 months ending in February and that, excluding the volatile food and energy categories, core PCE prices rose 2.8 percent. Some near-term measures of inflation expectations have recently moved up. We see this in both market- and survey-based measures, and survey respondents, both consumers and businesses, are mentioning tariffs as a driving factor. Beyond the next year or so, however, most measures of longer-term expectations remain consistent with our 2 percent inflation goal. The median projection in the SEP for total PCE inflation is 2.7 percent this year and 2.2 percent next year, a little higher than projected in December. In 2027, the median projection is at our 2 percent objective.

Our monetary policy actions are guided by our dual mandate to promote maximum employment and stable prices for the American people. At today’s meeting, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. Looking ahead, the new Administration is in the process of implementing significant policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation. It is the net effect of these policy changes that will matter for the economy and for the path of monetary policy. While there have been recent developments in some of these areas, especially trade policy, uncertainty around the changes and their effects on the economic outlook is high. As we parse the incoming information, we are focused on separating the signal from the noise as the outlook evolves. As we say in our statement, in considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will assess incoming data, the evolving outlook, and the balance of risks. We do not need to be in a hurry to adjust our policy stance, and we are well positioned to wait for greater clarity.

Excerpts of Jerome Powell’s responses as indicated to various questions:

COLBY SMITH. Thank you, Colby Smith with the New York Times. You just described inflation expectations as well-anchored, but has your confidence in that assessment changed at all, given the increase in certain measures and the high degree of uncertainty expressed by businesses, households, and forecasters?

CHAIR POWELL. So, when inflation expectations, of course, we do monitor inflation expectations very, very carefully, in basically every source we can find, and you know, shortterm, long-term, households, businesses, forecasters, market based. And I think the picture broadly is this, you do see increases widely in short-term inflation expectations, and people who fill out surveys and answer, you know, questionnaires, are pointing to tariffs about that. If you look — in the survey world, if you look a little further out, you really, you really don’t see much in the way of an increased longer-term expectation. Inflation expectations are mostly well anchored. If you look at the New York, for example, then you have market based, and it’s the same pattern, you know, people in markets are pricing in and break-evens, some higher inflation over the next year, must be related to tariffs. We know from the surveys. But if you look out five years, or five-year, five year, forward, you’ll see that break-evens have, are either flat or actually slightly down in the case of a longer-term one. So, we look at that, and we will be watching all of it very, very carefully. We do not take anything for granted, that’s at the very heart of our framework, anchored inflation expectations, but that’s what you see right now.

COLBY SMITH. And how much weight do you put on the deterioration in consumer confidence surveys? You said recently that this is perhaps not the best indication of future spending, but I’m curious, you know, what you think is behind this deterioration and to what extent it could be a leading indicator for hard data?

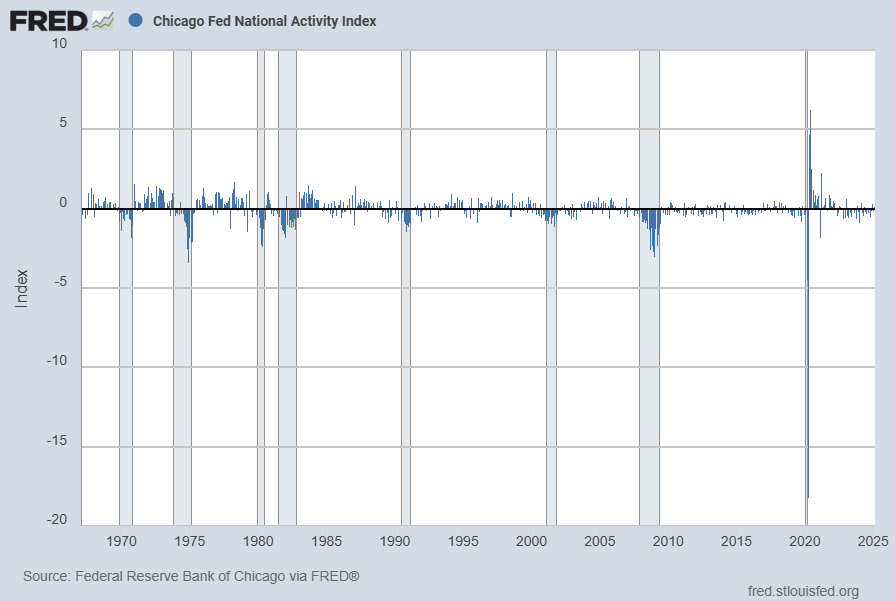

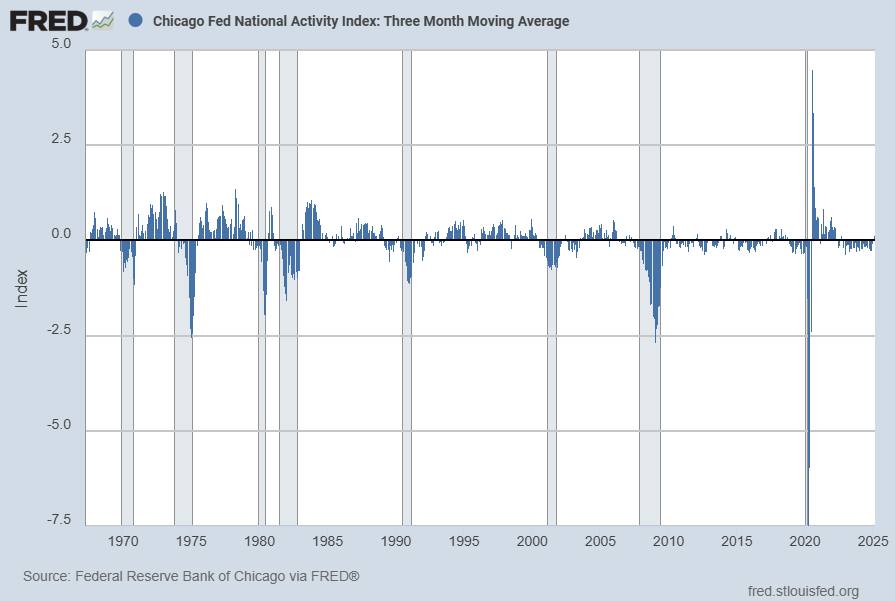

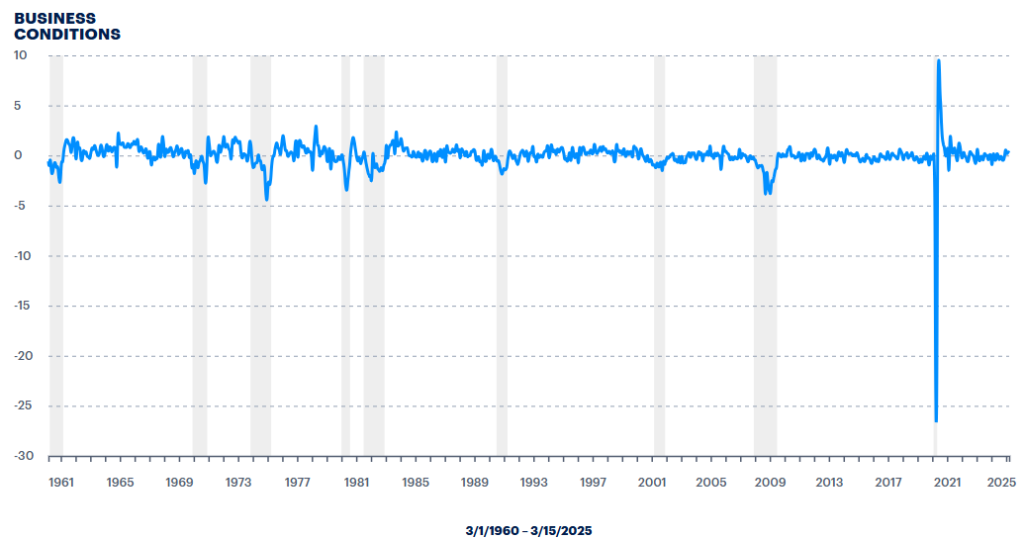

CHAIR POWELL. So, let’s start with the hard data. You know, we do see pretty solid hard data still. So, growth looks like it’s maybe moderating a bit, consumer spending moderating a bit, but still at a solid pace. Unemployment’s 4.1 percent, job creation most recently has been at a healthy level. Inflation has started to move up now, we think partly in response to tariffs and there may be a delay in further progress over the course of this year. So, that’s the hard data. Overall, it’s a solid picture. The survey data, of both household and businesses, show significant rise in uncertainty and significant concerns about downside risks. So how do we think about that? And that’s the, that is the question, as I mentioned the other day, as you pointed out, the relationship between survey data and actual economic activity hasn’t been very tight, there have been plenty of times where people are saying very downbeat things about the economy and then going out and buying a new car. But we don’t know that that will be the case here. We will be watching very carefully for signs of weakness in the real data. Of course we will. But I, you know, given where we are, we think our policy is in a good place to react to what comes, and we think that the right thing to do is to wait here for, you know, for greater clarity about what the economy is doing.

also:

KELLY O’GRADY. Thanks for taking our questions, Chair Powell. Kelly O’Grady, CBS News. So consumer sentiment has dipped dramatically but you say the economy and the hard data is still solid. What is your message to consumers that clearly disagree and don’t feel that strength? Because the hard data they’re looking at is their grocery bill.

CHAIR POWELL. Okay, so a couple things, the grocery bill is about past inflation, really. There was inflation in ’21, two, and three, and prices went up. The current level, it’s not the change in prices, it’s they’re unhappy, and they’re not wrong to be unhappy, that prices went up quite a bit and they’re paying a lot for those things. So that’s, I think that is the fundamental fact and has been for a long time, a couple years, why people are unhappy with the economy. It’s not that the economy is not growing, it’s not that inflation is really high, it’s not that unemployment is high. It’s none of those things. We have, you know, 4.1 percent unemployment, we’ve got 2 percent growth, and you know, it’s a pretty good economy. But, people are unhappy because of the price level. And I do, we completely understand and accept that.

KELLY O’GRADY. And just to follow-up, why are you still projecting two rate cuts this year if your own projections show inflation higher for longer? Does that mean you see a slowdown in economic growth as a real threat?

CHAIR POWELL. So, I think if you, yeah, I mean, remember we came into this with, at the December meeting, and the median was two cuts, the median was. And so you come in and you see, broadly speaking, weaker growth but higher inflation. And they kind of balance each other out, so you think, and unemployment is really, really only a 1/10 change. So it’s, there’s just not a big change in the forecast. There really isn’t. Modest, you know, meaningfully higher — sorry, growth, and meaningfully higher inflation, which call for different responses. Right? So, they cancel each other out and people just said, okay, I’m going to stay here. But the second factor is, it’s so highly uncertain, is just, you know, we’re sitting here thinking, and we obviously are in touch with businesses and households all over the country. We have an extraordinary network of contacts that come in through the reserve banks and put it in the Beige Book, and also through contacts at the Board. And we get all that, and we do understand that sentiment has fallen off pretty sharply, but economic activity has not yet. And so we’re watching carefully, so I would tell people that the economy seems to be, seems to be healthy. We understand that sentiment is quite negative at this time, and that probably has to do with, you know, turmoil at the beginning of an administration. It’s making, you know, big changes in areas of policy. And that’s probably part of it. I do think the underlying unhappiness people have about the economy though is more, is more about the price level.

also:

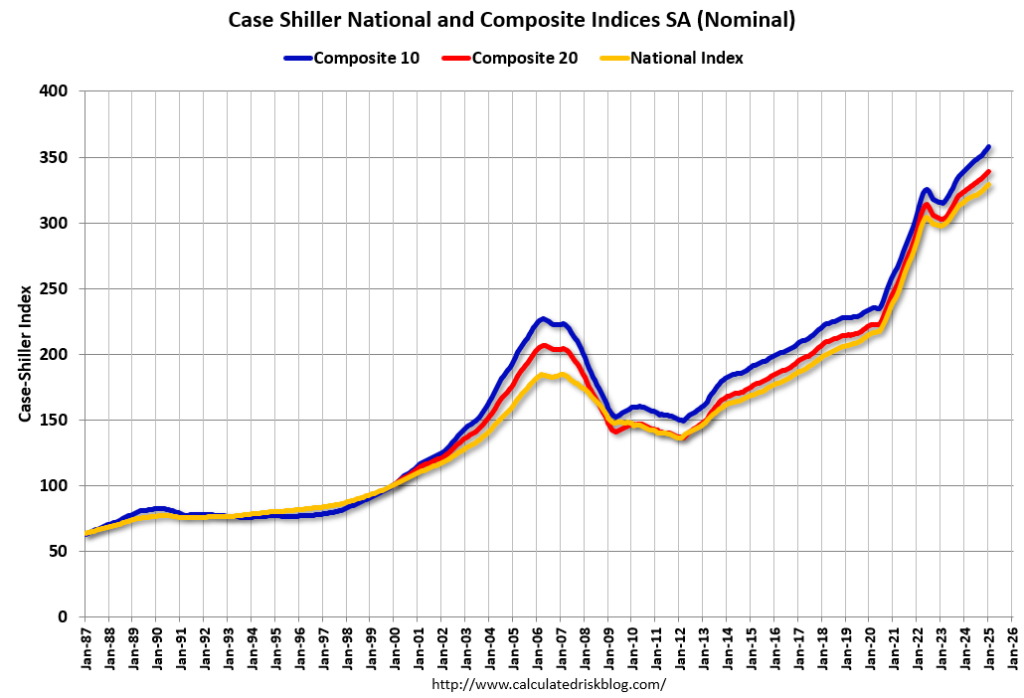

SIMON RABINOVITCH. Simon Rabinovitch with the Economist. Thank you Chair Powell. Several times today you said that you feel you’re well-positioned to wait for greater clarity. At the same time, you could point to quite a few growth risks at the moment. We’ve seen a stock market that’s gone quite wobbly, rapidly cooling housing sales, plunging confidence surveys. Today, not only did the SEP mark down the growth outlook 17 of 19 see risks to the downside. So my question is, how confident are you that you’re well-positioned? Or is that one more thing that you’re uncertain about?

CHAIR POWELL. I’m confident that we’re well-positioned in the sense that we’re wellpositioned to move in the direction we’ll need to move. I mean I, I don’t know anyone who has a lot of confidence in their forecast. I mean the point is, we are — we are at, you know, we’re at a place where we can cut, or we can hold, what is a clearly a restrictive stance, of policy. And that’s what I mean. I mean I think we’re — that’s well-positioned. Forecasting right now, it’s you know, forecasting is always very, very hard, and in the current situation, I just think it’s uncertainty is remarkably high.

SIMON RABINOVITCH. And sorry, standing here today, would you be surprised to pivot back towards rate cuts in May?

CHAIR POWELL. I think we’re not going to be in any hurry to move, and as I mentioned, I think we’re well-positioned to wait for further clarity. And not in any hurry.

also:

JENNIFER SCHONBERGER. Jennifer Schonberger with Yahoo Finance. As you look to navigate higher inflation and lower growth, the Fed has talked about heeding the lessons from the 1970s. Is the Fed willing to have a recession if it means breaking the back of inflation?

CHAIR POWELL. Well, fortunately, we’re in a situation where we have seen inflation move down from, you know, higher levels to pretty close to 2 percent, while the unemployment rate has remained very consistent with full employment, 4.1 percent. So, we now have inflation coming in from an exogenous source, but the underlying inflationary picture before that was, you know, basically 2 and 1/2 percent inflation I would say. And 2 percent growth, and 4 percent unemployment. So that’s what, that’s what we did together, the economy accomplished. So, I don’t see any reason to think that we’re looking at a replay of the ’70s or anything like that. You know, inflation, underlying inflation is, you know, still running in the twos, with probably a little bit of a pickup associated with tariffs. So I don’t think we’re facing, I wouldn’t say we’re in a situation that’s remotely comparable to that.

JENNIFER SCHONBERGER. And last month the idea of a DOGE dividend was proposed, which would send $5,000 checks to every taxpayer from DOGE savings. President Trump and Elon Musk have supported this. There’s reports there could be a bill introduced on Capitol Hill. What impact might that have on household savings and spending, in terms of your growth and outlook for inflation?

CHAIR POWELL. You know, it’s not appropriate for me to speculate on political ideas or fiscal policy for that matter. So, I’m going to, I’m going to pass on that one. Thank you.

_____

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 5698.94 as this post is written