U.S. Economic Indicators

Throughout this site there are many discussions of economic indicators. This post is the latest in a series of posts indicating U.S. economic weakness or a notably low growth rate.

The level and trend of economic growth is especially notable at this time. As seen in various measures and near-term projections, the U.S. economy is undergoing an outsized level of economic contraction. However, most people believe (and virtually all prominent economic forecasts indicate) that this historic level of contraction will be temporary in nature and that an economic rebound will have started in the third quarter of 2020.

As seen in the October 2020 Wall Street Journal Economic Forecast Survey the consensus (average estimate) among various economists is for -3.58% GDP growth in 2020, 3.70% GDP growth in 2021, and 3.02% GDP growth in 2022.

Charts Indicating U.S. Economic Weakness

Below are a small sampling of charts that depict weak growth or contraction, and a brief comment for each:

The Weekly Economic Index (WEI)

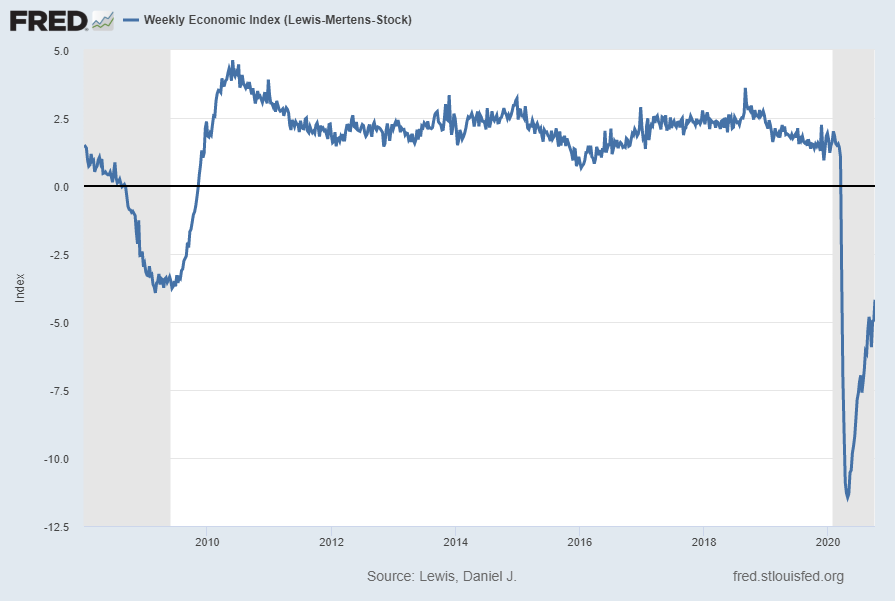

A recently-introduced indicator, the Weekly Economic Index, is an economic indicator that is a composite of 10 different weekly indicators. It is (purportedly) designed to provide a timely depiction of the U.S. economic trend. As seen below, it depicts the severity of the recent plunge in economic activity.

The Weekly Economic Index (WEI) with a value of -4.18, updated as of October 8, 2020 (incorporating data through October 3, 2020):

source: Lewis, Daniel J., Mertens, Karel and Stock, James H., Weekly Economic Index (Lewis-Mertens-Stock) [WEI], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed October 9, 2020: https://fred.stlouisfed.org/series/WEI

__

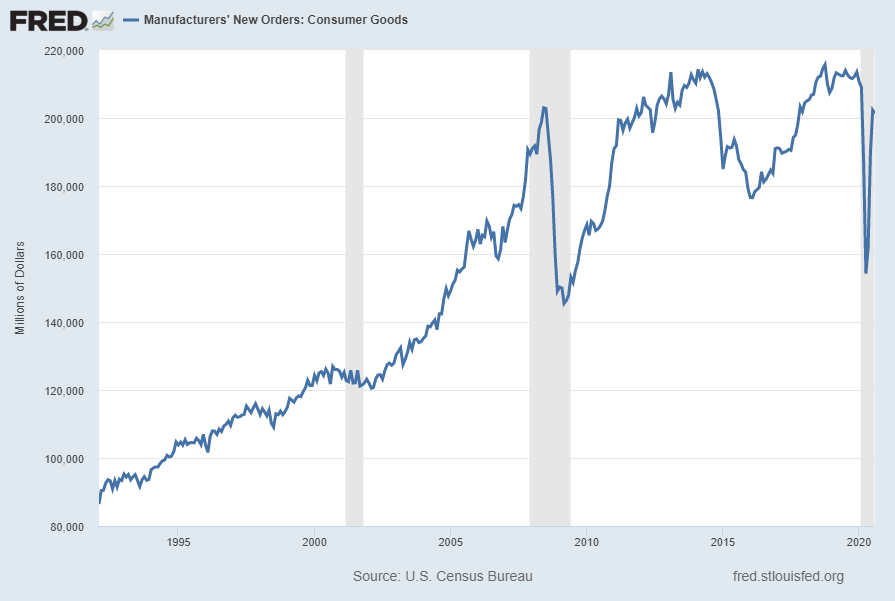

Value of Manufacturers’ New Orders for Consumer Goods Industries (ACOGNO)

A measure for consumer goods exhibiting a recent outsized weakening followed by a partial rebound is the “Value of Manufacturers’ New Orders for Consumer Goods Industries” (ACOGNO). Shown below is this measure with last value of $201,290 Million through August 2020 (last updated October 2, 2020):

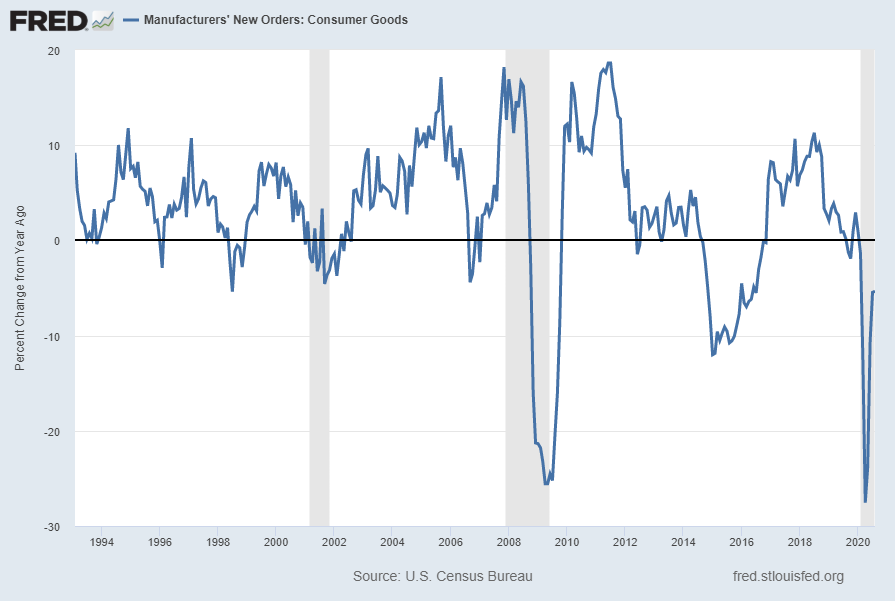

Displayed below is this same ACOGNO measure on a “Percent Change From Year Ago” basis with value -5.3%, last updated October 2, 2020:

source: U.S. Census Bureau, Value of Manufacturers’ New Orders for Consumer Goods Industries [ACOGNO], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed October 9, 2020: https://fred.stlouisfed.org/series/ACOGNO

__

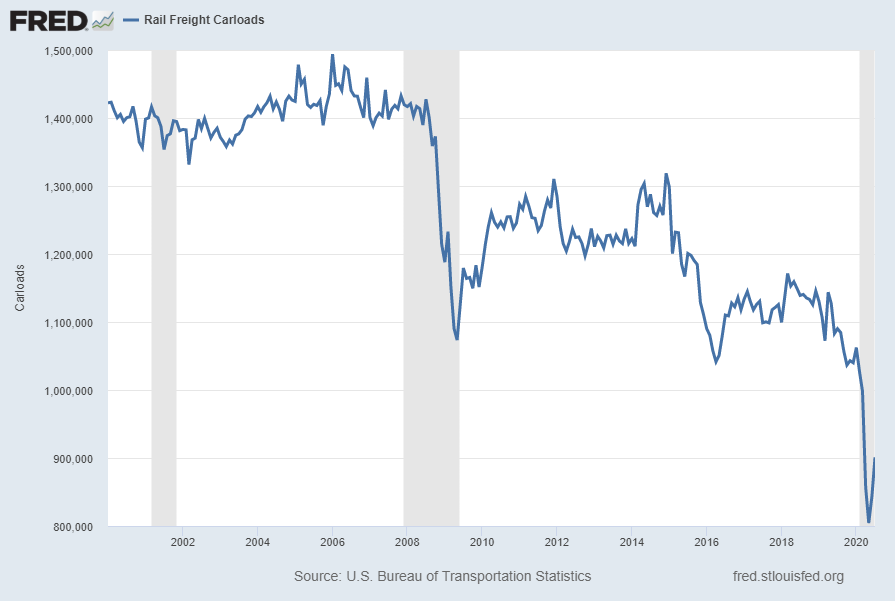

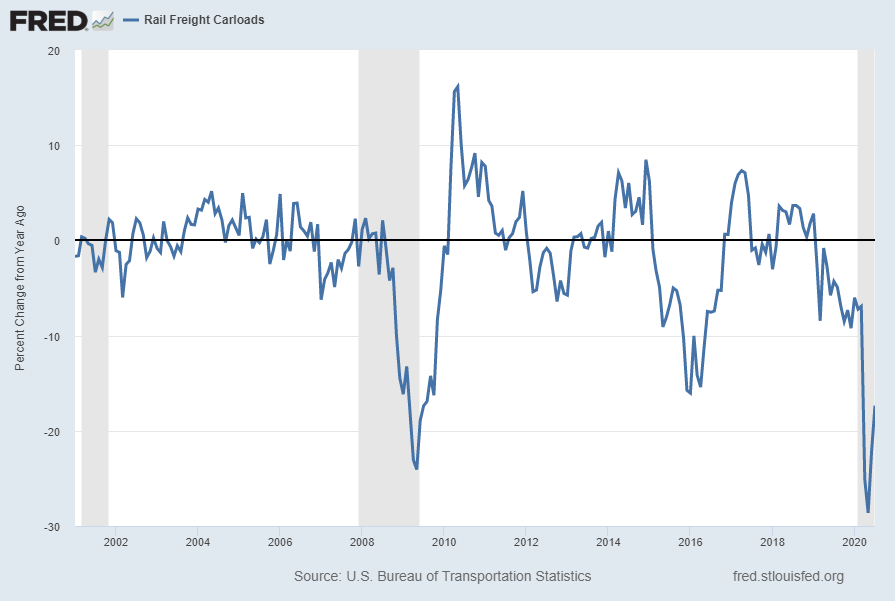

Rail Freight Carloads (RAILFRTCARLOADSD11)

“Rail Freight Carloads” continues to show a generally downward progression from a longer-term perspective. Shown below is a chart with data through July 2020 (last value of 900,903), updated September 16, 2020:

Here is the same measure on a “Percent Change From Year Ago” basis, with value -17.4%:

source: U.S. Bureau of Transportation Statistics, Rail Freight Carloads [RAILFRTCARLOADSD11], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed October 9, 2020: https://fred.stlouisfed.org/series/RAILFRTCARLOADSD11

__

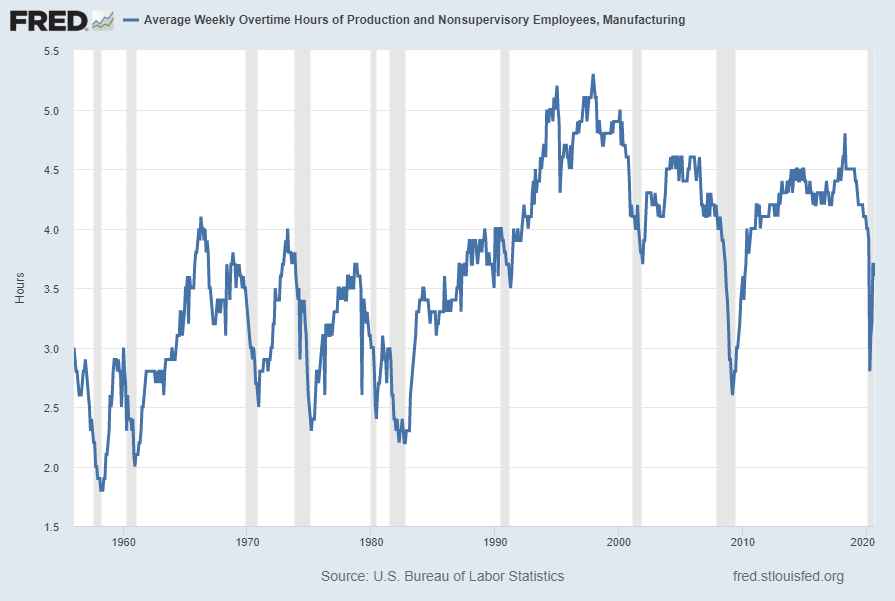

Average Weekly Overtime Hours of Production and Nonsupervisory Employees: Manufacturing (AWOTMAN)

Various U.S. manufacturing measures continue to indicate either a significant weakening in growth or a decline in various aspects of activity. An indication of weakening manufacturing activity is overtime hours for manufacturing. Shown below is the “Average Weekly Overtime Hours of Production and Nonsupervisory Employees: Manufacturing” measure (with last value of 3.6 hours through September) last updated October 2, 2020:

Below is this measure displayed on a “Percent Change From Year Ago” basis with value -14.3%:

source: U.S. Bureau of Labor Statistics, Average Weekly Overtime Hours of Production and Nonsupervisory Employees: Manufacturing [AWOTMAN], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed October 9, 2020: https://fred.stlouisfed.org/series/AWOTMAN

__

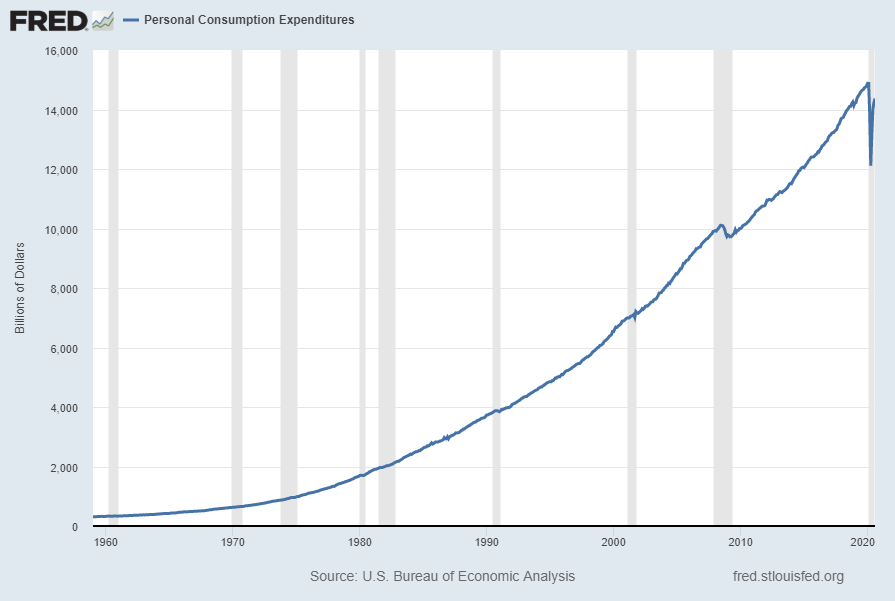

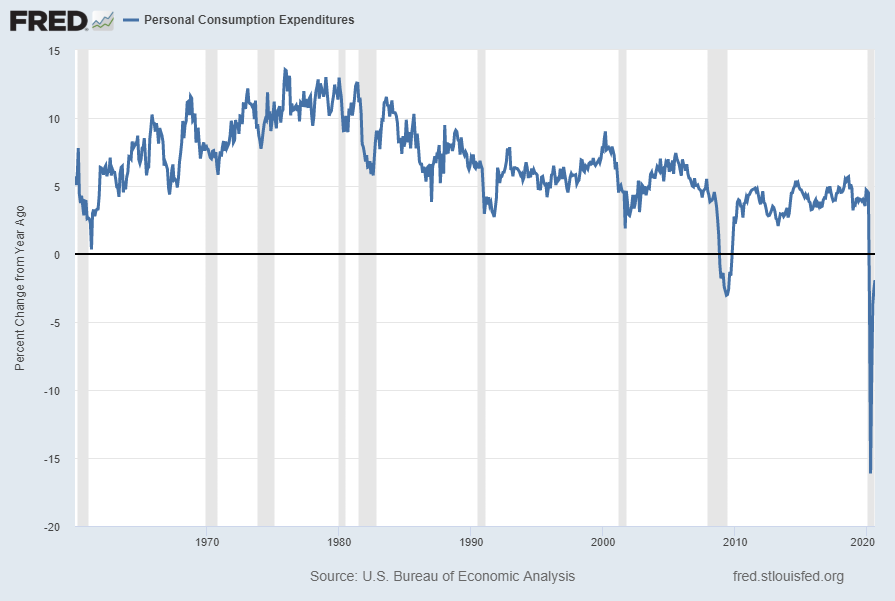

Personal Consumption Expenditures (PCE)

“Personal Consumption Expenditures” (PCE), continues to exhibit substantial weakness. Shown below is this measure with last value of $14,369.6 through August, last updated October 1, 2020:

Below is this measure displayed on a “Percent Change From Year Ago” basis with value -1.9%:

source: U.S. Bureau of Economic Analysis, Personal Consumption Expenditures [PCE], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed October 8, 2020: https://fred.stlouisfed.org/series/PCE

__

Other Indicators

As mentioned previously, many other indicators discussed on this site indicate slow economic growth or economic contraction, if not outright (gravely) problematical economic conditions.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3477.14 as this post is written

No comments:

Post a Comment