Here is an update of various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

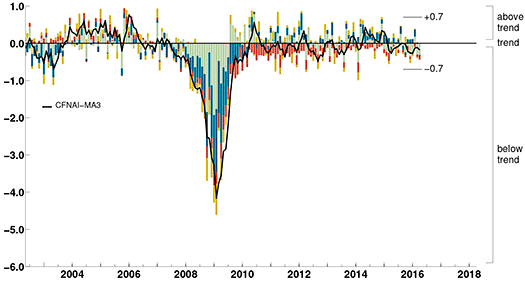

The April 2016 Chicago Fed National Activity Index (CFNAI) updated as of April 21, 2016: (current reading of -.44; current reading of CFNAI-MA3 is -.18):

–

As of April 15, 2016 (incorporating data through April 8, 2016) the WLI was at 134.2 and the WLI, Gr. was at 2.5%.

A chart of the WLI,Gr., from Doug Short’s post of April 15, 2016, titled “ECRI Weekly Leading Index: WLI Up 1.0 From Last Week“:

–

Here is the latest chart, depicting the ADS Index from December 31, 2007 through April 16, 2016:

–

The Conference Board Leading (LEI), Coincident (CEI) Economic Indexes, and Lagging Economic Indicator (LAG):

As per the April 21, 2016 press release, titled “The Conference Board Leading Economic Index (LEI) for the U.S. Increased,” (pdf) the LEI was at 123.4, the CEI was at 113.3, and the LAG was 120.9 in March.

An excerpt from the April 21 release:

With the March gain, the U.S. LEI’s six-month growth rate improved slightly but still points to slow, although not slowing, growth in the coming quarters,” said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. “Rebounding stock prices were offset by a decline in housing permits, but nonetheless there were widespread gains among the leading indicators. Financial conditions, as well as expected improvements in manufacturing, should support a modest growth environment in 2016.”

Here is a chart of the LEI from Doug Short’s blog post of April 17 titled “Conference Board Leading Economic Index: Increase in March“:

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2094.36 as this post is written

No comments:

Post a Comment