Recently Deloitte released their “

CFO Signals” “High-Level Summary” report for the 3rd Quarter of 2016.

As seen in page 2 of the report, "One hundred twenty-two CFOs responded during the two-week period ending August 19. Seventy-three percent of respondents are from public companies, and 80% are from companies with more than $1B in annual revenue. For more information, please see the “About the survey” section of this report."

Here are some of the excerpts that I found notable:

from page 3:

Perceptions

How do you regard the current and future status of the North American, Chinese, and European economies? Forty-six percent of CFOs describe the North American economy as good or very good (up from 40% last quarter), and 37% expect better conditions in a year (down from 39%). Ten percent regard China’s economy as good (up from 9% last quarter), and 14% expect improvement (up from 10%). In the aftermath of the Brexit vote, just 4% describe Europe’s economy as good (down from 6%), and only 10% see it improving in a year (down from 15%). Page 8.

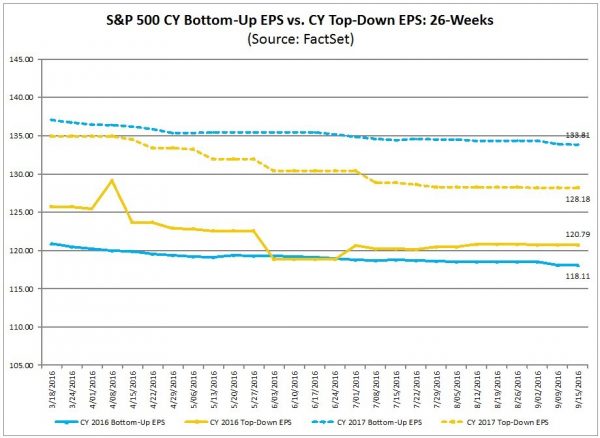

What is your perception of the capital markets? Seventy-one percent of CFOs say US equity markets are overvalued (up substantially from 56% last quarter and a new survey high). Eighty-nine percent say debt is currently an attractive financing option (up from 80%), and 42% of public company CFOs view equity financing favorably (up from 30% last quarter). Page 9.

Expectations

Compared to the past 12 months, how do you expect your key operating metrics to change over the next 12 months?* Revenue growth expectations rose slightly from last quarter’s 4.0% to 4.2%, but are still among their survey lows. Earnings growth expectations declined to 6.1%, well off last quarter’s 7.7% and near 1Q16’s survey low. Capital spending expectations, having increased sharply last quarter from 1Q16’s survey-low 1.7% to 5.4%, rose slightly to 5.6% this quarter. Domestic hiring growth expectations rose significantly to 2.3% from last quarter’s 1.1%. Pages 11-13.

Sentiment

Compared to three months ago, how do you feel now about the financial prospects for your company? This quarter’s net optimism declined from last quarter’s +30.0 to a still-strong +19.7, marking the fifteenth consecutive netpositive reading. Thirty-five percent of CFOs express rising optimism (down from 49% last quarter), and the proportion citing declining optimism fell from 19% to 16%. Page 14.

Overall, what risks worry you the most? CFOs mention global economic stagnation, low interest rates, a strong dollar, and regulatory uncertainty— concerns that appear amplified by worries about Brexit, US elections, and the tenor of geopolitics worldwide. Page 15.

Special topic: Business environment

How much are macroeconomic factors affecting your business planning? Nearly 90% of CFOs say low interest rates are significantly impacting their business planning, and more than 80% say the same for a strong US dollar. About 70% cite impacts from slow European growth, and nearly 65% cite slow Chinese growth. Fifty-seven percent cite impacts from both the upcoming US elections and the UK’s Brexit vote. Page 16.

*Averages are means that have been adjusted to eliminate the effects of stark outliers.

from page 4:

Mixed sentiment and expectations

This quarter’s net optimism1 of +19.7 is down from last quarter’s +30.0 (which came after a dismal +1.7 in the first quarter), but it still indicates considerable strength. Sentiment is net-positive across all industries except Retail/Wholesale, with Manufacturing and Technology indicating particular strength.

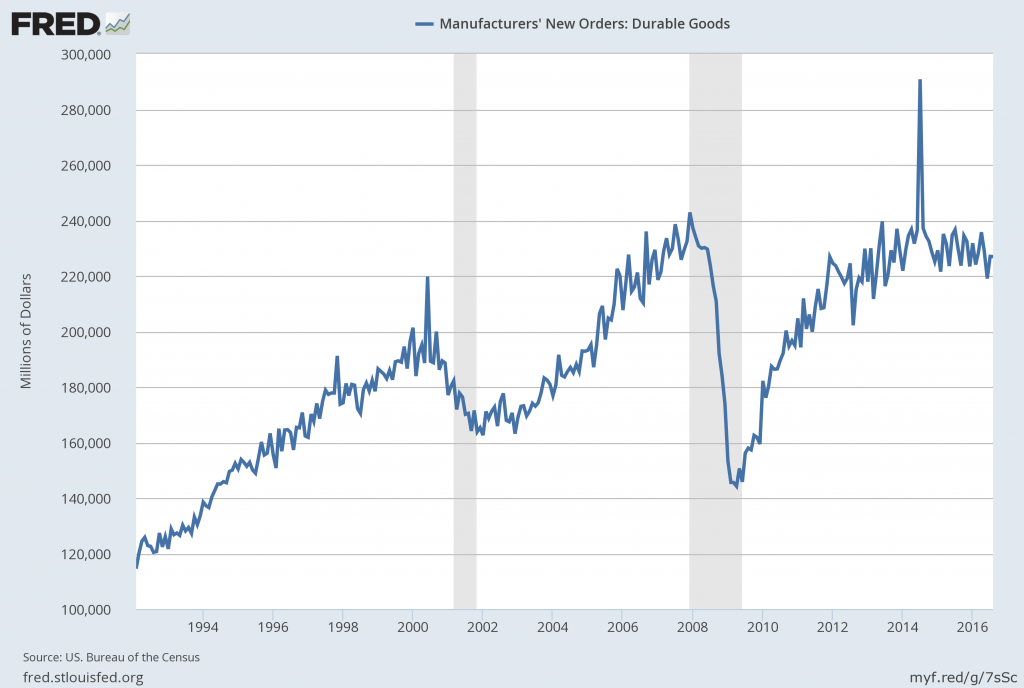

Despite this optimism, CFOs’ expectations for revenue, earnings, capital spending, and domestic hiring growth are mixed. This quarter’s 4.2%* expectation for yearover-year revenue growth is up from last quarter’s 4.0%* and from 3.3%* the quarter before that, but it is still among the lowest in the survey’s history. Similarly, this quarter’s earnings growth expectation of 6.1%* is barely above 1Q16’s survey-low 6.0%* and is well off last quarter’s 7.7%*.

On a more positive note, capital investment growth expectations, which bottomed out at just 1.7%* in 1Q16, rose to 5.4%* last quarter and to 5.6%* this quarter—well above the 4.7%* average over the past two years. Similarly, this quarter’s domestic hiring growth expectation of 2.3%* is well above the 1.1% to 1.4% levels we have seen over the last year and a half (and 1Q16’s low of 0.6%).

*Averages are means that have been adjusted to eliminate the effects of stark outliers.

¹ Net optimism is calculated as the difference between the proportions of those expressing rising and falling optimism. Accordingly, this metric does not explicitly account for the level of “no change” responses.

from page 11:

Revenue and earnings

Revenue[1]

Expectations remain among their survey lows; weakness is again evident across nearly all industries, but Energy/Resources continued to improve:

Other than one optimistic quarter in 4Q15, revenue growth has been on a downward trend since 2Q15 and come in at or near survey lows. This quarter’s 4.2% is up from last quarter’s 4.0% and from 3.3% the quarter below that, but it is still among the lowest in the survey’s history. The median this quarter repeated at 4.0%, and 83% of CFOs expect year-over-year gains (considerably up from the last two quarters). The distribution2 of this quarter’s responses is the lowest in almost two years.

Country expectations (this quarter/last quarter): US 3.9%/3.7%; Canada 6.2%/3.1%; Mexico 8.0%/8.6%.

Industry expectations (this quarter): Highest are T/M/E (8.0%) and Healthcare/Pharma (6.0%); lowest are Services (0.9%) and Manufacturing (2.8%).

Earnings1

Expectations declined across all geographies; Retail/Wholesale showed strength, while Financial Services came in near its survey low:

Earnings expectations have mostly been trending downward since the survey was launched in 2Q10. This quarter’s earnings growth expectations came in at 6.1%, barely above the 1Q16 survey low of 6.0% and well off of last quarter’s 7.7%. The median fell from 7.0% to 5.0%, and the percentage of CFOs expecting year-overyear gains rose from 76% last quarter to 81%. The distribution2 of responses was well below the average for this metric.

Country expectations (this quarter/last quarter): US 6.2%/7.3%; Canada 3.8%/9.4%); Mexico 8.5%/9.7%.

Industry expectations (this quarter): Highest are Retail/Wholesale (10.4%) and T/M/E (7.5%); lowest are Services (3.2%) and Financial Services (4.2%); notable is Healthcare/Pharma (5.7%, down from 10.9%).

[1] All averages have been adjusted to eliminate the effects of stark outliers.

[2] “Distribution” refers to the spread of the middle 90% of responses.

from page 13:

Domestic and offshore hiring

Domestic hiring[1]

Expectations rebounded with several industries showing significant improvement:

Domestic hiring expectations have been around 1.2% since 2Q15 and bottomed out in 1Q16 at 0.6%. This quarter’s 2.3% breaks that trend and is well up from last quarter’s 1.1%. The median remained 1.0%, and the proportion of CFOs expecting gains declined slightly from 55% to 53% (about even with the survey average). The distribution2 of responses is among the lowest for this metric.

Country expectations (this quarter/last quarter): US 1.9%/0.9% (secondlowest level in three years); Canada 4.8%/0.9%; Mexico 7.0%/3.9%.

Industry expectations (this quarter): Highest are T/M/E (7.3%), Healthcare/Pharma (3.6%), and Technology (3.3%); lowest are Manufacturing (1.0%), Energy/Resources (1.3%), and Services (2.1%).

Offshore hiring1

Expectations remain near their three-year low:

Offshore hiring growth expectations fell markedly in 1Q16 and have stayed low since then. This quarter’s 1.9% is only slightly up from last quarter’s three-year-low of 1.8%. The median remains at 0.0%, and 43% of CFOs expect gains (up from last quarter’s 39%).

Country expectations (this quarter/last quarter): US 1.9%/1.9%; Canada 1.1%/0.0%; Mexico 4.5%/1.6%.

Industry expectations (this quarter): Highest is Technology (4.1%); lowest are Energy/Resources (0.5%) and Manufacturing (1.3%).

Domestic wage growth1

Expectations down somewhat, but still comparatively high:

Domestic wage growth declined to 2.7% from last quarter’s 3.1%. The median held at 3.0%, and 97% of CFOs expect gains.

Country expectations (this quarter/last quarter): US 2.7%/3.1%; Canada 2.6%/2.2%; Mexico 4.3%/4.6%.

Industry expectations (this quarter): Highest is T/M/E (4.0%); lowest are Energy/Resources (2.3%) and Manufacturing (2.6%).

[1] All averages have been adjusted to eliminate the effects of stark outliers.

[2] “Distribution” refers to the spread of the middle 90% of responses.

from page 15:

Most worrisome risks

External concerns

Rising concerns about the tenor and potential economic impact of geopolitics—especially in Europe and the US:

Heightened election and policy concerns: Regulatory concerns are again strong and industry dependent. US election worries skyrocketed last quarter and increased this quarter (again with concerns around international trade and tax policy). Concerns about the tenor of the worldwide political environment rose sharply.

Concerns about broader global economic performance: For several quarters, including this one, CFOs’ concerns have appeared to be shifting from a specific focus on Europe and China to a more generalized focus on global economic stagnation and volatility.

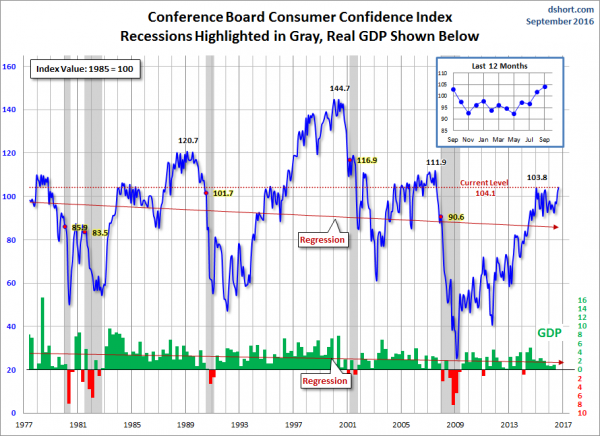

Moderating concerns about the US economy: Perhaps influenced by equity and real estate markets that are near all-time highs, strengthening consumer sentiment, and mostly positive economic news this quarter, CFOs’ concerns about the US economy appeared to decline. Still, rising concerns about political and policy uncertainty and lagging business spending suggest CFOs see potential risks to future US economic performance.

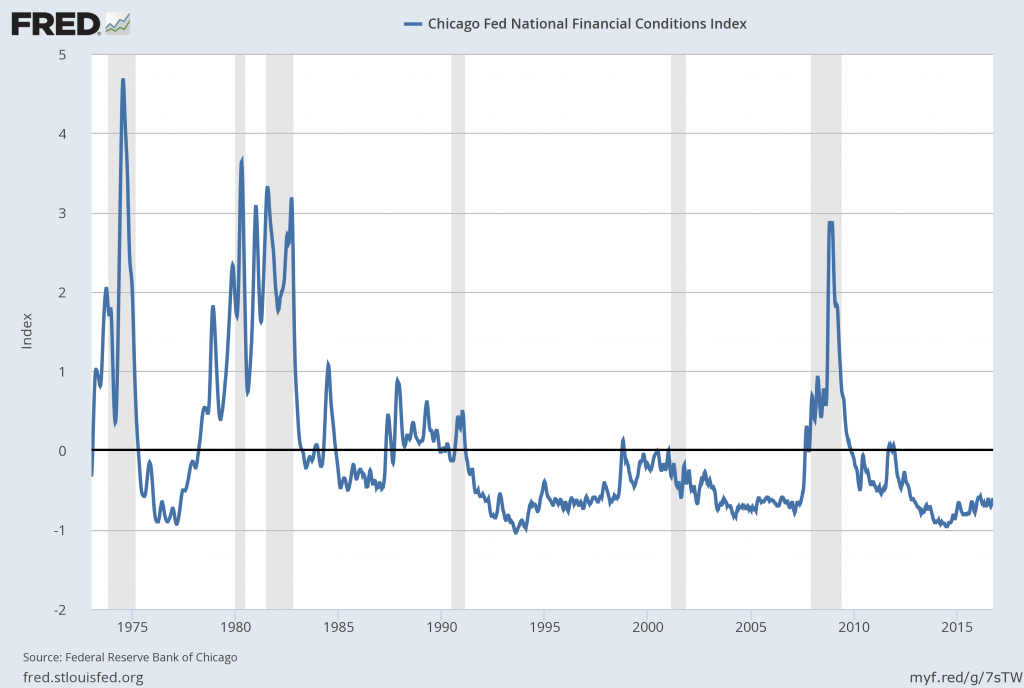

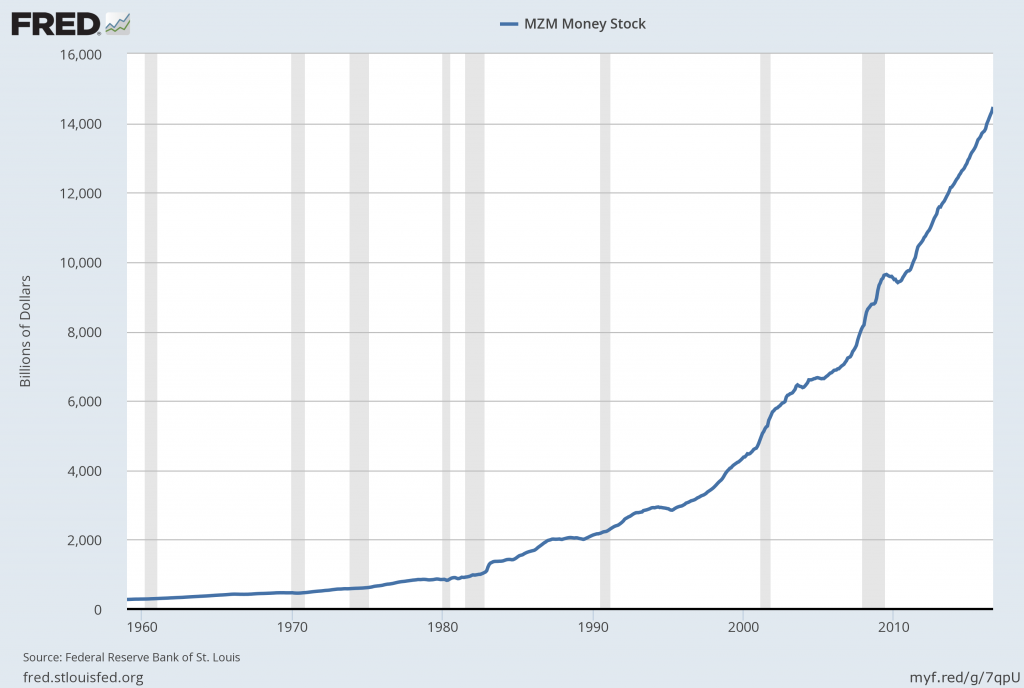

Less concern about capital markets; more about interest rates: With equity markets having recovered strongly, concerns about financial market risk appear to have declined. Concerns about a strong dollar and global debt levels also decreased, but concerns about interest rates (the possibility of rate increases and the longterm impacts of continuing low rates) rose sharply.

Falling commodity price worries: After climbing sharply over the last two quarters, worries about oil and other commodity prices fell significantly this quarter.

Internal concerns

Talent again the top internal challenge:

Consistent talent challenges: Concerns around securing and retaining key personnel continued this quarter, as did those related to leadership succession.

Escalating growth and execution concerns: CFOs again voiced concerns about executing their growth initiatives, innovating, and executing against their strategies and plans.

–

Among the various charts and graphics in the report are graphics depicting trends in “Own Company Optimism” and “Economic Optimism” found on page 6.

_____

I post various business and economic surveys because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2149.85 as this post is written