From Jerome Powell’s opening comments:

Job gains averaged 240,000 per month over the past three months, well above the pace needed in the longer run to absorb new entrants into the labor force. The unemployment rate remained low in February at 4.1 percent, while the labor force participation rate moved higher. Over the past four years, the participation rate has remained roughly unchanged. That’s a sign of improvement, given that the aging of our population is putting downward pressure on the participation rate, and we expect that the job market will remain strong.

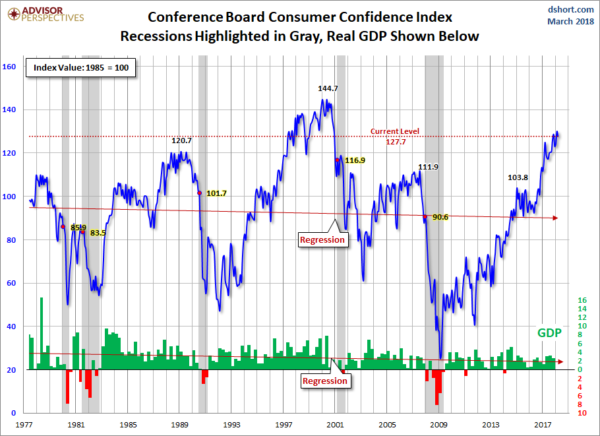

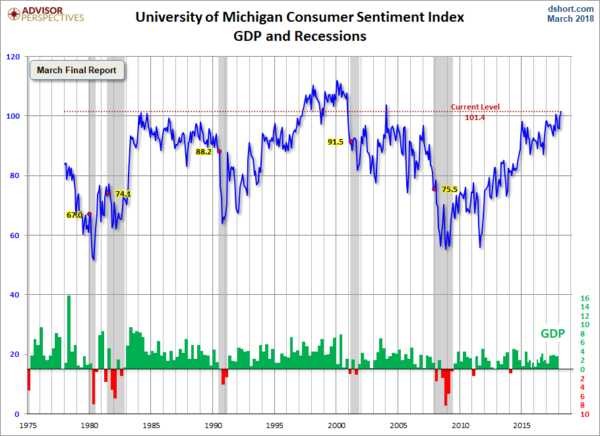

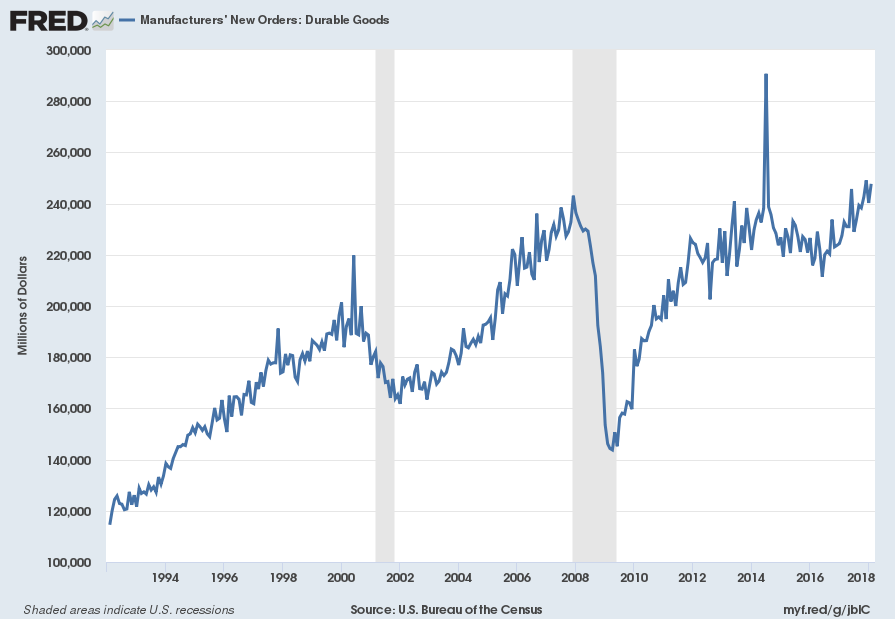

Although the growth rates of household spending and business investment appear to have moderated early this year, gains in the fourth quarter were strong and the fundamentals underpinning demand remain solid. Indeed, the economic outlook has strengthened in recent months. Several factors are supporting the outlook: fiscal policy has become more stimulative, ongoing job gains are boosting incomes and confidence, foreign growth is on a firm trajectory, and overall financial conditions remain accommodative.

Jerome Powell’s responses as indicated to the various questions:

MICHAEL DERBY. I’m Mike Derby from Dow Jones Newswires. I have a question about the future of the mechanics of monetary policy. I wanted to know whether you favor sticking with the system that you have now of keeping interest on excess reserves and reverse repo–the reverse repo rate to control interest rates, or do you want to shift back to the old way of doing things at some point of targeting the fed funds market? And, do you have any concern that if you do stick with the current system that as rates rise that you might see issues where the Fed is under–is being criticized for paying out ever larger shares of money to banks, you know, to control interest rates that some might perceive as a subsidy to the banks that are getting this money?

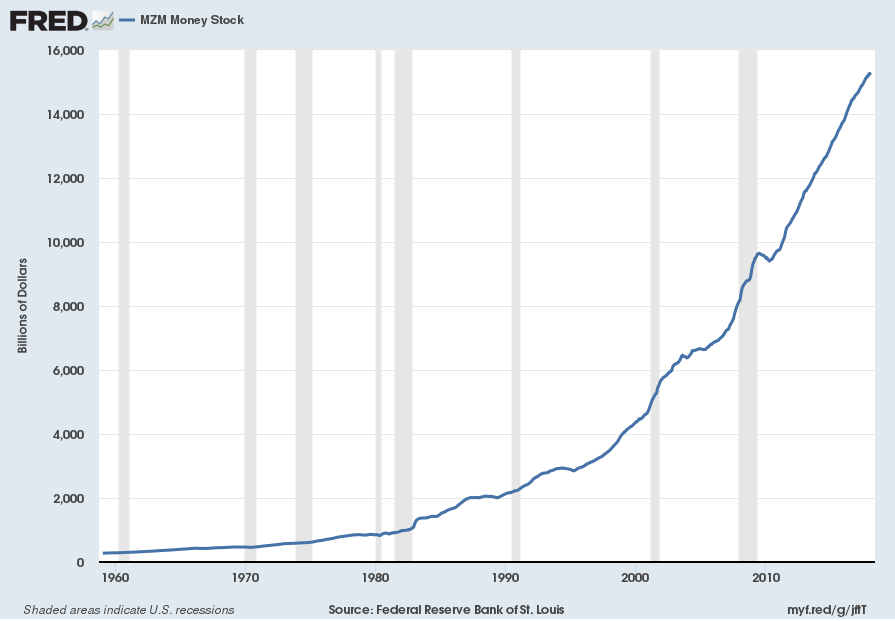

CHAIRMAN POWELL. Sure. Our current framework for implementing monetary policy is working very well. We have excellent control over rates, and it’s working. And it’s–you described it accurately. We haven’t made a decision to keep that as our longer-run framework. We haven’t really addressed that question. We’ve had meetings where we’ve talked about it, and we’ve agreed that it’s working well. But it’s–and it’s not something I see us as needing to urgently address. I think we’re continuing to learn about this framework. For example, one, in the longrun, the size of the balance sheet’s going to depend on the public’s demand for our liabilities, including currency and reserves. So, we don’t know what the demand is for reserves in a world where you have, you know, you have regulations that require banks to hold lots of high quality liquid assets, and reserves are one of those. So, it’s not something we’re looking at resolving in the near-term.

You mentioned the question of interest on excess reserves, and I think it’s a little bit of a misnomer to think that there’s a subsidy there. We pay interest on excess reserves. We can’t pay interest in excess reserves that is above the general level of short-term interest rates. So, we’re paying rates that banks can get from other interest rates from any other investment in the shortterm money markets. In addition, remember that those liabilities–those are our liabilities. The assets that we have on the other side are treasury securities and mortgage-backed securities, which we yield much higher than interest on reserves. So, in fact, it’s not a subsidy, and it’s not a cost to the taxpayer.

also:

GREG ROBB. Over here. Thank you, Chairman. Thank you very much. Greg Robb from MarketWatch. Several of your colleagues recently have been speaking and expressing concern about financial imbalances and rising signs of financial imbalances. I was wondering if you could give us your view on the asset markets. Are–do you see any bubbles? And do you have the tools you need, you think, to combat those? Thank you very much.

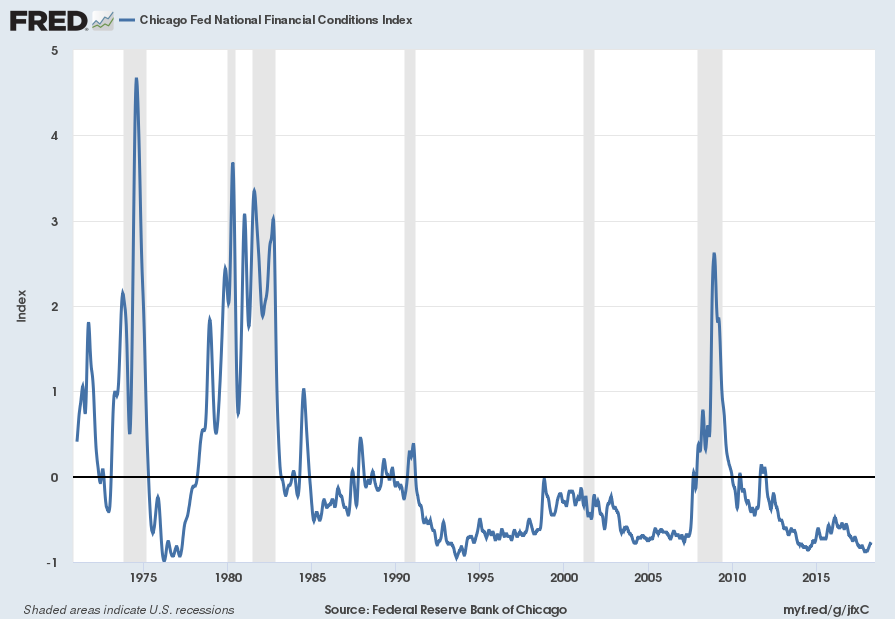

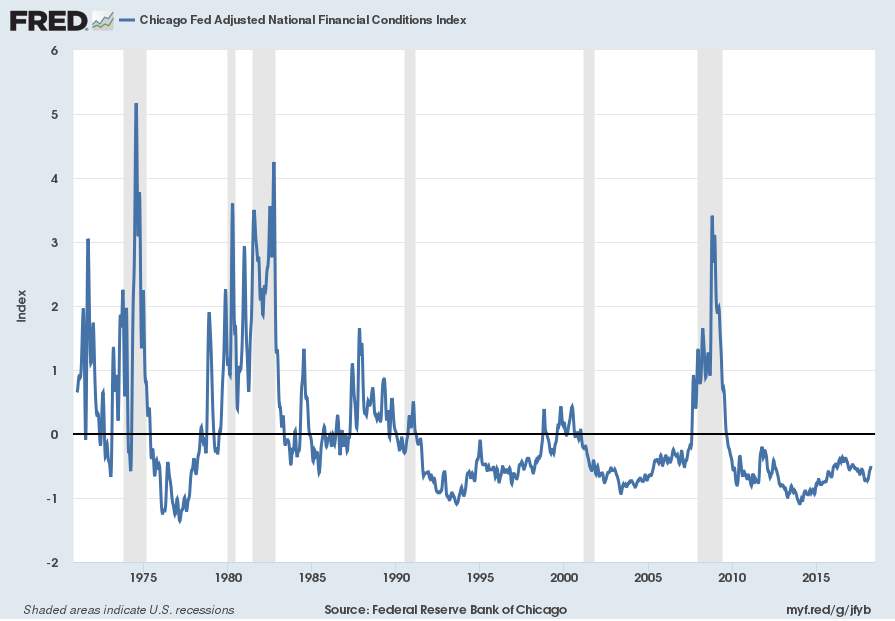

CHAIRMAN POWELL. Since the financial crisis, we’ve been monitoring financial conditions and financial stability issues very carefully, and the FOMC receives regular briefings about the staff framework and sort of measures of various aspects of financial stability risks, and the current view of the Committee is that financial stability vulnerabilities are moderate, let’s say, and I’ll go through a couple of pieces of that.

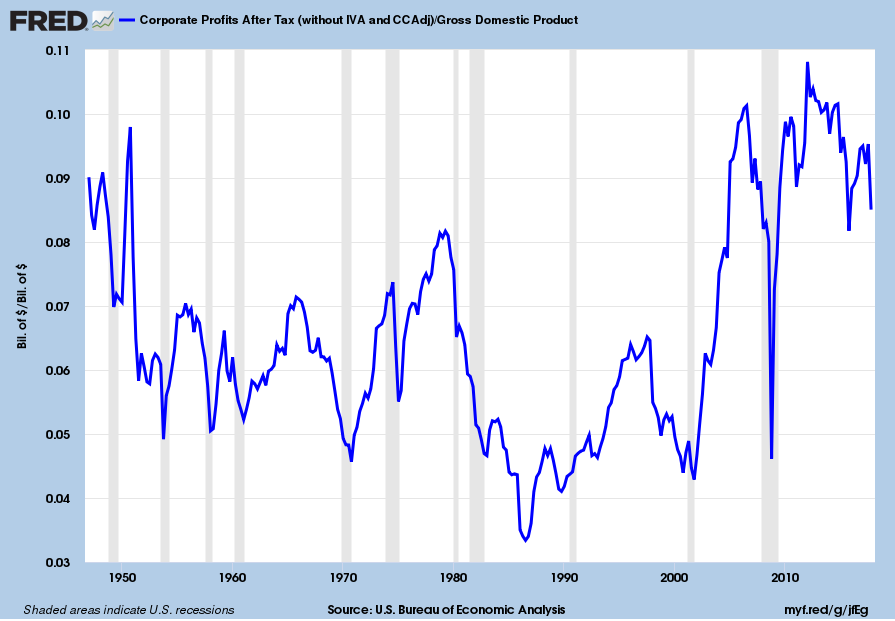

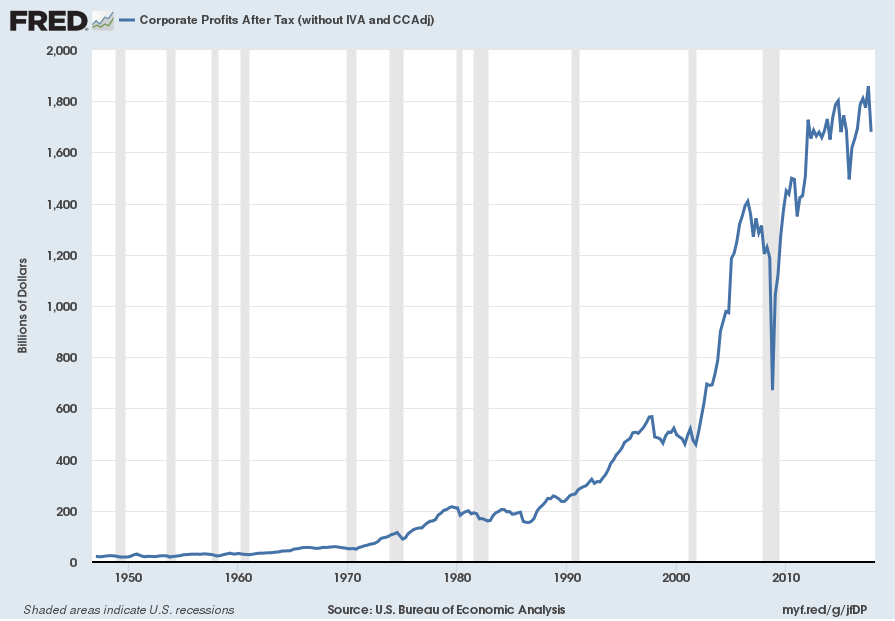

So, if you look at the banking system, particularly the large financial institutions, you see higher capital. You see much higher liquidity. You see them more aware of their risks and better able to manage them with stress testing. And if one–if something does go wrong, you’ve got better ability to deal with the failure of those institutions. So, therefore, you don’t see high leverage. You don’t see excess risk-taking in great quantity the way you see before the crisis. If you look at households, household balance sheets are in much better condition. If you look at nonfinancial corporations, you see–you do see relatively elevated levels of borrowing, but nothing that suggests, you know, serious risks. And, of course, default rates are very low. So, those readings look okay. I should mention also that for large financial institutions, they’re no longer funded by a lot of short-term wholesale funding, which can disappear very quickly. So, they’re far less vulnerable to liquidity issues. Overall, those aspects, I think, suggest low levels of vulnerability.

You identified the, really, one area where, which is an area of focus, which is asset prices. So, in some areas, asset prices are elevated relative to their longer-run historical norms. You can think of some equity prices. You can think of commercial real estate prices in certain markets. But we don’t see it in housing, which is key. And so, overall, if you put all of that into a pie, what you have is moderate vulnerabilities in our view. In terms of whether we have the tools, you know, we have some tools, and I think we certainly will use them. We have–I think the stress test is a really important tool that we have for the largest financial institutions and for the smaller financial institutions. We regularly use that to–as a way to test against various, you know, market shocks, certainly for the larger institutions.

also:

NANCY MARSHALL-GENZER. Nancy Marshall-Genzer with Marketplace. Does the interest rate hike today suggest that Americans are being paid enough? Are you satisfied with the rate of wage growth right now?

CHAIRMAN POWELL. As I mentioned, you know, we’ve had unemployment decline sharply since, I guess, 2010, when it peaked at 10 percent and down to 4.1 percent now, and we’ve seen only modest increases in wages. So, on the one hand, what wages should in theory represent is inflation plus productivity increases. You should get paid for your productivity plus inflation, and productivity’s been very low. Inflation’s been low. So, these low wage increases, in a sense, they do make sense in that–from that perspective.

On the other hand, as the market is tightened, as labor markets have tightened, and we hear reports of labor shortages that we see that, you know, groups of unemployed are diminishing, and the unemployment rate is going down, we haven’t seen, you know, higher wages, wages going up more. And I would–I think I’ve been surprised by that, and I think others have as well. In terms of what’s the right level, I don’t think I have a view on what the right level of wages is, but I think we will know that the labor market is getting tight when we do see a more meaningful upward move in wages.

also:

MYLES UDLAND. Thanks. Myles Udland, Yahoo Finance. Chair Powell, I’m curious if the Fed would be willing to tolerate an inverted yield curve. We continue to see these spread between the two-year and the 10-year tighten, even with longer-term yields coming up since the beginning of the year. This is a dynamic that has typically preceded recessions, and we’re likely to see shorter-term rates come up as the Fed continues to increase rates. So, I’m just curious if you guys have discussed that, if you’d be willing to push back against that, or if that’s a dynamic you’d be comfortable with?

CHAIRMAN POWELL. You know, it’s an interesting question, and there are a range of views there. I think it’s true that yield curves have tended to predict recessions if you look back over many cycles, but a lot of that was just situations in which inflation was allowed to get out of control, and the Fed had to tighten, and that put the economy into a recession. That’s really not the situation we’re in now, so I don’t know that that’s–I don’t know that–I don’t think that recession probabilities are particularly high at the moment, any higher than they normally are. But, having said that, I think it’s–there are good questions about what a flat yield curve or inverted yield curve does to intermediation. It’s hard to find in the research data, but nonetheless, I think those are issues that we’ll be watching carefully.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2686.76 as this post is written