Below are Jerome Powell’s comments I found most notable in the order they appear in the transcript. (Please note that in general I don’t necessarily agree with his comments, and in many cases disagree with them):

SCOTT PELLEY, CBS NEWS / 60 MINUTES: There’s only one question that anyone wants an answer to, and that is: when does the economy recover?

JEROME POWELL, CHAIRMAN OF THE FEDERAL RESERVE: It’s a good question. And very difficult to answer because it really does depend, to a large degree, on what happens with the coronavirus. The sooner we get the virus under control, the sooner businesses can reopen. And more important than that, the sooner people will become confident that they can resume certain kinds of activity. Going out, going to restaurants, traveling, flying on planes, those sorts of things. So that’s really going to tell us when the economy can recover.

PELLEY: Many states are beginning to reopen their economies. Do you consider the virus under control?

POWELL: Well, I think we’re going to see what happens with that. People will need to take certain measures to protect themselves. Wash their hands, wear masks in certain situations and things like that. And I do think that over the next couple of months, you’re going to be seeing the beginnings of the recovery, as people, as businesses reopen and people go back to work.

The big thing we have to avoid during that period is a second wave of the virus. But if we do, then the economy can continue to recover. We’ll see GDP move back up after the very low numbers of this quarter. We’ll see unemployment come down. But I think though it’ll be a while before we really feel, well recovered.

PELLEY: Well, that is the question that everyone wants an answer to: “What is a while?” Can there be a recovery without a reasonably effective vaccine?

POWELL: Well, I think you’ll see, again assuming there’s not a second wave of the coronavirus, I think you’ll see the economy recover steadily through the second half of this year. I do think that people will be careful about resuming their typical spending behavior. So certain parts of the economy will recover much more slowly.

Travel, entertainment, things that we do that involve being around lots of other people.

So for the economy to fully recover, people will have to be fully confident. And that may have to await the arrival of a vaccine. But in any case, the economy can continue to, can start getting better fairly soon.

also:

PELLEY: What economic reality do the American people need to be prepared for?

POWELL: Well, I would take a more optimistic cut at that, if I could, and that is: this is a time of great suffering and difficulty. And it’s come on us so quickly and with such force, that you really can’t put into words the pain people are feeling and the uncertainty they’re realizing. And it’s going to take a while for us to get back.

But I would just say this. In the long run, and even in the medium run, you wouldn’t want to bet against the American economy. This economy will recover. And that means people will go back to work. Unemployment will get back down. We’ll get through this. It may take a while. It may take a period of time. It could stretch through the end of next year. We really don’t know. We hope that it will be shorter than that, but no one really knows. What we can do is the part of it that we can control — is to be careful as businesses go back to work. And each of us individually and as a group, you know, take those measures that will protect ourselves and each other from the further spread of the virus.

PELLEY: As this period of time grows longer, what begins to happen to the economy?

POWELL: There’s a real risk that if people are out of work for long periods of time, that their skills atrophy a little bit and they lose contact with the workforce. This is something that shows up in the data — that longer and deeper recessions tend to leave behind damage to people’s careers. And that weighs on the economy going forward.

You could say the same thing about businesses. The small and medium size businesses that are so important to this country, if they have to go through a wave of avoidable insolvencies, you’ve lost something there that’s more than just a few businesses.

You know, it’s really the job creation machine. And if that happens, it will take some time to recover from it.

I think the good news is that we have policies that can go some way toward minimizing those effects. And that’s by keeping people and businesses out of insolvency just for maybe three or six more months while the health authorities do what they can do. We can buy time with that. And so I think that kind of support may be appropriate.

PELLEY: Some of the best economic analysts in the world report to you. And I wonder what they’re telling you the height of unemployment will be.

POWELL: Again, nobody knows. I would say this though. It seems as a reasonable base case that there will be more layoffs probably this month and next month. And as we sit here, 20 million people have lost their jobs in a period of really two months. And it’s heartbreaking because where we were just two months ago was we had the lowest unemployment in 50 years, the lowest African-American unemployment ever since we began measuring it.

We had low- and moderate-income communities telling us that this was the best labor market, that you can finally see the benefits of what a tight labor market actually means. More opportunity. And it looked like we would continue to see that going forward for some time and further and further benefits.

Instead, we have this situation where 20 million people have lost their jobs. And my sense is that it’s likely that we’ll have a couple more months of net job losses. Then, assuming that the economy does begin to reopen and we do that successfully, you’ll see people going back to work.

The good news is that the 20 million people who’ve been laid off overwhelming report themselves as having been laid off temporarily. They’re considered temporarily unemployed. And that’s because they expect to go back to their old job.

So if those businesses can reopen and if we can do it in a way that doesn’t create further problems with the virus, then people can go back to work. So I would say the peak unemployment might be in the next couple of months. And then you might see it coming down over the second half of the year.

also:

PELLEY: 25% is the estimated height of unemployment during the Great Depression. Do you think history will look back on this time and call this the Second Great Depression?

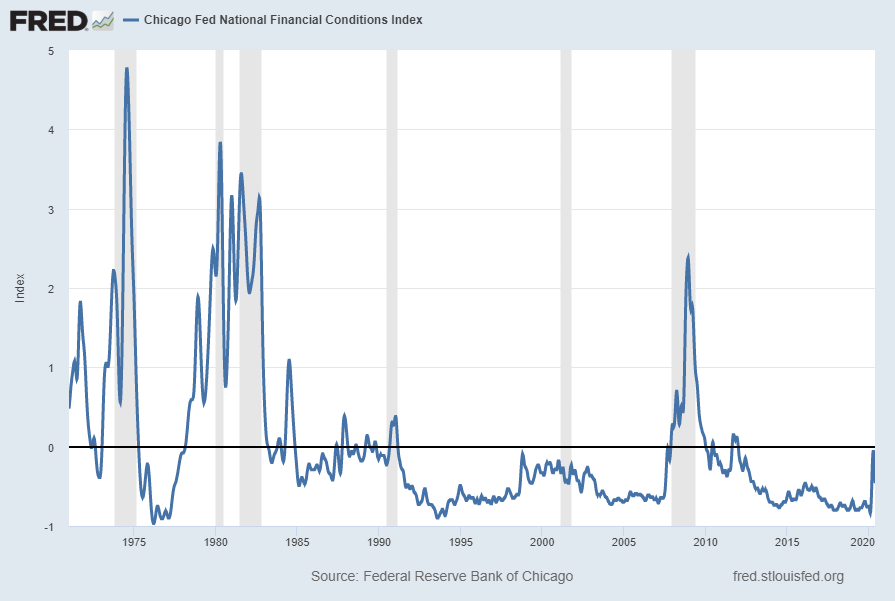

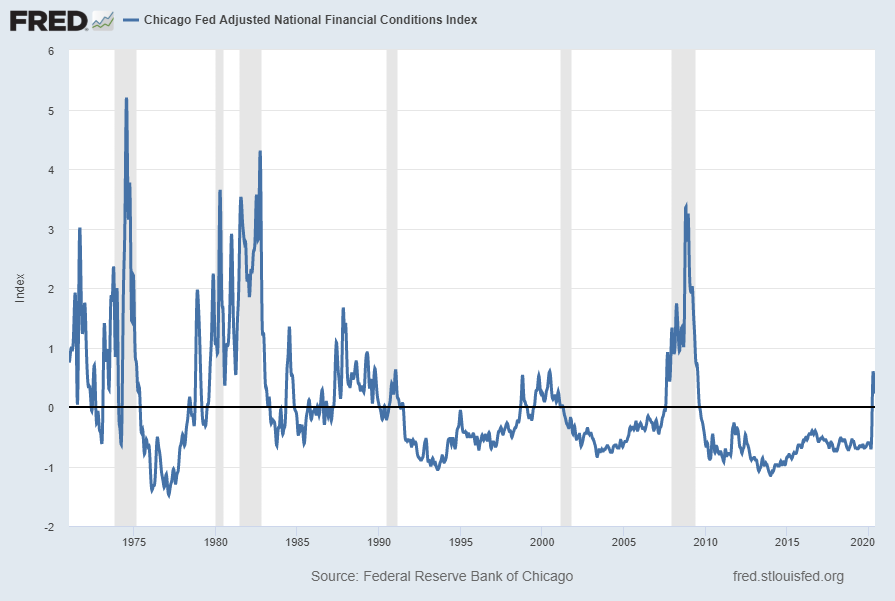

POWELL: No, I don’t. I don’t think that’s a likely outcome at all. There’re some very fundamental differences. The first is that the cause here– we had a very healthy economy two months ago. And this is an outside event, it is a natural disaster, in effect. And that’s one big difference. In the ’20s when the Depression, well, when the crash happened and all that, the financial system really failed. Here, our financial system is strong has been able to withstand this. And we spent ten years strengthening it after the last crisis. So that’s a big difference. In addition, the last thing I’ll say is that the government response in the ’30s, the central banks were trying to raise interest rates to keep us on the gold standard all around the world. Exactly the opposite of what needed to be done.

In this case, you have governments around the world and central banks around the world responding with great force and very quickly. And staying at it. So I think all of those things point to what will be — it’s going to be a very sharp downturn. It should be a much shorter downturn than you would associate with the 1930s.

also:

PELLEY: Are the banks sound?

POWELL: So after the last financial crisis, the banks more than doubled their capital and liquidity and they’re far more aware and better at managing the risks they’re taking. They’re so much stronger than they were before the financial crisis, the last financial crisis. In fact, they were right at the heart of that. They were a key mechanism for amplifying bad things that happened. That’s not the case at all now. They’ve been strong. They’ve done all the things you would hope they would do. Companies have pulled down their lines of credit. They’ve funded those. There’s — much more cash has flooded into the banking system as people have sold risky assets. And the banks have absorbed all of that. So the banks have been strong so far.

PELLEY: And for people who wonder whether they should take their money out of the bank and put it in a mattress, you tell them what?

POWELL: There’s no need to do that. No need at all. The banks have been strong, they’ve been fine. There’s absolutely no need to do that.

PELLEY: There’s no worry there?

POWELL: No.

also:

PELLEY: What we’re seeing is the federal government borrowing trillions, upon trillions of dollars to try to dig us out of this hole. How long can that go on?

POWELL: Well, if you take a longer perspective, the U.S. has been spending more than it’s been taking in for some time. And that’s something we’re going to have to deal with. The time to deal with that, the time to get on a sustainable fiscal path, which really just means that the economy is growing faster than the debt, and that means you’ve got to control the growth of the debt — the time to do that is when the economy is strong. When unemployment is low, when economic activity is high, that’s when you deal with that problem. This is not the time to prioritize that concern.

The United States is the world’s reserve currency. The dollar is the world’s reserve currency. And we have the ability to borrow at low rates. We have the ability to service that debt. And I would say this is the time when we can use that strength to our longer run benefit. It is true that deficits are going to be big for a couple of years here. And that we’ll have to deal with that. The time to deal with that though is when we’re through this recovery.

Again, this is an economic shock that’s different and bigger than any in our lifetime. But it’s not from inside the economy. It’s from outside the economy. And so it doesn’t say anything bad about our economy. We can get back to a healthy economy fairly quickly. And the spending that we’re doing to support people and businesses will help us do that.

also:

PELLEY: What gives you hope in this dark time?

POWELL: Well, as I mentioned, in the long run, I would say I would never bet against the American economy or the American people. We have a great economy. We have highly industrious people. We have the most dynamic economy in the world. And we’re the home of so much of the great technology in the world.

So in the long run, I would say the U.S. economy will recover. We’ll get back to the place we were in February; we’ll get to an even better place than that. I’m highly confident of that. And it won’t take that long to get there. It will take some time to get there. So I think we’re going to need to help each other through this. And we will.

also:

PELLEY: Finally, what metrics are you looking at here hour by hour, day to day, to divine what the future is going to be?

POWELL: You know, at the moment, the thing that matters more than anything else is the medical metrics, frankly. It’s the spread of the virus. It’s all the things associated with that. Of course, we’re also looking at the employment data.

But in a sense, the real-time economic data that we’re seeing is just a function of how successful the social distancing measures are. So the data we’ll see for this quarter, which ends in June, will be very, very bad. There’ll be a, you know, big decline in economic activity, big increase in unemployment. But in a sense, those are a byproduct. So what we’re really looking at is getting the medical data, which is not what we usually look at, taken care of so that the economic data can start to recover. And that we think can happen as soon as the third quarter.

_____

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2953.91 as this post is written