From Chairman Powell’s opening comments:

CHAIR POWELL. Good afternoon everyone, and welcome. I will begin with an overview of economic conditions and an explanation of the decisions the Committee made at today’s meeting.

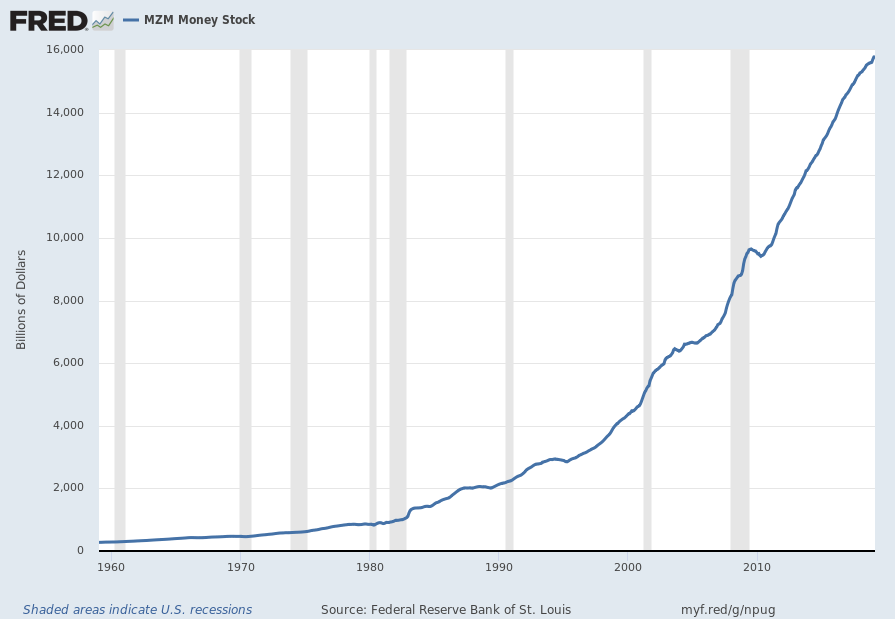

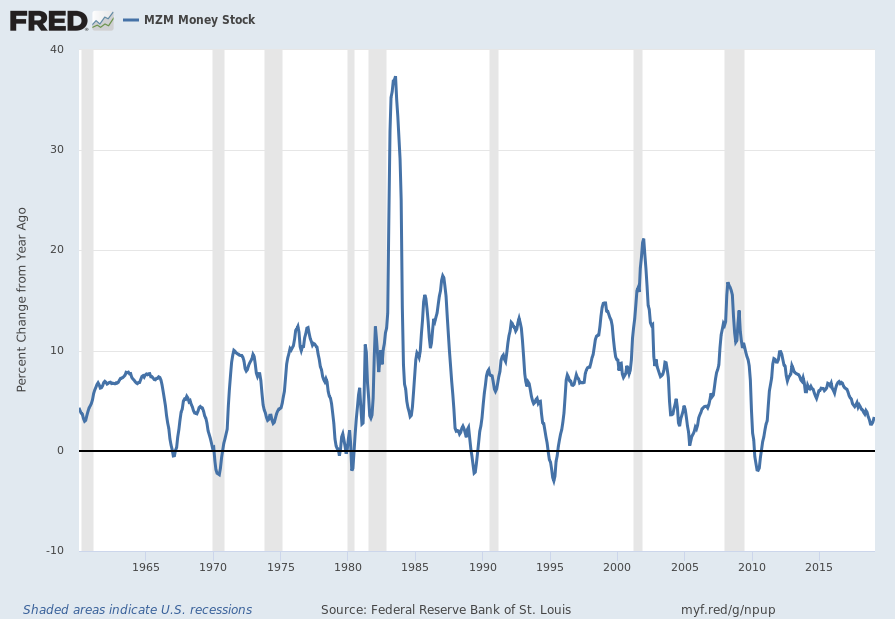

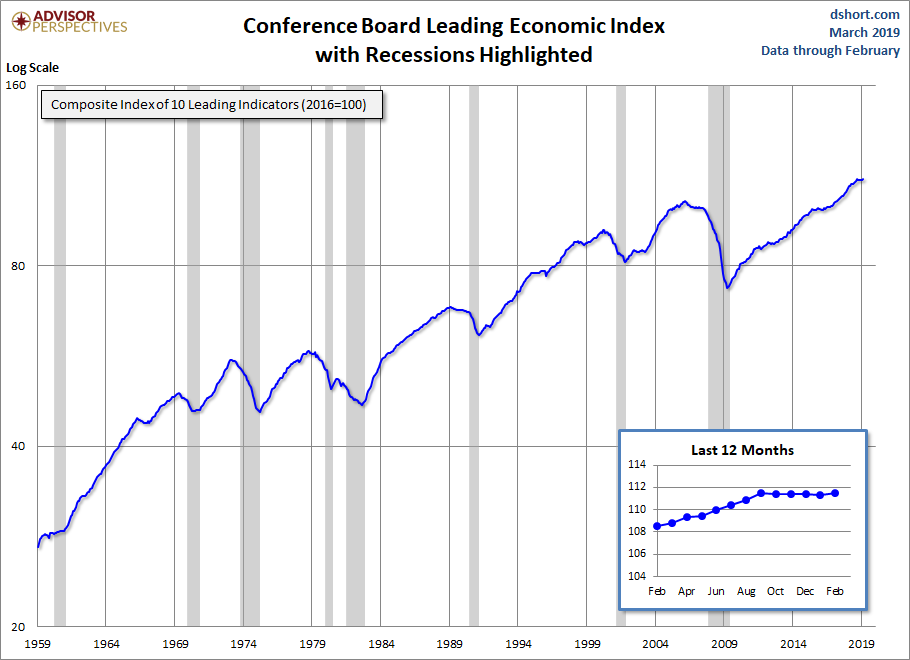

My colleagues and I have one overarching goal: to sustain the economic expansion, with a strong job market and stable prices, for the benefit of the American people. The U.S. economy is in a good place, and we will continue to use our monetary policy tools to help keep it there. The jobs market is strong, showing healthier wage gains and prompting many people to join or remain in the workforce. The unemployment rate is near historic lows, and inflation remains near our 2 percent goal. We continue to expect that the American economy will grow at a solid pace in 2019, although likely slower than the very strong pace of 2018. We believe that our current policy stance is appropriate.

also:

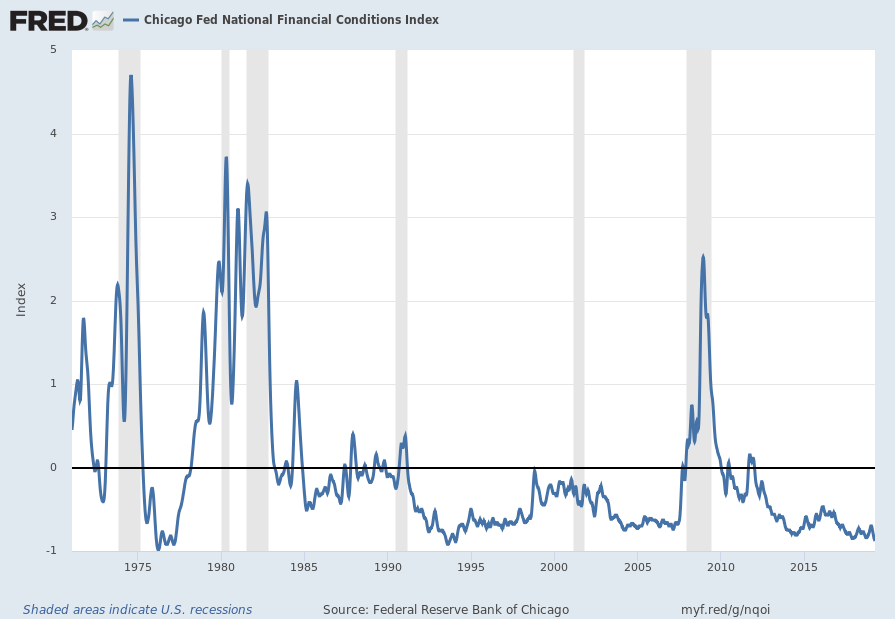

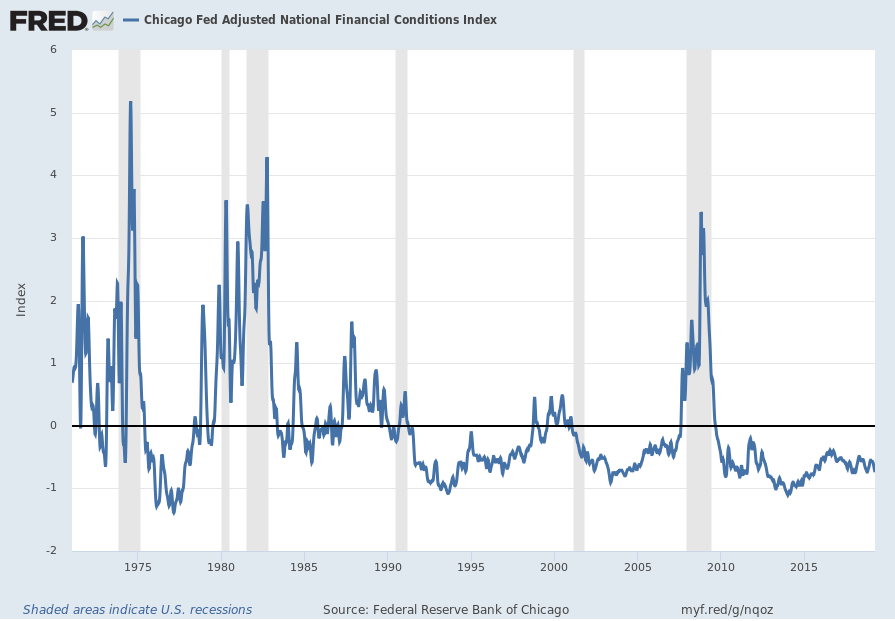

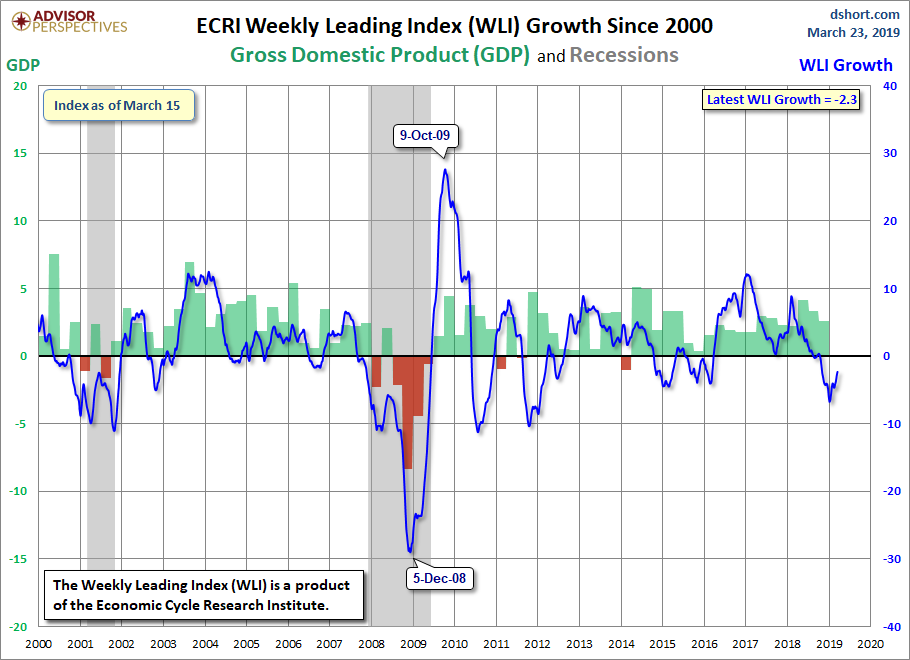

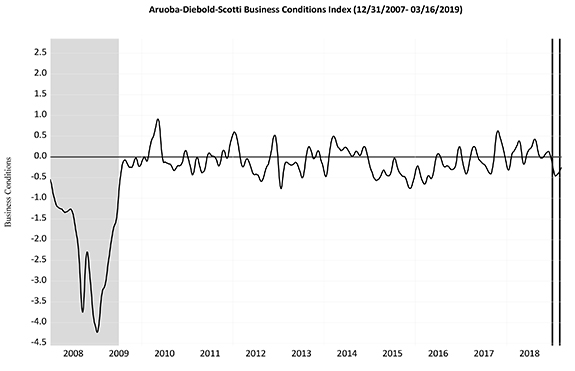

Data arriving since September suggest that growth is slowing somewhat more than expected. Financial conditions tightened considerably over the fourth quarter. While conditions have eased since then, they remain less supportive of growth than during most of 2018. Growth has slowed in some foreign economies, notably in Europe and China. While the U.S. economy showed little evidence of slowdown through the end of 2018, the limited data we have so far this year have been somewhat more mixed. Unusually strong payroll job growth in January was followed by little growth at all in February. Smoothing through these variations, average monthly job growth appears to have stepped down from last year’s strong pace, but job gains remain well above the pace necessary to provide jobs for new labor force entrants. Many other labor market indicators continue to show strength. Weak retail sales data for December bounced back considerably in January, but on balance seem to point to somewhat slower growth in consumer spending. Business fixed investment also appears to be growing at a slower pace than last year. Inflation has been muted, and some indicators of longer-term inflation expectations remain at the low end of their ranges in recent years. Along with these developments, unresolved policy issues such as Brexit and the ongoing trade negotiations pose some risks to the outlook.

Jerome Powell’s responses as indicated to the various questions:

HEATHER LONG. Heather Long from the Washington Post. On the broader economy, can you clarify how worried the FOMC is about a steep slowdown. Some of the actions today look like there is more worry, and on the balance sheet, can you clarify, does the FOMC see the runoff as a form of monetary tightening?

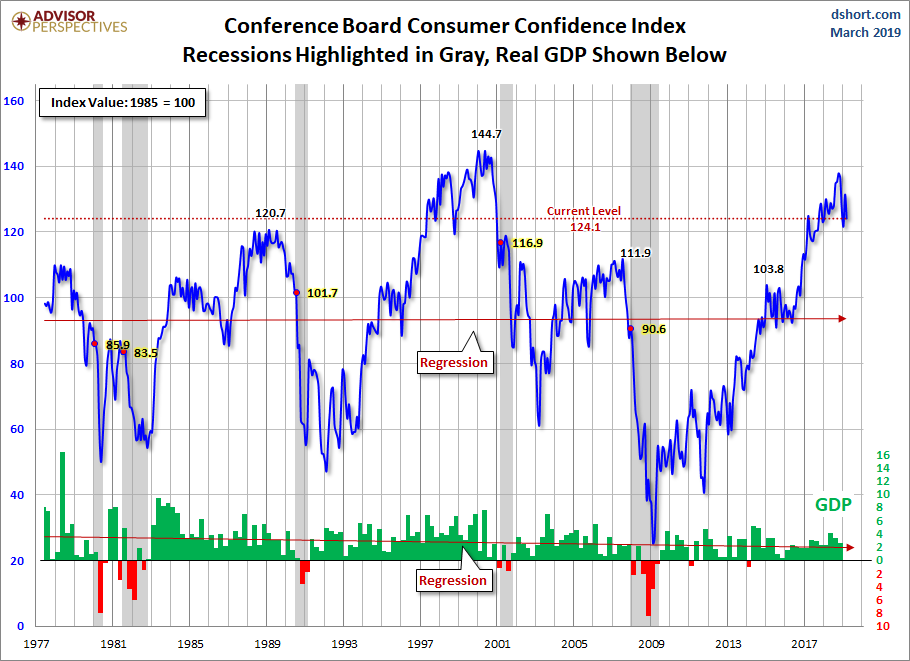

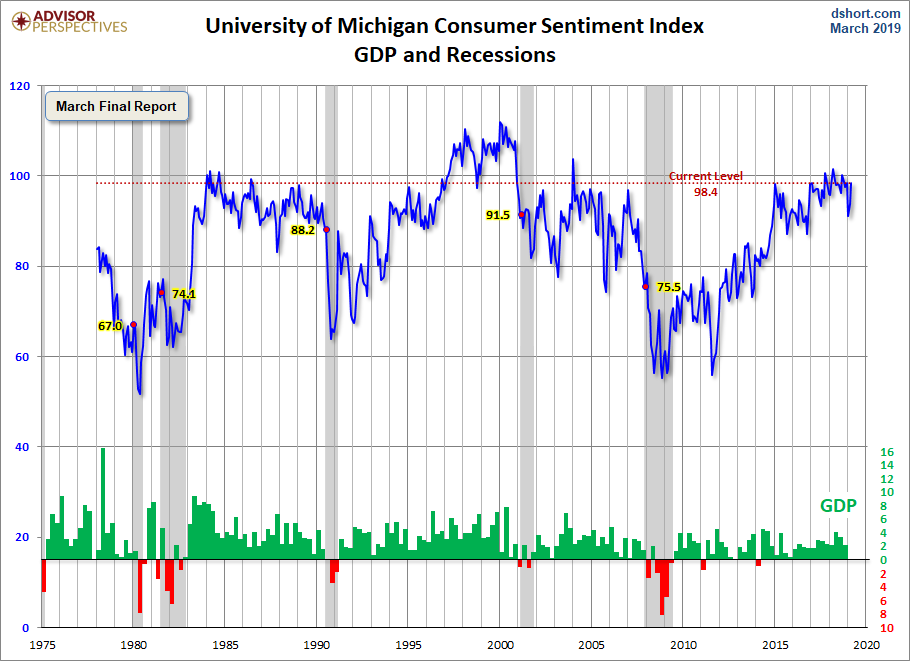

CHAIR POWELL. So, on the outlook, our outlook is a positive one. So, as I mentioned, FOMC participants continue to see growth this year of around two percent, just a bit below what we saw back in at the end of last year. And part of that is seeing that economic fundamentals, underlying economic fundamentals are still very strong. You have a strong labor market by most measures. You have rising incomes. You’ve got very low unemployment. You have confident surveys for households and also for businesses that are at attractive levels, and you also have financial conditions that are more accommodative than they were a couple of months ago. So, we see the outlook as a positive one. As far as balance sheet, the balance sheet plan, the answer to that is, you asked whether that’s related to our monetary policy in effect, and the answer is really no. We still think of the interest rate tool as the principal tool of monetary policy, and we think of ourselves as returning the balance sheet to a normal level over the course of the next six months, and were not really thinking of those as two different tools of monetary policy.

STEVE LIESMAN. Steve Liesman, CNBC. Mr. Chairman, can you talk about how global developments are affecting the U.S.? What’s the cause of the weakness over there? How much is it responsible for the downgrade in GDP over here and what impact are tariffs both in the United States and retaliatory tariffs having on both the U.S. and the global economies? Thank you.

CHAIR POWELL. So, global economy was a tailwind for the United States in 2017. That was the year of synchronized global growth, and we began 2018 expecting and hoping for more of the same. What happened instead is that the global economy started to gradually slow, and now we see a situation where the European economy has slowed substantially and so has the Chinese economy, although the European economy more. And just as strong global growth was a tailwind, weaker global growth can be a headwind to our economy. How big is that effect? It’s hard to be precise about it, but clearly we will feel that. It is an integrated global economy, and global financial markets are integrated as well. In terms of what’s causing it, it seems to be a range of different things. In China you have, you know, factors that are very specific to China. The main point though is that I would say the outlook, let’s look at the outlook, Chinese authorities have taken many steps since the middle of last year to support economic activity, and

I think the base case is that ultimately Chinese activity will stabilize at an attractive level. And in Europe, you know, we see some weakening, but, again, we don’t see, we don’t see recession, and we do see positive growth still. You ask about tariffs. I would say tariffs may be a factor in China. I don’t think they’re the main factor. I think the main factors are the levering campaign that the government undertook a couple of years ago and also just the longer term slowing to a more sustainable pace of growth that economies find as they mature. In terms of our own economy, the level of tariffs is relatively small in the size of our economy, relative to the size of our economy. We have since the beginning of the year and before really been hearing from our extensive network of business contacts, a lot of concerns about tariffs, concerns about material costs on imported products and the loss of markets and things like that, depending on which industry. So, there’s a fair amount of uncertainty. It’s hard to say how much of an effect that’s having on our economy. It’s very hard to tease that apart, but I will say it’s been a prominent concern among our business contacts for some time now.

also:

JIM TANKERSLEY. Hi, Mr. Chairman, Jim Tankersley, New York Times. I’m curious, you’re now a full percentage point, actually more than a percentage point below the White House in your projections for growth this year. By my calculations, that’s the largest spread we’ve seen since the end of the recession between the White House and the Fed. Why, for one, do you see, do you see the economy so differently than they do, and do you worry at all about implications for policy from that?

CHAIR POWELL. I haven’t, I haven’t seen their projection. I wouldn’t comment on their projection. I would take it this way. You can think of growth as being composed of two things. And one is really growth in the workforce, more hours worked, and the other is productivity. Its output per hour. You can really think of growth as those two things. And I’ve been calling, often mentioned these days that it would be great if we had national level policies to support higher labor force participation. The United States is now one of the lowest countries among the advanced economies in terms of our labor force participation by prime age workers. And that’s a place where we can grow faster. If we can bring more people into the labor force and give them a chance to contribute to and benefit from our overall prosperity, that will be a great thing for the country. So, I would like to see that. Productivity is much harder. Very difficult to project productivity over long stretches of time. It’s a function of evolving technology. So, I guess I would say what’s the, what is the potential growth rate? It’s quite hard to know with any precision, and I just would like to see us, you know, undertake an effort to make it be as high as it can sustainably be.

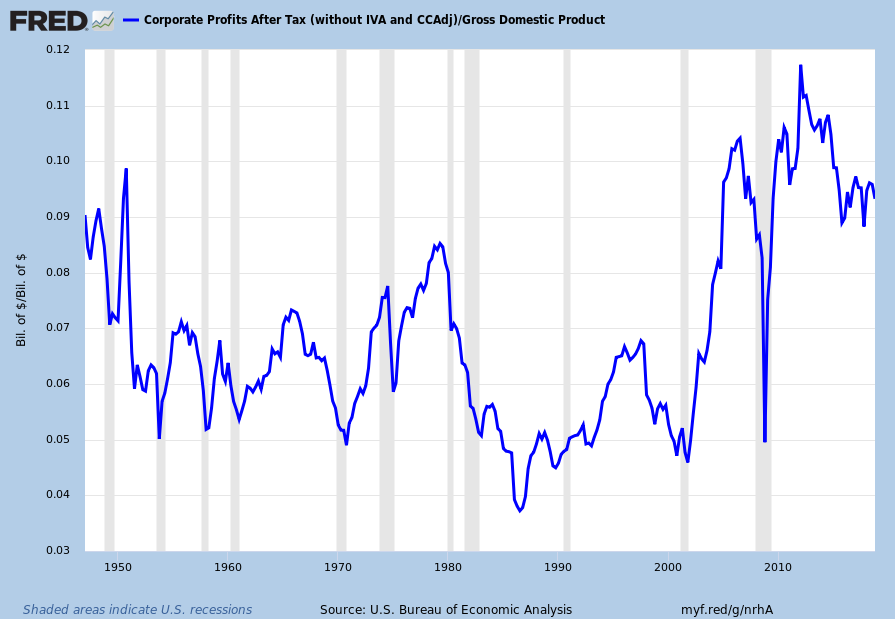

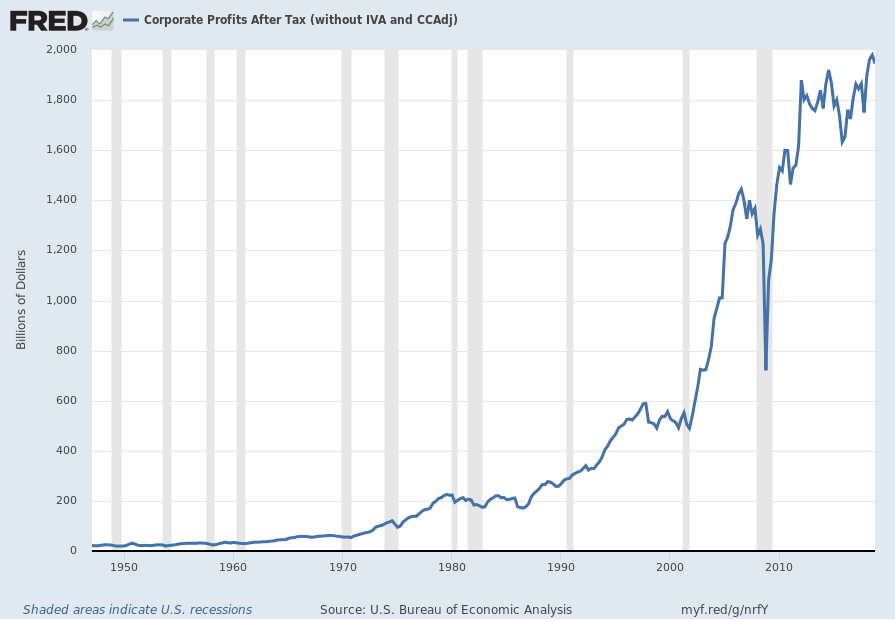

JIM TANKERSLEY. If I could follow up on that, do you see the tax cuts, the 2017 tax cuts as having provided a large boost to labor force participation as the White House does.

CHAIR POWELL. I would say so. I think it’s clear that the tax and spending policies that were adopted early last year supported demand in a significant way last year. And it’s also the case, I think, that they should have some supply side effects. I think it’s hard to know, it’s hard to identify those with any precision, and we hope they’re, we hope they’re very large. And the idea would be that lowering corporate taxes would spur more corporate investment, which would spur more productivity, and lowering individual taxes would spur greater labor force participation. I wouldn’t want to be handing, you know, assigning creditor blame for that, but I do think that the performance of labor force participation over the last really three or four years has been an upside surprise that most people didn’t see coming, and it’s extremely welcome.

also:

TREVOR HUNNICUTT. Trevor Hunnicutt from Reuters. You mentioned that you have kind of a positive outlook as it regards the economy but also see slower growth on the household side and the business side. Given how big of a part of the U.S. economy that is, what gives you kind of confidence that the slowdown we’re seeing is temporary.

CHAIR POWELL. So on the household side, what we saw was a very weak reading on retail sales in December and then a bounceback in the January reading, and, you know, it was a surprise, I would say, and inconsistent with a significant amount of other data. We’re not dismissing it in any way, but I would go back to what is it that supports consumer spending. It’s 70 percent of the economy, as you point out, and its strong economic underlying fundamentals. So, rising wages, high levels of employment, low levels of unemployment, high levels of job creation. Confidence.

The household confidence surveys have moved back up to where they were last summer. So we look at those fundamentals, and we think that looks like a setting in which consumption will have support from underlying economic fundamentals. And that’s really what we’re thinking there. So, you know, we’re also patiently watching and waiting and not assuming. We’re not taking no signal from the incoming data. That’s why we called it out in our statement. So, I think our eyes are open on this.

NICK TIMIRAOS. Nick Timiraos of the Wall Street Journal. Chair Powell, in 1998 the Fed eased policy in a way that some say may have avoided a recession, others say may have helped fuel the NASDAQ tech stock bubble, and financial conditions have eased considerably this year since the policy pivot that you made clear in January, the S&P, for example, it’s just three percent below last summer’s peak. And so I wonder, does this episode from 20 years ago bear at all on your thinking today about the risks posed by rising asset values in an environment of a shallower policy path?

CHAIR POWELL. We’re in a very different world today and post crisis, because we now very carefully monitor financial conditions and financial stability concerns on an ongoing basis, and we publish a report twice a year, and we have quarterly board meeting and briefings where we look deeply into these things. So this is something we have very much on our radar screen.

And I would say overall we don’t see financial stability vulnerabilities as high. There are some aspects of the financial markets that we’re carefully monitoring, and those are in the nature of things that might be amplifiers to a downturn as opposed to a financial stability concern, which might lead to a financial crisis and that kind of thing, which we don’t see.

So, we do monitor that, and I would also say, you know, that the whole question of monetary policy and financial stability is an unsettled and difficult one in our world. We do think that the principal tools for, you know, for managing financial stability are regulation, supervision, macroprudential tools, and those sorts of things as opposed to changing the interest rate. But we’re certainly very mindful of financial conditions and those risks.

NICK TIMIRAOS. If I could ask a followup? If it’s the case that we’re in a lower neutral interest rate world where you could have more asset price appreciation, do you think the Fed needs more macroprudential tools so that it doesn’t have to lean on monetary to do so much.

CHAIR POWELL. It’s a very difficult question with a long answer. We, in our system, we mainly rely on through the cycle tools like high capital and stress tests. Our financial stability system is built on those tools. High capital, high liquidity, resolution planning, stress testing. So those are always on. We also have some tools, like the countercyclical capital buffer, which we can deploy at times when vulnerabilities are meaningfully above normal. But we do rely on those tools. And I would say our banks are well capitalized. They’re far better capitalized and better aware of their risks and more liquid than they were before the financial crisis. So they’ll be more resilient in, you know, in difficult states of the economy.

also:

NANCY MARSHALL-GENZER. Nancy Marshall-Genzer with Marketplace. Just a quick follow-up on Brexit. You mentioned that you’re making sure that U.S. financial institutions are ready for whatever outcome. I’m wondering, can you be a little more specific about that, and also how are you preparing for any pressures that a hard Brexit would put on the U.S. dollar?

CHAIR POWELL. Well, as I mentioned, you know, with the stress test that the largest financial institutions, and those are the ones that tend to be active internationally, that they undergo every year, we put them through very large financial shocks with large losses and big changes in markets every year. And we vary that every year. So, that’s a pretty good, you know, having done that for a number of years now, that’s, and having them be required to have adequate capital and liquidity even after all that happens. So that’s a good thing to have done knowing that you’re going into something that’s quite unknown, which may prove stressful. It may not prove stressful depending on what the outcome is. So, I think all that has probably prepared our institutions well. That said, nothing like this has happened in recent years, and so it’s really hard to be confident. So, we’re very watchful about what’s going on.

[ Inaudible Comment ]

So we don’t, you know, the dollar is really the business of the Treasury Department. It’s certainly a financial condition unto itself that plays into our models, but we don’t, you know, seek or model or attempt to affect the dollar directly with our policies.

_____

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2854.14 as this post is written