This post provides an update to various past posts discussing

deflation and “deflationary pressures,” including the most recent post, that of September 21, 2015 titled “

U.S. Deflation – September 21, 2015 Update.” I have extensively written of “deflationary pressures” and deflation as I continue to believe that prolonged and deep U.S. deflationary conditions are on the horizon, and that such deflationary conditions will cause, as well as accompany, inordinate economic hardship. [note: to clarify, for purposes of this discussion, when I mention “deflation” I am referring to the CPI going below zero. Also, I have been using the term “deflationary pressures” as a term to describe deflationary manifestations within an environment that is still overall inflationary but heading towards deflation.]

The subject of deflation contains many complex aspects, and accordingly no short discussion can even begin to be a comprehensive discussion of such. However, in this post I would like to highlight some recent notable developments.

Of note, the shortfall between the Federal Reserve’s stated inflation target (2% on the PCE Price Index) and the actual inflation reading continues. This 2% inflation target has been “missed” (inflation has been less than 2%) for well over three years. For reference, here is a chart of the PCE Price Index from Doug Short’s post of December 23, 2015, titled “

The Core PCE Price Index Remains Disappointingly Below Target“:

The issue of inflation continuing to be below the 2% target seems to be receiving more public discussion by the Federal Reserve. In the

December 16, 2015 FOMC Press Conference Fed Chair Janet Yellen said the following:

Since March, the Committee has stated that it would raise the target range for the federal funds rate when it had seen further improvement in the labor market and was reasonably confident that inflation would move back to its 2 percent objective over the medium term. In our judgment, these two criteria have now been satisfied.

“Market-based” measures of inflation expectations include the Federal Reserve Bank of Atlanta’s series titled “

Deflation Probabilities,” which has recently noticeably increased, but still remains low at 6% as of the January 20, 2016 reading.

Another “market-based” measure of inflation is the “10-Year Breakeven Inflation Rate,” described in FRED as:

Here is the long-term chart, with a reading of 1.32 percent as of January 20, 2016:

While neither the inflation surveys or “market-based” measures depict a deflationary situation – or provide strong indications of impending deflation – is it correct to assume that they would? For many reasons I don’t believe that they will provide significant “advance” warning of impending deflation.

While deflation has many attributes and causes, one of its characteristics is its relative rarity since the beginning of the 20th Century. As I mentioned in the November 14, 2013 post (“

Thoughts Concerning Deflation”):

Given that deflationary episodes have been recently relatively nonexistent, “seeing” and “proving” explicit signs of such an impending condition is especially challenging.

I continue to believe that the many continuing signs of “deflationary pressures” is a foreboding. Among these signs is the pronounced weakness in many commodities. One such measure is the Bloomberg Commodity Index, as seen below:

(charts courtesy of StockCharts.com; chart creation and annotation by the author)

Still another sign is

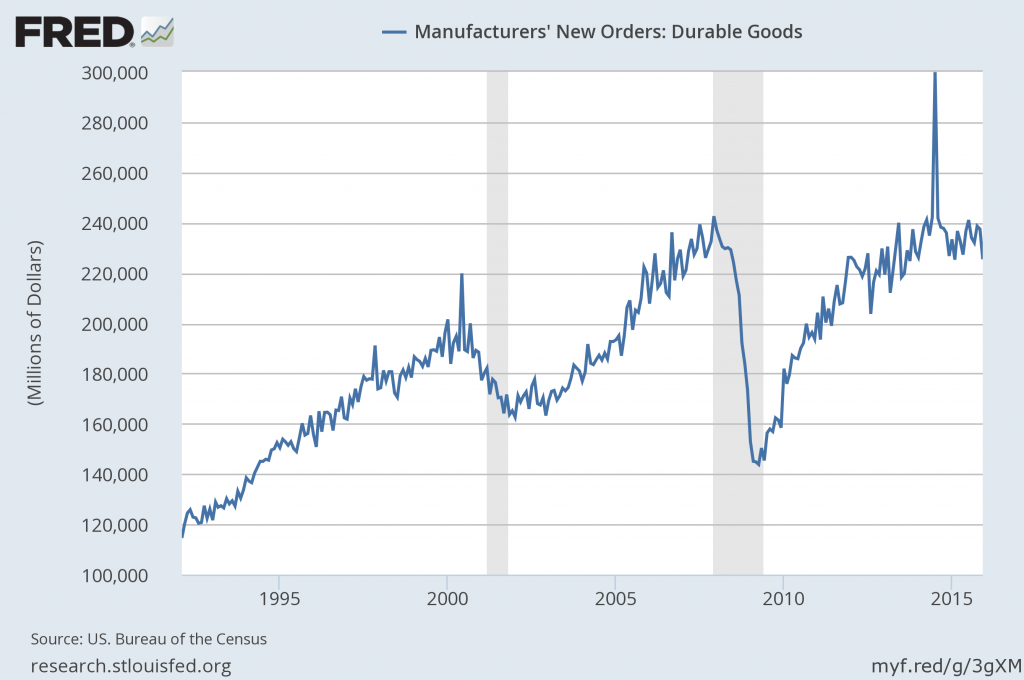

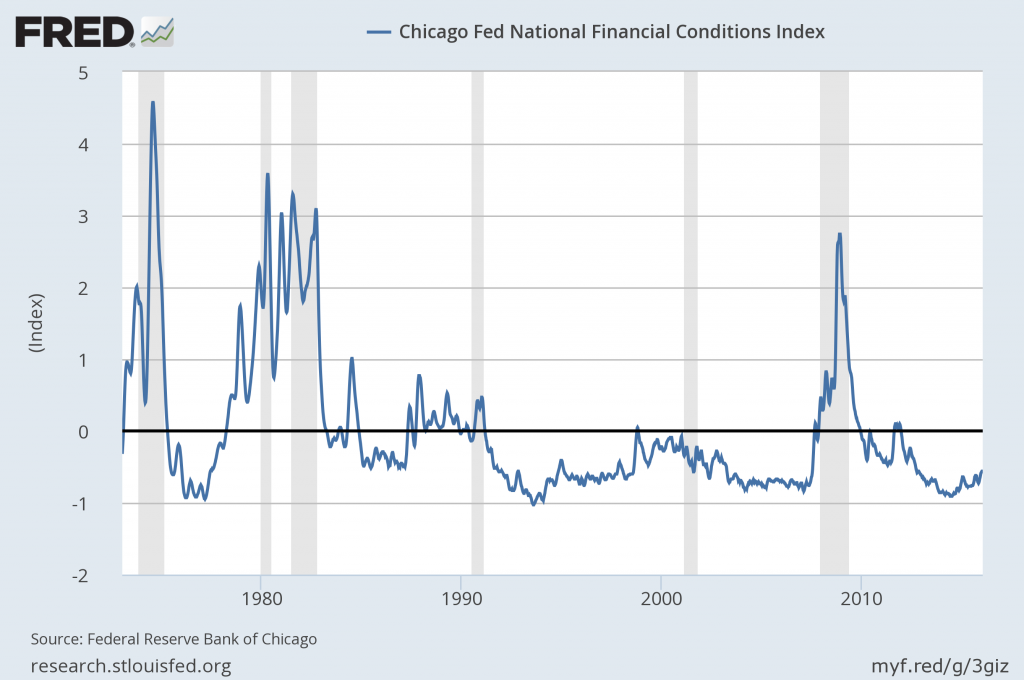

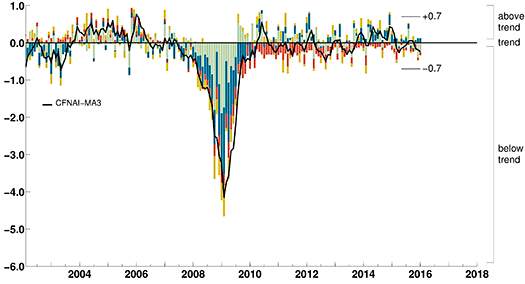

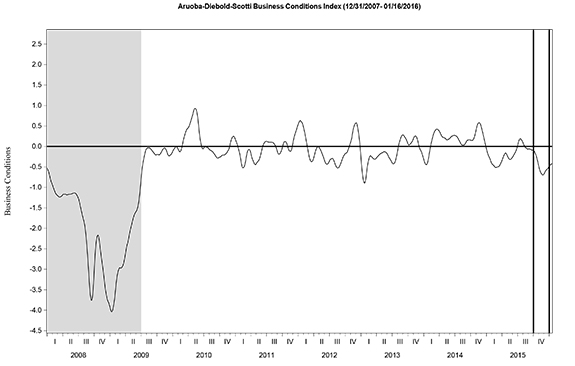

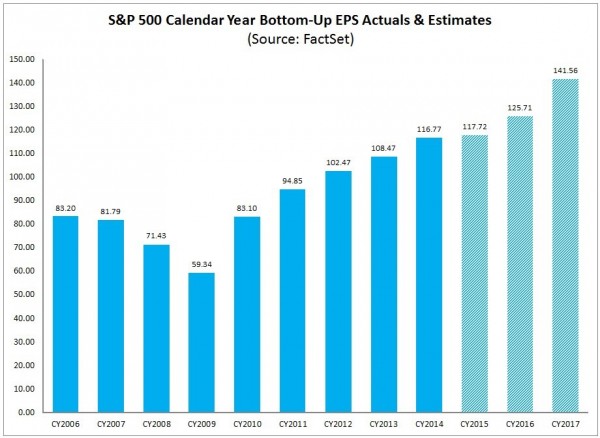

economic weakness. While there is widespread consensus that U.S. economic growth remains stable, my analyses indicates that the economy continues to have many problematical areas of weakness and the widespread consensus concerning current and future economic stability is (substantially) incorrect.

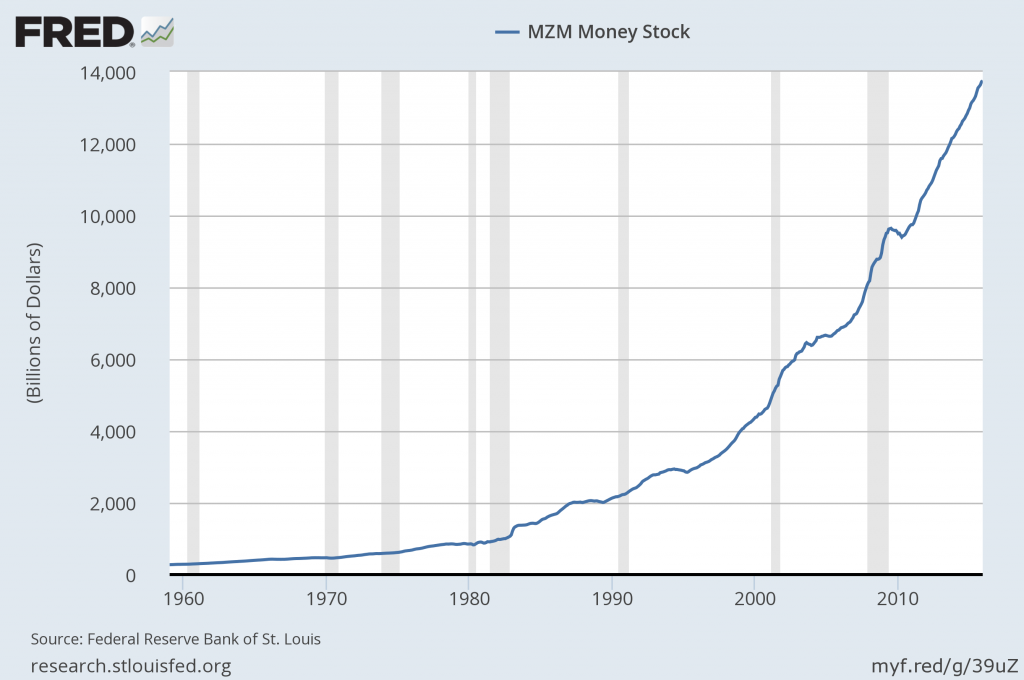

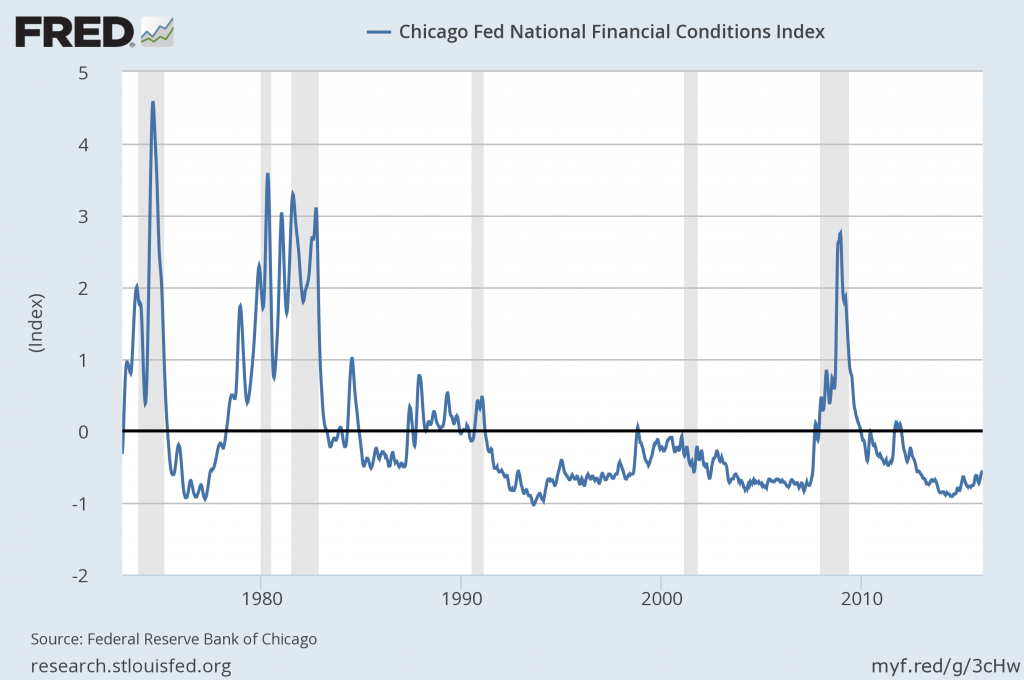

In conclusion, I continue to believe that significant (in extent and duration) U.S. deflation is on the horizon. As discussed in the aforementioned November 14, 2013 post, deflation often accompanies financial system distress. My analyses continue to show an exceedingly complex future financial condition in which an exceedingly large “

financial system crash” will occur, during and after which outright deflation will both accompany and exacerbate economic and financial conditions.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1903.63 as this post is written