From Janet Yellen’s opening comments:

CHAIR YELLEN. Good afternoon. As you know from our policy statement released a short time ago, the Federal Open Market Committee reaffirmed the current 0 to 1/4 percent target range for the federal funds rate. Since the Committee met in July, the pace of job gains has been solid, the unemployment rate has declined, and overall labor market conditions have continued to improve. Inflation, however, has continued to run below our longer-run objective, partly reflecting declines in energy and import prices. While we still expect that the downward pressure on inflation from these factors will fade over time, recent global economic and financial developments are likely to put further downward pressure on inflation in the near term. These developments may also restrain U.S. activity somewhat but have not led at this point to a significant change in the Committee’s outlook for the U.S. economy.

also:

The labor market has shown further progress so far this year toward our objective of maximum employment. Over the past three months, job gains averaged 220,000 per month. The unemployment rate, at 5.1 percent in August, was down four-tenths of a percent from the latest reading available at the time of our June meeting, although that decline was accompanied by some reduction in the labor force participation rate over the same period. A broader measure of unemployment that includes individuals who want and are available to work but have not actively searched recently and people who are working part time but would rather work full time has continued to improve. That said, some cyclical weakness likely remains: While the unemployment rate is close to most FOMC participants’ estimates of the longer-run normal level, the participation rate is still below estimates of its underlying trend, involuntary part-time employment remains elevated, and wage growth remains subdued.

Inflation has continued to run below our 2 percent objective, partly reflecting declines in energy and import prices. My colleagues and I continue to expect that the effects of these factors on inflation will be transitory. However, the recent additional decline in oil prices and further appreciation of the dollar mean that it will take a bit more time for these effects to fully dissipate. Accordingly, the Committee anticipates that inflation will remain quite low in the coming months. As these temporary effects fade and, importantly, as the labor market improves further, we expect inflation to move gradually back toward our 2 percent objective. Survey-based measures of longer-term inflation expectations have remained stable. However, the Committee has taken note of recent declines in market-based measures of inflation compensation and will continue to monitor inflation developments carefully.

Janet Yellen’s responses as indicated to the various questions:

STEVE LIESMAN. Steve Liesman, CNBC. Madam Chair, this notion of uncertainty and economic and global developments, is it fair to say that it could be many months before those global developments worked their way to the U.S. economic data, and that you would not have the certainty that you're looking for to raise interest rates for many months and perhaps well into next year?

CHAIR YELLEN. Well, Steve, I think, you can see from the SEP projections that most participants continued to think that economic conditions will call for or make appropriate an increase in the federal funds rate by the end of this year. Four participants moved their projections into 2016 or later, but the great majority of participants continued to hold that view, and of course, there will always be uncertainty. We can't expect that uncertainty to be fully resolved. But in light of the developments that we have seen and the impacts on financial markets, we want to take a little bit more time to evaluate the likely impacts on United States. And, as I mentioned, the inflation outlook has softened slightly. We've had some further developments, namely lower oil prices and a further appreciation of the dollar that have put some downward pressure in the near term on inflation. Now, we fully expect those further effects like the earlier moves in the dollar and in oil prices to be transitory, but there is a little bit of downward pressure on the inflation and we would like to see some further developments and this importantly could include, is likely to include further improvements in the labor market that would bolster our confidence that inflation will move back to 2 percent over the medium term.

also:

BINYAMIN APPELBAUM. Binyam Appelbaum, the New York Times. The economic projections that you all released today show that committee members expect roughly a three-year period in which the unemployment rate will be at its lowest sustainable level and yet inflation will not rise above 2 percent. That seems extraordinary could you talk about why as a moment ago you said, we are expecting inflationary pressures when unemployment is at a low level? Why is inflation going to be so weak for so long under those circumstances and does it indicate when you are projecting that basically much of a decade will pass without the Fed reaching its inflation target? Does it indicate that you have failed to do enough to revive this economy in recent years?

CHAIR YELLEN. Well, we have been very focused, Binyam, on doing everything we can to revive this economy and to achieve our maximum employment objective. And after we took the funds rate down to zero, as you know, we put in place a number of other extraordinary measures including forward guidance and large scale asset purchases in order to speed the recovery and attain both our inflation objective and our maximum employment objective. And I mean when you look at the projection, you see as you mentioned that we see sufficient growth to push the unemployment rate. It's already very close to participants' estimates of its longer run normal level. We expect the unemployment rate to fall slightly or at least participants project that that it will fall slightly below that level. As that occurs, we would expect labor force participation, the cyclical component of that to diminish over time and we would hope to see some decline in the portion of slack that's reflected in high levels of part-time involuntary employment.

Now, inflation is going back in our projection to 2 percent. It takes 2018 to get there. It's awfully close in 2017 and it's not terribly far away even next year. We have very large drags from import prices and energy prices and over the next year or so, those things should dissipate and the behavior of inflation should mainly if we-- if our understanding of the inflationary process is correct and if inflation expectations are well anchored at 2, which I believe they are. As the labor market heals and as that healing progresses, we will see further upward pressure on inflation. That's what we expect. Now, it's a slow process, it's characterized by lags and that's why it takes a few years as the inflation, as the unemployment rate falls and even overshoots its longer-run normal level, it just takes some time for inflation to get back to 2 percent. But the overshooting helps it get back faster than it otherwise would, and it certainly important for us and I think our credibility hinges on defending our inflation target, not only from threats that it rises above but also that we not have-- that over the medium term that we want to see inflation get back to 2 percent. And we believe the policies we're following are designed to accomplish that and will do so.

also:

PETER BARNES. Hi, Chairman Yellen. Peter Barnes, FOX Business. Could you talk about a little bit more specifically about what foreign developments you discussed in the meeting today, what you're concerned about? We all assume it might be China. That was in the July minutes. Are you concerned about the Chinese economy slowing and the markets there? Do you have any concerns about the European economy? And then related to stock markets, could I ask you how you feel about US equity markets right now because you did talk about your concerns about them back in May. You saw they were generally quite high and we're worried about potential dangers in US equity market evaluations but now equity prices have pulled back. Thank you.

CHAIR YELLEN. So, with respect to global developments, we reviewed developments in all important areas of the world but we're focused particularly on China and emerging markets. Now, we've long expected, as most analysts have, uh, to see some slowing in Chinese growth over time as they rebalance their economy. And they have planned that I think there are no surprises there. The question is whether or not there might be a risk of a more abrupt slowdown than most analysts expect. And I think developments that we saw in financial markets in August, in part reflected concerns that uh, Chinese-- there was downside risk to Chinese economic performance and perhaps concerns about the deafness with which policymakers were addressing those concerns.

In addition, we saw a very substantial downward pressure on oil prices and commodity markets and those developments have had a significant impact on many emerging market economies that are important producers of commodities, as well as more advanced countries including Canada, which is an important trading partner of ours that has been negatively affected by declining commodity prices, declining energy prices.

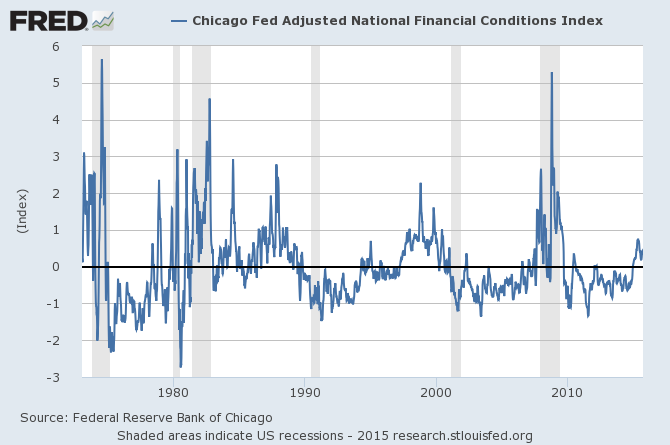

Now, there are a lot of countries that are net importers of energy, that are positively affected by those developments but emerging markets, important emerging markets have been negatively affected by those developments. And we've seen significant outflows of capital from those countries, pressures on their exchange rates and concerns about their performance going forward. So, a lot of our focus has been on risks around China but not just China, emerging markets, more generally in how they may spill over to the United States. In terms of thinking about financial developments and our reaction to them, I think a lot of the financial developments were really-- so we don't want to respond to market turbulence. The Fed should not be responding to the ups and downs of the markets and it is certainly not our policy to do so. But when there are significant financial developments, it's incumbent on us to ask ourselves what is causing them. And of course what we can't know for sure, it seem to us as though concerns about the global economic outlook were drivers of those financial developments. And so, they have concerned us in part because they take us to the global outlook and how that will affect us. And to some extent, look, we have seen a tightening of financial conditions during, as I mentioned, during the inter-meeting period. So, the stock market adjustment combined with a somewhat stronger dollar and higher risk spreads thus represent some tightening of financial conditions.

Now, in and of itself, it's not the end of story in terms of our policy because we have to put a lot of different pieces together. We are looking at, as I emphasized, a US economy that has been performing well and impressing us by the pace at which it's creating jobs and the strength of domestic demand. So, we have that. We have some concerns about negative impacts from global developments and some tightening of financial conditions. We're trying to put all of that together in the picture. I think, importantly we see in our statement that in spite of all of this, we continue to view the risks to economic activity and labor markets as balanced. So, it's a lot of different pieces, different cross currents, some strengthening the outlook, some creating concerns, but overall, no significant change in the economic outlook.

also:

MICHAEL MCKEE. Michael McKee from Bloomberg Radio on television. If the economy develops as the summary of economic projection suggests, you will see improvement in labor markets but it won't push inflation up any faster. So I'm wondering what the argument is for raising rates this year as suggested by the dot plot, because even allowing for long and variable lags, you're not forecasting an inflation problem that would seem to suggest the need for a steeper and faster rate path for at least a couple of years.

CHAIR YELLEN. So, if we maintain a highly accommodative monetary policy for a very long time from here and the economy performs as we expect, namely it's strong and the risk that are out there don't materialize, my concern will be that we will have much more tightening in labor markets than you see in these projections and the lags will be probably slow, but eventually we will find ourselves with a substantial overshoot of our inflation objective and then we'll be forced into a kind of stop-go policy. We will have pushed the economy so far it will have become overheated. And we will then have to tighten policy more abruptly than we like. And instead of having slow steady growth improvement in the labor market and continued improvement in good performance in the labor market, I don't think it's good policy to have to then slam on the brakes and risk a downturn in the economy.

also:

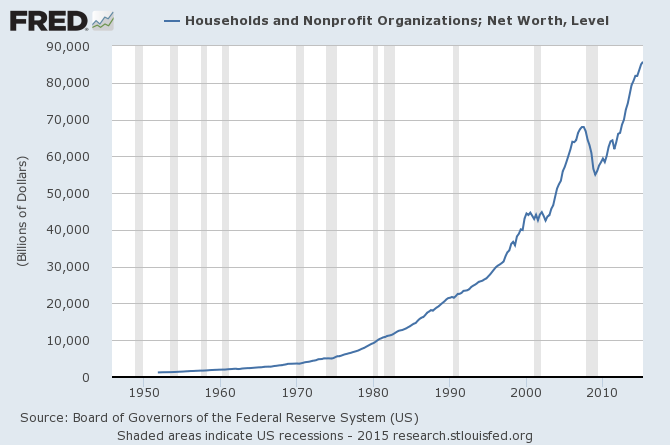

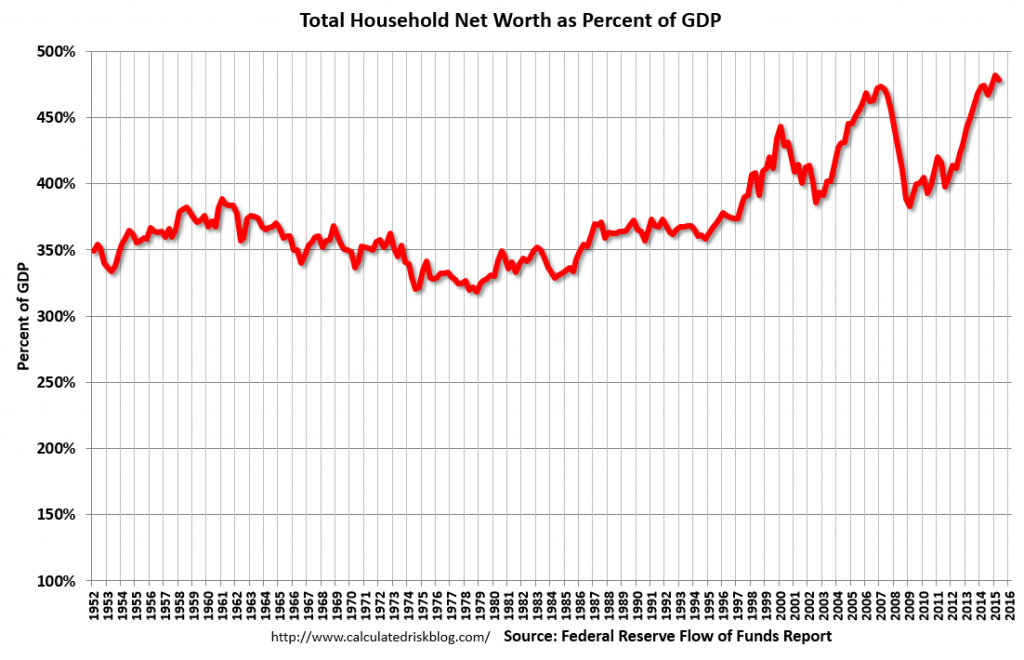

NANCY MARSHALL-GENZER. Nancy Marshall-Genzer with Marketplace. You mentioned you've gotten a lot of unsolicited advice, the folks outside. But there is another side that says the Fed should raise interest rates because keeping rates so long-- so low for so long has actually exacerbated the wealth gap. Do you think the Fed has widened the wealth gap with its low interest rate policy? These people say low interest rates mainly benefit the wealthy.

CHAIR YELLEN. Well, I guess I really don't see it that way. It is true that interest rates affect asset prices but they have complex effect through balance sheets, through liabilities and assets. To me the main thing that an accommodative monetary policy does is put people back to work. And since income and equality is surely exacerbated by a high-- having high unemployment and a weak job market that has the most profound negative effects on the most vulnerable individuals, to me, putting people back to work and seeing a strengthening of the labor market that has a disproportionately favorable effect on vulnerable portions of our population, that's not something that increases income and equality.

There have been a number of studies that have done-- been done recently that have tried to take account of many different ways in which monetary policy acting through different parts of the transmission mechanism affect inequality. And there's a lot of guesswork involved and different analyses can come up with different things. But a pretty recent paper that's quite comprehensive concludes that policy has not exacerbated income and equality.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1967.64 as this post is written