On Wednesday, January 30, 2019 Jerome Powell gave his scheduled January 2019 FOMC Press Conference. (link of video and related materials)

Below are Jerome Powell’s comments I found most notable – although I don’t necessarily agree with them – in the order they appear in the transcript. These comments are excerpted from the “Transcript of Chairman Powell’s Press Conference“ (preliminary)(pdf) of January 30, 2019, with the accompanying “FOMC Statement.”

From Chairman Powell’s opening comments:

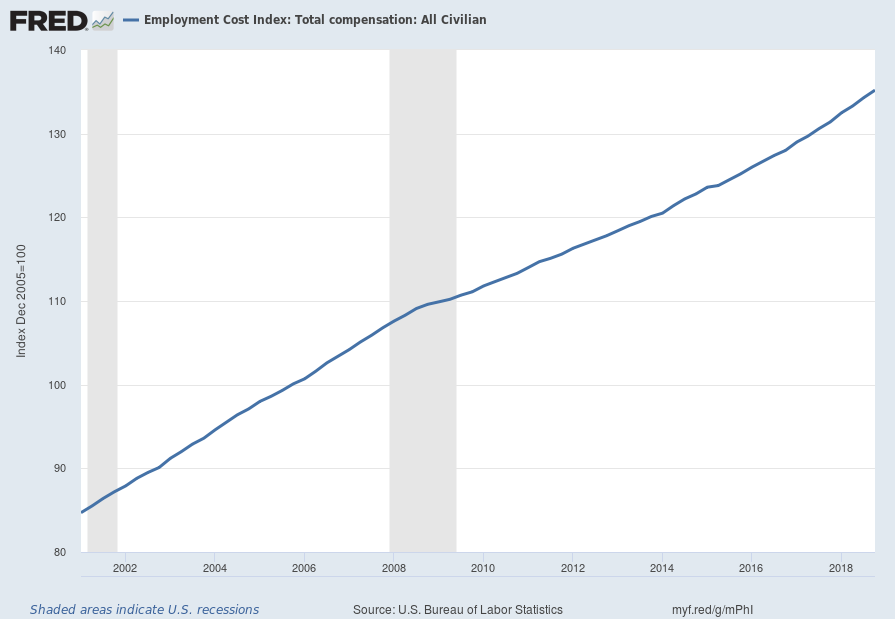

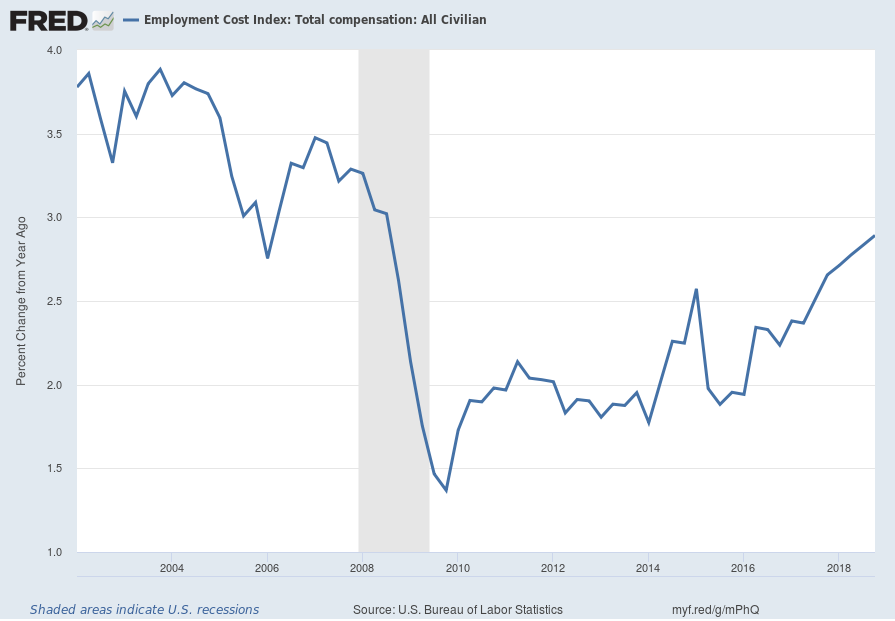

CHAIRMAN POWELL: Good afternoon, everyone, and welcome. I will start with a recap of our discussions, including our assessment of the outlook for the economy, and the judgments we made about our interest rate policy and our balance sheet. I will cover the decisions we made today, as well as our ongoing discussions of matters on which we expect to make decisions in coming meetings. My colleagues and I have one overarching goal: to sustain the economic expansion, with a strong job market and stable prices, for the benefit of the American people. The U.S. economy is in a good place, and we will continue to use our monetary policy tools to help keep it there. The jobs picture continues to be strong, with the unemployment rate near historic lows and with stronger wage gains. Inflation remains near our 2 percent goal. We continue to expect that the American economy will grow at a solid pace in 2019, although likely slower than the very strong pace of 2018. We believe that our current policy stance is appropriate at this time.

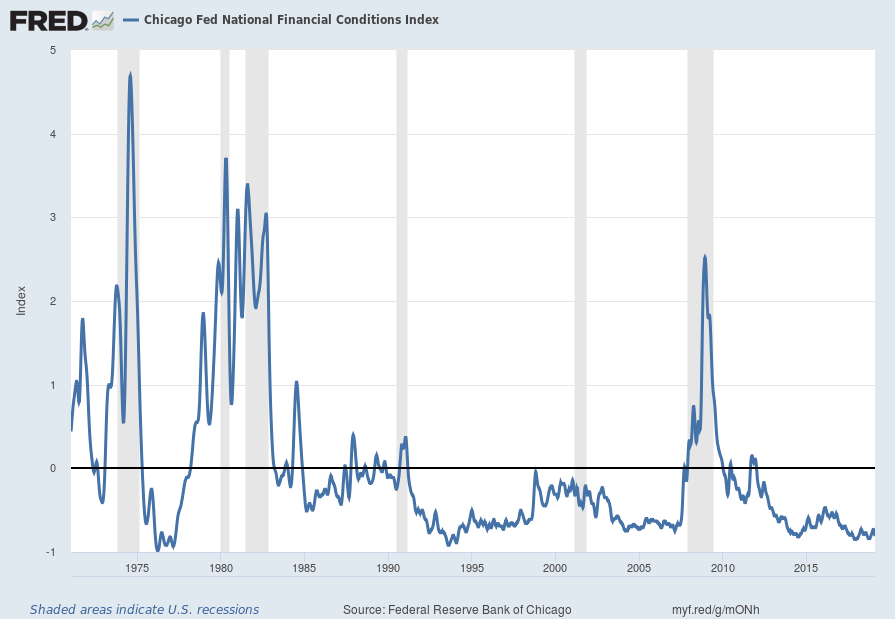

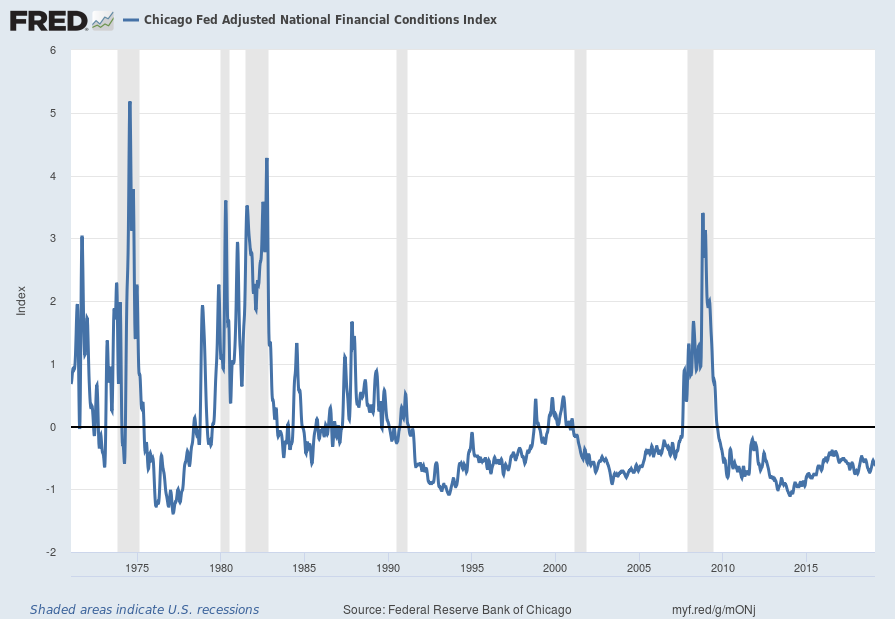

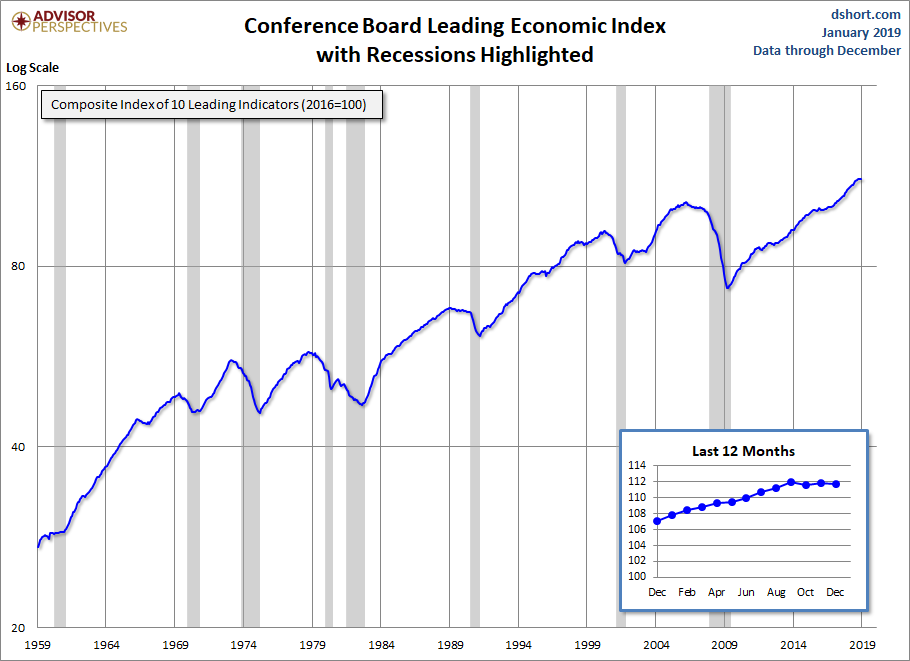

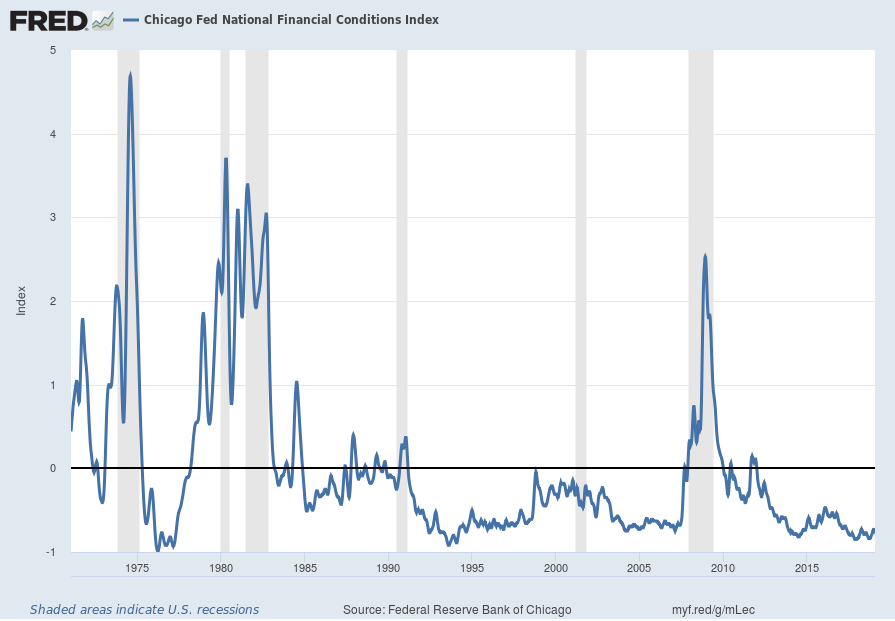

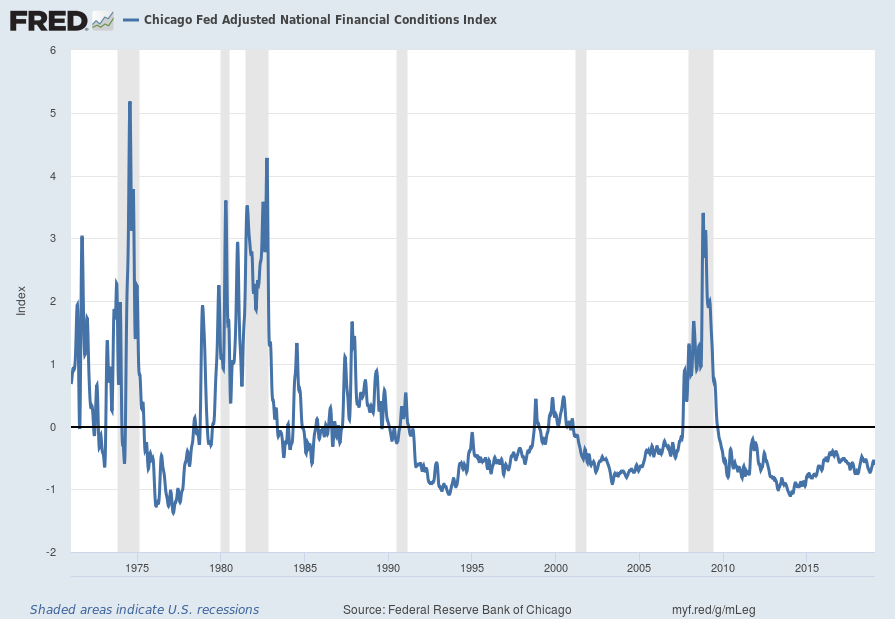

Despite this positive outlook, over the past few months we have seen some cross-currents and conflicting signals about the outlook. Growth has slowed in some major foreign economies, particularly China and Europe. There is elevated uncertainty around several unresolved government policy issues, including Brexit, ongoing trade negotiations, and the effects from the partial government shutdown in the United States. Financial conditions tightened considerably late in 2018, and remain less supportive of growth than they were earlier in 2018. And, while most of the incoming domestic economic data have been solid, some surveys of business and consumer sentiment have moved lower, giving reason for caution.

also:

In addition, the case for raising rates has weakened somewhat. The traditional case for rate increases is to protect the economy from risks that arise when rates are too low for too long, particularly the risk of too-high inflation. Over the past few months, that risk appears to have diminished. Inflation readings have been muted, and the recent drop in oil prices is likely to push headline inflation lower still in coming months. Further, as we noted in our post-meeting statement, while survey-based measures of inflation expectations have been stable, financial market measures of inflation compensation have moved lower. Similarly, the risk of financial imbalances appears to have receded, as a number of indicators that showed elevated levels of financial risk appetite last fall have moved closer to historical norms.

In this environment, we believe we can best support the economy by being patient in evaluating the outlook before making any future adjustment to policy.

Jerome Powell’s responses as indicated to the various questions:

HEATHER LONG. Heather Long from the Washington Post. Last week, the IMF said risks are clearly skewed to the downside for the U.S. and global economy. Can you clarify, does the FOMC see risks as skewed to the downside, particularly after you removed the statement about risk being balanced?

CHAIRMAN POWELL. We had an extensive discussion of the baseline and also of the risks to the baseline and the risks are of course the fact that financial conditions have tightened, that global growth has slowed, as well as some, let’s say, government related risks like Brexit and trade discussions and also the effects and ultimate disposition of the shutdown. So we looked at – we look at those. And the way we think of it is that policy, we will use our policy and we have to offset risks to the baseline. So we view the baseline as still solid and part of that is the way we adjusted our baseline to address those risks. So that’s the way we’re thinking about that now.

also:

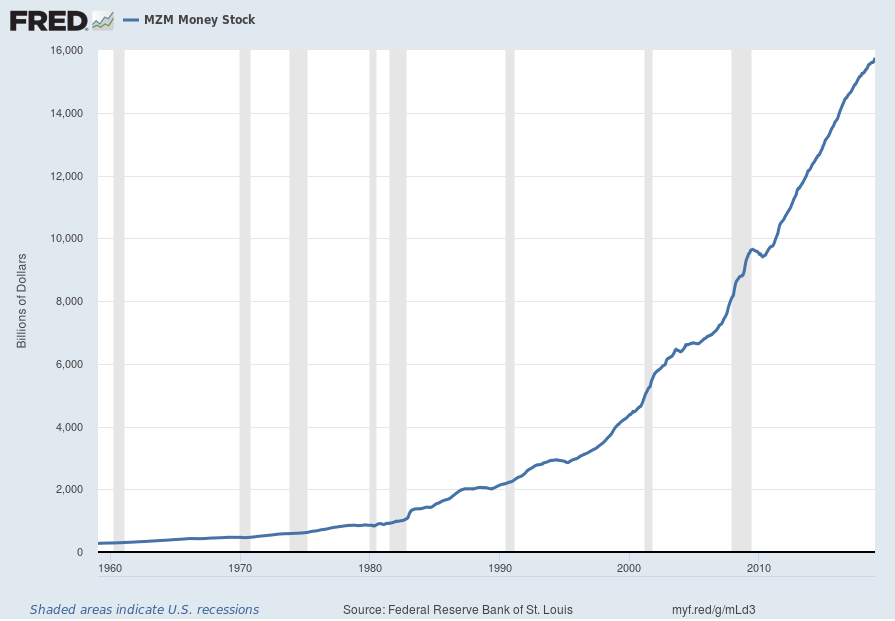

STEVE LIESMAN. Steve Liesman, CNBC. Mr. Chairman, did the Committee discuss an actual change to the runoff policy or the runoff schedule right now? If so, is that under consideration right now and when might we know? The second thing is, I have to nail down this thing. You guys, Fed folks, keep mentioning the market average or the market outlook for the size of the balance sheet. Are you endorsing the market average, which is 3-1/2 trillion? And if you’re not endorsing it, why do you keep mentioning it?

CHAIRMAN POWELL. Okay. So, today I’m here to talk about decisions and also discussions about decisions that haven’t been made. So we’re talking about the latter thing, which is discussions and so I can’t get ahead of where decisions are. But so the Committee is — what we’re looking to do is create a whole plan that will bring us to our goal, our longer run goal which is a balance sheet no larger than it needs to be for us to efficiently conduct — efficiently and effectively conduct monetary policy, but to do so in a way that doesn’t put our goals at risk or result in unnecessary market turmoil. So there are a lot of pieces to that and we’ve learned over time that it’s — when making these — when designing these plans, like for example the original normalization plan, it’s good to take your time. Let the best ideas rise to the top. Let them stand the test of time and argument and then move when you’re really comfortable with what you’ve got and when you feel you can communicate it clearly. So I don’t want to get ahead of that process today.

So we’ve discussed — there are a number of pieces to that puzzle. There are several different pieces to them and I think they’re coming and I’m very pleased with the progress that we’ve made and, you know, the piece that you mentioned is something that is in those discussions. That’s the first question. I’m not going to give our estimate or ratify anybody else’s estimate of what the equilibrium balance sheet is here today. There are estimates out there but I’m not at a point today where I’m going to be giving out numbers on that. But there are estimates and I think they’re consistent with what I said, broadly speaking.

also:

BINYAMIN APPELBAUM. Binyamin Appelbaum, New York Times. I am struggling a little bit to understand what has changed since we sat here with you six weeks ago. You’ve said today that you think that inflation would be the reason that the Fed would need to continue raising rates. Has the inflation outlook shifted that dramatically in the last six weeks? Can you speak specifically to why you’ve moved from a posture of saying we expect to keep raising rates this year to a posture of standing still?

CHAIRMAN POWELL. I’d point to a couple of things. First, the narrative of slowing global growth continues, if you will. The incoming data have shown more of that. We’ve seen that both in China and in Western Europe, and so that’s an important — that has important implications for us and that story has — let’s just say it continues.

And in addition — I mean, I think important — possibly less important now, probably less important now but has been the shutdown, which will leave some sort of imprint on first quarter GDP. We don’t know the ultimate resolution of it. If that’s all there is and the shutdown is gone and there isn’t another shutdown, then we’ll get most of that back in the second period — second quarter.

So those things — in addition, you know, you have to look back. Financial conditions began to tighten in the fourth quarter and they now have persisted and remain tighter — significantly tighter, let’s say — than they were and that’s something that we have to take into account as well. So that’s where we are.

also:

EDWARD LAWRENCE. Edward Lawrence from FOX Business News, thank you Mr. Chairman. The long-term federal funds rate is 2.8 percent. I’ve talked in the last year with a number of Fed presidents who worry that under 3 percent is not enough to handle the next recession. You say that’s your first tool. That’s your primary means of adjusting monetary policy. So with a larger balance sheet — with a larger balance sheet, could you — how could you handle that next recession then with the combination of those two?

CHAIRMAN POWELL. I guess the sense of your question is that we could be in a situation in the future — we hope not — but we could be in a situation where we’d like to cut rates more than we can effectively and we hit the zero lower bound. We don’t think anything like that is in the cards. Now there’s no reason to think that it would be. But, as we said in today’s release, if that happens, then we’ll use the full range of our tools and that includes the balance sheet. But we would use it after using our conventional tools, which would be the interest rate and forward guidance about the interest rate.

EDWARD LAWRENCE. Even if you have a large balance sheet, 4 trillion? Above four trillion?

CHAIRMAN POWELL. Yes. There would be room to do substantially more.

also:

COURTENAY BROWN. Hi, Mr. Chairman. Courtenay Brown from Axios. A data dependency question, has there been a prioritization of market data over the economic data? How do you balance those two things?

CHAIRMAN POWELL. I would say that, you know, our mandate is maximum employment and stable prices and that’s about, you know, hard, real-side economic data. As I mentioned earlier, we — our tool, you know, our interest rate tool operates on the economy through financial conditions.

So financial conditions matter and they matter in the way that I suggested earlier, which is to say broad financial conditions changing over a sustained period, that has implications for the macro economy — it does. So if you lower interest rates and they stay low, every borrower in the country ultimately has a lower interest rate. That will have an effect on — over time — an effect on the economy. But again, the entire focus we have is on maximum employment and stable prices, not on any particular financial market or financial conditions generally.

_____

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2699.90 as this post is written