Various surveys, economic growth projections, and market risk indicators continue to indicate U.S. economic growth and financial system stability for the foreseeable future.

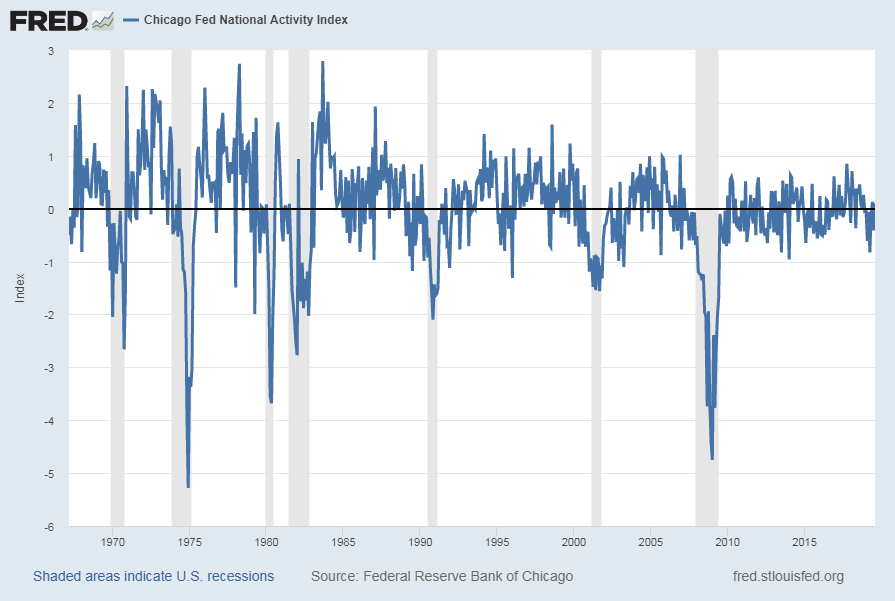

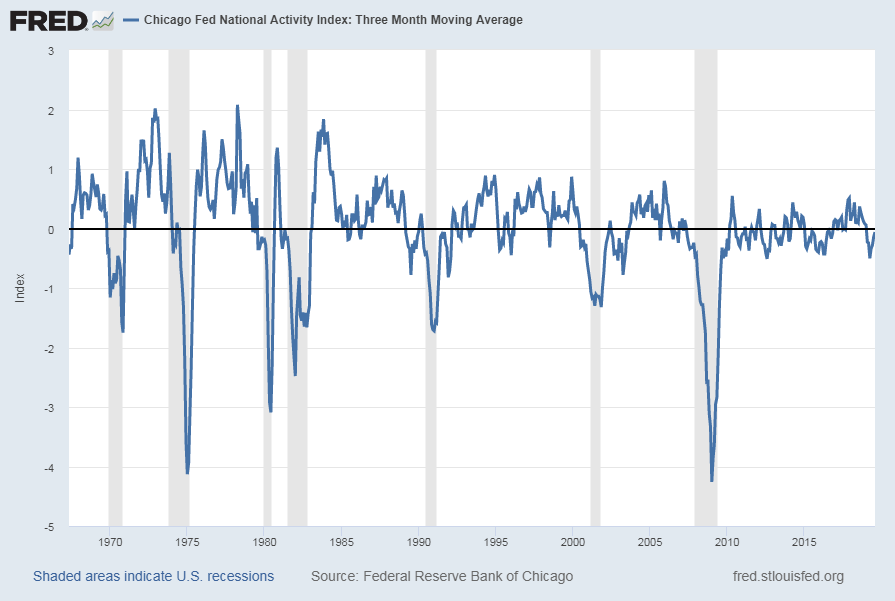

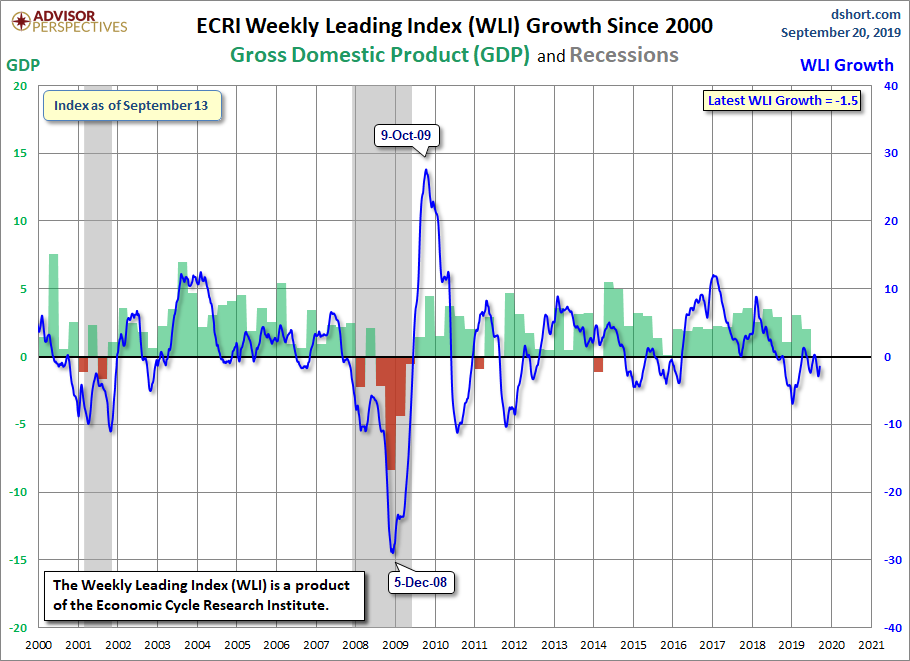

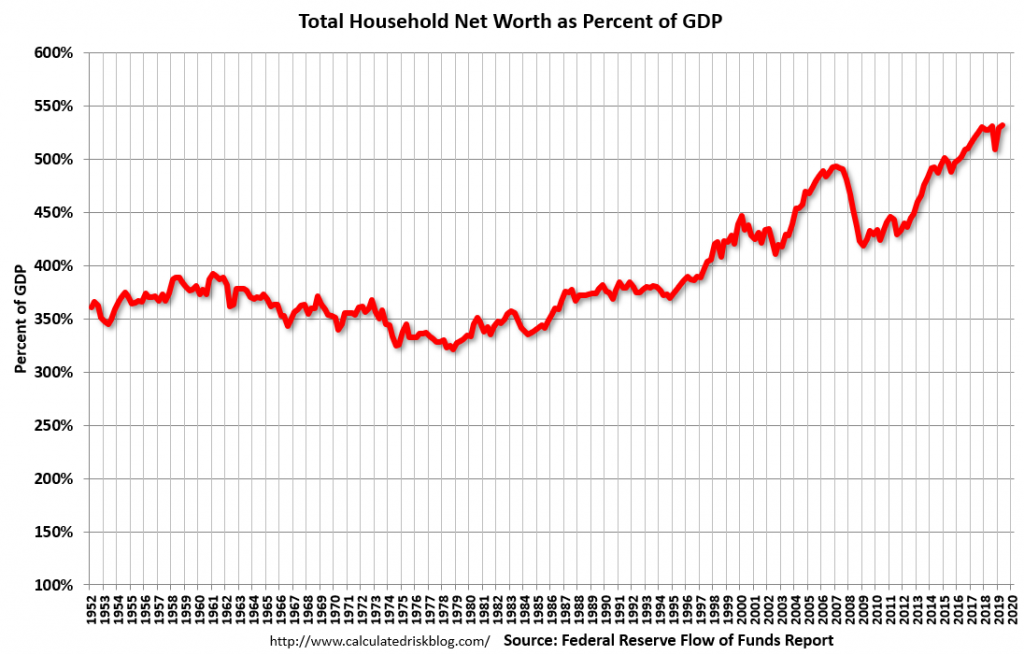

However, there are various indications – many of which have been discussed on this site – that this very widely-held consensus is in many ways incorrect. There are many exceedingly problematical financial conditions that continue to exist, some of which have grown in severity. As well, numerous economic dynamics continue to be worrisome and many economic indicators portray facets of weak growth or outright decline.

Of paramount importance is the resulting level of risk and the future economic implications.

From an “all things considered” standpoint, I continue to believe the overall level of risk is at a fantastic level, one that is far greater than that experienced at any time in the history of the United States.

Cumulatively, these highly problematical conditions will lead to future upheaval. The extent of the resolution of these problematical conditions will determine the ongoing viability of the financial system and economy as well as the resultant quality of living.

As I have previously written in “The U.S. Economic Situation” updates:

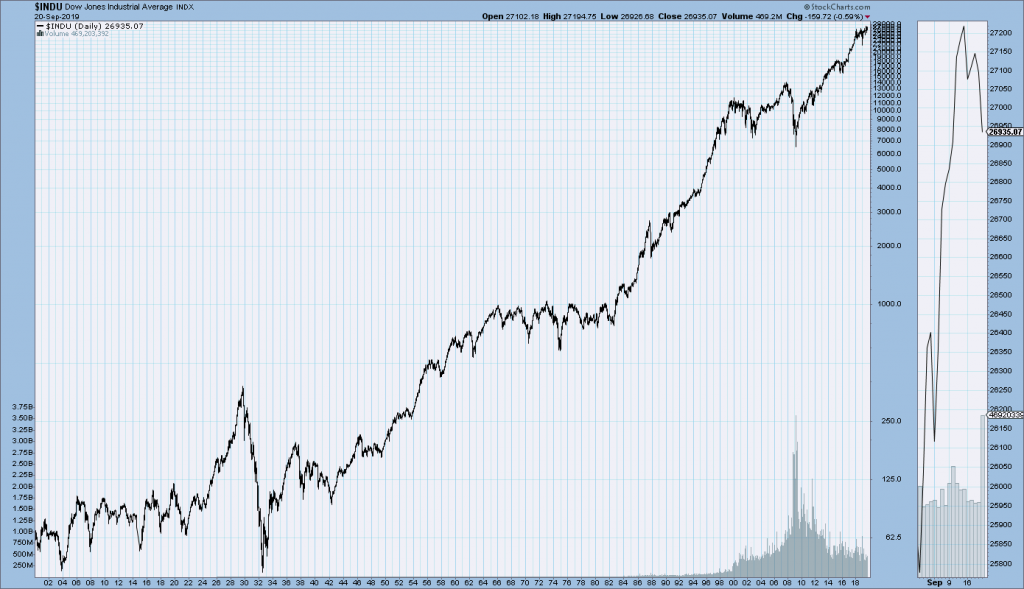

My analyses continues to indicate that the growing level of financial danger will lead to the next stock market crash that will also involve (as seen in 2008) various other markets as well. Key attributes of this next crash is its outsized magnitude (when viewed from an ultra-long term historical perspective) and the resulting economic impact. This next financial crash is of tremendous concern, as my analyses indicate it will lead to a Super Depression – i.e. an economy characterized by deeply embedded, highly complex, and difficult-to-solve problems.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2961.79 as this post is written