From Janet Yellen’s opening comments:

CHAIR YELLEN: Good afternoon. Earlier today, the Federal Open Market Committee decided to raise the target range for the federal funds rate by 1/4 percentage point, bringing it to 1/4 to 1/2 percent.

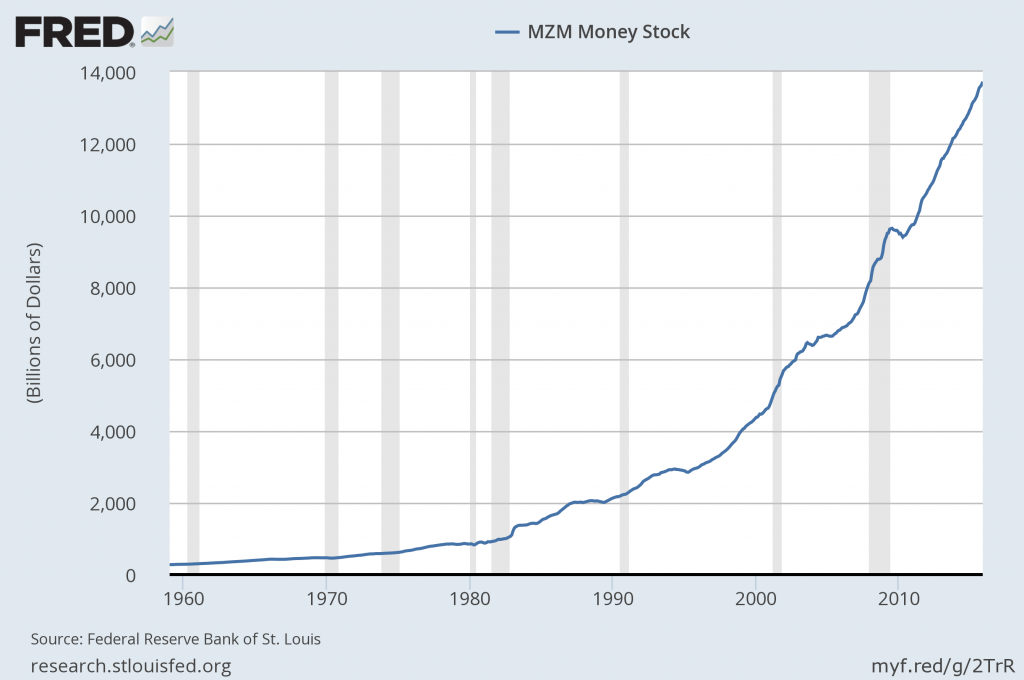

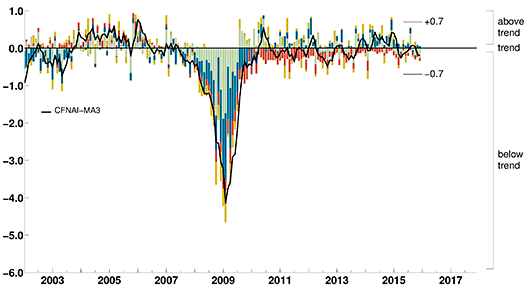

This action marks the end of an extraordinary seven-year period during which the federal funds rate was held near zero to support the recovery of the economy from the worst financial crisis and recession since the Great Depression. It also recognizes the considerable progress that has been made toward restoring jobs, raising incomes, and easing the economic hardship of millions of Americans. And it reflects the Committee’s confidence that the economy will continue to strengthen. The economic recovery has clearly come a long way, although it is not yet complete. Room for further improvement in the labor market remains, and inflation continues to run below our longer-run objective. But with the economy performing well and expected to continue to do so, the Committee judged that a modest increase in the federal funds rate target is now appropriate, recognizing that even after this increase monetary policy remains accommodative. As I will explain, the process of normalizing interest rates is likely to proceed gradually, although future policy actions will obviously depend on how the economy evolves relative to our objectives of maximum employment and 2 percent inflation.

also:

Since March, the Committee has stated that it would raise the target range for the federal funds rate when it had seen further improvement in the labor market and was reasonably confident that inflation would move back to its 2 percent objective over the medium term. In our judgment, these two criteria have now been satisfied.

The labor market has clearly shown significant further improvement toward our objective of maximum employment. So far this year, a total of 2.3 million jobs have been added to the economy, and over the most recent three months, job gains have averaged an estimated 218,000 per month, similar to the average pace since the beginning of the year. The unemployment rate, at 5 percent in November, is down six tenths of a percentage point from the end of last year and is close to the median of FOMC participants’ estimates of its longer-run normal level. A broader measure of unemployment that includes individuals who want and are available to work but have not actively searched recently and people who are working part time but would rather work full time also has shown solid improvement. That said, some cyclical weakness likely remains: The labor force participation rate is still below estimates of its demographic trend, involuntary parttime employment remains somewhat elevated, and wage growth has yet to show a sustained pickup.

also:

The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will continue to expand at a moderate pace and labor market indicators will continue to strengthen. Although developments abroad still pose risks to U.S. economic growth, these risks appear to have lessened since late summer. Overall, the Committee sees the risks to the outlook for both economic activity and the labor market as balanced.

Janet Yellen’s responses as indicated to the various questions:

MARTIN CRUTSINGER. Marty Crutsinger with the Associated Press. I guess the word is “finally.” The--and we have asked you for so long, “Why were you delaying? Why were you delaying?” So, I'll ask, given developments around the world that still--there is still weakness and the inflation is still nowhere near your target. What made you say “do it now?” Some have said it was because you feared a lack of credibility if you didn't move. Did that play a role in your decision?

CHAIR YELLEN. We decided to move at this time because we feel the conditions that we set out for a move, namely further improvement in the labor market and reasonable confidence that inflation would move back to 2 percent over the medium term, we felt that these conditions had been satisfied. We have been concerned, as you know, about the risks from the global economy. And those risks persist, but the U.S. economy has shown considerable strength. Domestic spending that accounts for 85 percent of aggregate spending in the U.S. economy has continued to hold up. It's grown at a solid pace. And while there is a drag from net exports, from relatively weak growth abroad, and the appreciation of the dollar, overall, we decided today that the risks to the outlook for the labor market and the economy are balanced.

And we recognize that monetary policy operates with lags. We would like to be able to move in a prudent, and as we've emphasized, gradual manner. It's been a long time since the Federal Reserve has raised interest rates, and I think it's prudent to be able to watch what the impact is on financial conditions and spending in the economy and moving in a timely fashion enables us to do this.

Again, I think it's important not to overblow the significance of this first move. It's only 25 basis points. It--monetary policy remains accommodative. We've indicated that we will be watching what happens very carefully in the economy in terms of our actual and forecast our projected conditions relative to our employment and inflation goals and will adjust policy over time as seems appropriate to achieve those goals. Our expectation as I've indicated is that policy adjustments will be gradual over time, but of course they will be informed by the outlook, which in turn will evolve with incoming data.

STEVE LIESMAN. Madam Chair, thank you. Steve Liesman, CNBC. Under the old regime, before you were raising rates, it was easy to understand within your mandate what you wanted to do. You wanted the unemployment rate to fall, you wanted inflation to rise, and it was easy for the public to judge the success or failure of your policy. Could you explain under the new regime what you’re looking for? Do you want the unemployment rate to stop falling? Do you want it to rise? And what is it you hope for from inflation, which I think is a little more understandable, or is neutral itself now a policy goal?

CHAIR YELLEN. Neutral is not a policy goal. It is an assessment. It's a benchmark that I think is useful for assessing the stance of policy. Neutral is essentially a stance of policy, a level of short-term rates, which if the economy were operating near its potential--and we're reasonably, not quite at that, but reasonably close to it--it would be a level that would maintain or sustain those conditions. So if this point, policy, we judge to be accommodative. The Committee forecasts that the unemployment rate will continue to decline. And I think that's important and appropriate for two reasons. First of all, as I've indicated, I continue to judge that there remains slack in the economy, margins of slack that are not reflected in the standard unemployment rate. And in particular, I pointed to the depressed level of labor force participation and also the somewhat abnormally high level of part-time employment. So further decline in the unemployment rate and strengthening of labor market conditions, will help to erode those margins of slack but also we want to see inflation move back to our 2 percent objective over the medium term, and so seeing above trend growth and continuing tightness, greater tightness in labor and product markets, I think that will help us achieve our objective as well with respect to inflation.

STEVE LIESMAN. Just to follow up, how does raising rates help get you to either of those goals?

CHAIR YELLEN. We have kept rates at an extremely low level and had a high balance sheet for a very long time. We have considered the risks to the outlook and worried about the fact that with interest rates at zero, we have less scope to respond to negative shocks than to positive shocks that would call for a tightening of policy. That is a factor that has induced us to hold rates at zero for this long. But we recognize that policy is accommodative, and if we do not begin to slightly reduce the amount of accommodation, the odds are good that the economy would end up overshooting both our employment and inflation objectives. What we would like to avoid is a situation where we have waited so long that we're forced to tighten policy abruptly, which risks aborting what I would like to see as a very long-running and sustainable expansion. So, to keep the economy moving along the growth path it's on with improving and solid conditions in labor markets, we would like to avoid a situation where we have left so much accommodation in place for so long that we overshoot these objectives and then have to tighten abruptly and risk damaging, damaging that performance.

also:

REBECCA JARVIS. Thank you, Rebecca Jarvis, ABC News. Historically most economic expansions fade after this long. How confident are you that our economy won't slip back into recession in the near term?

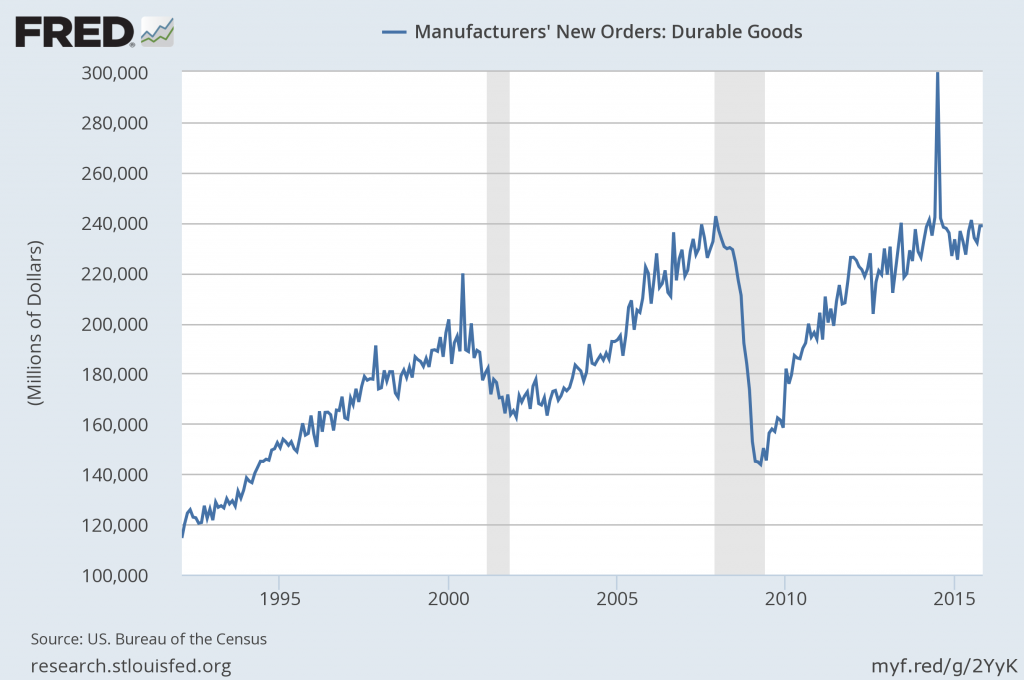

CHAIR YELLEN. So let me start by saying that I feel confident about the fundamentals driving the U.S. economy, the health of U.S. households and domestic spending. There are pressures on some sectors of the economy particularly manufacturing and the energy sector reflecting global developments and developments in commodity markets and energy markets, but the underlying health of the U.S. economy, I considered to be quite sound. I think it's a myth that expansions die of old age. I do not think that they die of old age. So the fact that this has been quite a long expansion doesn't lead me to believe that it's one that has, that its days are numbered. But the economy does get hit by shocks, and they were both positive shocks and negative shocks. And so there is a significant odd, you know, probability in any year that the economy will suffer some shock that we don't know about that will put it into recession. And so, I'm not sure exactly how high that probability is in any year but maybe at least on the order of 10 percent. So yes, there is some probability that that could happen and of course we'd appropriately respond, but it isn't something that is fated to happen because we've had a long expansion and I don't see anything in the underlying strength of the economy that would lead me to be concerned about that outcome.

also:

YLAN MUI. Hi, Ylan from the Washington Post. You said earlier that expansions don't die of old age, but I think the other half of that is that it's often central banks that kill them off instead. So I'm wondering how worried you are about the possibility that the Fed will have to turn around after hiking rates. Other central banks that have tried to raise rates have had to do just that. And how damaging you think that might be to the Fed's credibility?

CHAIR YELLEN. So, when you say that central banks often kill them, I think the usual reason that that has been true when that has been true is that central banks have begun too late to tighten policy, and they’ve allowed inflation to get out of control. And at that point, they have had to tighten policy very abruptly and very substantially, and it's caused a downturn, and the downturn has served to lower inflation. So, if you don't mind my flipping the question on you, I would point out that it is because we don't want to cause a recession through that type of dynamic at some future date that it is prudent to begin early and gradually.

Now, it is true that some central banks have raised rates and later turned around. Not in every case has that reflected a policy mistake. Economies are subject to shocks. Sometimes when they have raised rates, it hasn't been the wrong thing to do, but conditions have changed in a way that they have had to reverse policy to respond to shocks.

I'm not denying that there are situations where central banks have moved too early. We have considered the risk of that. We have weighed that risk carefully in making today's decision. I don't believe we'll have to do it. But, look, you know, as I've--as the Committee has said, we're watching economic developments closely, and we will adjust policy in whatever way is necessary to support the attainment of our objectives.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2041.89 as this post is written