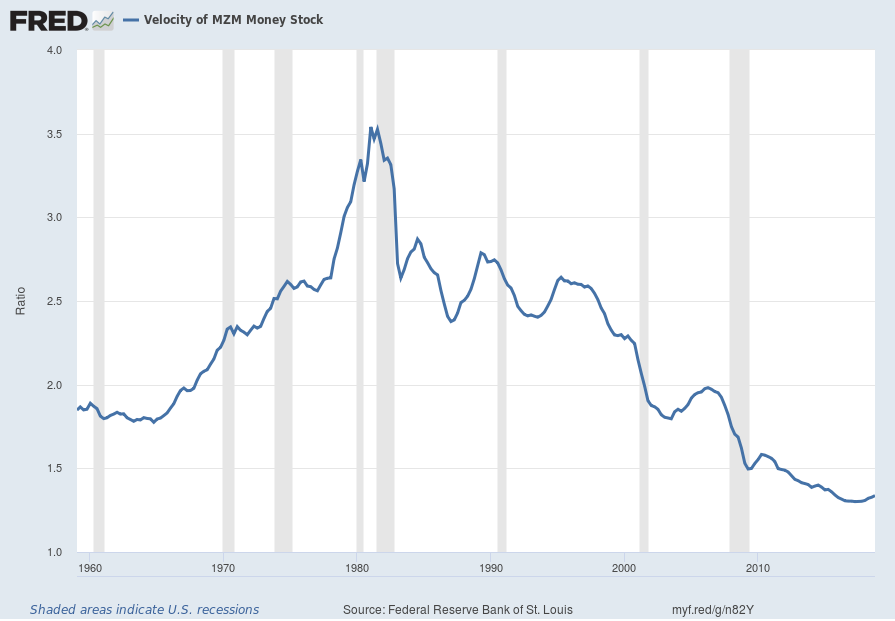

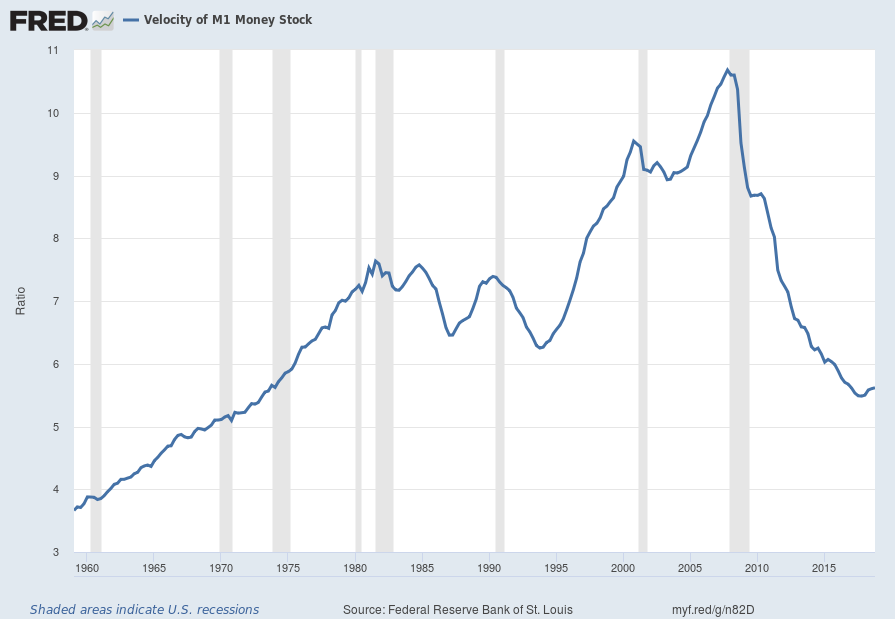

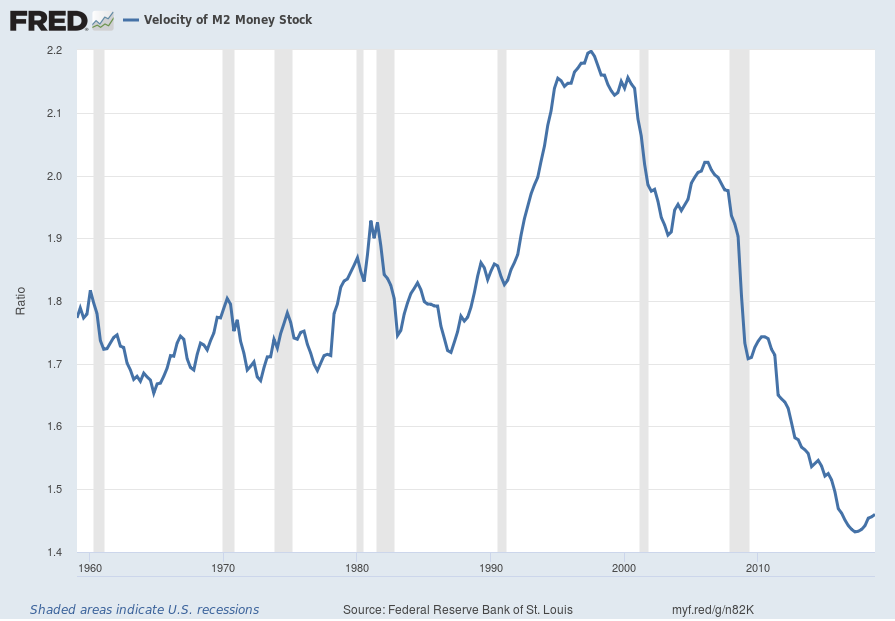

Here are three charts from the St. Louis Fed depicting the velocity of money in terms of the MZM, M1 and M2 money supply measures.

All charts reflect quarterly data through the 4th quarter of 2018, and were last updated as of February 28, 2019.

Velocity of MZM Money Stock, current value = 1.337:

Data Source: FRED, Federal Reserve Economic Data, Federal Reserve Bank of St. Louis; accessed February 28, 2019:

http://research.stlouisfed.org/fred2/series/MZMV

http://research.stlouisfed.org/fred2/series/MZMV

–

Velocity of M1 Money Stock, current value = 5.617:

Data Source: FRED, Federal Reserve Economic Data, Federal Reserve Bank of St. Louis; accessed February 28, 2019:

http://research.stlouisfed.org/fred2/series/M1V

http://research.stlouisfed.org/fred2/series/M1V

–

Velocity of M2 Money Stock, current value = 1.46:

Data Source: FRED, Federal Reserve Economic Data, Federal Reserve Bank of St. Louis; accessed February 28, 2019:

http://research.stlouisfed.org/fred2/series/M2V

http://research.stlouisfed.org/fred2/series/M2V

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

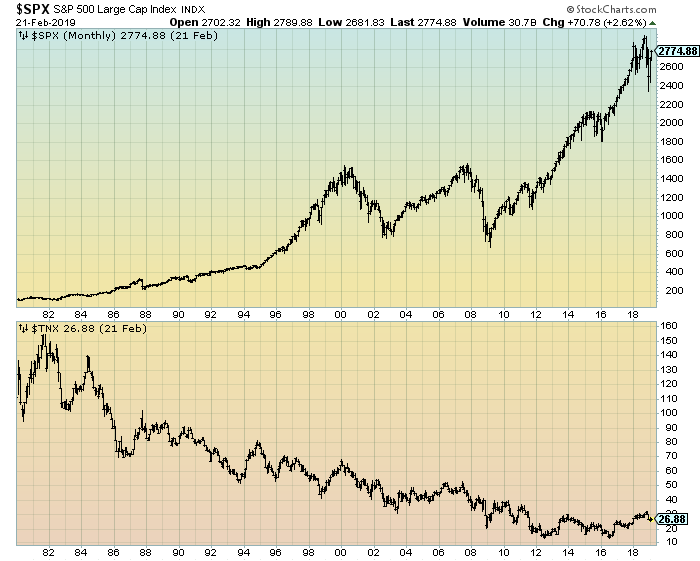

SPX at 2784.49 as this post is written