On Wednesday, October 30, 2019 FOMC Chairman Jerome Powell gave his scheduled October 2019 FOMC Press Conference. (link of video and related materials)

Below are Jerome Powell’s comments I found most notable – although I don’t necessarily agree with them – in the order they appear in the transcript. These comments are excerpted from the “Transcript of Chairman Powell’s Press Conference“ (preliminary)(pdf) of October 30, 2019, with the accompanying “FOMC Statement.”

From Chairman Powell’s opening comments:

CHAIR POWELL. Good afternoon and welcome.

My colleagues at the Federal Reserve and I are dedicated to serving the American people. We do this by steadfastly pursuing the goals that Congress has given us—maximum employment and stable prices. We are committed to making the best decisions we can, based on facts and objective analysis. Today, we decided to lower the interest rates for the third time this year. We took this step to help keep the U.S. economy strong in the face of global developments and to provide some insurance against ongoing risks. As I will explain shortly, the policy adjustments we have made since last year are providing—and will continue to provide—meaningful support to the economy. We believe that monetary policy is in a good place.

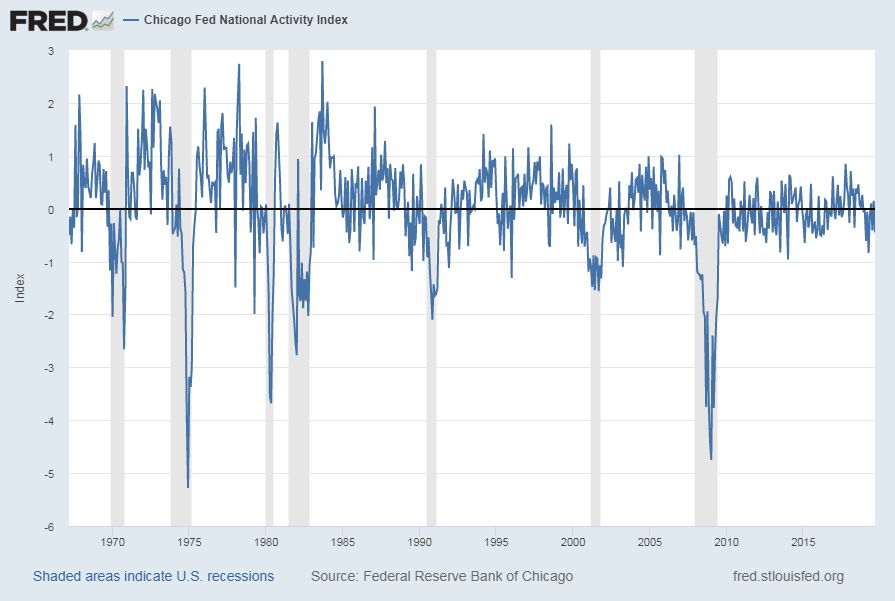

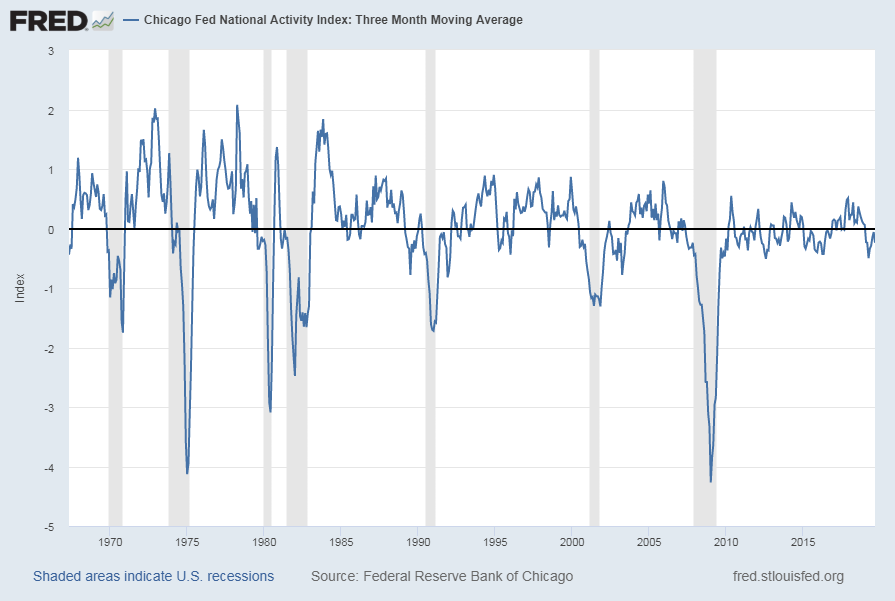

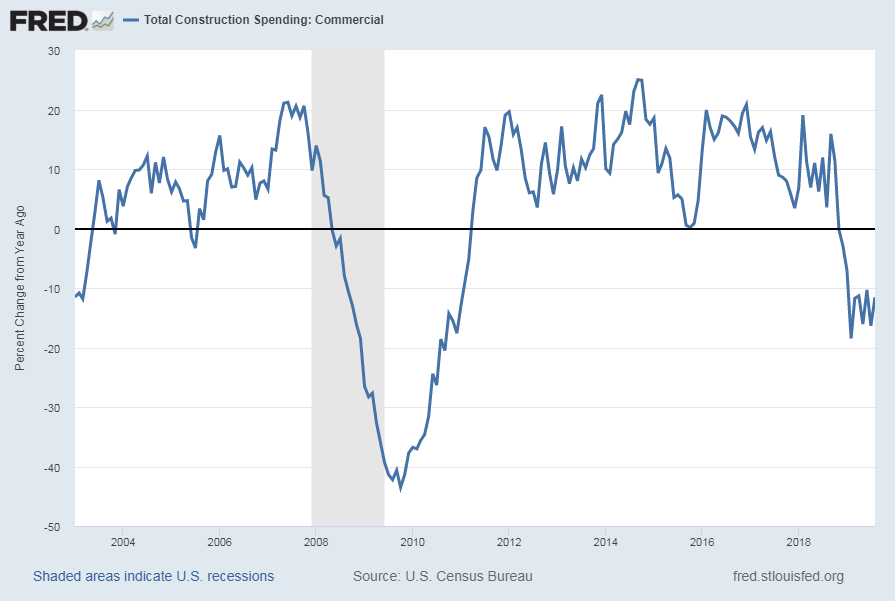

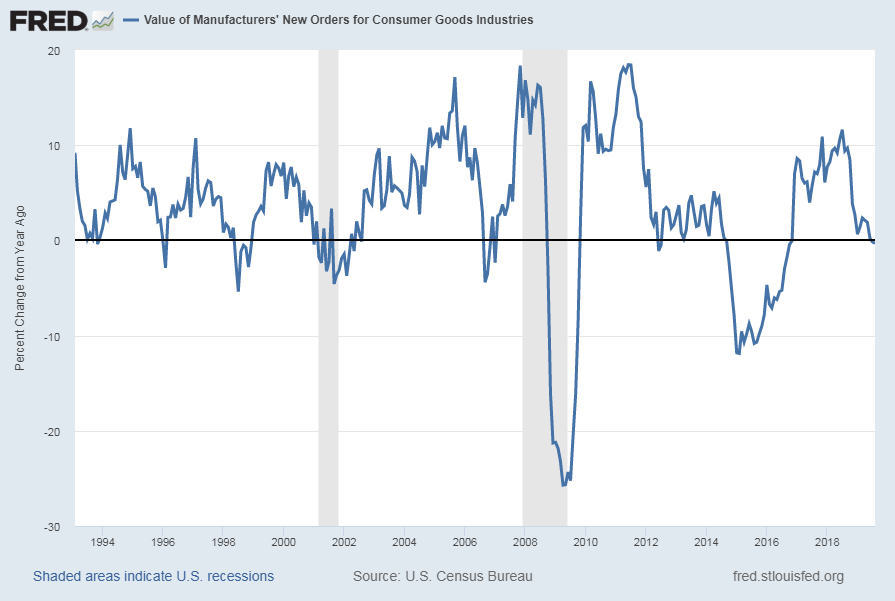

The U.S. economy is in its 11th year of expansion, and the baseline outlook remains favorable. The overall economy is growing at a moderate rate. Household spending continues to be strong—supported by a healthy job market, rising incomes, and solid consumer confidence. In contrast, business investment and exports remain weak, and manufacturing output has declined over the past year. Sluggish growth abroad and trade developments have been weighing on those sectors. Looking ahead, we continue to expect the economy to expand at a moderate rate, reflecting solid household spending and supportive financial conditions.

Jerome Powell’s responses as indicated to the various questions:

HEATHER LONG. Hi, Heather Long from the Washington Post. You just said that the risk to the outlook are moving in a positive direction. I’m wondering if you could specify is that on trade or are there other matters? This morning, we obviously learned that we’ve now had two quarters of contracting business investment which would seem to be moving the outlook in the other direction.

CHAIR POWELL. So, in terms of risks, what I was referring to there, the principal risks that we’ve been monitoring have been really slowing global growth and trade policy developments. As well as muted inflation pressure. So, I was really referring there to trade developments. We have that phase one potential agreement with China, which if signed and put into effect could have the effect of reducing trade tensions and producing uncertainty and that would bode well, we think, for business confidence and perhaps activity over time. So, that has the potential for being an improvement in the risk picture. Brexit, I would say as well, it appears that the risk of a no deal Brexit seems to have materially declined. I think on both situations there’s plenty of risk left, but I’d have to say that the risks seem to have subsided.

You ask about business investment, and that’s right. Business investment has been weakened. Today’s reading was weak as well, and it was broad across equipment and other parts of, parts of business fixed investment were weak. That’s consistent with what we’ve seen, but that’s the economy we’ve had this year. What we’ve had is an economy where the consumer is really driving growth and, you know, personal consumption expenditures were almost 3 percent in this quarter, in this first reading for the quarter. So, overall, we see the economy as having been resilient to the, you know, the winds that have been blowing this year.

also:

JEAN YUNG. Hi. Jean Yung from Market News. I wanted to ask about financial stability risk. Recently, the IMF and some other global policy makers have been expressing concerns over the high level of risk in corporate debt. So, as rates get lower in the U.S. and around the world, are you more worried about financial stability reach for yield?

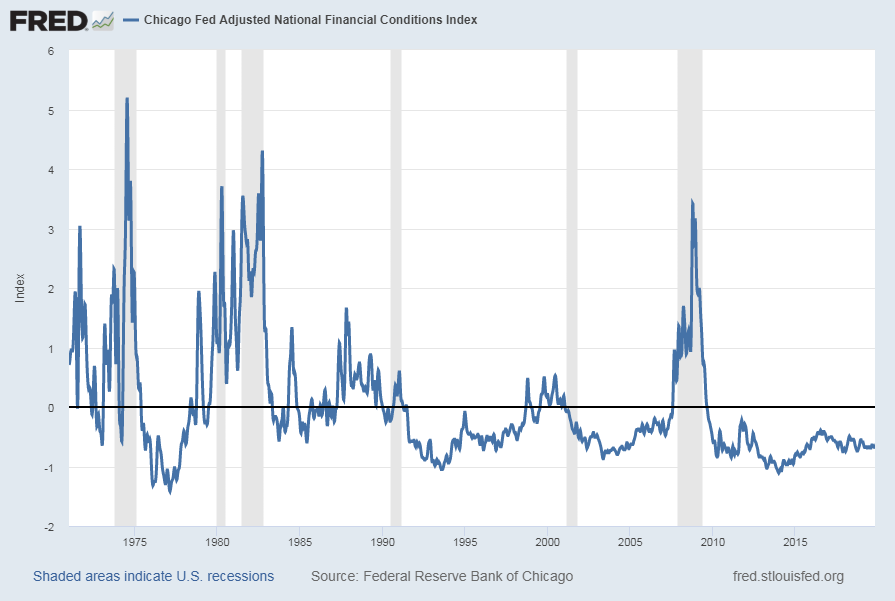

CHAIR POWELL. So, we monitor financial stability risks very carefully all of the time. It’s what we do since the financial crisis, as I’ve mentioned before. Currently, we don’t see large imbalances. This long expansion is notable for the lack of large financial imbalances like the ones we’ve seen certainly before the crisis happened. So, we have a four-part framework, I’ll quickly mention. The first is leverage in the financial system which is low by historical standards. The second is funding risk which is the risk of runnable funding, and that risk is also quite low for banks but also for, you know, the nonbanking financial sector. If you look at asset prices, we see some high asset prices, but not broadly across a range. We don’t see bubbles in that kind of thing. And, that leaves the fourth which is leverage in the nonfinancial sector and that’s households and businesses. So, with households, again, we don’t see leverage. We see them actually getting in very good shape financially in the aggregate. Obviously, plenty of households are not in great shape financially, but in the aggregate, the household sector’s in a very good place. That leaves businesses which is where the issue has been. Leverage among corporations and other forms of business, private businesses, is historically high. We’ve been monitoring it carefully and taking appropriate steps. That’s what I would say, but it’s corporate debt is one part of a larger part of our framework, and it is something that we’re paying quite a bit of attention to, and it’s been part of the last couple of shared national credit exams, and we’ve been monitoring it carefully and taking appropriate action.

_____

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3027.39 as this post is written

![Average Weekly Overtime Hours of Production and Nonsupervisory Employees: Manufacturing [AWOTMAN] Percent Change From A Year Ago](https://www.economicgreenfield.com/wp-content/uploads/2019/10/AWOTMAN_10-4-19-4.2-hours-6.7-Percent-Change-From-Year-Ago.png)