From Chairman Powell’s opening comments:

Over the past year, the economy has been growing at a strong pace, the unemployment rate has been near record lows, and inflation has been low and stable. All of those things remain true today. Since the September meeting of the FOMC, however, some crosscurrents have emerged. I’ll explain how my colleagues and I are incorporating those crosscurrents into our judgments about the outlook and the appropriate course of policy.

Since September, the U.S. economy has continued to perform well, roughly in line with our expectations. The economy has been adding jobs at a pace that will continue bringing the unemployment rate down over time. Wages have moved up for workers across a wide range of occupations, a welcome development. Inflation has remained low and stable, and is ending the year a bit more subdued than most had expected. Although some American families and communities continue to struggle and some longer-term economic problems remain, the strong economy is benefiting many Americans.

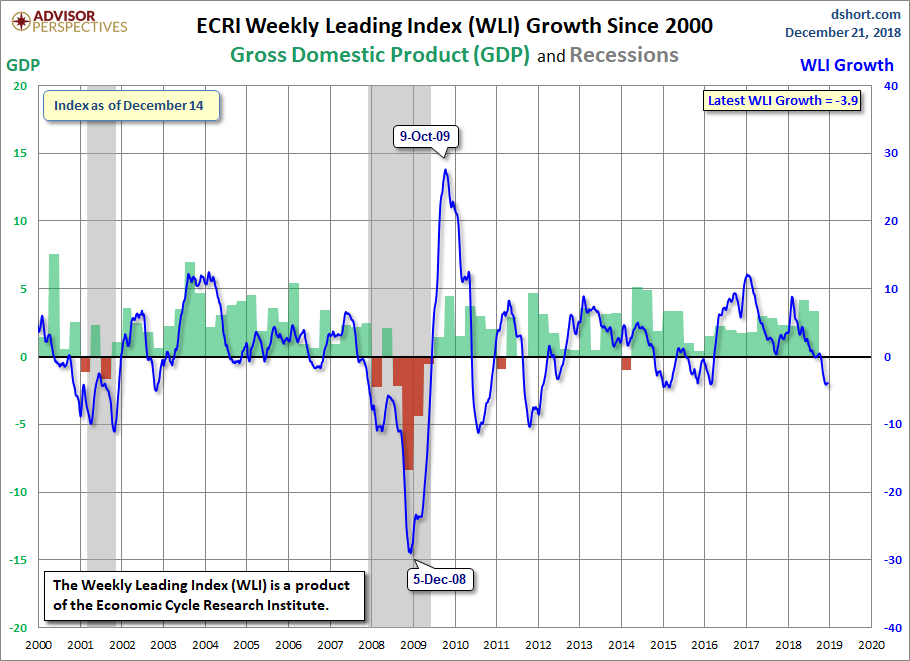

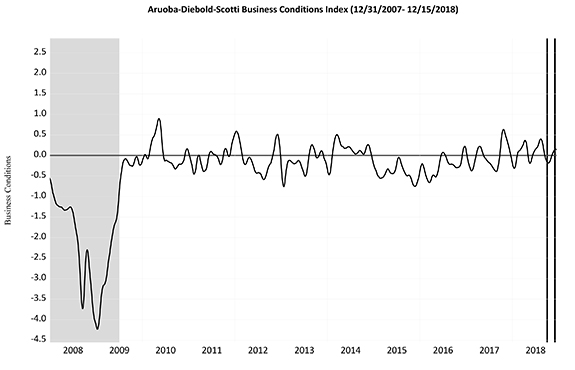

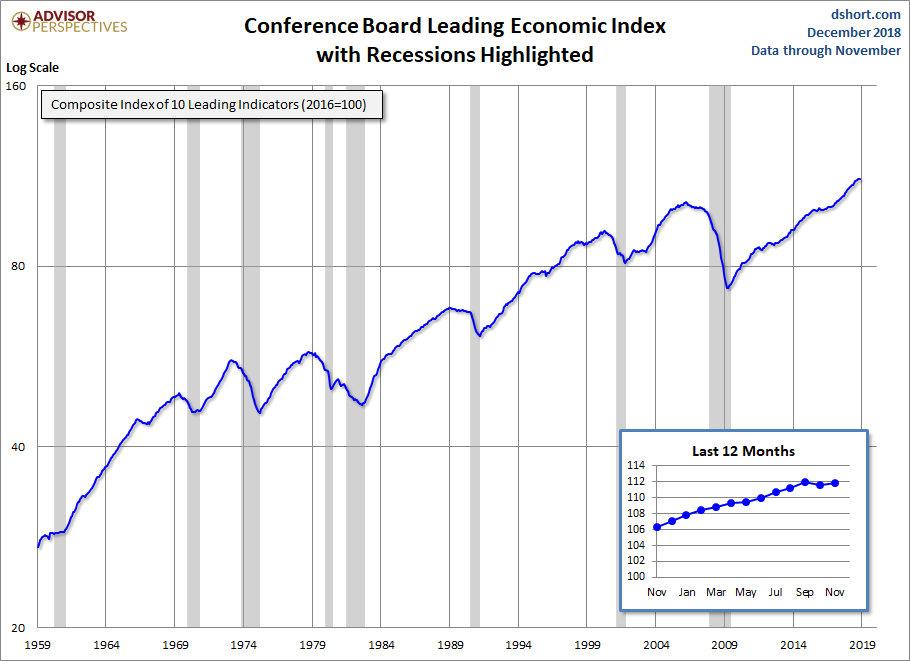

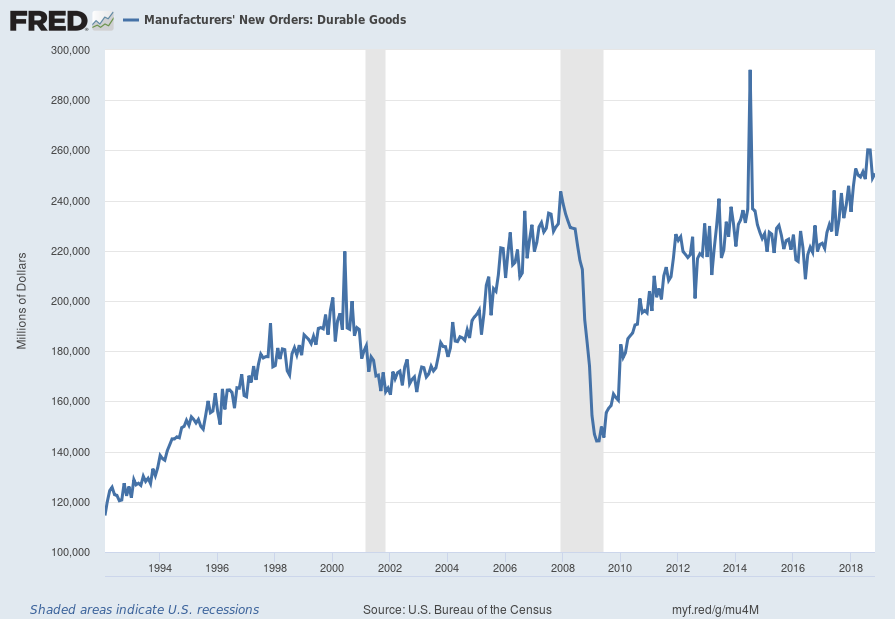

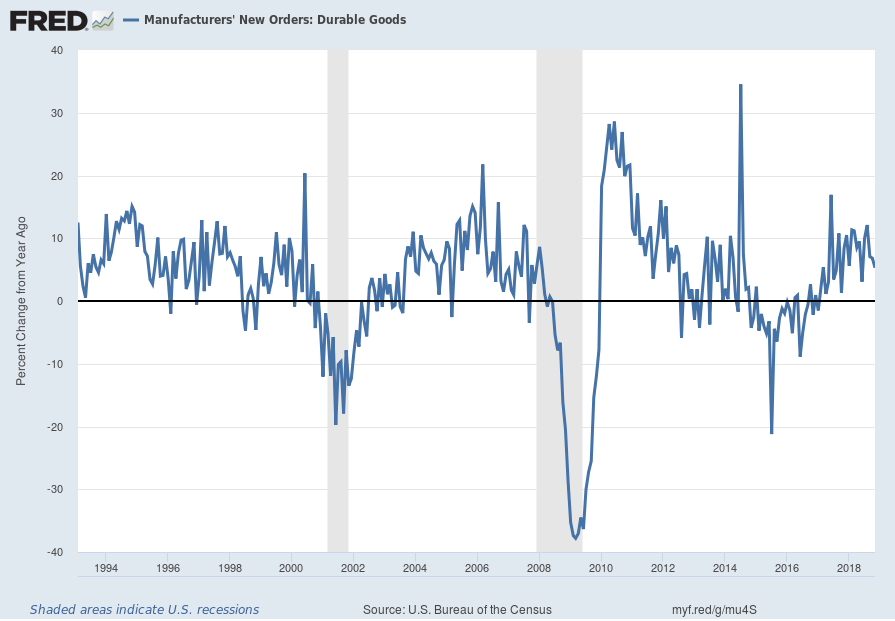

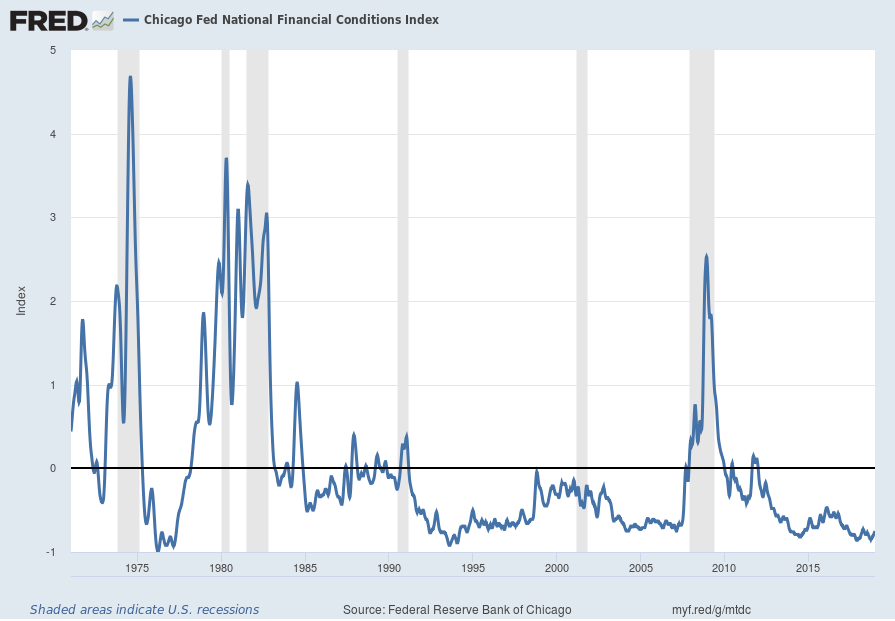

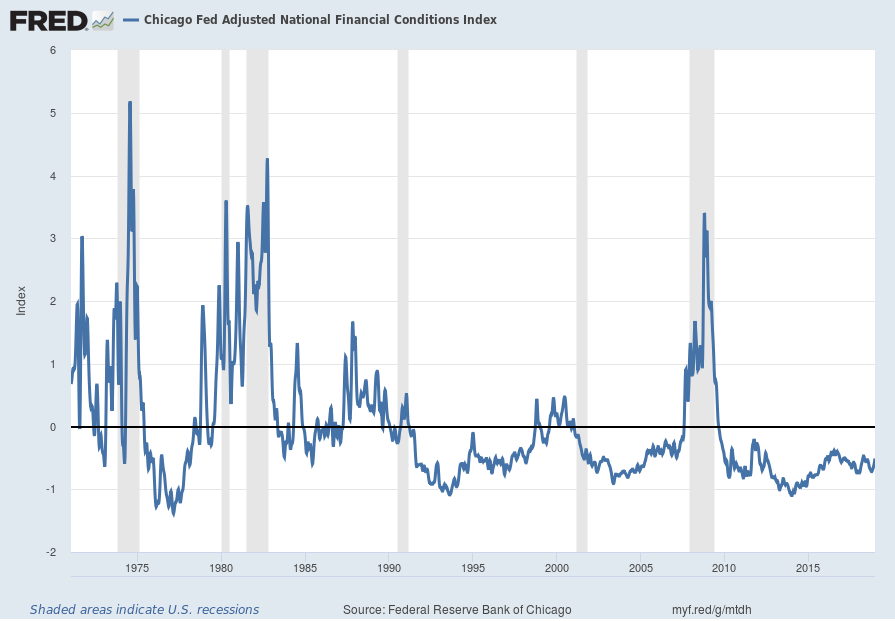

Despite this robust economic backdrop and our expectation for healthy growth, we have seen developments that may signal some softening relative to what we were expecting a few months ago. Growth in other economies around the world has moderated somewhat over the course of 2018, albeit to still-solid levels. At the same time, financial market volatility has increased over the past couple of months, and overall financial conditions have tightened–that is, they have become less supportive of growth.

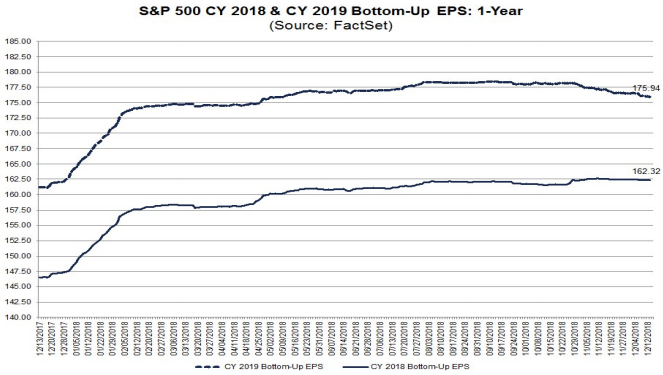

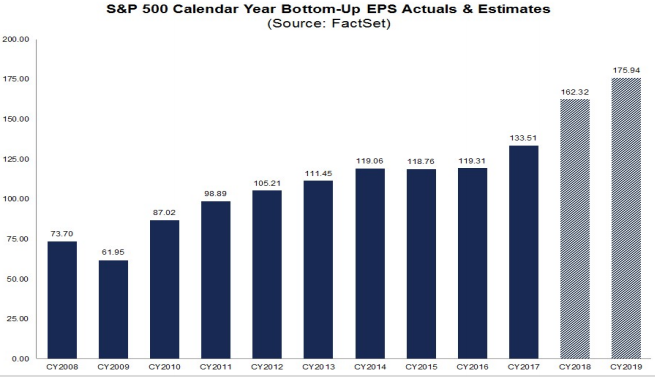

In our view, these developments have not fundamentally altered the outlook. Most FOMC participants have, instead, modestly lowered their growth and inflation forecasts for next year. The projections of Committee participants released today show growth continuing at healthy levels, the unemployment rate falling a bit further next year, and inflation remaining near 2 percent. The projections also show a modestly lower path for the federal funds rate, which should support the economy and keep us near our goals. As the economy struggled to recover from the financial crisis and the subsequent recession, the Committee held our policy rate near zero for seven years to give the economy the best chance to recover. And the economy did recover steadily, if slowly at times. Three years ago the Committee came to the view that the best way to achieve our mandate was to gradually move interest rates back to levels that are more normal in a healthy economy. Today, we raised our target range for short-term interest rates by another quarter of a percentage point. As I’ve mentioned, most of my colleagues expect the economy to continue to perform well in the coming year. Many FOMC participants had expected that economic conditions would likely call for about three more rate increases in 2019. We have brought that down a bit and now think it is more likely that the economy will grow in a way that will call for two interest rate increases over the course of next year.

Jerome Powell’s responses as indicated to the various questions:

BINYAMIN APPLEBAUM. Binyamin Applebaum, The New York Times. You’re about to undershoot your inflation target for the seventh straight year. Your new forecasts say that you’re going to undershoot it for the eighth straight year. Should we interpret the dot plot is suggesting that some members of your Committee believe that policy should be in a restrictive range by the end of next year? And if so, can you help us to understand why people would be advocating restrictive monetary policy at a time of persistent inflation undershoots?

CHAIRMAN POWELL. Well, we, as a Committee, we do not desire inflation undershoots. And you’re right, inflation has continued to surprise to the downside, not by a lot though, I think. We’re very close to 2 percent, and you know, we do believe it’s a symmetric goal for us. Inflation is symmetric around 2 percent, and that’s how we’re going to look at it. We’re not trying to be under 2 percent. We’re trying to be symmetrically around 2 percent, and I don’t, you know, I’ve never said that I feel like we’ve achieved that goal yet. The only way to achieve inflation symmetrically around 2 percent is to have inflation symmetrically around 2 percent, and we’ve been close to that. We haven’t gotten there yet, and we have not declared victory on that. So, that remains to be accomplished.

JEANNA SMIALEK. Hi, Jeanna Smialek, Bloomberg News. Just following up on Binyamin’s question. I guess if you haven’t achieved 2 percent inflation and you don’t see an overshoot, which would be sort of implied by a symmetrical target, what’s the point in raising rates again at all?

CHAIRMAN POWELL. So again, I go back to the health of the economy. When you look at 2018, as I mentioned, this the best year since the financial crisis. You’ve had growth well above trend. You’ve got unemployment dropping. You’ve got inflation moving up to 2 percent. And we also have a positive forecast, as I mentioned, and in that context, we think this move was appropriate for what is a very healthy economy.

Policy at this point does not need to be accommodative. It can move to neutral. It seems appropriate that it be neutral. We’re now at the bottom end of range of estimates of neutral. So that’s the basis upon which we made the decision. I also think we took onboard, you know, the risks to that, and, you know, we’re certainly cognizant of them.

also:

NANCY MARSHALL-GENZER. Nancy Marshall-Genzer with Marketplace. Do you still think core PCE is a good measure of whether the economy is overheating? What do you think of other measures like setting a target for economic growth and relying more on that?

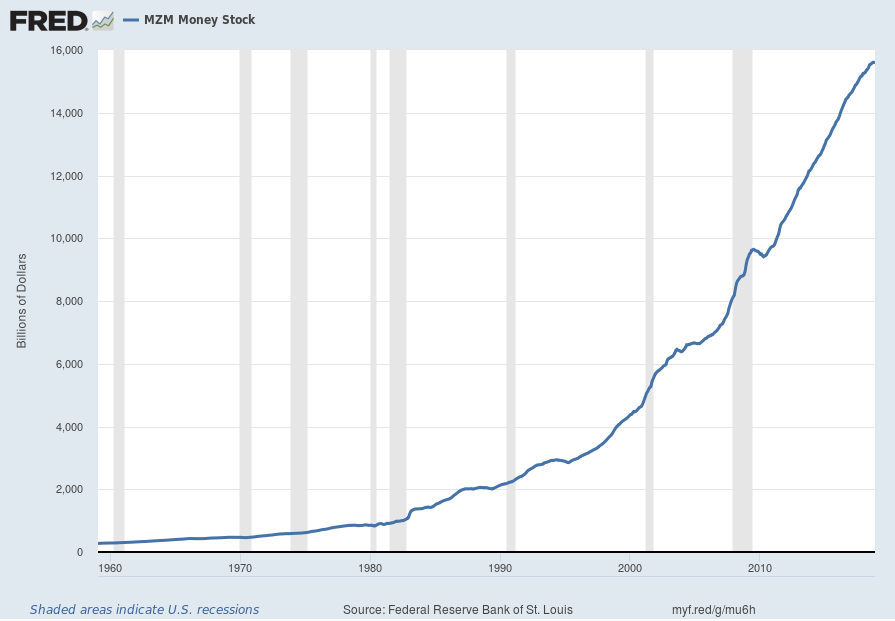

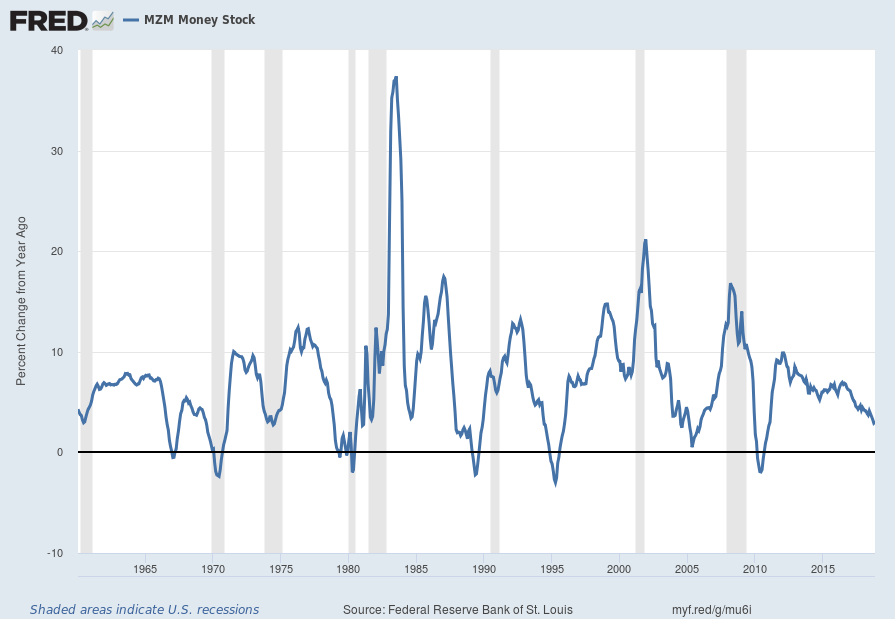

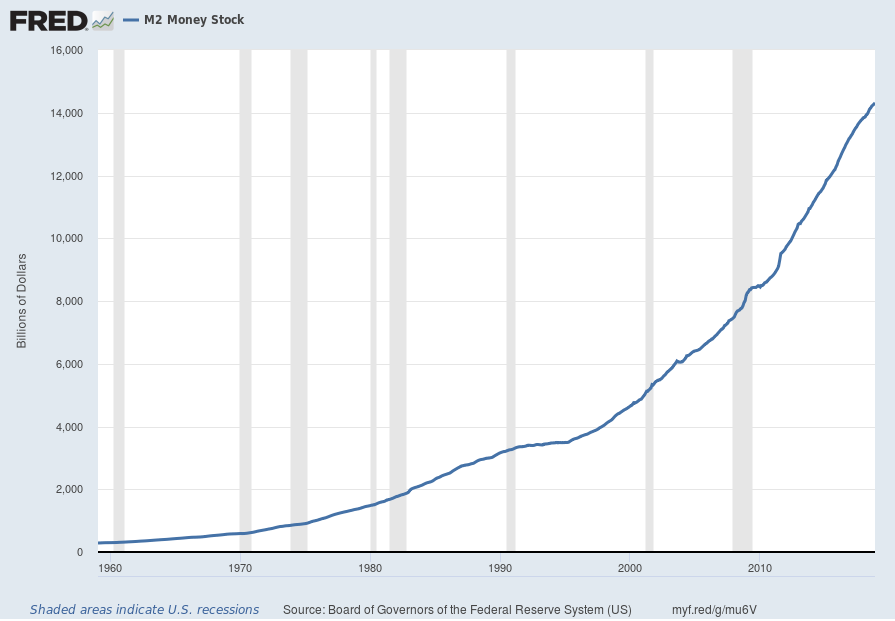

CHAIRMAN POWELL. Well, I think we look at both, but core PCE is a good indicator. It has, what’s happened over really 50 years is that inflation has become much less reactive to changes in growth. There was a time when inflation reacted really quickly to changes in growth and changes in unemployment. And that time is behind us. And that is often attributed to the success of central banks in anchoring inflation expectations so that people believe that inflation will come back to the target or around the target so it doesn’t go down as much, inflation doesn’t go down as much, and a downturn doesn’t go up as much when the, you know, when the economy is strong. It’s really true, though, that inflation has not reacted a lot on a road from 10 percent unemployment to now 3.7 percent unemployment. Now it did move up last year. But in terms of just targeting growth, you know, I think actually think our dual mandate works very well, which is maximum employment and stable prices. Most of the time, those two things work together. When they work temporarily in different ways, we take a balanced approach. But I think that approach has served us well, and I think we can work well with it.

also:

COURTENAY BROWN. Hi Chairman, Courtenay Brown from Axios. I’m wondering if you could clear up what’s become a little bit of a debate in the financial community. You said in October in an interview with PBS that interest rates were a long way from neutral. A month later you said interest rates were just below neutral. And I think a lot of people interpreted that as a shift in tone from you. Were they right to interpret it that way?

CHAIRMAN POWELL. You know, monetary policy is a forward-looking exercise, and I’m going to, I’m just going to stick with that. It’s, where we are right now is we’re at the lower end of the range of neutral. We’ve arrived effectively at the bottom end of that range. And, you know, there are implications of that. For that, as I mentioned, going forward, there’s real uncertainty about the path, the pace rather, and the destination for further rate increases. And we’re going to be letting incoming data inform our thinking about the appropriate path.

_____

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2470.23 as this post is written