From Janet Yellen’s opening comments:

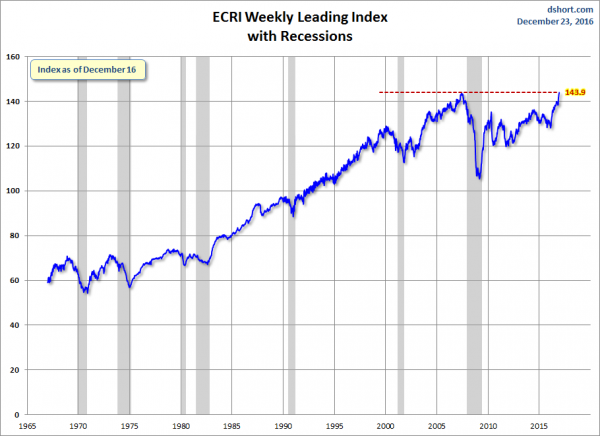

CHAIR YELLEN: Good afternoon. Today, the Federal Open Market Committee decided to raise the target range for the federal funds rate by 1/4 percentage point, bringing it to 1/2 to 3/4 percent. In doing so, my colleagues and I are recognizing the considerable progress the economy has made toward our dual objectives of maximum employment and price stability. Over the past year, 2-1/4 million net new jobs have been created, unemployment has fallen further, and inflation has moved closer to our longer-run goal of 2 percent. We expect the economy will continue to perform well, with the job market strengthening further and inflation rising to 2 percent over the next couple of years. I’ll have more to say about monetary policy shortly, but first I’ll review recent economic developments and the outlook.

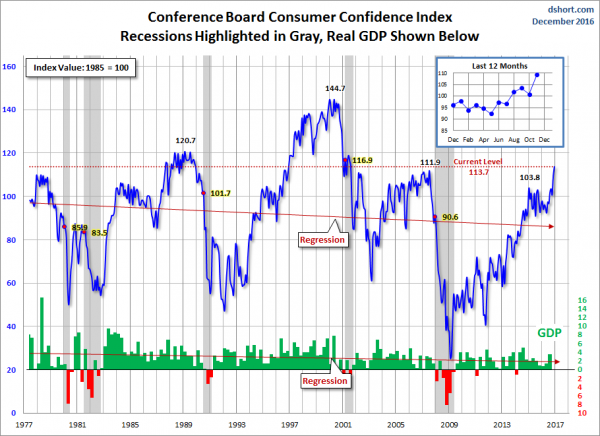

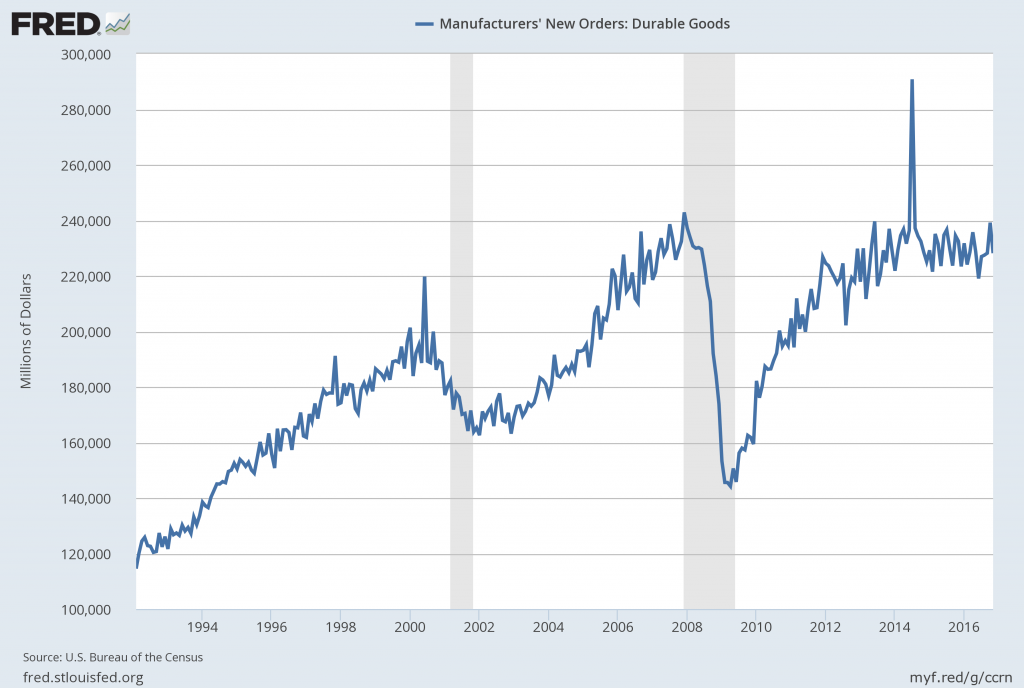

Economic growth has picked up since the middle of the year. Household spending continues to rise at a moderate pace, supported by income gains and by relatively high levels of consumer sentiment and wealth. Business investment, however, remains soft, despite some stabilization in the energy sector. Overall, we expect the economy will expand at a moderate pace over the next few years.

Job gains averaged nearly 180,000 per month over the past three months, maintaining the solid pace that we’ve seen since the beginning of the year. Over the past seven years, since the depths of the Great Recession, more than 15 million jobs have been added to the U.S. economy. The unemployment rate fell to 4.6 percent in November, the lowest level since 2007, prior to the recession. Broader measures of labor market slack have also moved lower, and participation in the labor force has been little changed, on net, for about two years now, a further sign of improved conditions in the labor market given the underlying downward trend in participation Page 2 of 20 stemming largely from the aging of the U.S. population. Looking ahead, we expect that job conditions will strengthen somewhat further.

Janet Yellen’s responses as indicated to the various questions:

JAMES PUZZANGHERA. Hi. Jim Puzzanghera with the LA Times. For the average American, can you explain what the impact of this hike and three additional hikes will be next year? And should they feel more confident in the economy now that you are raising rates to a slightly faster pace?

CHAIR YELLEN. So, let me say that our decision to raise rates is-- should certainly be understood as a reflection of the confidence we have in the progress the economy has made and our judgment that that progress will continue and the economy is proven to be remarkably resilient. So it is a vote of confidence in the economy. As you know, this was a decision that was well anticipated in markets and I think it will have relatively small effect on market rates. It could boost very slightly some short-term interest rates that could have an effect on borrowing costs that are linked to them. But overall, I think that households and firms will see very modest changes from this decision. But certainly, it's important for households and businesses to understand that my colleagues and I have judged the course of the U.S. economy to be strong so that we're making progress toward our inflation and unemployment goals. We have a strong labor market and we have a resilient economy.

also:

BINYAMIN APPLEBAUM. About how the system should be improved?

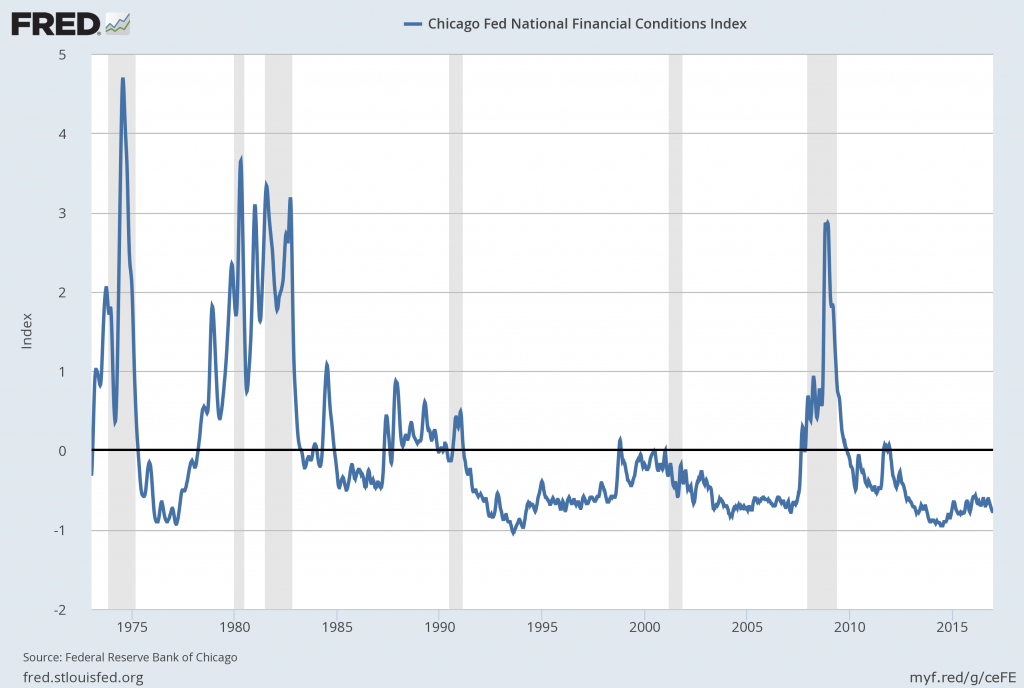

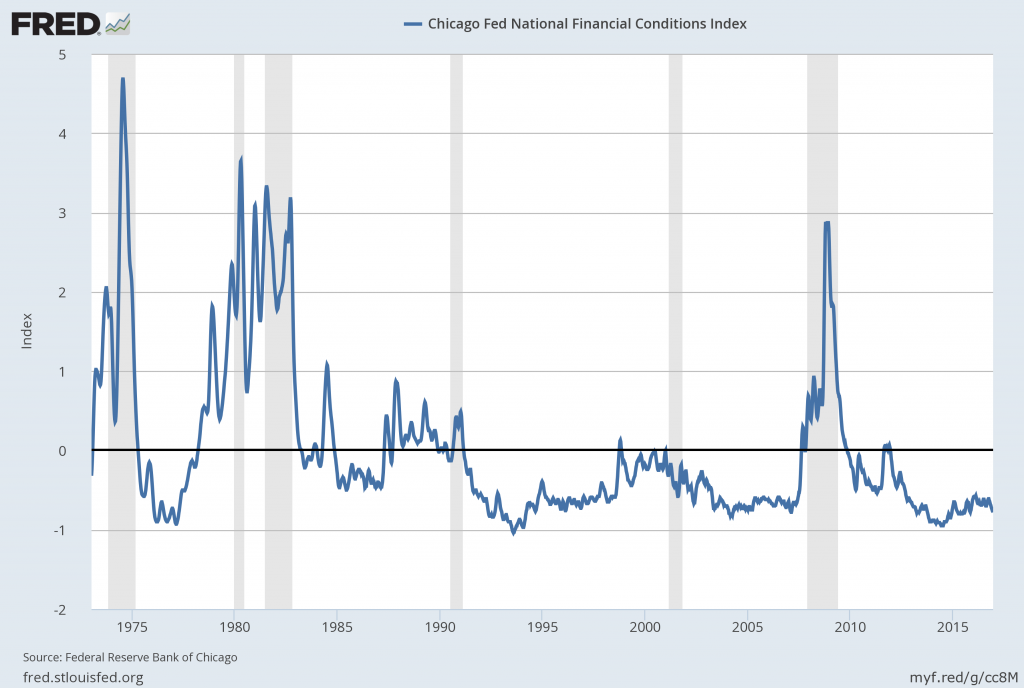

CHAIR YELLEN. About how-- Financial rate. Yeah. So, OK on financial regulation, I feel that we lived through a devastating financial crisis that took a huge toll on our economy. And most members of Congress and the public came away from that experience feeling that it was important to take a set of steps that would result in a safer and stronger financial system. And I feel that we have done that. That has been our mission since the financial crisis for the last six or seven years. That's what Dodd-Frank was designed to do. I think it's very important that we have reduced the odds that a systemically important firm could fail by requiring higher capital, higher liquidity by performing stress tests that provide us another way of insuring that the firms we count on to supply credit to households and businesses would be able to go on doing that even in the face of a severely adverse shock. The firms, the largest firms have a great deal more capital than they did before the crisis. Those are important changes. We have placed the toughest regulations on those firms that are systemically important. I would advise that-- and we have been trying to do this, that it's important to look for ways to relieve regulatory burden on community banks and smaller institutions to tailor regulation so that it's appropriate for the systemic risk profile of the particular institutions. I think there was broad agreement also that we should end too big to fail and that means not only reducing the odds of the failure of a systemically important institution but also making sure that should such a firm fail that it could be resolved in an orderly way. And the living wills process has been about that and I think we've made considerable progress in making sure that the largest and most systemic firms conduct their businesses in a day-to-day way with some thought about-- with important thinking in place about whether or not the way they are conducting their business would aid resolution in the event that they encountered a severe negative shock. So, this is progress, I would say, is very important not to roll back. There may be some changes that could be made and we've suggested a few like eliminating the burden of compliance with the Volcker rule or incentive compensation, regulations for smaller banks or modestly raising the threshold for banks that are subject to enhanced prudential supervision. But I would urge that it's important to keep this in place.

also:

NANCY MARSHALL-GENZER. Hi, Nancy Marshall-Genzer with Marketplace. Wondering about slack, when do you think the slack in the labor market will have worked its way through so we're no longer talking about it at press conferences and it's not such a big issue?

CHAIR YELLEN. So, this is not something that it's possible to judge precisely. My colleagues write down their best estimates of a normal longer run unemployment rate. The median stands at 4.8 percent, so we're close possibly-- the unemployment rate right now is ever so slightly below but in the neighborhood. If we look at larger, broader measures of slack like the U6 measure that includes involuntary part-time employment and those who are marginally attached to the labor force. They're slightly higher than pre-recession levels, but they've come down considerably. We look at a broad array of indicators of the labor market, and if you look at job openings or the hires rate or the quick rate or difficulty of hiring workers as reported in business surveys, you know, I would say the labor market looks a lot like the way it did before the recession that it's-- We're roughly comparable to 2007 levels when we thought the, you know, there was a normal amount of slack in the labor market. The labor market was in the vicinity of maximum employment.

also:

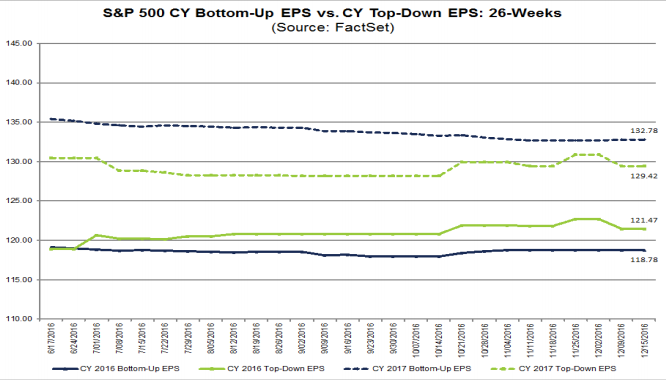

PETER BARNES. On equity prices, you have talked about whether or not the valuations are still-- are within historical ranges of norms. Is this Dow 20,000 kind of within historical norms? Are you comfortable with that?

CHAIR YELLEN. Well, I think rates of return in the stock market relative to-- Remember that the level of interest rates is low and taking that into account, I believe it's fair to say that they remain within normal ranges.

also:

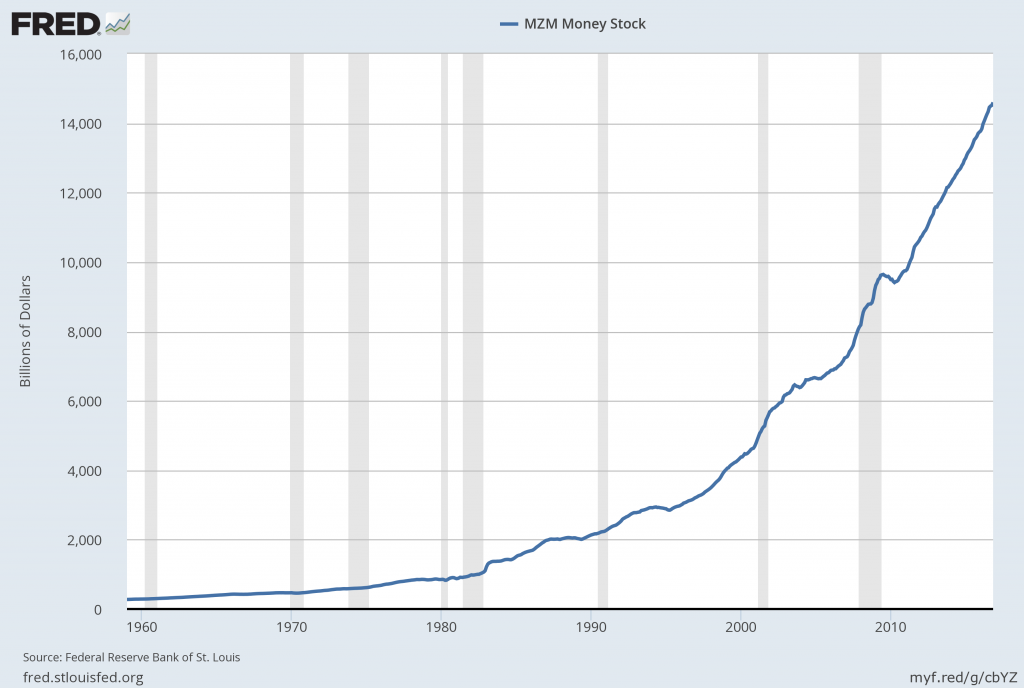

JUSTINE UNDERHILL. Justine Underhill, Yahoo Finance. So the Fed's balance sheet has grown to over $4 trillion dollars. And as the Fed begins removing policy accommodation, under what circumstances would you see the Fed removing or possibly winding down its balance sheet? And either letting mature-- securities mature or possibly outright selling bonds from the-- SOMA portfolio?

CHAIR YELLEN. So, we've indicated in our normalization principles that we expect to diminish the size of our portfolio over time largely by ceasing reinvestments of principal rather than by selling securities. We've indicated that once the process of normalization of the federal funds rate is well under way, we would probably begin to allow our portfolio to run off. We've not yet made any precise decisions about when that will occur. We want to feel that if the economy were to suffer an adverse shock, that we have some scope through traditional means of interest rate cuts to be able to respond to that. Now there's no mechanical rule about what level of the federal funds rate we might deem appropriate to begin that process. It's not something that only depends on the level of the federal funds rate, it also depends on our judgment of the amount of momentum in the economy and the possible concerns about downside risks of the economy. So, we've not yet made this decision, but it is something that we have long planned to begin to allow our balance sheet to run off. And then it would take several years. And we would end up if all goes well with the substantially smaller balance sheet than we have at present.

also:

MIKE DERBY. Mike Derby from Dow Jones Newswires. I'm wondering if the unexpected outcome of the election and the sense that a lot of people are really upset with how the economy is performing despite having, you know, aggregate economic statistics that look pretty good. Is that causing you in any way to think differently about how you evaluate the economy, like what sort of things you look for to get a sense of what's going on in the economy. Is, you know, basically, did-- how things turn on the election, is it making you think differently about how you evaluate the economy's performance and how it's dealing?

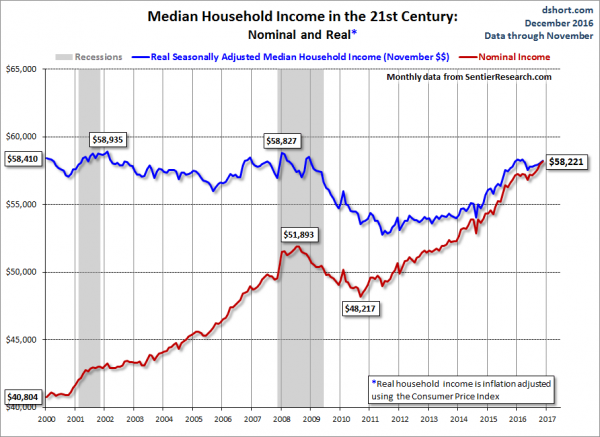

CHAIR YELLEN. Well, I mean, we've long been aware. And I've spoken about previously disturbing trends in the economy, particularly, rising wage inequality, income inequality, and the fact that a significant share of our population hasn't been enjoying significant real wage gains if any. And so, these are longstanding concerns. These are not new phenomenon, but the recession was very severe and probably exacerbated developments that had long been affecting many American workers and households. And I think they are quite disturbing. Now, they’re ones that the Fed is not well-positioned, I think our policies can affect the general level of economic activity and slack in the labor market, the level, the rate of inflation which we focus on. But I think it's important for policymakers more broadly to be attentive to these trends and to think about policies that could address them. We've been quite attentive with respect to particular demographic groups in the labor market, particularly minorities tend to be very badly affected by downturns. We've discussed that, we've been focused on it. It's not just since the election, and are pleased to see that they are enjoying gains. For example, the African-American unemployment rate at this point is now rough-- about back to 2007 levels as well. But these are important trends, and I think it's important for policy to address them.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2262.03 as this post is written