Inflation

Inflation is a complex and problematical issue. Due to its importance it is highly monitored and is integral to the economic management of the country.

Recently, inflation has increased and has reached multi-decade high levels. Currently (March 2022) there has been conflicting signals as to whether this higher level of inflation is transitory (largely caused by supply chain disruptions) or whether inflation will continue to increase. Recently I wrote the following posts which discuss the rationale behind each of these scenarios:

“The Belief That Current Inflation Levels Will Subside” [February 8, 2022]

“The Belief That Current Inflation Levels Will Increase” [February 16, 2022]

As noted in the “…Inflation Levels Will Subside” post above, the overwhelming consensus among professional forecasters and the official Federal Reserve projections is that inflation will subside throughout 2022.

While the current high levels of inflation create a number of problems, even more pernicious is the possibility of hyperinflation occurring. As I noted in the “…Inflation Levels Will Increase” post noted above:

Lastly, if high levels of inflation persist – and further increase – there is a possibility of a hyperinflationary environment occurring. A hyperinflation would be exceedingly problematical.

While there is no standardized definition of hyperinflation, its general characteristics are sustained, very high levels of inflation that typically increases in an ever-accelerating fashion. Both accompanying and exacerbating this hyperinflation is the rapid decline of the currency. As seen in various historical episodes, hyperinflation almost invariably leads to total destruction of the economic system, which is both highly traumatic as well as chaotic.

Of course, the United States has never experienced hyperinflation. The only episode of sustained levels of high inflation in recent history has been that of the 70s and early 80s.

The paramount question is whether the current levels of high inflation can somehow lead to a hyperinflation or – alternately – if the United States is heading toward hyperinflation at some point in the more-distant future.

Inflation and hyperinflation are notably complex topics. As well, due to there not being any high levels of officially-stated U.S. inflation for decades – and no hyperinflation – there is no historical U.S. context.

Any detailed discussion of hyperinflation would be very lengthy and complex. However, the following aspects of our current economic situation are [highly] problematic and can serve as preconditions for substantial and rapidly ever-increasing levels of inflation (i.e. hyperinflation.) Many of these conditions have been broadly discussed in the “A Substantial U.S. Dollar Decline And Consequences” page:

Rapid, Substantial, And Unexpected Inflation

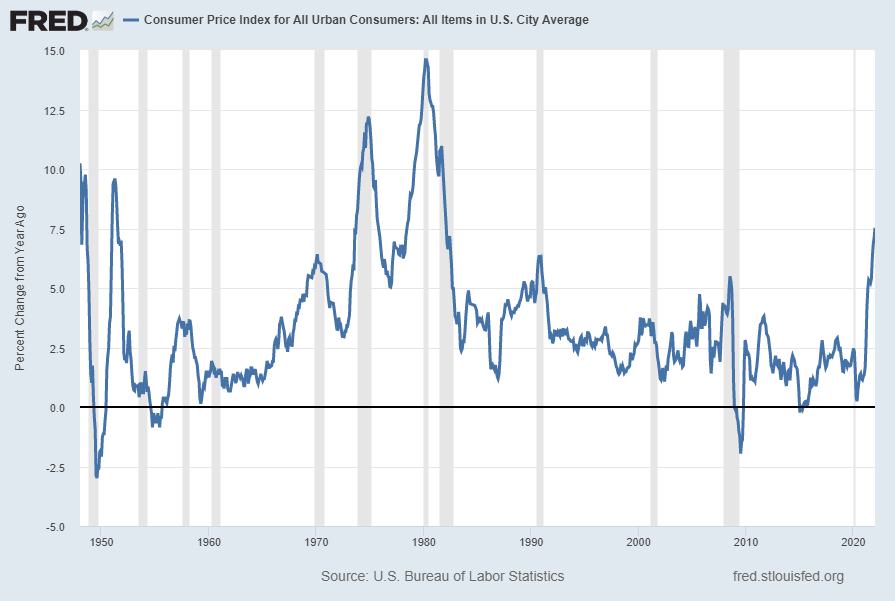

As seen in the following long-term chart of the most commonly cited U.S. inflation measure, Headline CPI, the increase in inflation has been rapid and, when viewed from a long-term historical perspective, substantial. Of further note, this inflation has been almost entirely unexpected. This “headline CPI” figure is at 7.5% as of the latest update of February 10, 2022 (from the January 2022 CPI report):

source: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average [CPIAUCSL], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 10, 2022: https://fred.stlouisfed.org/series/CPIAUCSL

Very High Amounts Of “Money Printing”

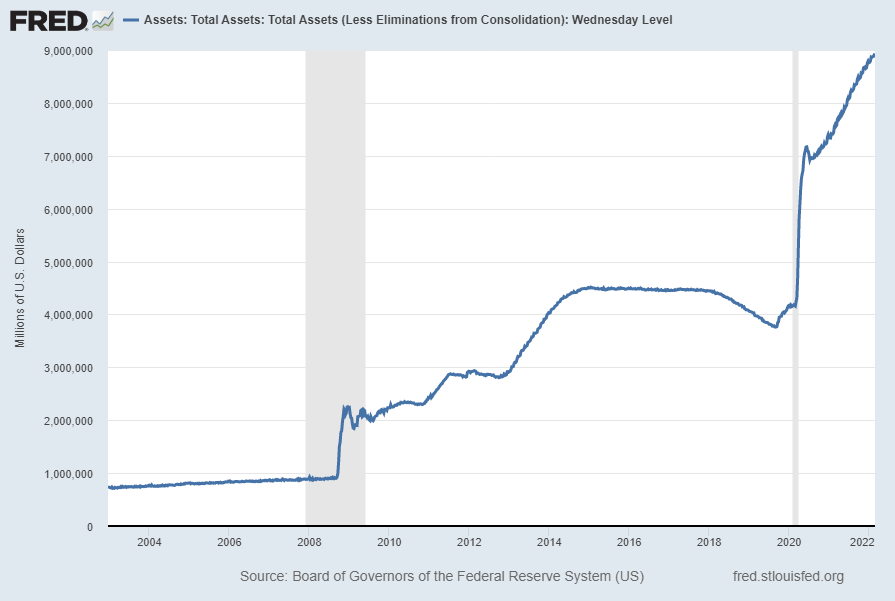

Over the last few years there has been a very high degree of “money printing.” This money printing has ostensibly been done for various reasons, including to provide economic support during the pandemic. While there can be many ways to depict this growth – including long-term money supply charts – one way is to show the growth in the Federal Reserve’s balance sheet. Shown below is a long-term chart of the Total Assets on the Federal Reserve’s balance sheet. The value is $8.928129 Trillion as of the February 24, 2022 update, reflecting data through February 23, 2022:

source: Board of Governors of the Federal Reserve System (US), Assets: Total Assets: Total Assets (Less Eliminations from Consolidation): Wednesday Level [WALCL]; retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 28, 2022: https://fred.stlouisfed.org/series/WALCL

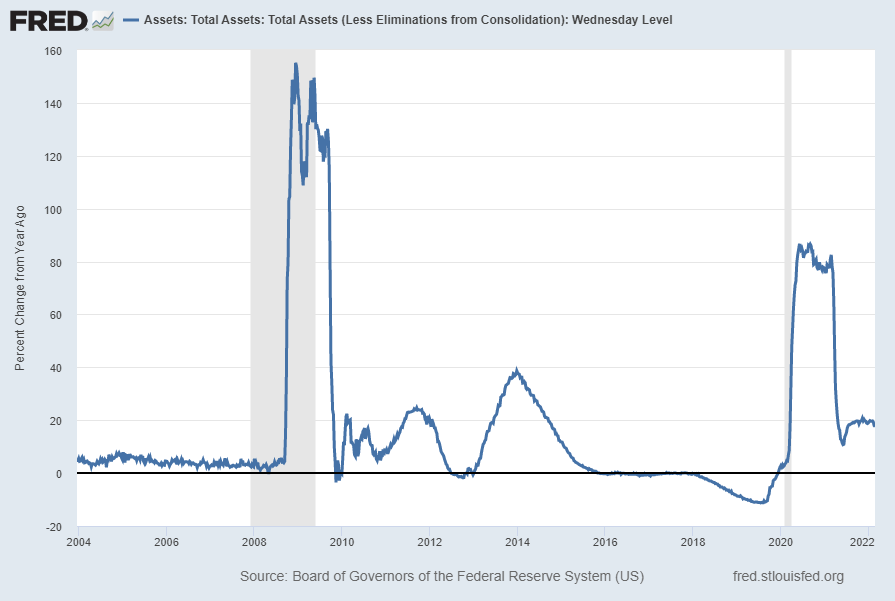

Here is this “Total Assets…” chart on a “Percent Change From Year Ago” basis, with a current value of 17.6%:

Abnormally Low Interest Rates Given The Level Of Inflation

Interest rates have been exceedingly low for a number of years. Of paramount concern is whether these ultra-low interest rates – especially the Fed Funds Rate – is appropriate given the current inflationary environment. Given that the (purported) primary inflation remedy is to “raise interest rates,” the primary question is whether the Federal Reserve is “behind the curve.” Various measures indicate that the current level of the Fed Funds Rate should be significantly above current levels.

For example, the Federal Reserve Bank of Cleveland’s “Simple Monetary Policy Rules” as of March 1, 2022 indicates (on a median basis) a Fed Funds Rate based upon these rules should be above 3%. Other indicators suggest that the Fed Funds Rate should be above – perhaps substantially – 5%. This compares to a current (as of the March 1, 2022 update) Federal Funds Effective Rate of .08 percent.

While, in theory, the Federal Reserve can raise the Fed Funds Rate by any amount at any time, various constraints exist with regard to the broad economy and overall financial system. As well, it is well-documented that monetary policy works with a lag that is typically measured in years. This lag may be 1-2 years if not more.

As such, given the constraints and the lag, any increase in the Fed Funds Rate will likely be both measured and slow to take effect…i.e. to decrease the rate of inflation. Of note, this assumes that such increases in the Fed Funds Rate is indeed the proper and optimal method to quell inflation. All told, if one believes that the current inflation is embedded and is likely to maintain or increase going forward, one can easily come to the conclusion that the Federal Reserve is “behind the curve” – perhaps to a (highly) substantial degree.

Substantial Price Appreciation Of Commodities

The price appreciation of various early-stage inputs continues to be highly notable. The continuing price appreciation is (very) high when viewed from a long-term historical perspective. One example is the Bloomberg Commodity Spot Index, which recently (early March 2022) experienced its highest one-week price appreciation ever.

While this commodity price appreciation is not necessarily “proof” that inflation will continue to increase, it does seemingly contradict the theory that current high levels of general inflation have either peaked and/or will significantly subside in coming months.

Currency Implications During Hyperinflation

The extremely rapid depreciation of a currency during hyperinflation is a paramount concern. A rapidly falling currency creates an exceedingly dire situation.

Various prior hyperinflations in other countries appear to have occurred over the course of years. This length of time (ostensibly) provides enough “time to act” to the formation and gestation of very high inflation. However, other episodes appear to have blossomed over the course of a few months.

If the United States is heading to a hyperinflation, the issue is whether such a condition will occur gradually (i.e. over years) or if the manifestation will occur over a compact time period such as months. Given various dynamics of the current economic and financial era, as well as various issues such as those discussed above, there are many reasons to support the idea that very high inflation can develop in a historically (very) compressed time frame.

The Complexity Of Hyperinflations And The Aftermath

As noted above, the dynamics of hyperinflations are complex and largely lack societal understanding. Given the lack of any high levels of inflation in the U.S. in decades any hyperinflation in the U.S. would seem especially foreign in nature. Given this history, any gestation of hyperinflation will likely be very hard to predict, assess, and ameliorate.

Throughout this site there has been much discussion of the vulnerability of the U.S. Dollar to a substantial decline, and the implications of such. The dangers of a rapidly falling (collapsing) currency can hardly be understated. As Keynes has said, as seen in his book Economic Consequences of the Peace, chapter 6:

“Lenin was right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

(posted March 9, 2022)

No comments:

Post a Comment