Recently there have been a variety of discussions as to whether

the stock market is experiencing a bubble. Among the main drivers of such

discussion is the stock market's seemingly near-constant price advancements,

frequent record-high closes, and the duration of the advance, all of which are

against the backdrop of the (at best) slow-growth economy. For reference,

here is a daily chart of the S&P500 from 2009, with the 50dma and 200dma:

(click on chart to enlarge image)(chart courtesy of StockCharts.com; chart creation and annotation by the author)

One such article discussing whether the stock market is

experiencing a bubble is the Saturday, November 16 Barron's article titled

"Bubble Trouble?" An excerpt:

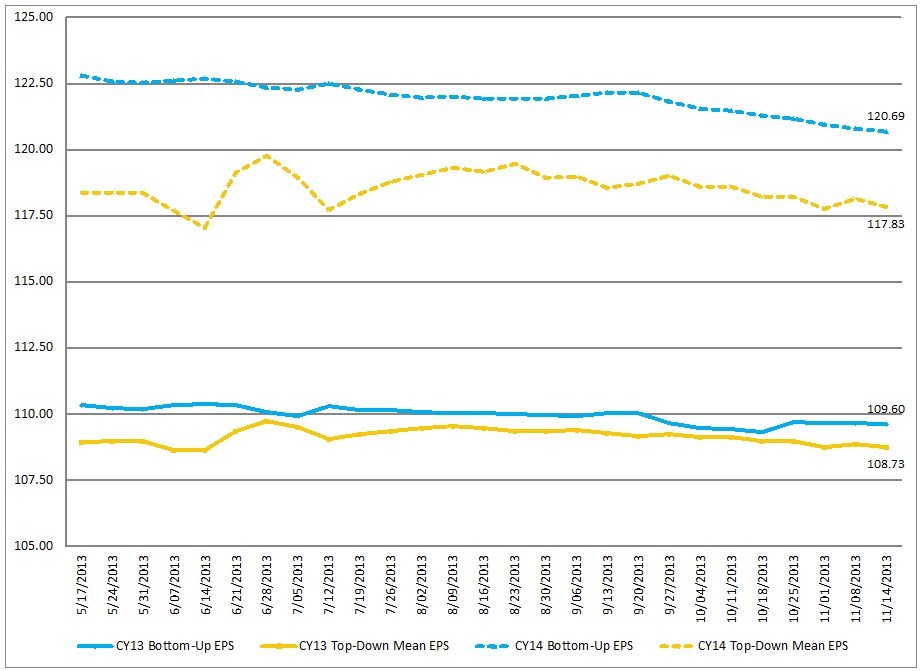

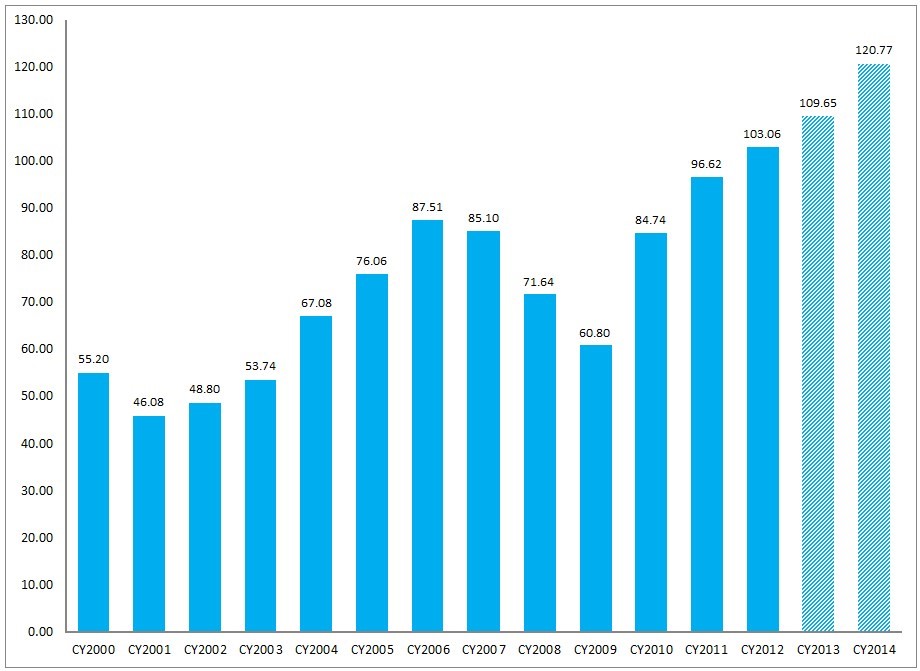

The S&P 500 is valued at 16 times projected 2013 operating profits of $109 and at 15 times estimated 2014 earnings of $120. Those price/earnings ratios are about equal to the long-run average. Even if next year's earnings growth is closer to this year's projected 5% than to the aggressive current estimate of 10%, the S&P 500 forward P/E is 15.6, which doesn't look excessive at a time of near-zero short-term rates, a 2.71% yield on the 10-year Treasury note, and sub-6% average yield on junk bonds. The S&P 500 dividend yield is 2%, but the earnings payout ratio is historically low at about 35%, meaning companies have room to further boost dividends.

“Stock prices have risen pretty robustly but if you look at traditional measures,” such as price-earnings ratios, “you would not see stock prices in territory that suggests bubble-like conditions,” she said.

My comments:

My posts concerning the existence of the stock market being an

asset bubble date back to 2011. I view the argument as to whether the stock market is experiencing a bubble based upon two general areas: technical analysis and fundamental analysis.

While I believe there to be many reasons to believe stocks are in a bubble based upon technical measures, in this post I will focus on fundamental measures.

In particular, the common (and seemingly predominant) argument made that stocks are fairly or attractively valued is based upon a (forward) PE basis. Various year 2014-2015

S&P500 earnings forecasts continue to portray attractive growth in earnings. While, as indicated by the Barron's article mentioned above, stocks don't appear to be in a bubble based upon (forward) PE-based valuation measures, current levels of earnings are, in many ways, favorably impacted by various factors.

Even if one assumes that EPS is - or should be - the primary stock market valuation metric - these numerous benevolent factors within the current earnings environment seem to lack general recognition. Whether these factors will persist - and whether they "deserve" to be accorded full valuation - should perhaps be the focal issue.

While a full discussion of these factors would be exceedingly lengthy and, at times, very complex, below are some of the more notable factors:

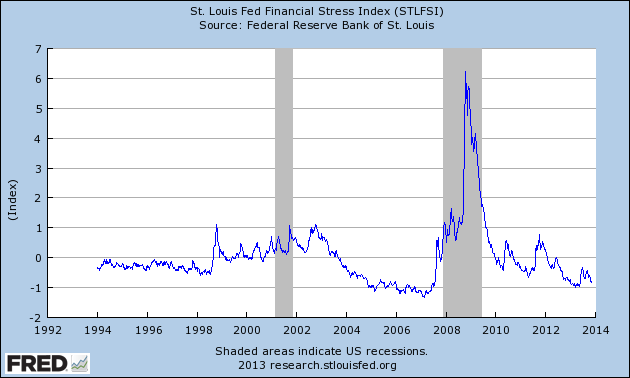

(Ultra) Low interest rates - While, due to numerous factors, it is difficult to accurately quantify how much the (ultra) low interest rate environment has directly and indirectly bolstered earnings, the (ultra) low interest rate environment has had a (very) significant impact on earnings. I discuss this in the ProfitabilityIssues.com posts of September 25, 2013 ("

Corporate Interest Cost Savings") and the July 29, 2013 post ("

Impact Of Low Interest Rates On Corporate Profitability.")

Lagging Revenue Growth - While S&P500

earnings have no doubt been robust, corporate revenue growth has consistently

lagged. This is problematical in many ways, both from a corporate

performance standpoint as well as a general economic standpoint. From a

corporate performance standpoint, it raises many issues, including both the

"quality of earnings" as well as to the sustainability of earnings.

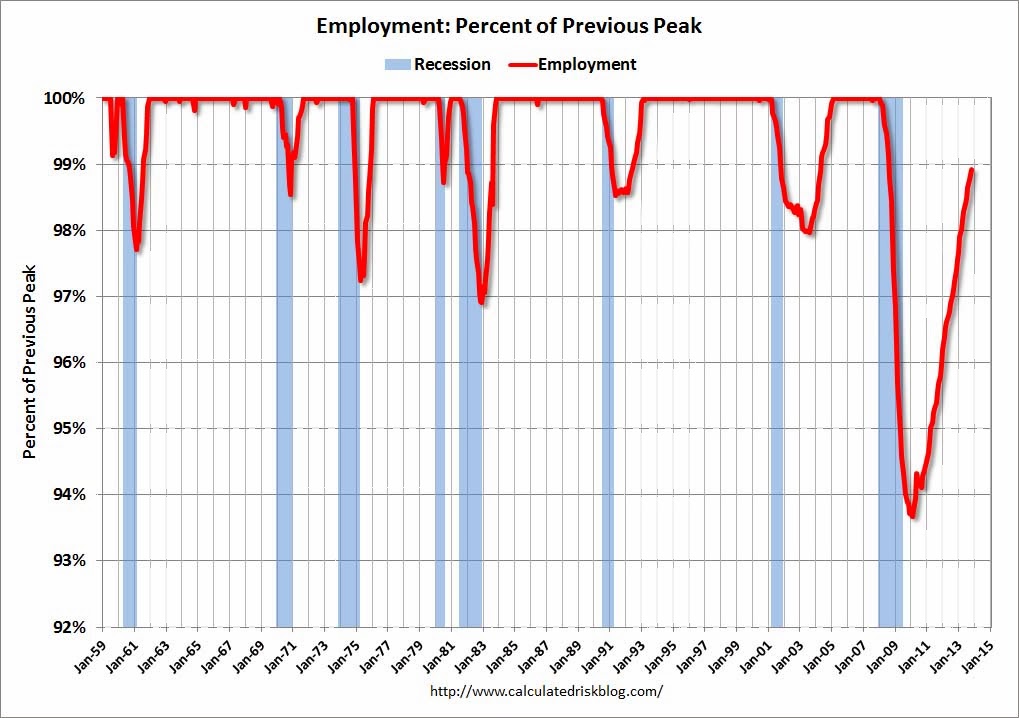

From a general economic standpoint, it strongly appears as if employment

growth, among other factors, would likely be considerably higher if revenue

growth was higher.

Share buybacks - While, from an overall perspective, share buybacks aren't a predominant factor, this is yet another area in which EPS has been significantly bolstered. (note: this share buyback factor, as well as others, is also discussed in Lance Roberts' post titled "

Analyzing Earnings As Of Q3 2013.")

Also of note is that various levels of profitability – including the S&P500′s operating margins, operating profits, and

After-Tax Corporate Profits as a Percentage of GDP - are at or near record-high levels. Cumulatively, these levels raise questions about the sustainability of corporate earnings growth. As well, they raise the issue of what a decline in corporate earnings may look like. These "decline" scenarios, although estimates, often look rather precipitous, especially if one starts thinking about such issues as long-term mean reversion as well as a "reversal" of the positive earnings factors mentioned above, such as the ultra-low interest rate environment.

As to the valuation of the stock market, when one uses stock market valuation measures other than PE, one often sees the stock market as either being (very) expensive or in "bubble" territory. These other valuation measures include the Q-Ratio, market capitalization to GDP, CAPE ("Shiller PE"), etc. (note: these factors are discussed in Doug Short's "

Market Valuation Overview" updates as well as various of John Hussman's commentaries, including that of November 11, 2013 titled "

A Textbook Pre-Crash Bubble.")

Cumulatively, on an "all things considered basis," my

analysis continues to indicate that not only is the stock market experiencing a

bubble but - although it doesn't necessarily outwardly appear as such - also

that this stock market bubble is enormous. While some choose to use

(forward) PE ratios as the main determinant of whether the stock market is a

bubble, I believe this is misleading.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1781.37 as this post is written