What is the official definition of an (economic) depression? Although the term is often heard, the term seems to lack a well-structured definition.

There is a section discussing depressions on The NBER's Business Cycle Dating Procedure: Frequently Asked Questions page. As seen in the discussion, it says:

The term depression is often used to refer to a particularly severe period of economic weakness. Some economists use it to refer only to the portion of these periods when economic activity is declining. The more common use, however, also encompasses the time until economic activity has returned to close to normal levels. The most recent episode in the United States that is generally regarded as a depression occurred in the 1930s.

also:

However, just as the NBER does not define the term depression or identify depressions, there is no formal NBER definition or dating of the Great Depression.

A January 14, 2009 article in Forbes, titled "What Is A Depression, Anyway?" also examines the issue as to how a depression is defined, and finds "While there's a fairly standard definition for a recession (two quarters of shrinking gross domestic product), there isn't one for a depression." However, the article later states with regard to a depression:

... a 10% contraction is often cited as the tipping point.

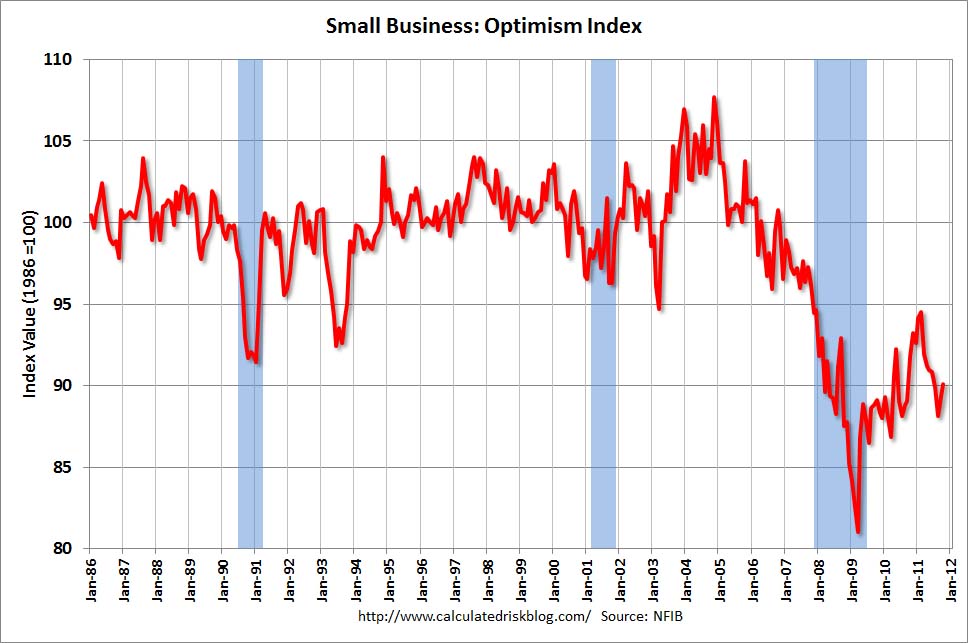

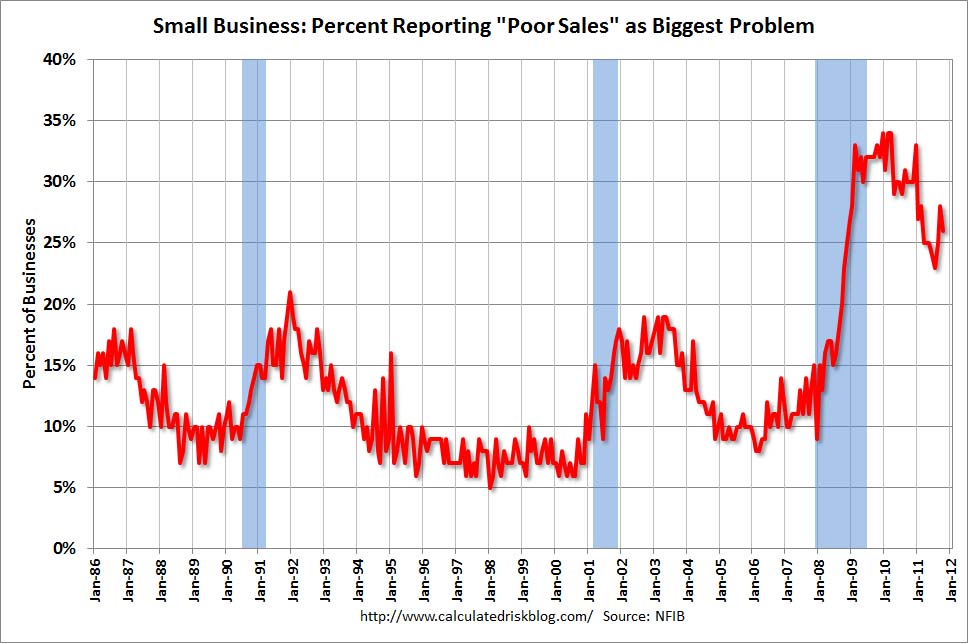

A March 10, 2009 CalculatedRisk blog post titled "What is a depression?" also examines the issue. An excerpt:

Although there is no formal definition, most economists agree it is a prolonged slump with a 10% or more decline in real GDP.

As well, other sources confirm the lack of a standardized definition, although the 10% decline in economic activity (measured via real GDP) is most commonly cited.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1195.19 as this post is written