Recently Deloitte released their “

CFO Signals” “High-Level Summary” report for the 3rd Quarter of 2017.

As seen in page 2 of the report, there were 160 survey respondents. As stated: “Each quarter (since 2Q10), CFO Signals has tracked the thinking and actions of CFOs representing many of North America’s largest and most influential companies.

All respondents are CFOs from the US, Canada, and Mexico, and the vast majority are from companies with more than $1 billion in annual revenue. For a summary of this quarter’s response demographics, please see the sidebars and charts on this page. For other information about participation and methodology, please contact nacfosurvey@deloitte.com.”

Here are some of the excerpts that I found notable:

from page 3:

Perceptions

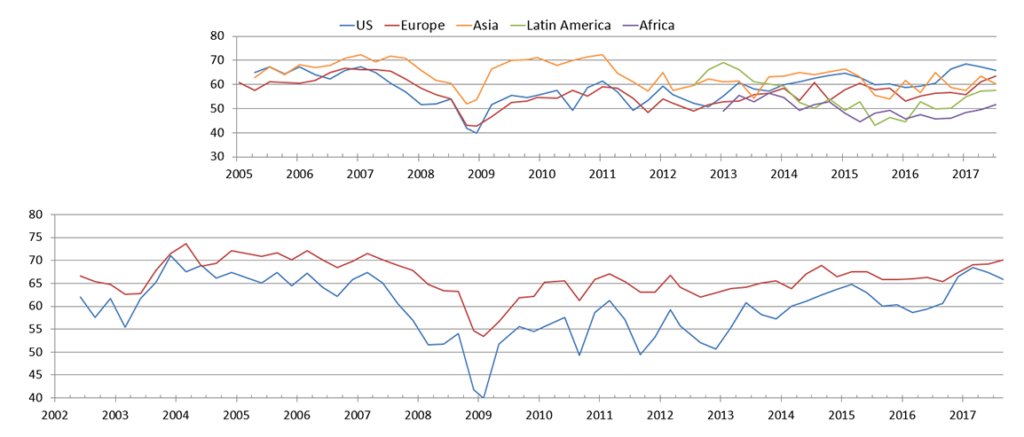

How do you regard the current/future status of the North American, Chinese, and European economies? Perceptions of North America declined, with 64% of CFOs rating current conditions as good (still high), and 45% expecting better conditions in a year (down from 58% last quarter). Perceptions of Europe rose to 29% and 32%; China was flat at 32% and 30%. Page 6.

What is your perception of the capital markets? Eighty-three percent of CFOs say debt financing is attractive (down slightly from 85%). Attractiveness of equity financing rose for public company CFOs (from 42% to 48%) and decreased for private company CFOs (from 46% to 35%). Eighty-three percent of CFOs now say US equities are overvalued—a new survey high. Page 7.

Sentiment

Overall, what risks worry you the most? CFOs voice growing concerns about US political turmoil and geopolitical conflict; talent challenges again top CFOs’ internal worries, and technological change is a rising concern. Page 8.

Compared to three months ago, how do you feel about the financial prospects for your company? The net optimism index declined from last quarter’s +44 to +29 this quarter. About 45% of CFOs express rising optimism (down from 55%), and 16% express declining optimism (up from 11%). Page 9.

Expectations

What is your company’s business focus for the next year? CFOs indicate a strong bias toward revenue growth over cost reduction (60% vs. 20%) and investing cash over returning it (56% vs. 14%). They shifted back to a bias toward new offerings over existing ones (42% vs. 34%), and indicated a bias toward current geographies over new ones (62% vs. 19%). Page 10.

Compared to the past 12 months, how do you expect your key operating metrics to change over the next 12 months? Revenue growth expectations remain above the two-year average at 5.7% (up from 5.6% last quarter). Earnings growth slid from 8.7% to 7.9%, but remains above the two-year average. Capital spending growth fell from 9.0% to 7.3%, while domestic hiring growth rose from 2.1% to 2.6%. US CFOs trailed in almost all metrics. Page 11.

from page 9:

Sentiment

Coming off a survey high two quarters ago, optimism continued to decline— largely on growing pessimism in the US; Healthcare/Pharma and Technology improved, but Manufacturing and

(Please note that all responses were collected prior to Hurricane Harvey.)

This quarter’s net optimism declined significantly from last quarter’s +44 to a stillstrong +29. About 45% of CFOs expressed rising optimism (down from 55%), and 16% cited declining optimism (up from 11%).

Net optimism for the US declined sharply from last quarter’s +47 to +28 this quarter. Canada rose from +20 to +31, while optimism in Mexico declined from +50 to +39.

Healthcare/Pharma optimism rose sharply from +33 to +57, and Technology rose from +27 to +46. On the other hand, Manufacturing optimism fell sharply from +52 to +22, and Energy/Resources fell from +47 to just +19.

Please see the appendix for charts specific to individual industries and countries.

from page 11:

Expectations

Growth in key metrics, year-over-year

Bolstered by Canada and Mexico, domestic hiring surged and other metrics remain strong.

Earnings growth declined to 7.9% from last quarter’s 8.7%. The US declined but remained above its two-year average. Canada declined but remains strong. Mexico sits at its highest level in a year. Energy/Resources and Technology lead; Healthcare/Pharma and T/M/E trail.

Capital investment growth fell to 7.3% from 9.0%, still among its five-year highs. The US declined but remains above its two-year average. Canada declined but remains strong. Mexico fell below its two-year average. Energy/Resources, Healthcare/Pharma, and Financial Services are highest; Services, Technology, and Manufacturing are lowest.

Domestic hiring growth spiked to 2.6% from 2.1%. Canada hit its second-highest level in three years. Mexico rose to its highest level in a year. The US trails but hit its highest level in two years. Technology and Retail/Wholesale lead, while Healthcare/Pharma and Manufacturing trail. Wage pressures are evident in Mexico.

Please see the appendix for charts specific to individual industries and countries.

–

Among the various charts and graphics in the report are graphics depicting trends in “Own Company Optimism” on page 9 and “Economic Optimism” found on page 6.

_____

I post various business and economic surveys because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2500.60 as this post is written