Asset Bubbles

I have discussed the Bond Market Bubble and its many facets in many past posts. The bond market bubble is highly notable due to its magnitude and duration. My analyses (as this is written in early April 2020) indicate that the bond market bubble is simply enormous in size. It may be the largest bubble of any type in history. Of note, as I have mentioned frequently, there are many other immensely large asset bubbles currently in existence, perhaps most notably the stock market bubble. I recently wrote of that bubble on “The Immense Stock Market Bubble And Future Economic Consequences” page.

The effects of this bond bubble on the financial markets and economy are of paramount importance. The demise of the bond market bubble will have tremendous, far-reaching implications for many aspects of the modern-day economy and financial system.

Asset bubbles, in general, have common characteristics. One characteristic is that prices reach extreme levels that are unsustainable, i.e. the prices often fall back dramatically after the bubble “bursts.” Another characteristic is that, with the passing of time, there are many signs of what may be called “excessive” positive sentiment.

While a thorough discussion of the bond market bubble, including its many effects, causes, and current and future implications would be extensively lengthy and at times (very) complex, below is a discussion of various notable issues.

Characteristics Of The Bond Market Bubble

One of the foremost aspects of the bond market bubble has been its duration. As seen in the following chart, depicted on a monthly LOG scale, interest rates, as seen in the 10-Year U.S. Treasury Yield, have been falling since the early 80s:

(click on charts to enlarge images)(charts courtesy of StockCharts.com; chart creation and annotation by the author)

Another foremost aspect of the bond market bubble has been its extent. As seen in the chart above, rates have fallen precipitously. From an ultra long-term historical perspective, many record-low yields have been achieved recently, including those for the 10-Year U.S. Treasury.

To give a perspective as to how low rates have fallen, many will remember when money markets still paid in the 7% range, not to mention the peak of interest rates during the “inflationary” period.

It should be noted that many, if not most, observers do not believe that there is a bubble in bonds. From their perspective, the level of bond yields is normal given many characteristics of the economy and financial system.

Financial Aspects

There are innumerable effects of strongly rising bond prices and the concomitant falling interest rates which have occurred during the bond bubble. In the past I have written of many of these far-reaching consequences.

From a financial perspective, a very broad array of fixed-income products have seen their valuations increase substantially during the bond bubble. These assets are found, directly or indirectly, in most portfolios, including those of pension funds.

As well, accompanying (and possibly due to) the substantial appreciation of these fixed income assets, the pricing of risk has been (greatly) diminished. Also, the availability of capital for high-risk fixed-income assets has expanded greatly. Low-quality bonds, which previously would not have been marketable or otherwise viable, have become so in very substantial quantities.

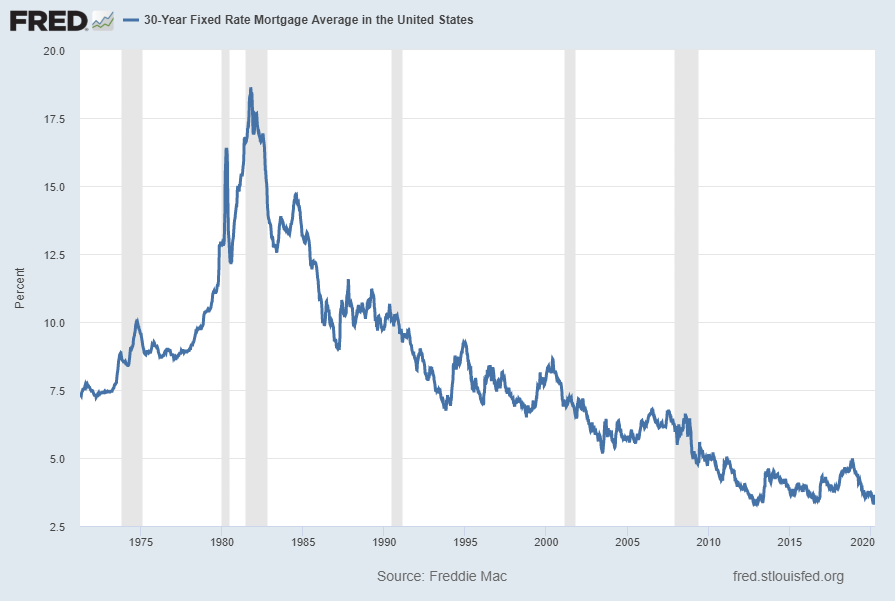

Three other areas greatly impacted by interest rates deserve mention. First, as seen in the current financial era, interest rates greatly impact the housing market via mortgage rates. As well, there are various other ancillary issues regarding interest rates and the housing market, such as refinancings and equity withdrawals.

Below is a long-term chart of 30-year fixed mortgage interest rates:

source: Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 6, 2020: https://fred.stlouisfed.org/series/MORTGAGE30US

Second, many believe that (ultra-) low interest rates have contributed to, or caused, the stock market bubble. This is further discussed in a variety of posts, including that of March 1, 2017 titled “Low Interest Rates And The Stock Market Bubble.”

Third, interest rates increasingly are impacting the U.S. fiscal situation. The U.S. National Debt has grown rapidly, for various reasons. One such reason is that incurring debt has been seen as a “solution” to many problems. This important dynamic is further discussed in “America’s Trojan Horse.”

As the amount of government debt has grown rapidly, so has the interest cost. This increasing expense, although large, has in large part been “affordable” in large part due to the ultra-low interest rates.

Also of note is the amount of corporate indebtedness, which has grown substantially. Perhaps much of this increase in debt has occurred, in essence, because of its availability as a form of (very) cheap financing. As mentioned above, the bond market bubble has meant that debt has become available not only in greater quantities, even for low-quality issuers, but also at low(er) interest rates.

Corporate earnings, both directly and indirectly, have been aided by (ultra-) low, falling interest rates. Although the full extent is largely indeterminable, there are indications that the effect has been substantial.

The Pace And Extent Of Future Rising Interest Rates

Given the size of the bond market bubble, a paramount question is what interest rate levels to expect once the bubble bursts? As well, at what pace will the resulting rising rates occur?

Due to the size and duration of the bubble, these questions are difficult to answer. As well, there is the issue of when, and at what point, these rising interest rates would possibly plateau. I have previously referred to this post-bubble sustainable interest rate as the “natural rate.”

Due to many factors, I expect interest rates to rise much faster and greater than one might reasonably expect. As I have previously written, such as in the February 6, 2013 post titled “The Bond Bubble – February 2013 Update“:

While I have not spent considerable effort trying to ascertain the level of this “natural” interest rate, I have little doubt that such a “natural” rate on the 10-Year Treasury would be at least 5%-10% and most likely considerably higher (possibly multiples thereof). Of course, such rates would have massive implications on a number of fronts.

Financial Consequences Of Increasing Rates

As stated in the April 6, 2010 post (“The Threat Of Rising Interest Rates“):

Some areas that would be impacted by rising interest rates would include: real estate, all facets of lending, the bond market, corporate profitability, etc. The list is virtually endless.

During a rising interest rate environment, the amount of fixed-income asset price depreciation, especially given today’s ultra-low levels, is very notable.

Also, as discussed above, low interest rates have enabled both the funding of government debt, as well as keeping interest rate costs manageable. As interest rates increase significantly, there will not only be [substantially] increased interest expense, but also a likely reluctance for investors to buy Treasuries in a falling market. These dynamics likely will prove extremely problematical on many fronts. One facet of deficit spending, that for economic stimulus packages, will likely be greatly impeded. As well, various social “safety net” spending programs will likely be imperiled in a rising rate environment.

Another paramount issue regarding the Treasury market is its purported “safe haven” status. During the current era, Treasury securities, perhaps most notably the 10-Year Treasuries, have been viewed as a “safe haven.” In essence, during periods of perceived financial instability, investors have sought to buy them as a way to preserve (or increase) asset value. Through this cycle, Treasuries have in essence become a “safe haven.” However, as I wrote previously, such as in the December 10, 2013 post (“Additional Thoughts Concerning Rising Interest Rates“) I don’t expect 10-Year Treasuries will ultimately prove to be the “safe haven” many believe them to be.

Other ancillary problematical dynamics exist. A rising rate environment will have various adverse impacts on QE-related operations, such as that discussed in the June 26, 2013 post, “Potential Losses In The Federal Reserve’s Portfolio.”

Economic Consequences Of Increasing Rates

I have extensively discussed the economic consequences of substantially increasing interest rates. As I wrote in the aforementioned April 6, 2010 post:

Falling interest rates over the last 20 years have been an “enabler” of much of our current day economy.

One may also say that the current-era economy is predicated upon having (ultra-) low interest rates.

While many of the economic consequences of substantially increasing interest rates are “intertwined” with the financial aspects, it should be noted that the levels of consumer spending have almost certainly been aided and abetted by ultra-low interest rates. While the “boost” to consumer spending is difficult to precisely measure, in the current economic era there appears to be a strong inherent link between (ultra-) low interest rates, “affordability” and consumer spending.

Also, there are many other impacts of (rapidly) rising interest rates. The direct and indirect benefits that have accrued to corporations’ earnings during a falling interest rate environment, discussed above, can rapidly diminish during a (rapidly) rising interest rate environment. As well, the buttressing of business spending during a falling interest rate environment diminishes with rising interest rates.

(posted April 7, 2020)