As many are aware, Standard & Poor’s publishes earnings estimates for the S&P500. (My posts concerning their estimates can be found under the S&P500 Earnings label)

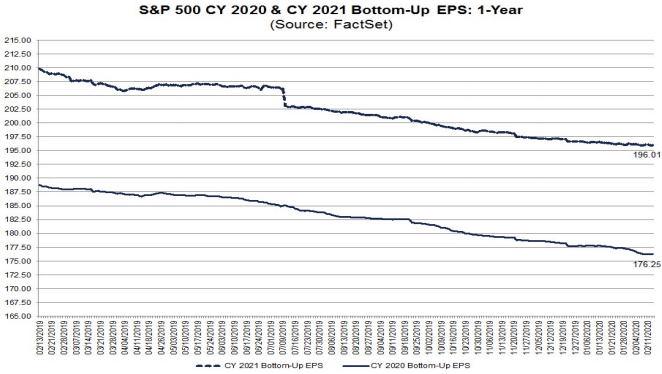

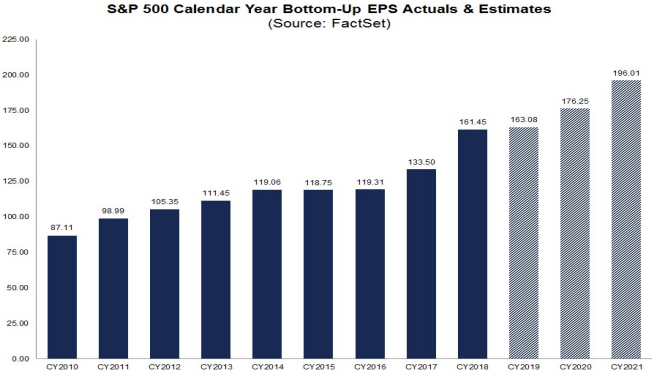

For reference purposes, the most current estimates are reflected below, and are as of February 14, 2020:

Year 2019 estimates add to the following:

-From a “bottom up” perspective, operating earnings of $155.78/share

-From a “top down” perspective, operating earnings of N/A

-From a “bottom up” perspective, “as reported” earnings of $138.91/share

Year 2020 estimates add to the following:

-From a “bottom up” perspective, operating earnings of $173.91/share

-From a “top down” perspective, operating earnings of N/A

-From a “bottom up” perspective, “as reported” earnings of $161.22/share

Year 2021 estimates add to the following:

-From a “bottom up” perspective, operating earnings of $194.65/share

-From a “top down” perspective, operating earnings of N/A

-From a “bottom up” perspective, “as reported” earnings of $176.20/share

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3383.25 as this post is written