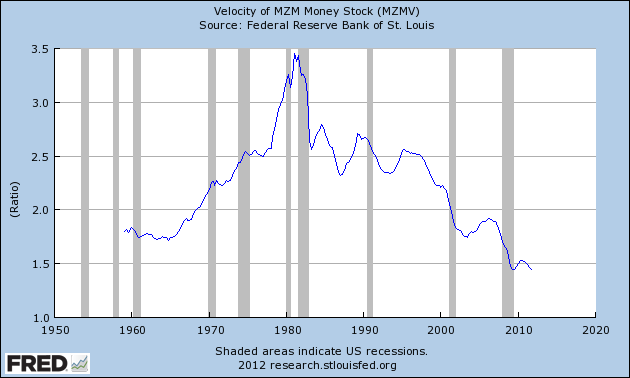

I find the following charts to be disturbing. These charts would be disturbing at any point in the economic cycle; that they depict such a tenuous situation now – 33 months after the official (as per the 9-20-10 NBER announcement) June 2009 end of the recession – is especially notable.

These charts raise a lot of questions. As well, they highlight the “atypical” nature of our economic situation from a long-term historical perspective. I regularly discuss many troubling characteristics of our economy in this

EconomicGreenfield blog.

All of these charts (except one, as noted) are from The Federal Reserve, and represent the most recently updated data.

The following 8 charts are from the St. Louis Federal Reserve:

(click on charts to enlarge images)

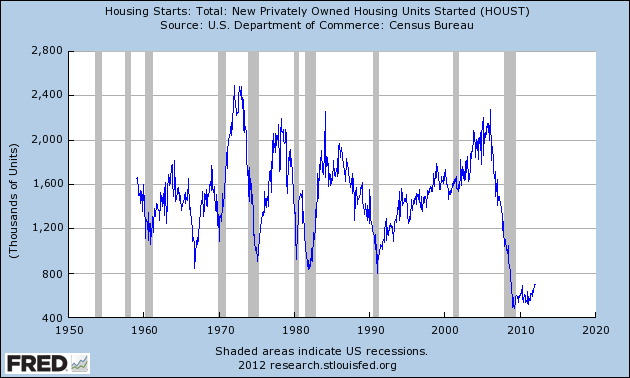

Housing starts (last updated 2-16-12):

-

The Federal Deficit (last updated 2-13-12):

-

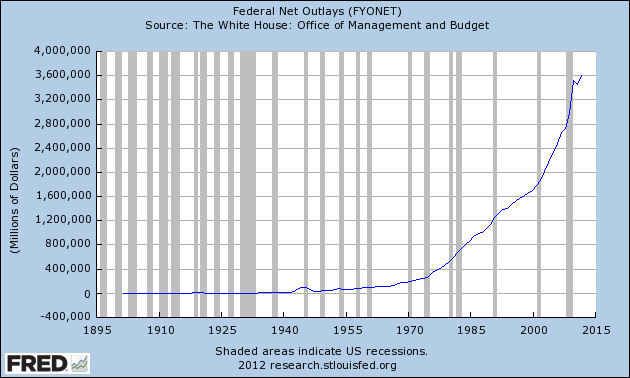

Federal Net Outlays (last updated 2-13-12):

-

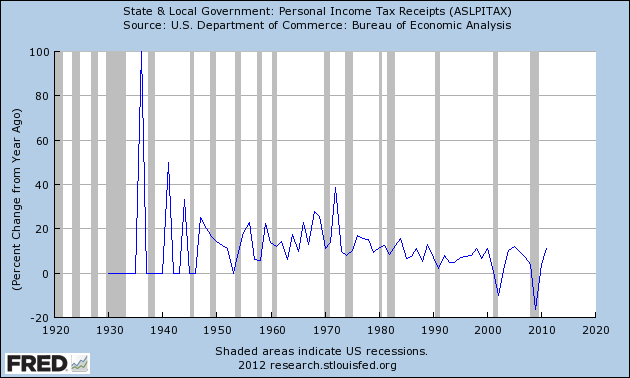

State & Local Personal Income Tax Receipts (% Change from Year Ago)(last updated 1-27-12):

-

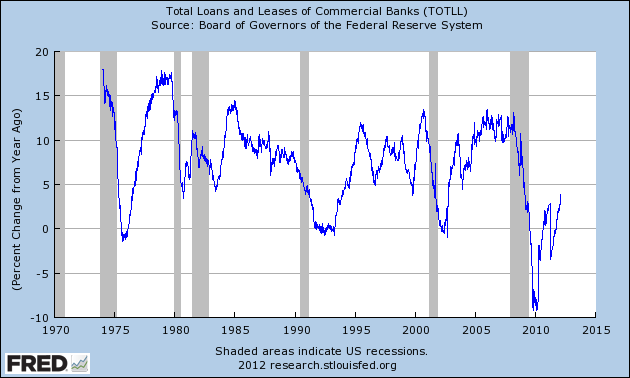

Total Loans and Leases of Commercial Banks (% Change from Year Ago)(last updated 2-21-12):

-

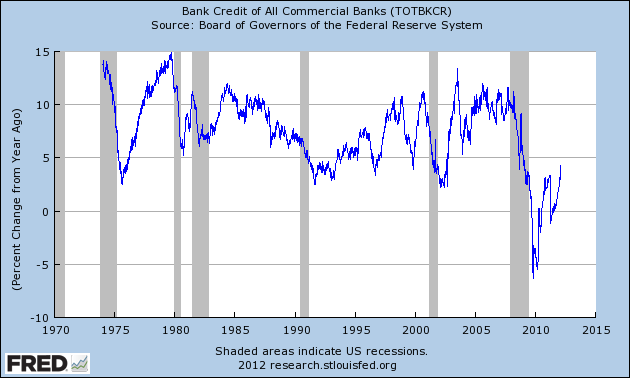

Bank Credit – All Commercial Banks (% Change from Year Ago)(last updated 2-21-12):

-

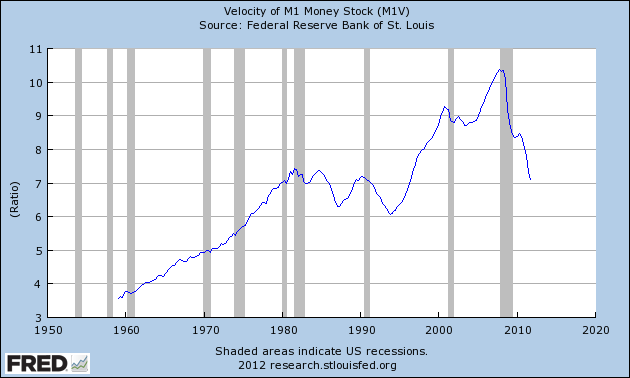

M1 Money Multiplier (last updated 2-16-12):

-

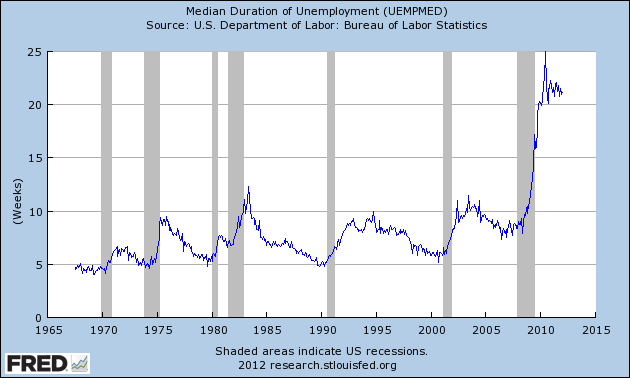

Median Duration of Unemployment (last updated 2-3-12):

-

-

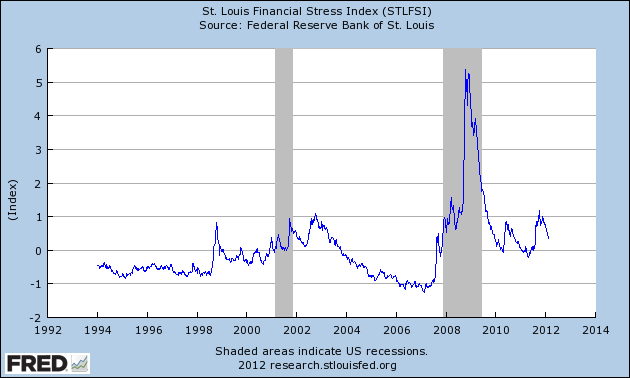

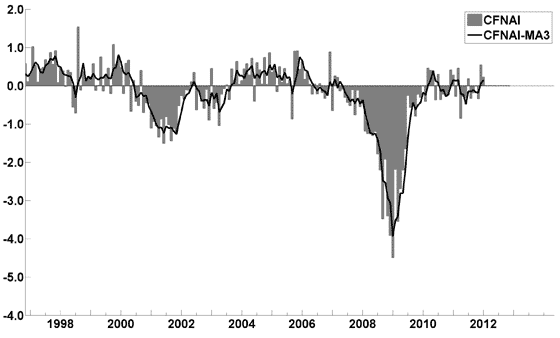

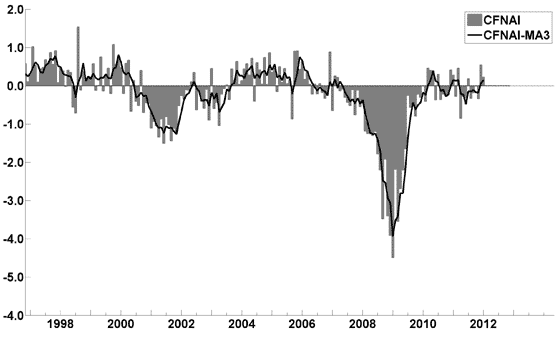

This last chart is of the Chicago Fed National Activity Index (CFNAI) and it depicts broad-based economic activity (last updated 2-21-12):

-

I will continue to update these charts on an intermittent basis as they deserve close monitoring…

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1362.34 as this post is written