Hunger in America 2014 is the sixth and most comprehensive study undertaken. The 2014 study reveals that each year, the Feeding America network of food banks provides service to 46.5 million people in need across the United States, including 12 million children and 7 million seniors. Through a network of 58,000 pantries, meal service programs, and other charitable food programs, the Feeding America network reaches people in need in every community across the U.S.

Other excerpts I found notable, from the full "

Hunger in America 2014" (pdf) report in the order they appear, include the following:

page 4:

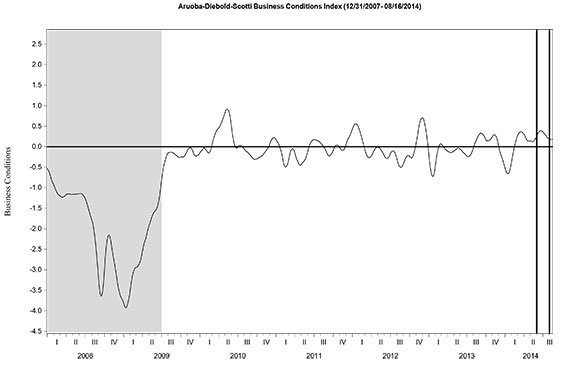

The economy has experienced an unusually slow recovery since the deep recession in 2008 and 2009. The nation’s poverty rate reached 15.1 percent in 2010, the highest rate since 1993. The poverty rate remained at 15 percent in 2012 with 46.5 million people living in poverty. This is the largest number living in poverty since statistics were first published more than 50 years ago. Sustained high poverty rates arise in part from high unemployment and falling household incomes. The U.S. unemployment rate exceeded 7.0 percent for five years between late 2008 and late 2013 (about 11 million people in any given month), the longest period of high unemployment in 70 years. While the unemployment rate indicates that a large number of people cannot find jobs, many others are employed part time because they cannot find full-time work. The government’s measure of underemployment that includes all of these groups averaged 14 percent in fiscal year 2013, compared to a prerecession rate of 8.4 percent in 2007. On average, about 24 million people were underemployed in 2013. Additionally, others may work full time but due to low wages their earnings do not lift them above the poverty line. Perhaps not surprisingly, real household income dropped 8.3 percent between 2007 and 2012. Poverty, unemployment, and income, along with other demographic characteristics, are key drivers of individual and household food insecurity across the country.

These economic trends have contributed to rapid growth in the numbers of households seeking and receiving food assistance. The number of people participating in SNAP, the largest federal food assistance program, rose to a new high of 47.6 million in 2013, up from 33.5 million in 2009. While some of this growth can be attributed to changes in SNAP rules, recent studies conclude that the weak economy explains most of the increase. Other government programs that provided nutrition assistance in 2013 also saw high levels of enrollment. About 9 million people received WIC benefits in 2013. In the same year, 21.5 million children received free or reduced-price school lunches, and 11.2 million children received school breakfasts.

page 44:

Feeding America food banks and their partner agencies provide food and services to people in all 50 states, Washington, DC, and Puerto Rico. We estimate that the Feeding America network is currently serving 46.5 million unique individuals in 15.5 million households annually across the United States. The number of clients served and other findings from the Client Survey are further discussed in Chapters 4 and 5. Feeding America carries out this work through the coordinated efforts of its food banks, their partner agencies, and the food programs operated by those agencies. This chapter describes the structure of the network, characteristics of partner agencies in the network, the services the partner agencies provide, and the challenges they face in delivering charitable food assistance, as reported on the Agency Survey.

page 88:

Based solely on the unduplicated client counts, it appears that the Feeding America network has seen an increase over the past four years in the number of clients served annually. Estimates from the HIA 2010 study placed the annual unduplicated client count at that time at 37 million individuals. This apparent growth in unduplicated clients served by the network is likely the combination of changes in the scope and interpretation of the HIA study between 2010 and 2014, and actual growth in the network during that time. Some increase in the number of annual unduplicated clients is expected due to inclusion of additional programs not previously represented in the data.

page 131:

- Across all client households, 84 percent are food insecure. In households with at least one child that number rises to 89 percent.

- Client households report making spending tradeoffs between paying for food and paying for other necessities, such as medical care, housing, and utilities. Sixty-six percent of households report choosing between paying for food and medicine or medical care each year, and 31 percent do so every month. Fifty-seven percent of households choose between paying for food and housing annually, with 27 percent doing so on a monthly basis.

- Sixty-three percent of households plan for charitable food assistance as a part of their monthly household budget.

- More than half (55 percent) of client households receive monthly benefits from the federal Supplemental Nutrition Assistance Program (SNAP). Almost half of those not receiving SNAP benefits have never applied, most commonly because they did not think they were eligible. Seventy-two percent of households not receiving SNAP benefits may in fact be income eligible for SNAP.

- Clients and their households often utilize multiple coping strategies to ensure they have enough food. More than 50 percent receive help from family or friends; 79 percent purchase inexpensive, unhealthy food; 40 percent water down food and drinks to make them last longer; and 23 percent grow food in a garden. Fifty-five percent of households report employing three or more coping strategies to get enough food each year.

Additional details and discussion can be found in the full "Hunger in America 2014" report mentioned above.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1976.70 as this post is written