On September 8, President Obama gave the Address by the President to a Joint Session of Congress. It concerned the economy and the American Jobs Act. (I highlighted what I believed to be the most notable excerpts in a September 9 blog post titled "President Obama's Address of September 8 2011")

In the Address, President Obama said the following:

This quote is from President Kennedy's American University Speech of June 10, 1963. (another transcript is found here.)President Kennedy once said, “Our problems are man-made –- therefore they can be solved by man. And man can be as big as he wants.”

I find this quote to be interesting in its logic. From today's perspective, how applicable is it to our economic problems, the context in which President Obama was referring to?

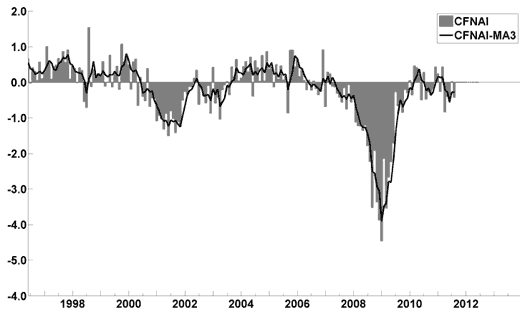

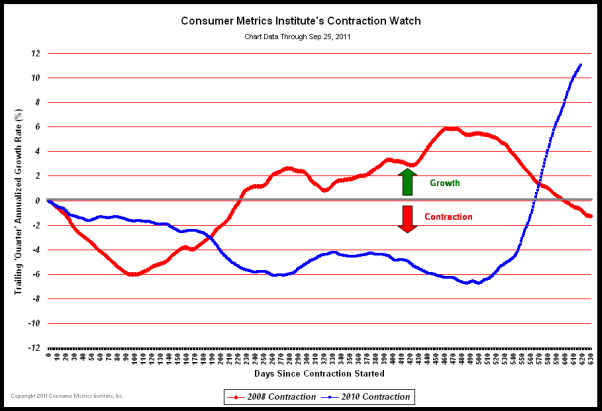

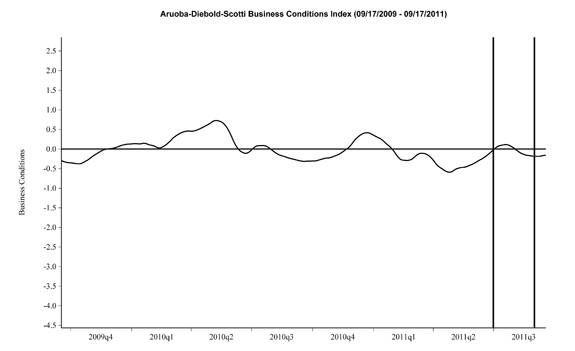

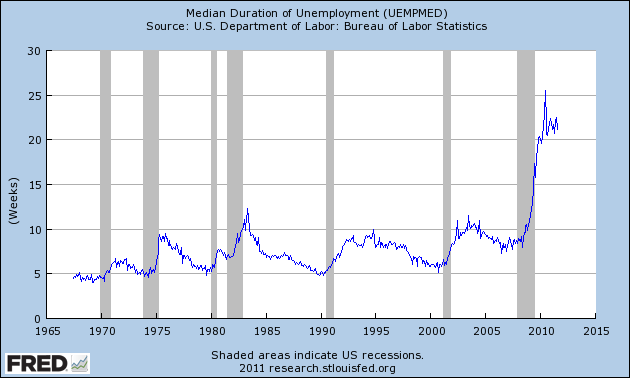

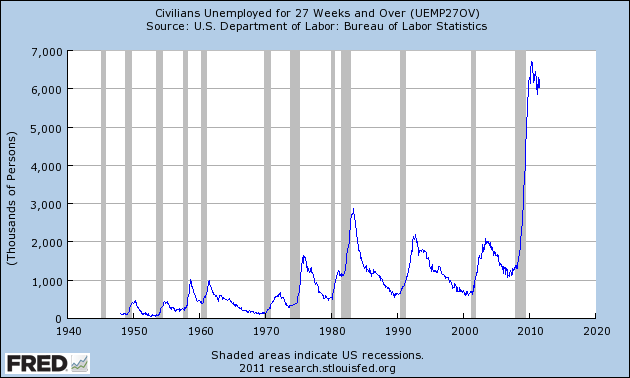

I continue to believe that our current economic situation is of great complexity. As I wrote in "A Special Note On Our Economic Situation" :

_____What separates this period of economic weakness from those that have preceded it is its complexity.

The Special Note summarizes my overall thoughts about our economic situation

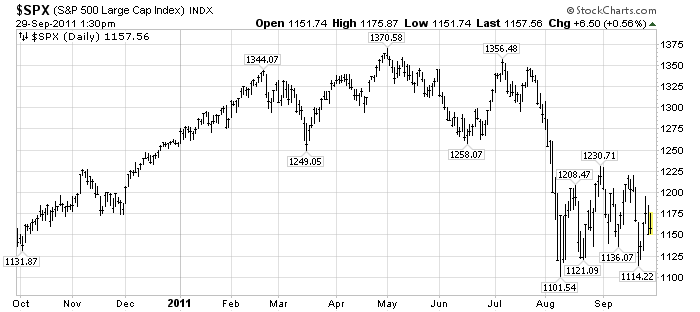

SPX at 1160.40 as this post is written