For a variety of reasons, I am not as enamored with ECRI’s WLI and WLI Growth measures as many are.

However, I do think the measures are important and deserve close monitoring and scrutiny.

Other past notable 2012 reaffirmations of the September 30, 2011 recession call by ECRI were seen (in chronological order) on March 15 (“

Why Our Recession Call Stands”) as well as various interviews and statements the week of May 6, including:

Also, subsequent to May 2012:

–

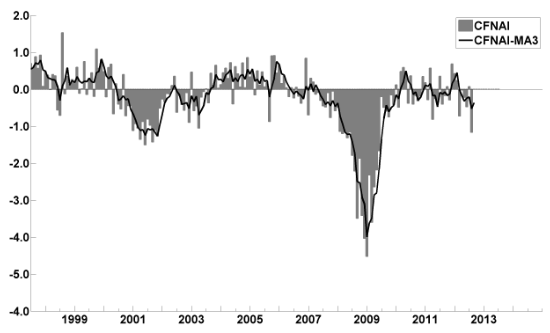

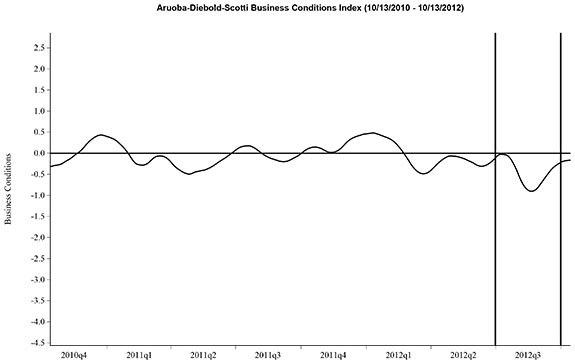

(click on charts to enlarge images)

-

This next chart depicts, on a long-term basis, the Year-over-Year change in the 4-week moving average of the WLI:

-

This last chart depicts, on a long-term basis, the WLI, Gr.:

_________

I post various economic indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1427.77 as this post is written