Since the S&P500 highs of early May and early July I have written a variety of posts warning of what I considered cautionary signs for the stock market.

One of those posts was on August 29, titled "The Near Term Direction Of The Stock Market." In that post I commented:

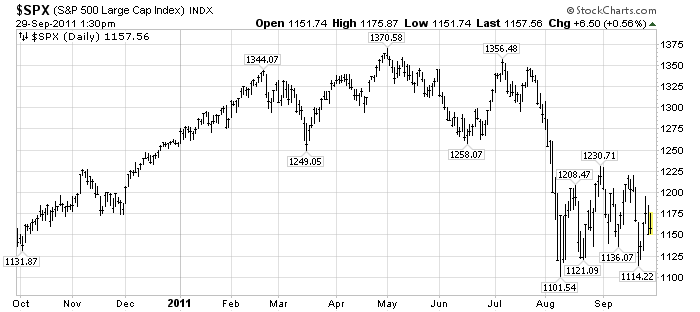

I still believe that we will see a near-term low in the S&P500 below that August 9 low of 1101.54.Was that August 9 low a “true bottom” – i.e. one that will not be breached, at least in the short-term? I believe that the answer will be “no.”

Additionally, the stock market "price action" feels very “unsettled” to me, and, as such, I think the “danger” here is rather high.

My analysis indicates the main underlying driver of the peril continues to be “deflationary pressures” as I have mentioned recently, such as in the aforementioned August 29 post.

For reference, here is a 1-year daily chart of the S&P500, annotated with notable prices:

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1157.56 as this post is written

No comments:

Post a Comment