Here is an update of various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

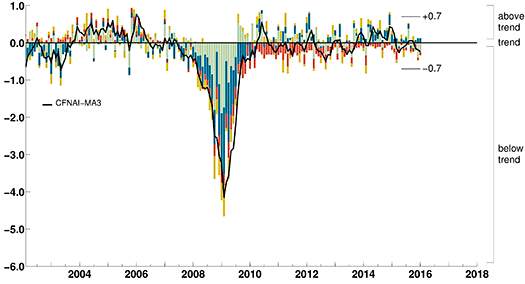

The January 2016 Chicago Fed National Activity Index (CFNAI) updated as of January 22, 2016: (current reading of -.22; current reading of CFNAI-MA3 is -.24):

–

As of January 22, 2016 (incorporating data through January 15, 2016) the WLI was at 130.2 and the WLI, Gr. was at -1.9%.

A chart of the WLI,Gr., from Doug Short’s post of January 22, 2016, titled “ECRI Weekly Leading Index: Decrease from the Previous Week“:

–

Here is the latest chart, depicting the ADS Index from December 31, 2007 through January 16, 2016:

–

The Conference Board Leading (LEI), Coincident (CEI) Economic Indexes, and Lagging Economic Indicator (LAG):

As per the January 22, 2016 press release, titled “The Conference Board Leading Economic Index (LEI) for the U.S. Declined Slightly,” (pdf) the LEI was at 123.7, the CEI was at 113.0, and the LAG was 119.9 in December.

An excerpt from the January 22 release:

“The U.S. LEI fell slightly in December, led by a drop in housing permits and weak new orders in manufacturing,” said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. “However, the index continues to suggest moderate growth in the near-term despite the economy losing some momentum at the end of 2015. While the LEI’s growth rate has been on the decline, it’s too early to interpret this as a substantial rise in the risk of recession.”

Here is a chart of the LEI from Doug Short’s blog post of January 22 titled “Conference Board Leading Economic Index: Slight Decrease in December“:

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1893.90 as this post is written

No comments:

Post a Comment