U.S. Economic Indicators

Throughout this site there are many discussions of economic indicators. At this time, the readings of various indicators are especially notable. This post is the latest in a series of posts indicating U.S. economic weakness or a notably low growth rate.

The level and trend of economic growth is especially notable at this time. As seen in various measures and near-term projections, the U.S. economy is undergoing an outsized level of economic contraction. As seen in many surveys and projections, most people believe that this historic level of contraction will be temporary in nature and that an economic rebound will start in the third quarter of 2020.

As seen in the April 2020 Wall Street Journal Economic Forecast Survey the consensus (average estimate) among various economists is for -4.9% GDP growth in 2020 and 5.1% GDP growth in 2021.

Charts Indicating U.S. Economic Weakness

Below are a small sampling of charts that depict weak growth or contraction, and a brief comment for each:

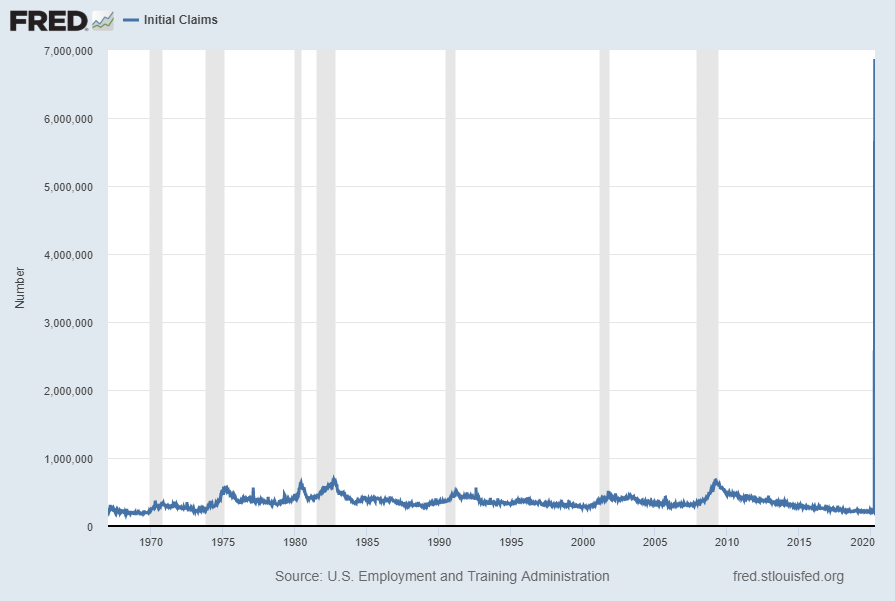

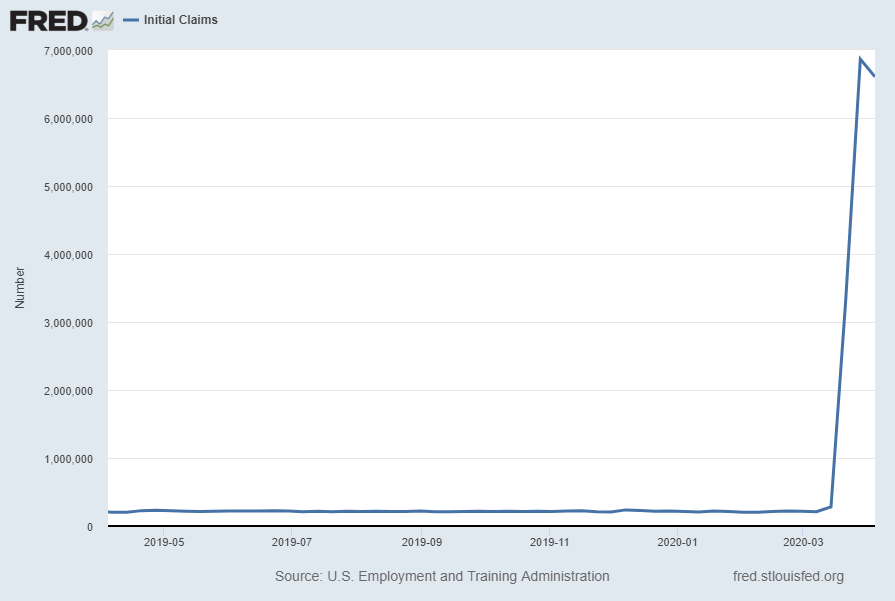

Initial Claims for Unemployment

Initial Claims have spiked in a fashion that has never before been encountered. This is a reflection of many different aspects of the current economic environment. This spike serves as a testament to the speed and magnitude of the unemployment problem. In the last three weeks there have been 16.78 million claims.

Below is a long-term (from 1967) chart of the Initial Claims measure, with a current (as of the April 9, 2020 update, reflecting the April 4 data) value of 6.606 million:

Below is the same chart with a 1-year timeframe:

__

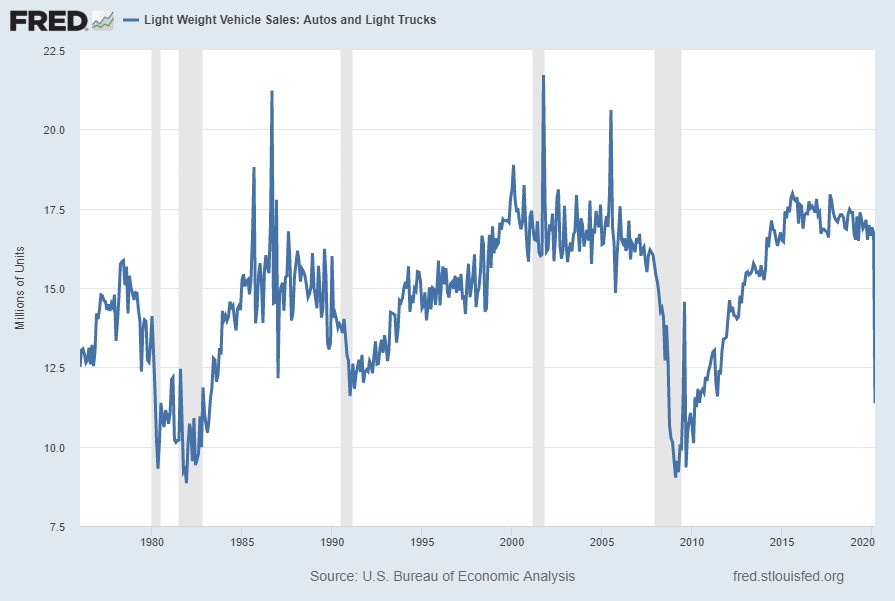

Auto Sales

Auto sales has an extensive impact on economic activity. Auto sales, according to the current reading (through March 2020, updated on April 3) is 11.372 million vehicles SAAR. As shown below, this is a substantial decline when viewed against recent sales trends:

source: U.S. Bureau of Economic Analysis, Light Weight Vehicle Sales: Autos and Light Trucks [ALTSALES], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 10, 2020: https://fred.stlouisfed.org/series/ALTSALES

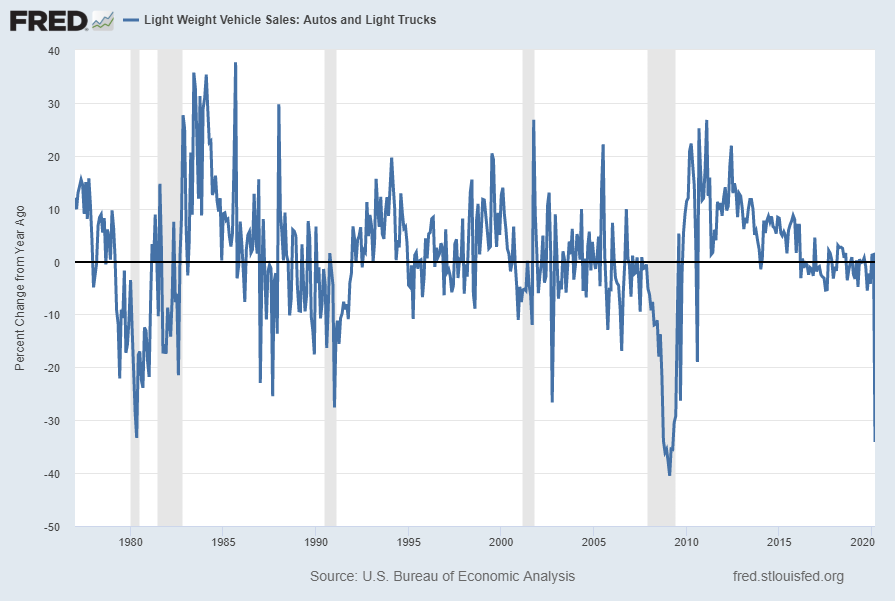

As seen below, the decline seen in this same measure on a “Percent Change From Year Ago” basis, with value -34.1%, is highly notable over the shown time frame:

__

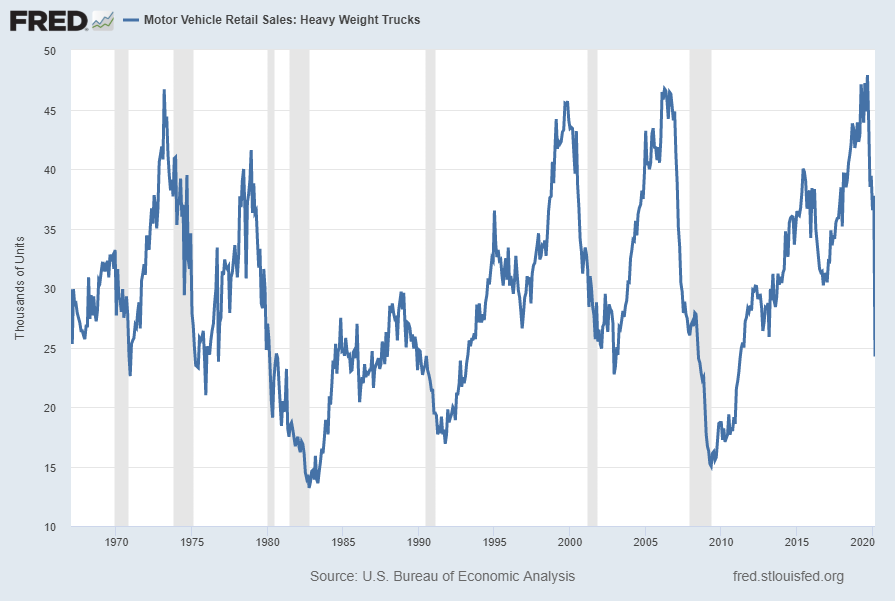

Motor Vehicle Retail Sales: Heavy Weight Trucks

Sales of “Heavy Weight Trucks” (HTRUCKSSA) is deeply contracting on a “Percent Change From Year Ago” basis. Shown below is this measure with last value of 24.25 Thousand through March 2020, last updated April 3, 2020:

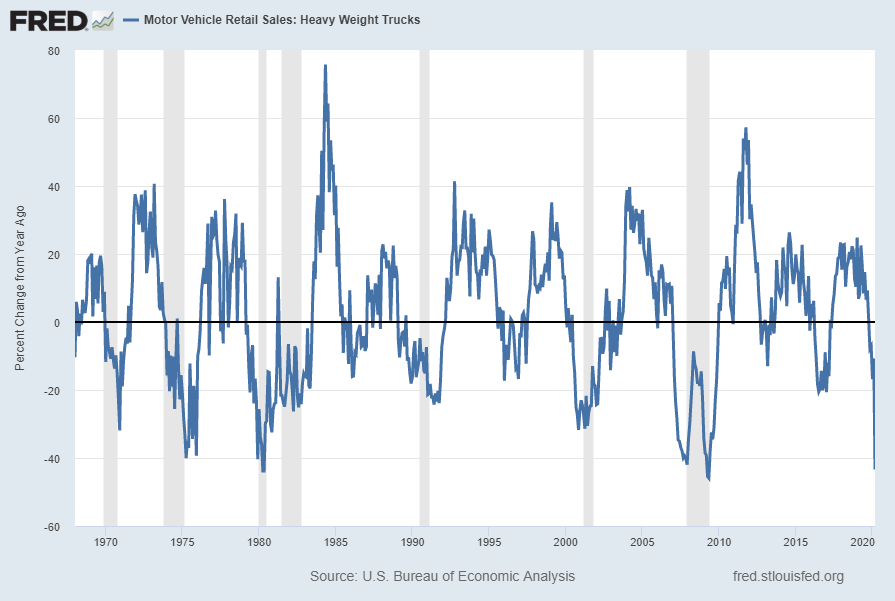

Below is this measure displayed on a “Percent Change From Year Ago” basis with value -43.4%:

source: U.S. Bureau of Economic Analysis, Motor Vehicle Retail Sales: Heavy Weight Trucks [HTRUCKSSA], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 10, 2020: https://fred.stlouisfed.org/series/HTRUCKSSA

__

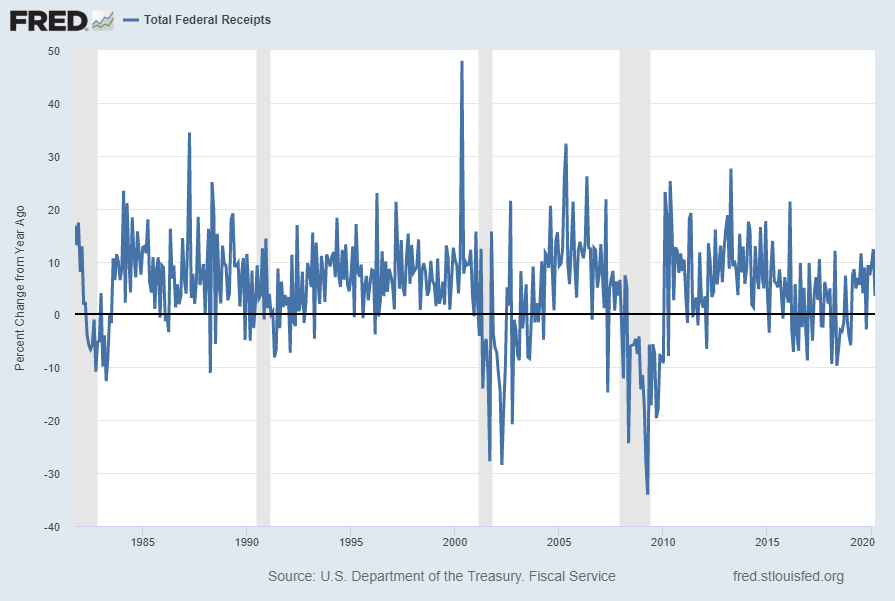

Total Federal Receipts

“Total Federal Receipts” growth continues to be intermittent in nature since 2015. As well, the level of growth does not seem congruent to the (recent) levels of economic growth as seen in aggregate measures such as Real GDP.

“Total Federal Receipts” through March had a last monthly value of $236,766 Million. Shown below is the measure displayed on a “Percent Change From Year Ago” basis with value 3.5%, last updated April 10, 2020:

source: U.S. Department of the Treasury. Fiscal Service, Total Federal Receipts [MTSR133FMS], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed April 10, 2020:

https://fred.stlouisfed.org/series/MTSR133FMS

https://fred.stlouisfed.org/series/MTSR133FMS

__

Other Indicators

As mentioned previously, many other indicators discussed on this site indicate economic weakness or economic contraction, if not outright (gravely) problematical economic conditions.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2789.82 as this post is written

No comments:

Post a Comment