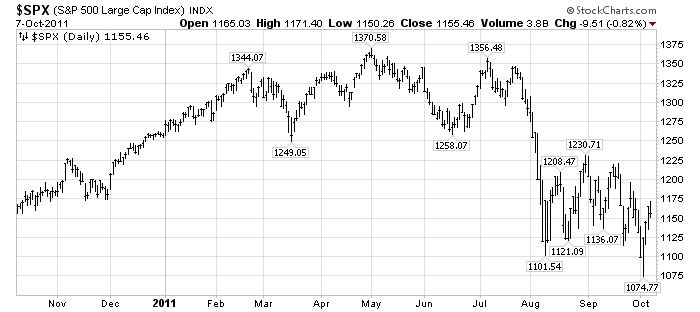

In my post of September 29 ("Near-Term Direction Of The Stock Market - Update") I had reiterated my view that the S&P500 would fall below the August 9 low of 1101.54.

It did fall below that 1101.54 level, reaching a bottom of 1074.77 on October 4.

The question now becomes whether that 1074.77 was a "lasting bottom," or whether there is more near-term downside. I believe that the 1074.77 low will not be a "lasting bottom" - i.e. it will be breached to the downside in the near-term.

This may seem illogical to some, as we have seen a strong rebound from that 1075-level over the last few days. Friday's close of 1155.46, as well as strong futures indications this morning, have led many to become bullish.

This strong rebound seems to me to be a strong "bounce" more than anything else. I continue to believe what I wrote in the aforementioned September 29 post - "...the stock market “price action” feels very “unsettled” to me, and, as such, I think the “danger” here is rather high."

There are many aspects of the financial and economic situation - many that I have recently written of - that lead me to believe this continues to be a dangerous situation.

Here is an updated chart of the S&P500, on a 1-year daily basis through 10-7-11 with price labels, for reference:

(click on chart to enlarge image)(chart courtesy of StockCharts.com)

_____

Since the S&P500 highs of early May and early July I have written a variety of posts warning of what I considered cautionary signs for the stock market. Most of those posts can be found in the "stock market" category.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1155.46 as this post is written

No comments:

Post a Comment