Here is an update on various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

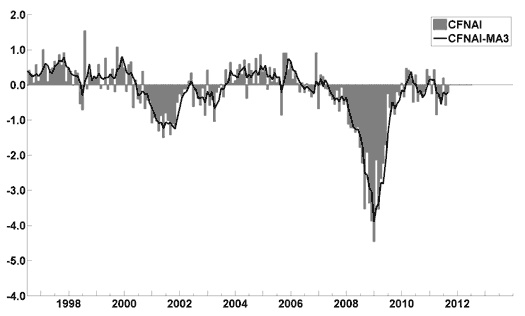

The October Chicago Fed National Activity Index (CFNAI)(pdf) updated as of October 24, 2011:

-

The USA TODAY/IHS Global Insight Economic Outlook Index:

An excerpt from the September 27 update titled “Index forecasts continued weak growth” :

-The September update of the USA TODAY/IHS Global Insight Economic Outlook Index shows real GDP growth, at a six-month annualized growth rate, remaining below 2% through February. Persistent unemployment, elevated debt levels, high energy and food prices and low confidence have stalled consumer spending. Businesses are hesitant to expand amid uncertainty.

The ECRI WLI (Weekly Leading Index):

As of 10/14/11 the WLI was at 120.4 and the WLI, Gr. was at -10.1%.

-

The Dow Jones ESI (Economic Sentiment Indicator):

The Indicator as of August 31 was at 41.5, as seen below:

-

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index:

Here is the latest chart, depicting 10-15-09 to 10-15-11:

-

The Conference Board Leading (LEI) and Coincident (CEI) Economic Indexes:

As per the October 20 release, the LEI was at 116.4 and the CEI was at 103.3 in September.

An excerpt from the October 20 release:

_________Says Ken Goldstein, economist at The Conference Board: “The LEI is pointing to soft economic conditions through the end of 2011. There is a risk that already low confidence – consumer, business and investor – could weaken further, putting downward pressure on demand and tipping the economy into recession. The probability of a downturn starting over the next few months remains at about 50 percent.”

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1229.05 as this post is written

No comments:

Post a Comment