With the recent increase in interest rates, perhaps the paramount question is what impact a rising interest rate environment will have on the economy.

First, for reference, here is a long-term chart of interest rates from 1962, as seen in Doug Short's post of August 17 titled "Treasury Yields In Perspective" :

(click on chart to enlarge image)

As one can see, the overall trend in interest rates has been declining, dating back to the peak seen in the early-80s.

The impacts that these falling interest rates have had is extensive, and many of the impacts lack (full) recognition. As I have previously commented, most recently in my February 6, 2013 post, "Falling interest rates over the last 20 years have been an “enabler” of much of our current day economy."

While the list of ways in which lower interest rates have acted as a benevolent factor to the economy is exceedingly lengthy, one such notable area is the impact lower interest rates have had on corporate earnings. I highlighted two estimates concerning the positive impact of declining interest rates on corporate profitability in my July 29 ProfitabilityIssues.com post titled "Impact Of Low Interest Rates On Corporate Profitability."

Although there are various areas which benefit from increased interest rates, from an "all-things-considered" basis rising interest rates have many problematic aspects for our current-era economy. While 10-Year Treasury Yields were above 5% as recently as 2007 - with no seeming adverse economic impact - I believe that the economy will have difficulties "absorbing" higher yields far before that 5%+ rate on the 10-Year Treasury is again reached.

The impact of the recent rising interest rate environment is particularly noteworthy, not only because of the historically-rapid speed of its ascent, but also because, as I have commented before, my analyses indicate that interest rates can rise to levels much higher than generally expected. I have written extensively about my belief that there is an exceedingly large bond bubble; if one believes that such is the case, the implications concerning the level of future interest rates is disconcerting. A "deflating" or "bursting" of such a large bubble will have widespread negative impacts on the economy and markets.

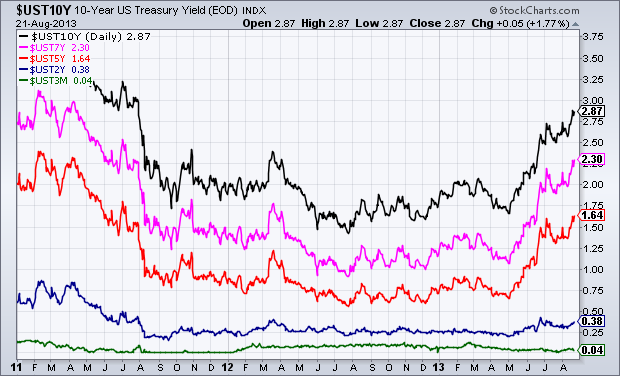

For reference, below is a chart depicting the recent movements of various (3-month, 2-Year, 5-Year, 7-Year and 10-Year) Treasury yields:

(click on chart to enlarge image)(chart courtesy of StockCharts.com; chart creation and annotation by the author)

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1642.80 as this post is written

No comments:

Post a Comment