I find the following charts to be disturbing. These charts would be disturbing at any point in the economic cycle; that they (on average) depict such a tenuous situation now – 49 months after the official (as per the 9-20-10 NBER announcement) June 2009 end of the recession – is especially notable.

These charts raise a lot of questions. As well, they highlight the “atypical” nature of our economic situation from a long-term historical perspective.

All of these charts (except one, as noted) are from the Federal Reserve, and represent the most recently updated data.

The following 8 charts are from the St. Louis Federal Reserve:

(click on charts to enlarge images)

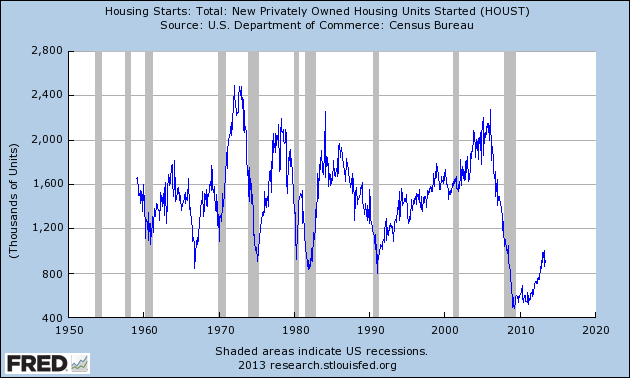

Housing starts (last updated 6-18-13):

-

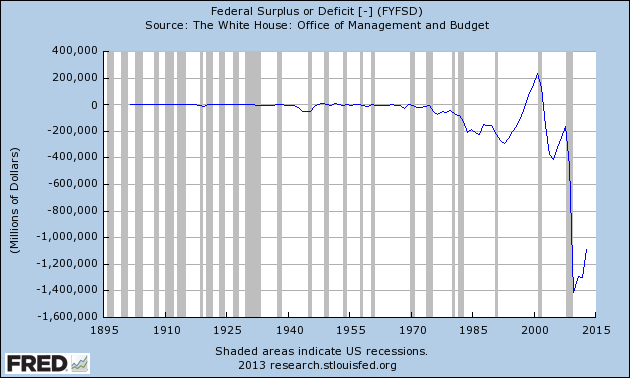

The Federal Deficit (last updated 4-19-13):

-

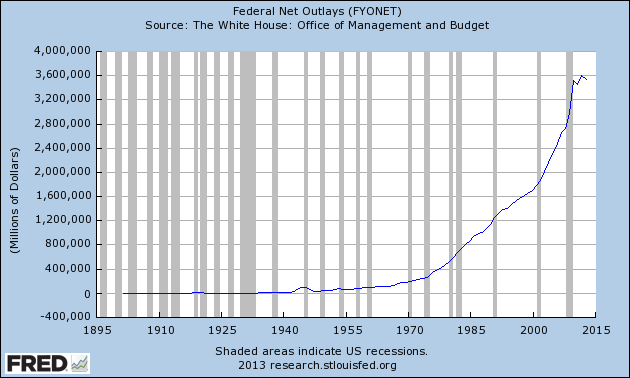

Federal Net Outlays (last updated 4-19-13):

-

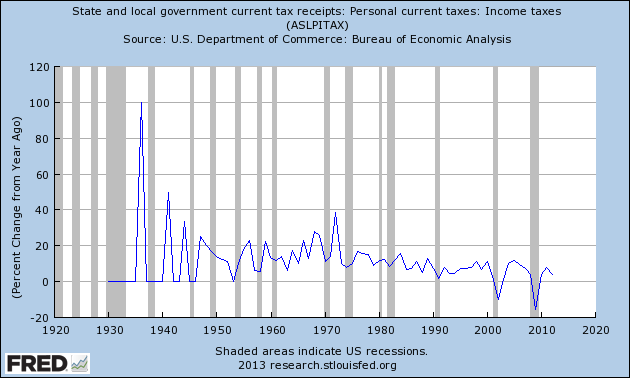

State & Local Personal Income Tax Receipts (% Change from Year Ago)(last updated 3-28-13):

-

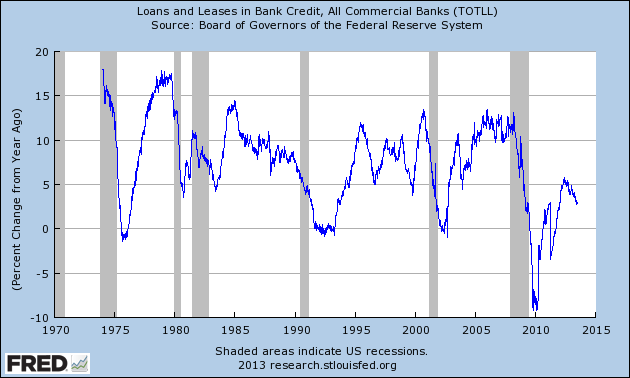

Total Loans and Leases of Commercial Banks (% Change from Year Ago)(last updated 6-28-13):

-

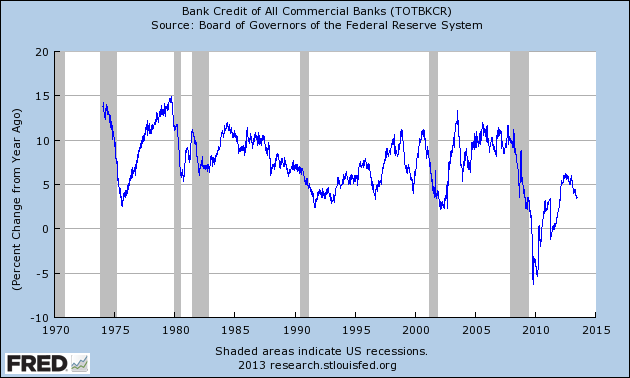

Bank Credit – All Commercial Banks (% Change from Year Ago)(last updated 6-28-13):

-

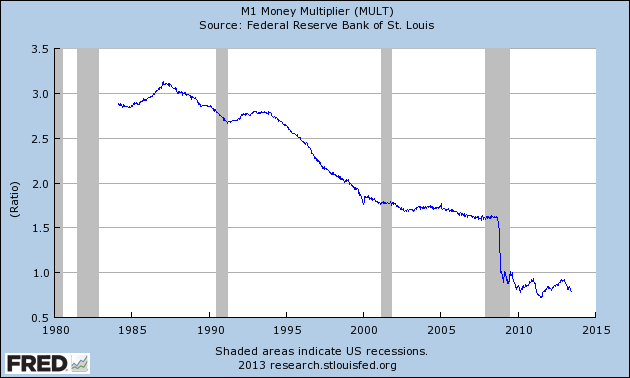

M1 Money Multiplier (last updated 6-20-13):

-

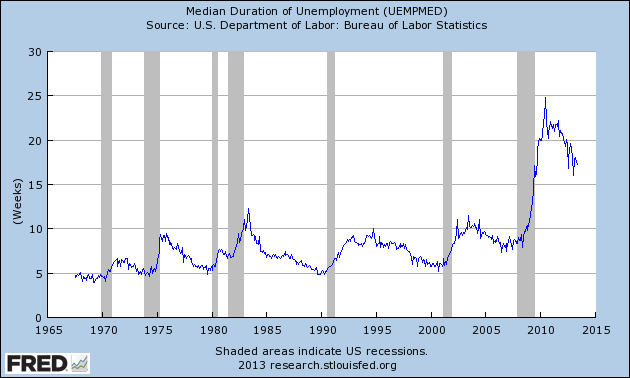

Median Duration of Unemployment (last updated 6-7-13):

-

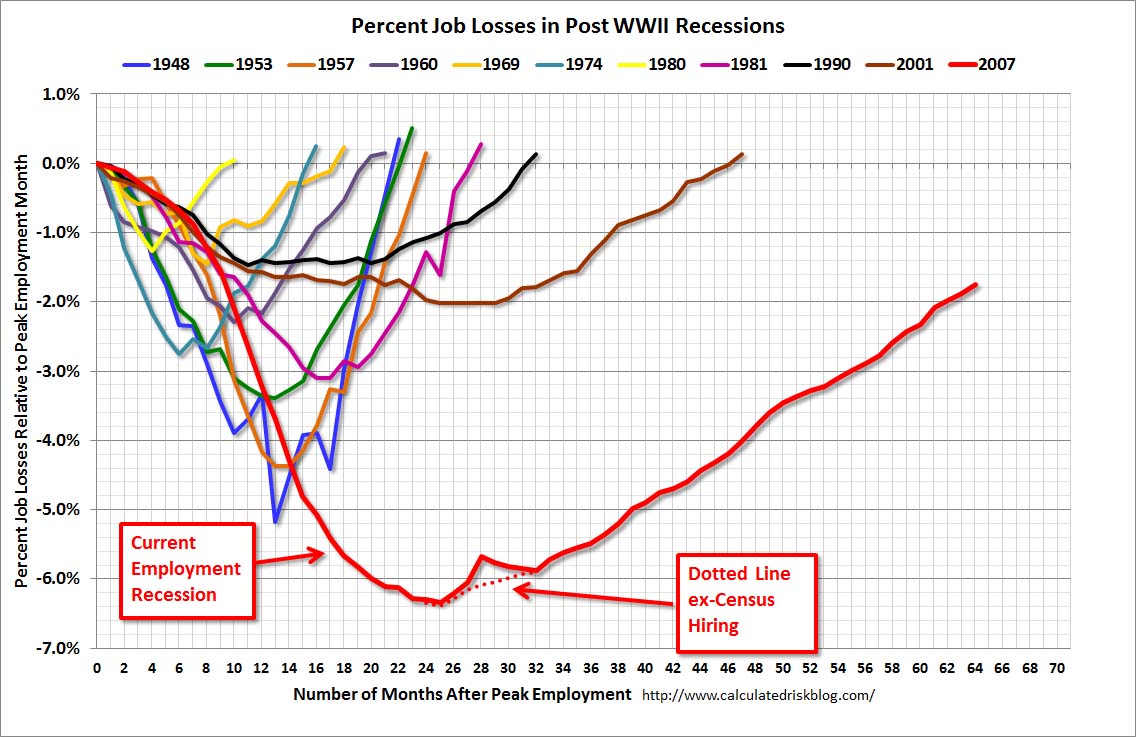

This next chart is from the CalculatedRisk.com blog post of June 7, 2013, titled "May Employment Report: 175,000 Jobs, 7.6% Unemployment Rate" and it shows (in red) the relative length and depth of this downturn and subsequent recovery from an employment perspective:

-

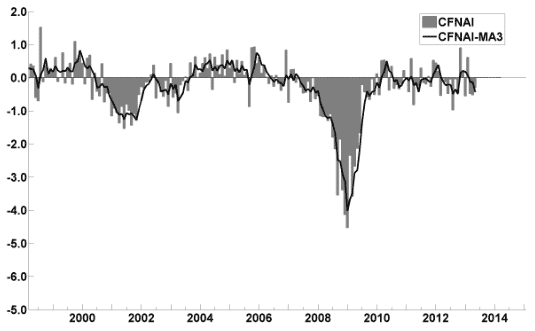

This last chart is of the Chicago Fed National Activity Index (CFNAI, and its 3-month moving average CFNAI-MA3) and it depicts broad-based economic activity (last updated 6-24-13):

-

I will continue to update these charts on an intermittent basis as they deserve close monitoring…

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1614.96 as this post is written

No comments:

Post a Comment