I find the following charts to be disturbing. These charts would be disturbing at any point in the economic cycle; that they (on average) depict such a tenuous situation now – 61 months after the official (as per the September 20, 2010 NBER BCDC announcement) June 2009 end of the recession – is especially notable.

These charts raise a lot of questions. As well, they highlight the “atypical” nature of our economic situation from a long-term historical perspective.

All of these charts are from the Federal Reserve, and represent the most recently updated data.

The following nine charts are from the St. Louis Federal Reserve:

(click on charts to enlarge images)

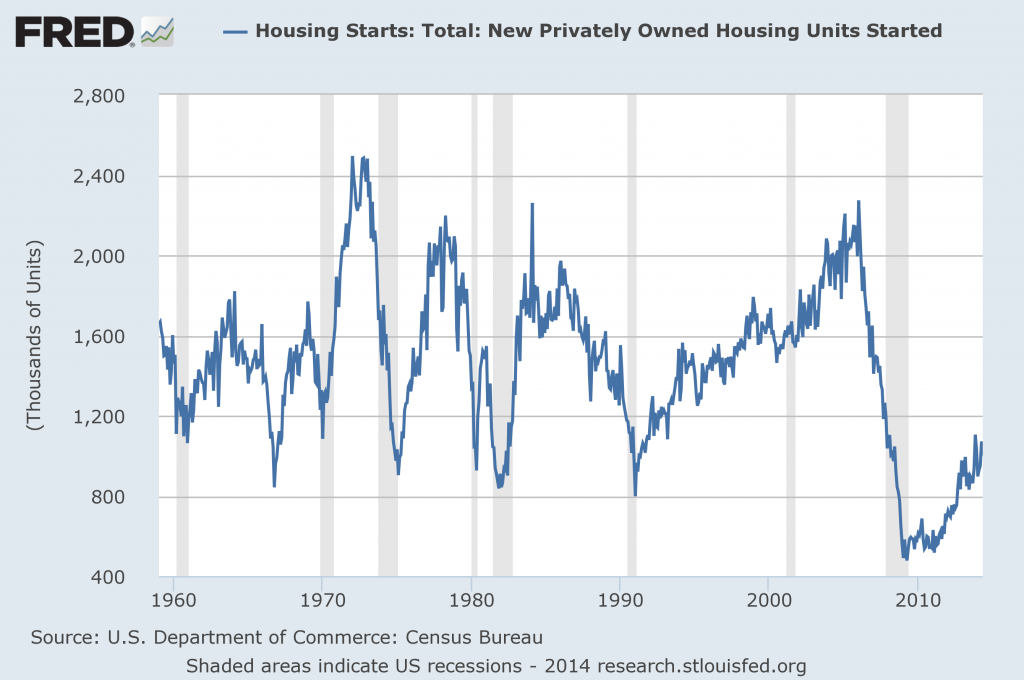

Housing starts (last updated 6-17-14):

-

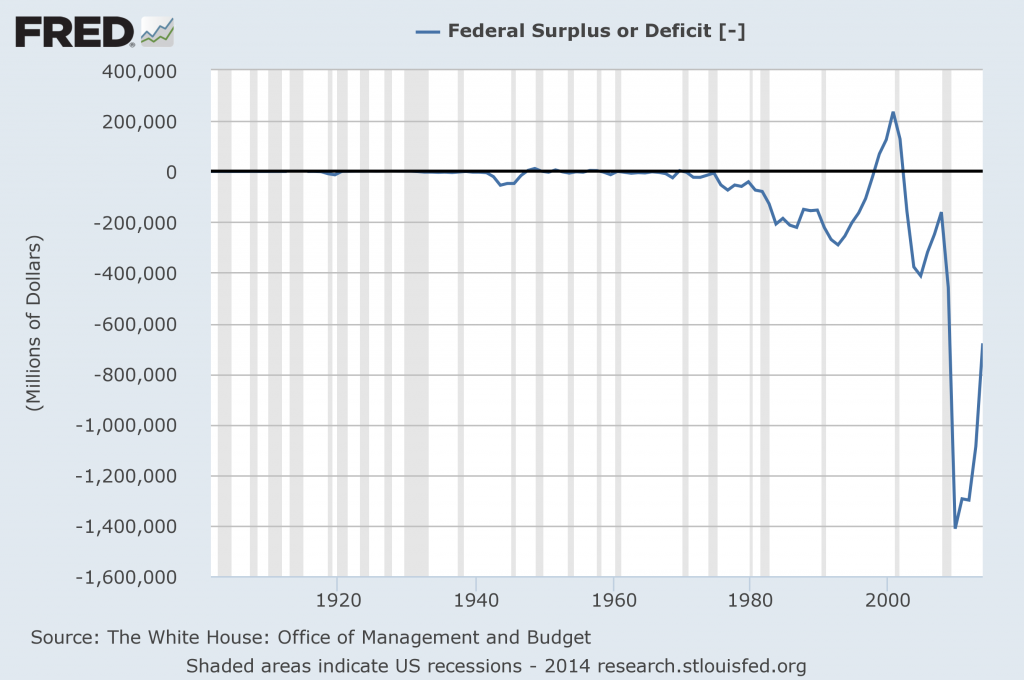

The Federal Deficit (last updated 3-14-14):

-

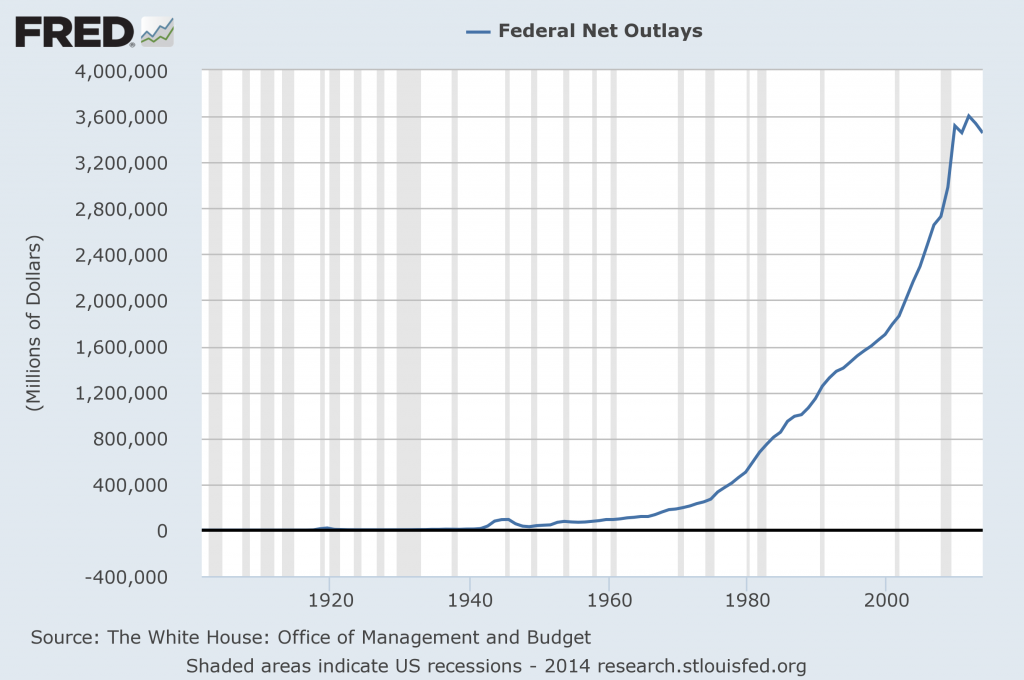

Federal Net Outlays (last updated 3-14-14):

-

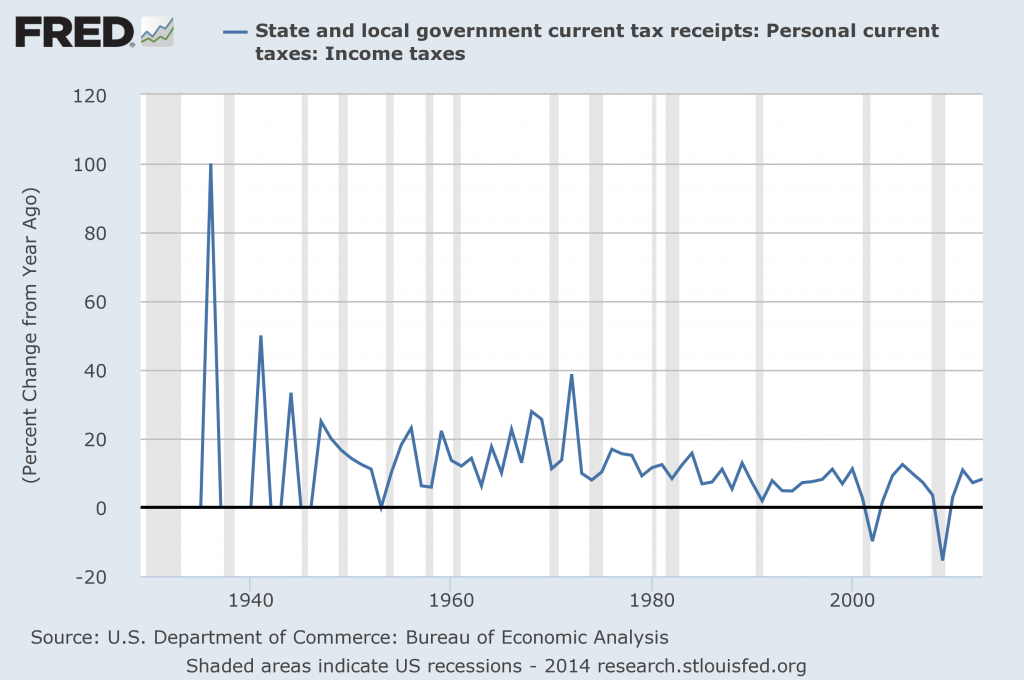

State & Local Personal Income Tax Receipts (% Change from Year Ago)(last updated 3-27-14):

-

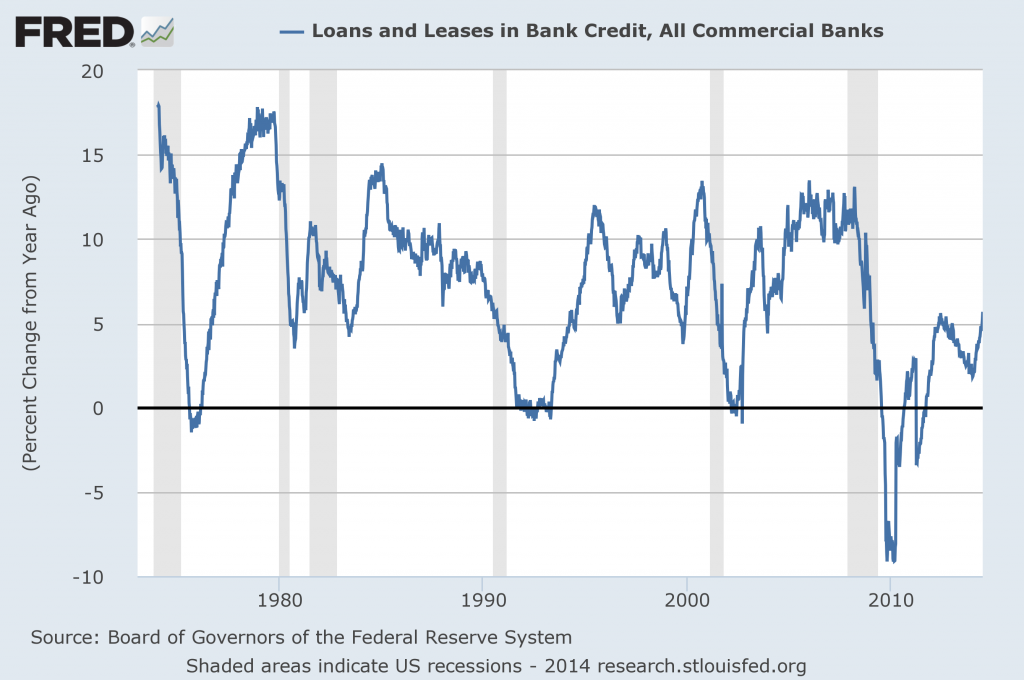

Total Loans and Leases of Commercial Banks (% Change from Year Ago)(last updated 7-11-14):

-

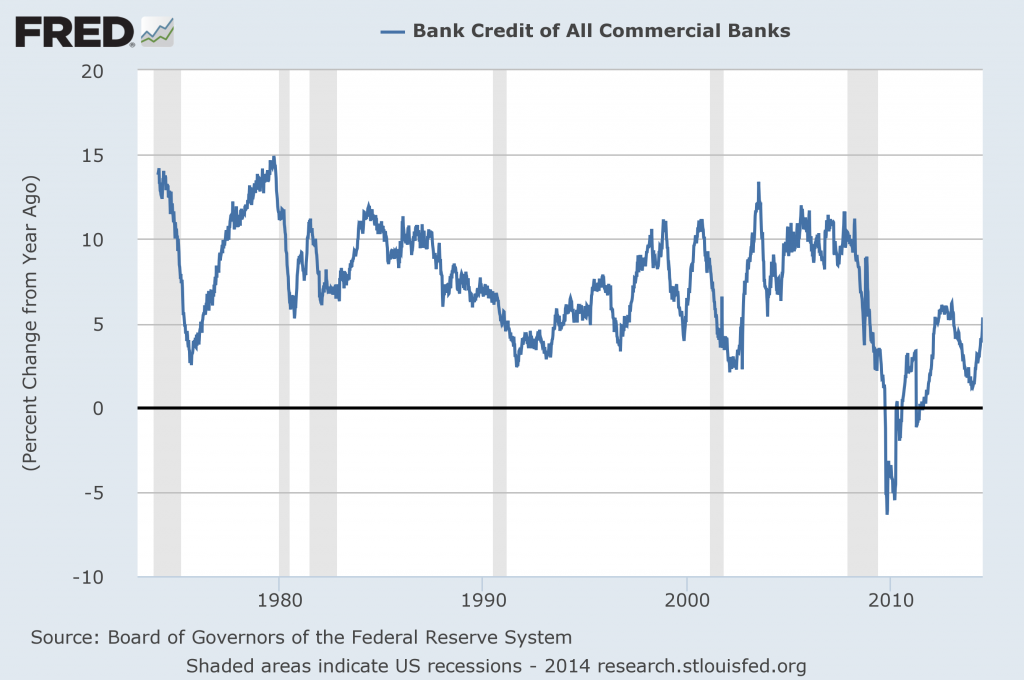

Bank Credit – All Commercial Banks (% Change from Year Ago)(last updated 7-11-14):

-

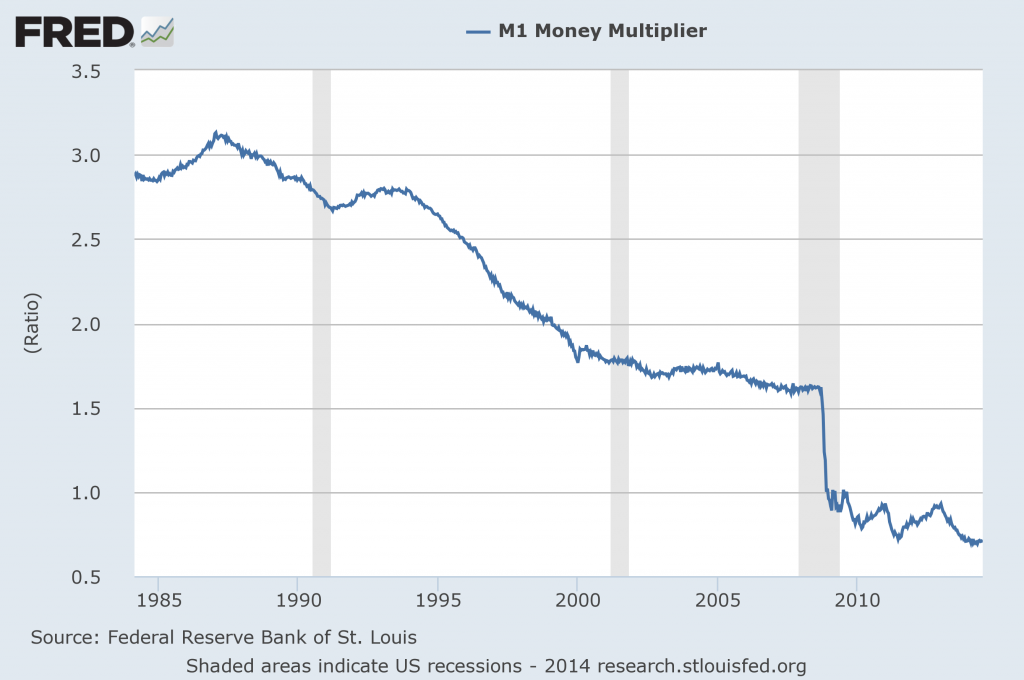

M1 Money Multiplier (last updated 7-3-14):

-

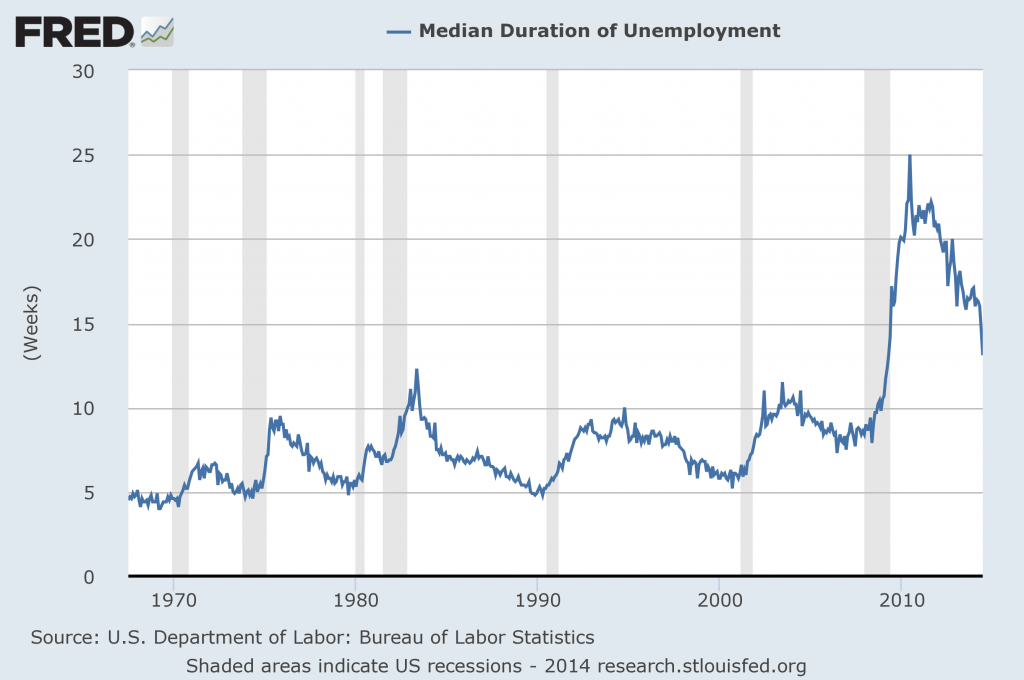

Median Duration of Unemployment (last updated 7-3-14):

-

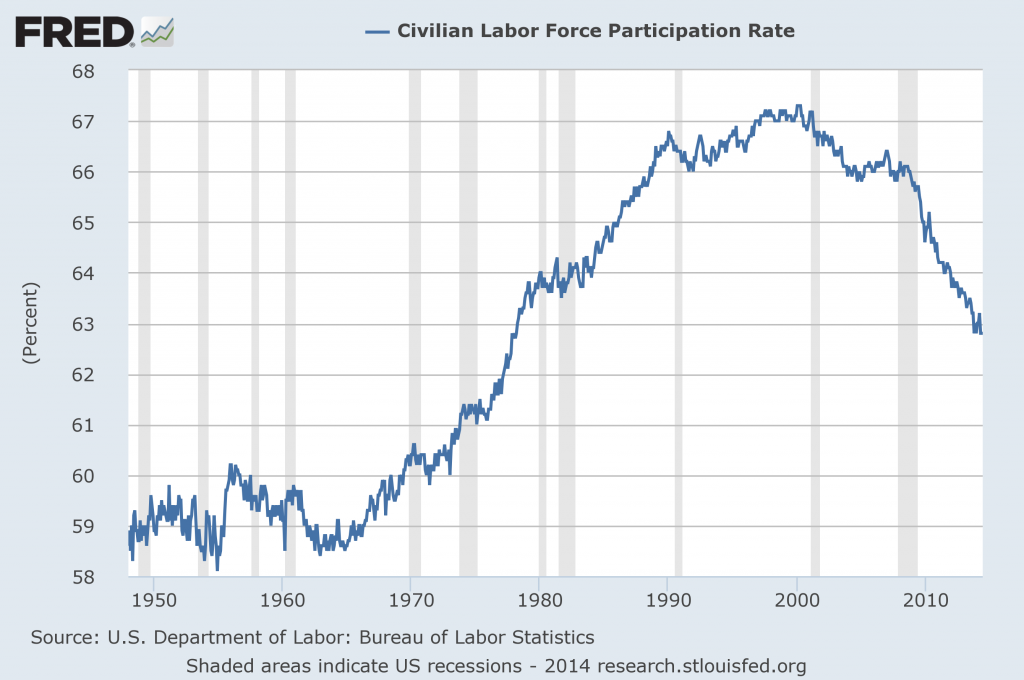

Labor Force Participation Rate (last updated 7-3-14):

-

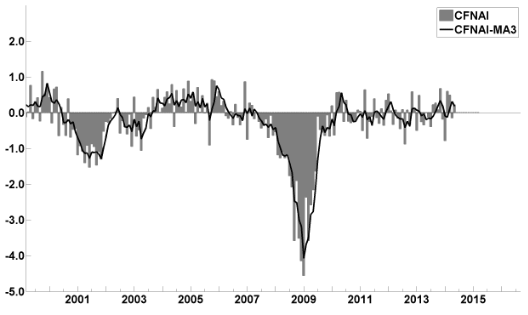

This last chart is of the Chicago Fed National Activity Index (CFNAI, and its 3-month moving average CFNAI-MA3) and it depicts broad-based economic activity (last updated 6-23-14):

-

I will continue to update these charts on an intermittent basis as they deserve close monitoring…

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1973.28 as this post is written

No comments:

Post a Comment