Here is an update of various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

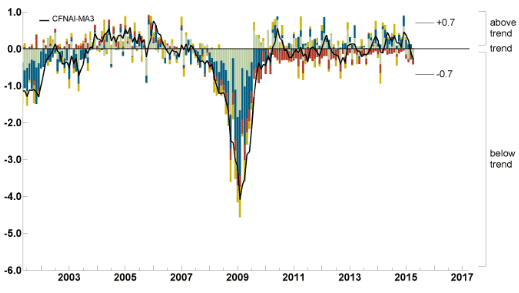

The April 2015 Chicago Fed National Activity Index (CFNAI) updated as of April 20, 2015:

–

As of April 17, 2015 (incorporating data through April 10, 2015) the WLI was at 132.5 and the WLI, Gr. was at -1.4%.

A chart of the WLI,Gr., from Doug Short’s post of April 17, 2015, titled “ECRI Recession Watch: Update“:

–

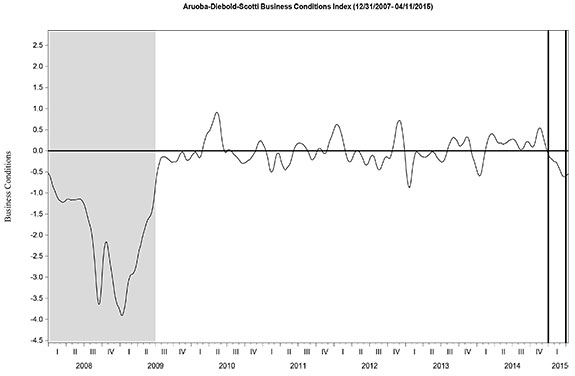

Here is the latest chart, depicting the ADS Index from December 31, 2007 through April 11, 2015:

–

As per the April 17, 2015 press release, titled “The Conference Board Leading Economic Index (LEI) for the U.S. Increased Again,” the LEI was at 121.4 and the CEI was at 112.0 in March.

An excerpt from the April 17 release:

“Although the leading economic index still points to a moderate expansion in economic activity, its slowing growth rate over recent months suggests weaker growth may be ahead,” said Ataman Ozyildirim, Economist at The Conference Board. “Building permits was the weakest component this month, but average working hours and manufacturing new orders have also slowed the LEI’s growth over the last six months.”

Here is a chart of the LEI from Doug Short’s blog post of April 17 titled “Conference Board Leading Economic Index Remains in Growth Territory“:

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2103.03 as this post is written

No comments:

Post a Comment