On December 7, 2016 the December Duke/CFO Global Business Outlook was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO survey, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

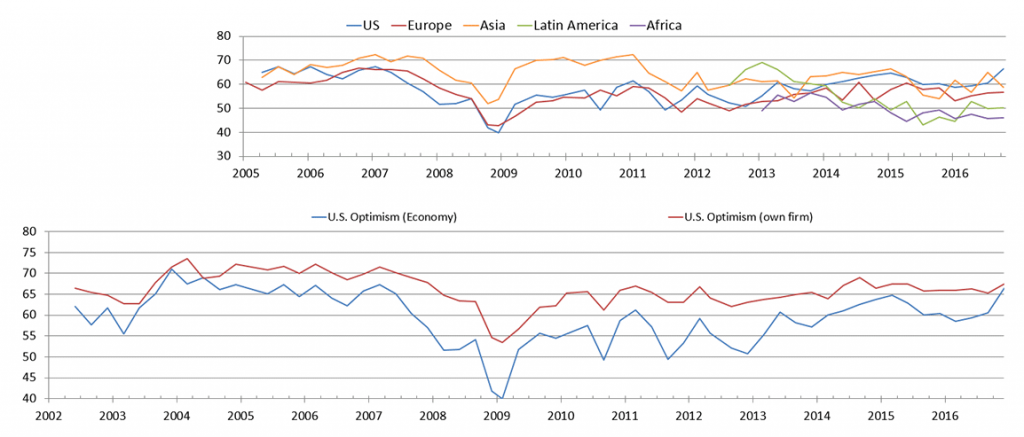

For the last five quarters, the Duke University/CFO Global Business Outlook Optimism Index has hovered around the long-term average of 60 (on a 100-point scale). This quarter, post-election, the index jumped to 66, the highest level in nearly a decade. The proportion of CFOs becoming more optimistic outweighs those becoming more pessimistic by 4 to 1. Historically, a jump in the optimism index has predicted strong employment growth and rising GDP over the next year.

also:

U.S. firms plan to increase their payrolls by 2 percent in 2017 and expect a median increase in capital spending of 2 percent. While modest, spending is up from last quarter's prediction of no growth.The corporate sector faces increased financial risk due to a recent increase in borrowing. U.S. manufacturing firms increased their borrowing as a percentage of assets by one-third over the past five years; and energy firms levered up by two-thirds. More than 60 percent of the firms in these industries say that this high debt load will limit future corporate investment."Weak business spending has dampened economic growth during the past two years," Graham said. "Finance chiefs tell us that any rebound in business spending will be muted because of debt loads at many firms that are already high."

The CFO survey contains two Optimism Index charts, with the bottom chart showing U.S. Optimism (with regard to the economy) at 66, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” tag)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this blog are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2247.93 as this post is written

No comments:

Post a Comment