U.S. Economic Indicators

Throughout this site there are many discussions of economic indicators. At this time, the readings of various indicators are especially notable. This post is the latest in a series of posts indicating U.S. economic weakness or a notably low growth rate.

While many U.S. economic indicators – including GDP – are indicating economic growth, others depict (or imply) various degrees of weak growth or economic contraction. As seen in the July 2018 Wall Street Journal Economic Forecast Survey the consensus (average estimate) among various economists is for 2.9% GDP growth in 2018. However, there are other broad-based economic indicators that seem to imply a weaker growth rate.

As well, it should be remembered that GDP figures can be (substantially) revised.

Charts Indicating U.S. Economic Weakness

Below are a small sampling of charts that depict weak growth or contraction, and a brief comment for each:

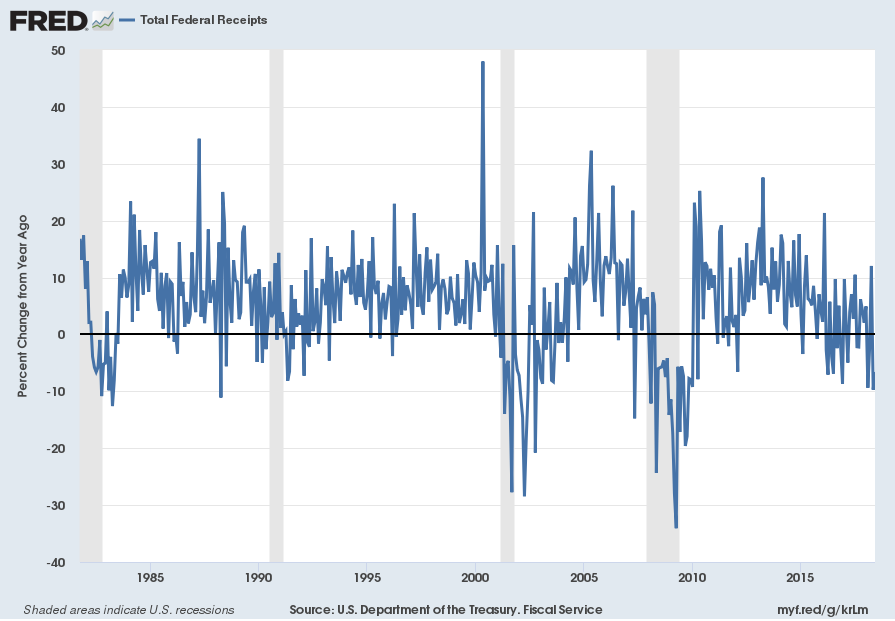

Total Federal Receipts

“Total Federal Receipts” growth continues to be intermittent in nature since 2015. As well, the level of growth does not seem congruent to the (recent) levels of economic growth as seen in aggregate measures such as Real GDP.

“Total Federal Receipts” through June had a last value of $316,278 Million. Shown below is the measure displayed on a “Percent Change From Year Ago” basis with value -6.6%, last updated July 12, 2018:

source: U.S. Department of the Treasury. Fiscal Service, Total Federal Receipts [MTSR133FMS], retrieved from FRED, Federal Reserve Bank of St. Louis, accessed July 12, 2018:

__

The Yield Curve

Many people believe that the Yield Curve is a leading economic indicator for the United States economy.

On March 1, 2010, I wrote a post on the issue, titled “The Yield Curve As A Leading Economic Indicator.”

While I continue to have the stated reservations regarding the “yield curve” as an indicator, I do believe that it should be monitored.

As an indication of the yield curve (i.e. a yield curve proxy), below is a weekly chart from January 1, 1990 through July 11, 2018. The top two plots show the 10-Year Treasury and 2-Year Treasury yields. The third plot shows the (yield) spread between the 10-Year Treasury and 2-Year Treasury, with the July 11, 2018 closing value of .27%. The bottom plot shows the S&P500:

(click on chart to enlarge image)(chart courtesy of StockCharts.com; chart creation and annotation by the author)

__

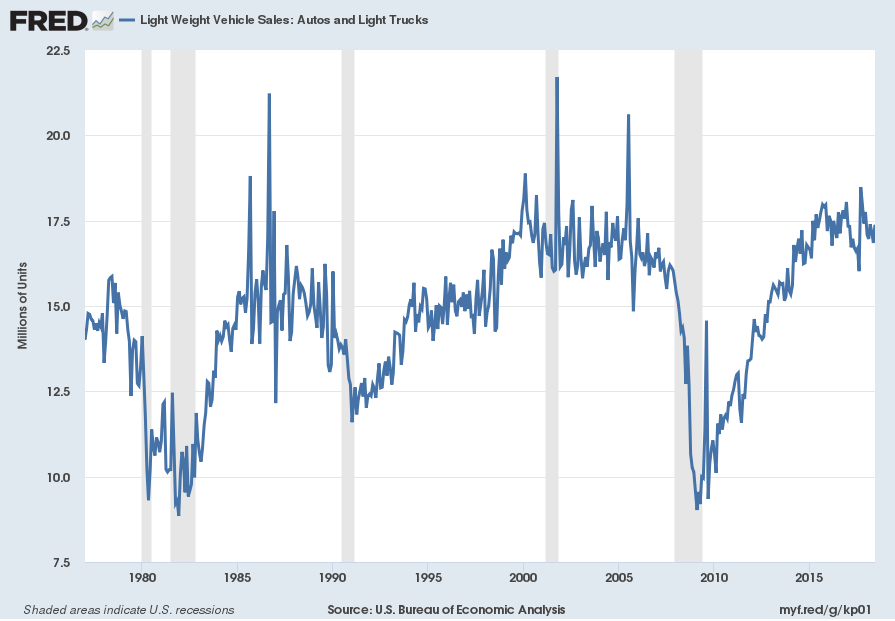

U.S. Auto Sales

U.S. auto sales have experienced significant growth over the post-2009 period as seen in the chart shown below. The current reading (through June) is 17.381 million vehicles SAAR. Of great economic importance is whether auto sales have peaked, which I believe has occurred, as well as other problematical characteristics of the light vehicle market. A long-term chart is shown below:

source: U.S. Bureau of Economic Analysis, Light Weight Vehicle Sales: Autos and Light Trucks [ALTSALES], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed July 10, 2018:

__

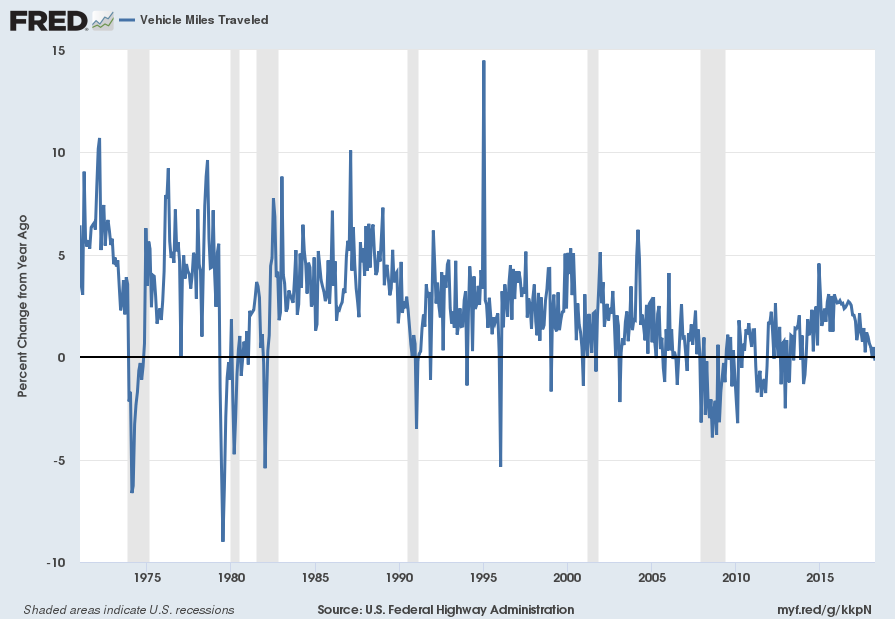

Vehicle Miles Traveled

I find the flagging growth trend in the “Vehicle Miles Traveled” (NSA) measure since 2015 to be notable.

“Vehicle Miles Traveled” through April had a last value of 272,442 Million. Shown below is the measure displayed on a “Percent Change From Year Ago” basis with value -.2%, last updated July 2, 2018:

source: U.S. Federal Highway Administration, Vehicle Miles Traveled [TRFVOLUSM227NFWA], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed July 12, 2018:

__

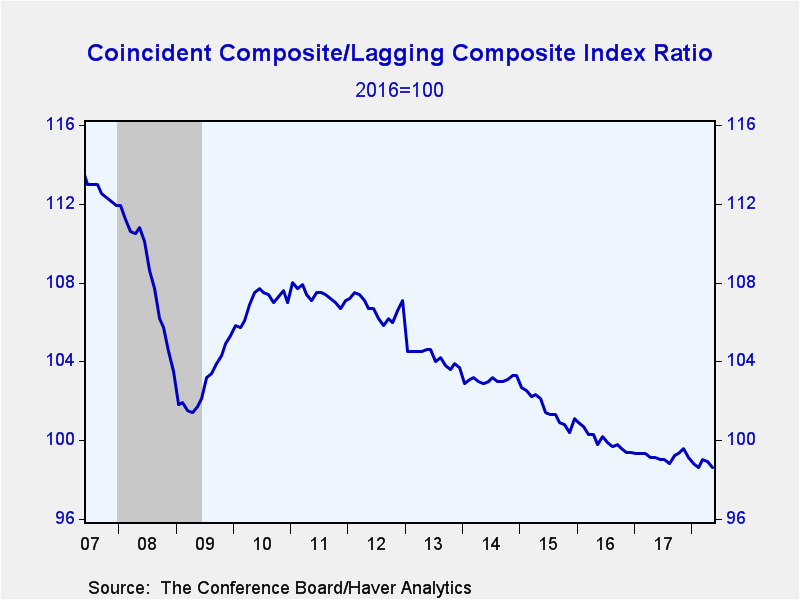

Alternate Growth Trend Measures

Another facet of economic activity is seen in the ratio of the Conference Board’s Coincident Composite Index to the Lagging Composite Index. I interpret the trends seen in this measure to be disconcerting, as the ratio has generally been sinking for years:

source: Haver’s June 21, 2018 post (“U.S. Leading Economic Indicators’ Rate of Increase Eases“)

__

Other Indicators

As mentioned previously, many other indicators discussed on this site indicate economic weakness or economic contraction, if not outright (gravely) problematical economic conditions.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2798.29 as this post is written

No comments:

Post a Comment