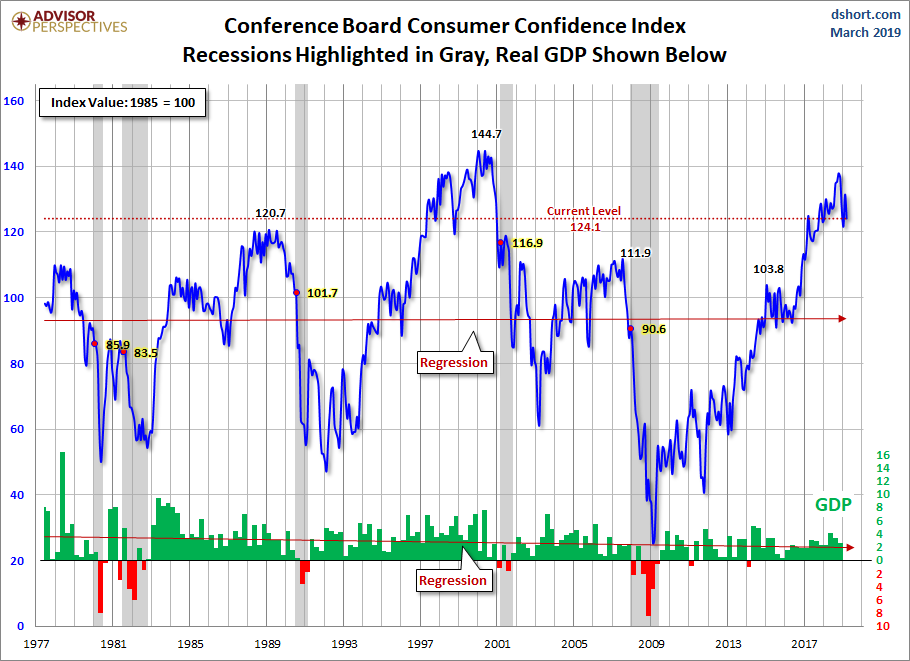

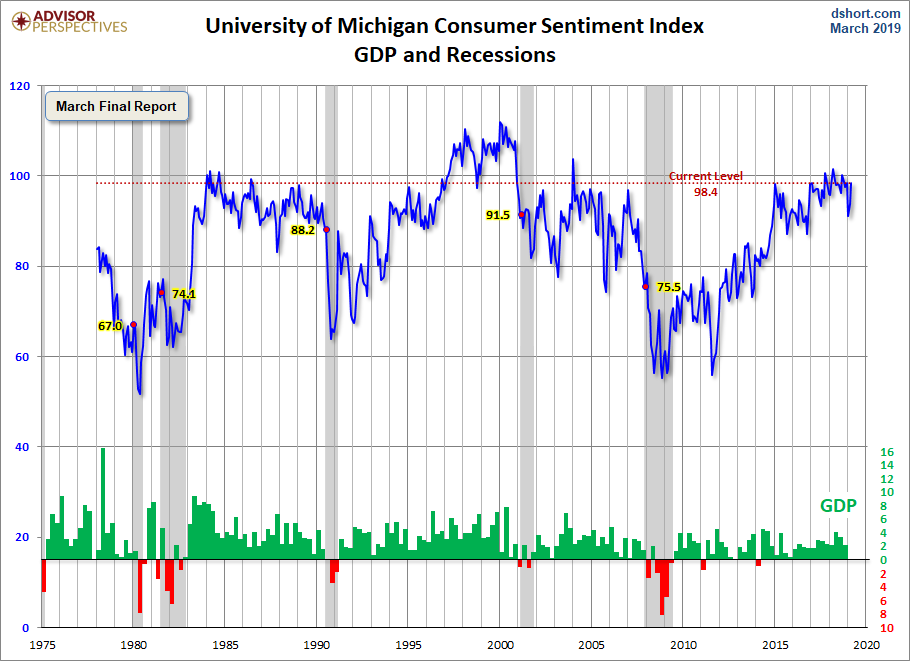

The Doug Short site had a post of March 29, 2019 (“Michigan Consumer Sentiment: March Final Rebounded“) that displays the latest Conference Board Consumer Confidence and Thomson/Reuters University of Michigan Consumer Sentiment Index charts. They are presented below:

(click on charts to enlarge images)

–

There are a few aspects of the above charts that I find highly noteworthy. Of course, until the sudden upswing in 2014, the continued subdued absolute levels of these two surveys was disconcerting.

Also, I find the “behavior” of these readings to be quite disparate as compared to the other post-recession periods, as shown in the charts between the gray shaded areas (the gray areas denote recessions as defined by the NBER.)

While I don’t believe that confidence surveys should be overemphasized, I find these readings to be notable, especially in light of a variety of other highly disconcerting measures highlighted throughout this site.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2827.25 as this post is written

No comments:

Post a Comment