Recently, the Federal Reserve has taken many substantial actions to address financial market weakness, as well as an actual and expected very large drop in economic activity.

In addition to the actions taken by the Federal Reserve, there are various actions taken at the Federal, State, and local levels. These programs are largely still being formulated.

Some of the stimulus programs being formulated at the Federal level are very large, likely in the trillions of dollars.

The following is a list of action, programs, and interventions recently taken by the Federal Reserve. Of note, many of these programs were enacted or otherwise used during the Financial Crisis. The below list does not necessarily include all of the actions taken to date:

-The Federal Reserve, in two steps (March 3 & March 15), decided to lower the target range for the federal funds rate to 0 to 1/4 percent; this second rate cut is discussed in the FOMC Press Conference discussed in the “March 15, 2020 FOMC Press Conference” post. As well, as discussed in that FOMC Press Conference, additional asset purchases, i.e. Quantitative Easing (QE).

Many other programs and interventions, as detailed on the Federal Reserve’s “Coronavirus Disease 2019 (COVID-19)” page. Among these programs are:

“Federal Reserve announces the establishment of temporary U.S. dollar liquidity arrangements with other central banks” (March 19, 2020)

“Federal bank regulatory agencies issue interim final rule for Money Market Liquidity Facility” (March 19, 2020)

“Federal Reserve Board broadens program of support for the flow of credit to households and businesses by establishing a Money Market Mutual Fund Liquidity Facility (MMLF)” (March 18, 2020)

“Federal Reserve Board announces establishment of a Primary Dealer Credit Facility (PDCF) to support the credit needs of households and businesses” (March 17, 2020)

“Federal Reserve Board announces establishment of a Commercial Paper Funding Facility (CPFF) to support the flow of credit to households and businesses” (March 17, 2020)

“Federal banking agencies provide banks additional flexibility to support households and businesses” (March 17, 2020)

“Federal Reserve Actions to Support the Flow of Credit to Households and Businesses” (March 15, 2020)

“Coordinated Central Bank Action to Enhance the Provision of U.S. Dollar Liquidity” (March 15, 2020)

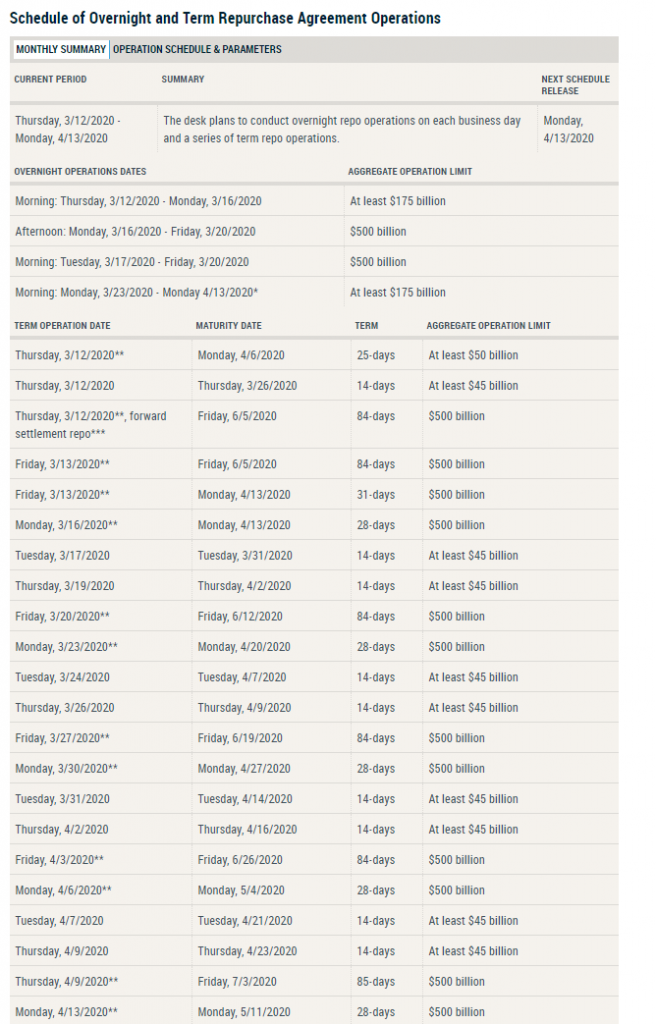

As well, there has been a very substantial, continuing increase in the Federal Reserve Repurchase Agreements (e.g. “repos”.) A list of the scheduled New York Federal Reserve’s Repo operations, as of the latest (March 16, 2020) update:

–

I have written extensively about interventions of all types, including Quantitative Easing (QE) and past stimulus programs. Posts discussing intervention measures can generally be found in the “Interventions” label.

As I have previously written, my analyses indicate that, in general, while interventions are intended to provide beneficial effects to the markets and economy, they also present an array of risks, detrimental impacts, and unintended consequences. They have many complex impacts on the economy and financial markets.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 2427.88 as this post is written

No comments:

Post a Comment