The following is an update of various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

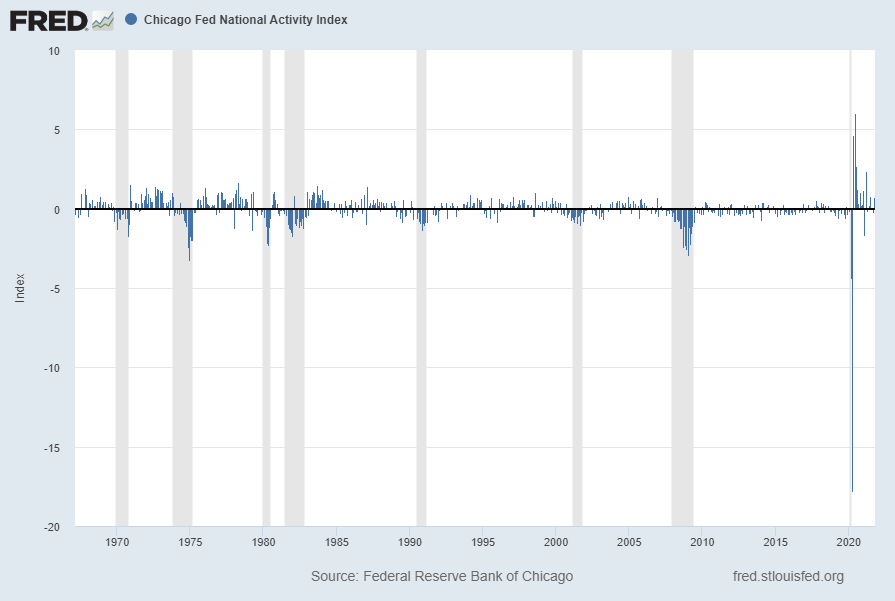

The November 2021 Chicago Fed National Activity Index (CFNAI) updated as of November 22, 2021:

The CFNAI, with a current reading of .76:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index [CFNAI], retrieved from FRED, Federal Reserve Bank of St. Louis, November 22, 2021;

https://fred.stlouisfed.org/series/CFNAI

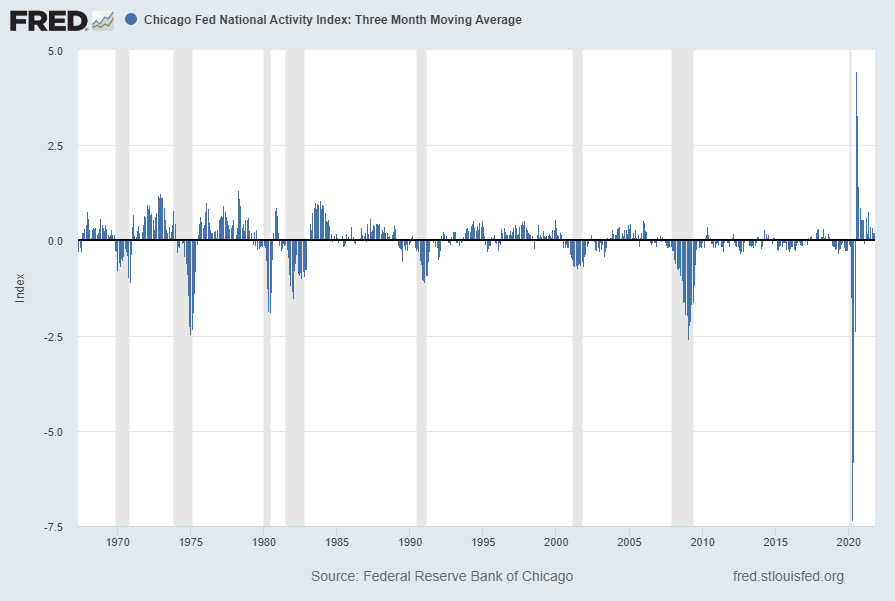

The CFNAI-MA3, with a current reading of .21:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis, November 22, 2021;

https://fred.stlouisfed.org/series/CFNAIMA3

–

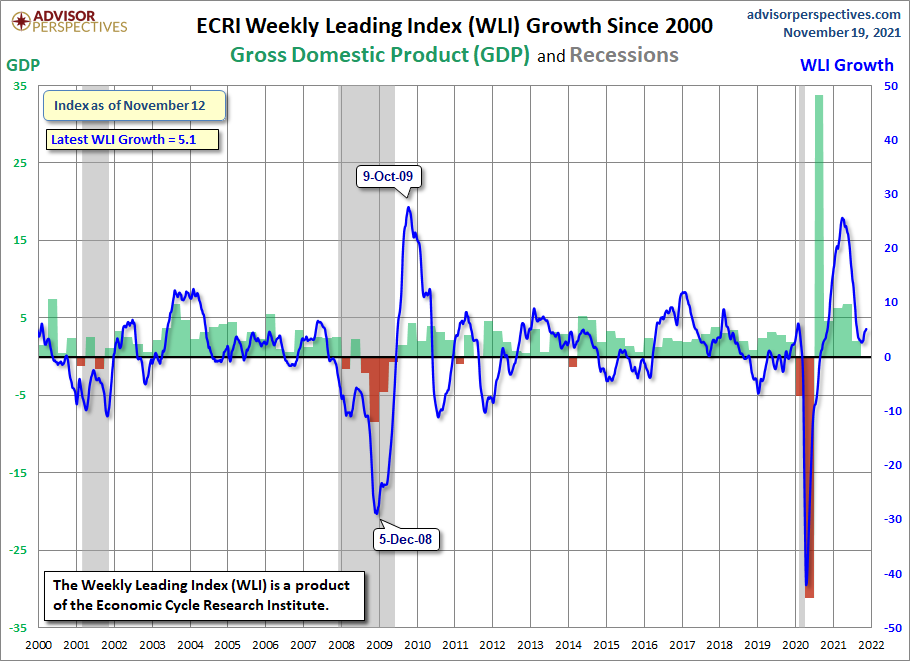

The ECRI WLI (Weekly Leading Index):

As of November 19, 2021 (incorporating data through November 12, 2021) the WLI was at 156.2 and the WLI, Gr. was at 5.1%.

A chart of the WLI,Gr., from the Advisor Perspectives’ ECRI update post of November 19, 2021:

–

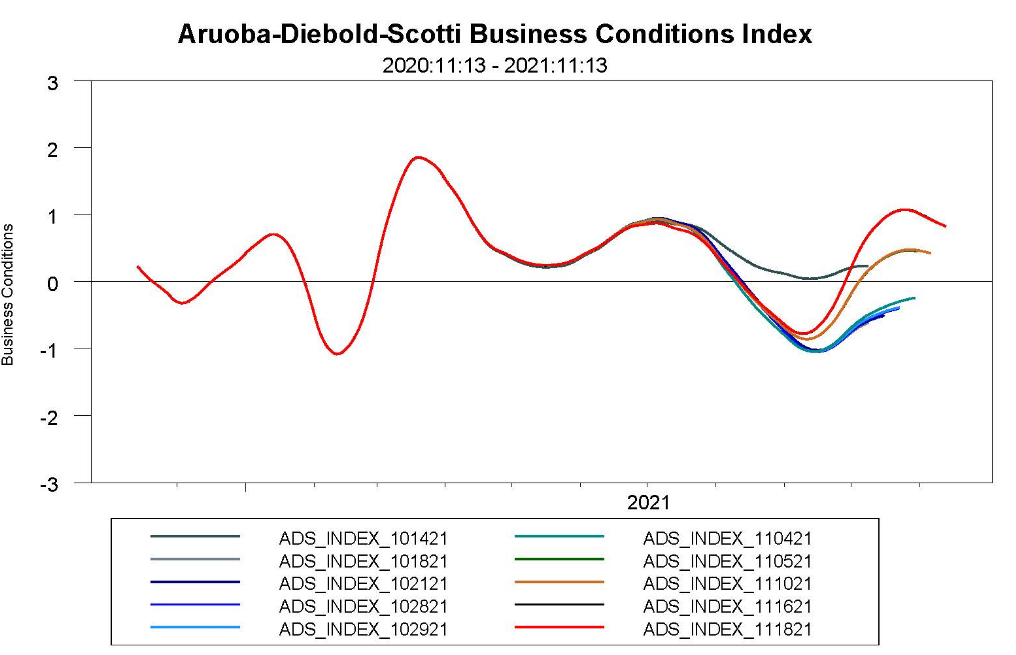

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index

The ADS Index as of November 18, 2021, reflecting data from November 13, 2020 through November 13, 2021, with last value .82162:

–

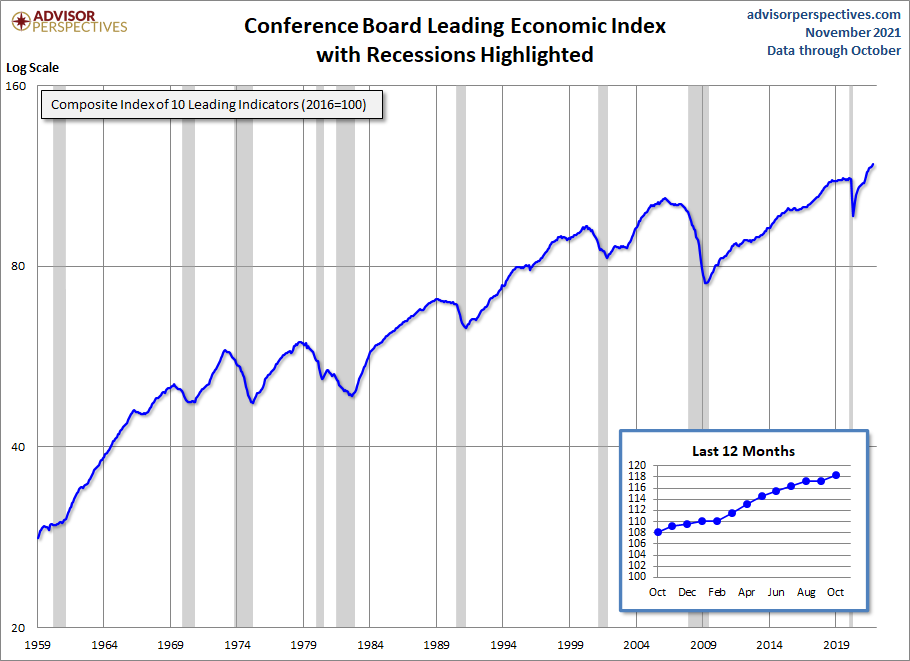

The Conference Board Leading Economic Index (LEI), Coincident Economic Index (CEI), and Lagging Economic Index (LAG):

As per the November 18, 2021 Conference Board press release, titled “The Conference Board Leading Economic Index (LEI) for the U.S. Increased in October” the LEI was at 118.3 in October, the CEI was at 106.3 in October, and the LAG was at 107.4 in October.

An excerpt from the release:

“The U.S. LEI rose sharply in October suggesting the current economic expansion will continue into 2022 and may even gain some momentum in the final months of this year,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. “Gains were widespread among the leading indicators, with only the average workweek and consumers’ outlook making negative contributions.

“However, rising prices and supply chain bottlenecks pose challenges to growth and are not expected to dissipate until well into 2022. Despite these headwinds, The Conference Board forecasts growth to remain strong in the fourth quarter at around 5.0 percent (annualized rate), before moderating to a still historically robust rate of 2.6 percent in Q1 2022.”

Here is a chart of the LEI from the Advisor Perspectives’ Conference Board Leading Economic Index update of November 18, 2021:

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4707.54 as this post is written

No comments:

Post a Comment