On December 2, 2021 the latest CFO Survey (formerly called the “Duke/CFO Global Business Outlook”) was released. It contains a variety of statistics regarding how CFOs view business and economic conditions.

In this CFO Survey press release, I found the following to be the most notable excerpts – although I don’t necessarily agree with them:

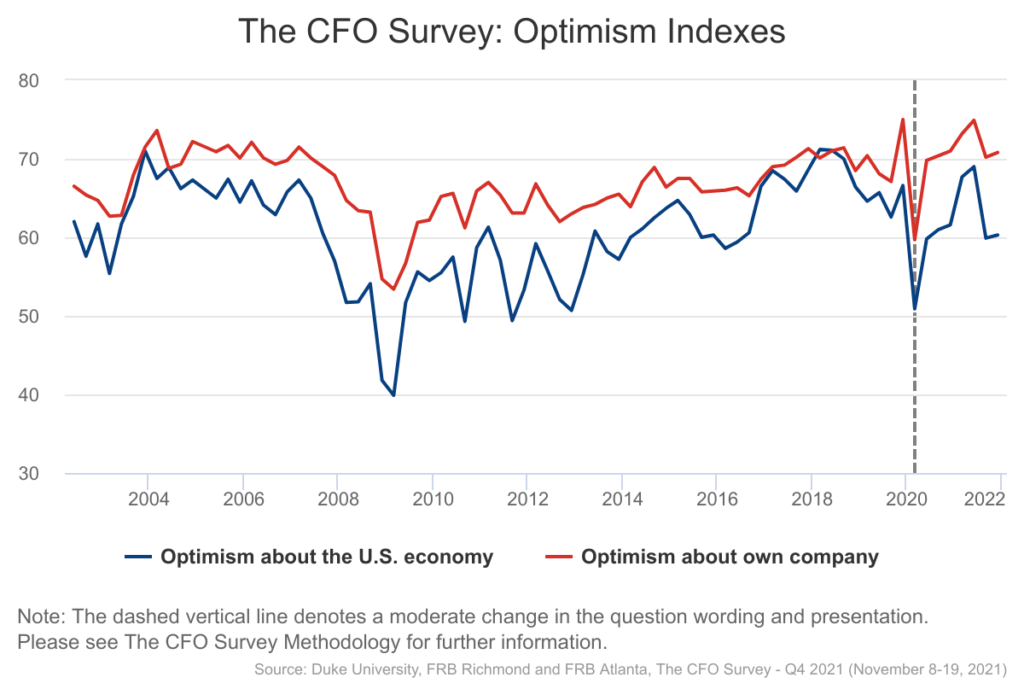

CFOs reported rising costs, growing revenues and unchanged optimism about U.S. economic prospects in the fourth quarter, according to the results of The CFO Survey, a collaboration of Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta. The most pressing concerns among CFOs in the fourth quarter were around labor availability, cost pressures and inflation, and supply-chain disruption.

Cost increases were a mounting challenge for respondent businesses. Almost 90 percent of firms reported larger-than-normal cost increases—a sharp rise from the second quarter of 2021. “The share of firms with abnormally large cost increases in at least some of their costs grew from 80 percent to almost 90 percent in just six months,” said Atlanta Fed economist Brent Meyer. “CFOs indicate that these cost pressures are not abating and will likely be with us for some time. Many firms, especially large firms, are passing on at least some of these cost increases.”

also:

Despite continuing production challenges, firms anticipated employment and revenue growth in 2021 and 2022. Meanwhile, optimism for both the U.S. economy and their own firms changed little in the fourth quarter. When asked to rank optimism about the overall U.S. economy on a scale of 0 to 100, the average rating from CFOs was 60.3, little changed from the 59.9 reading in the third quarter. Firms also expressed relatively unchanged optimism for their own firms, with average optimism at 70.8, up very slightly from the third quarter reading of 70.2.

This CFO Survey contains an Optimism Index chart, with the blue line showing U.S. Optimism (with regard to the economy) at 60.3, as seen below:

—

It should be interesting to see how well the CFOs predict business and economic conditions going forward. I discussed past various aspects of this, and the importance of these predictions, in the July 9, 2010 post titled “The Business Environment”.

(past posts on CEO and CFO surveys can be found under the “CFO and CEO Confidence” tag)

_____

I post various economic forecasts because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with many of the consensus estimates and much of the commentary in these forecast surveys.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 4561.95 as this post is written

No comments:

Post a Comment