The following is an update of various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

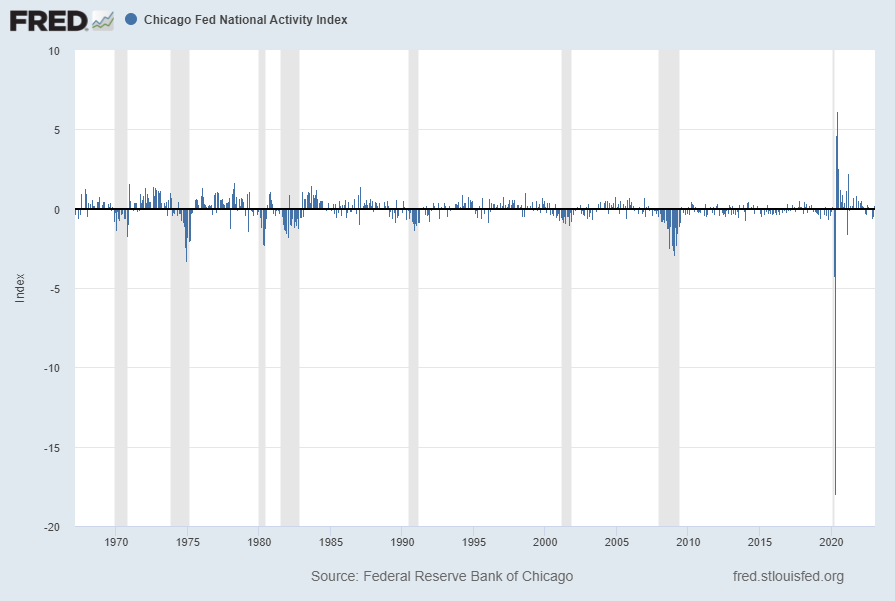

The February 2023 Chicago Fed National Activity Index (CFNAI) updated as of February 23, 2023:

The CFNAI, with a current reading of .23:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index [CFNAI], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 23, 2023:

https://fred.stlouisfed.org/series/CFNAI

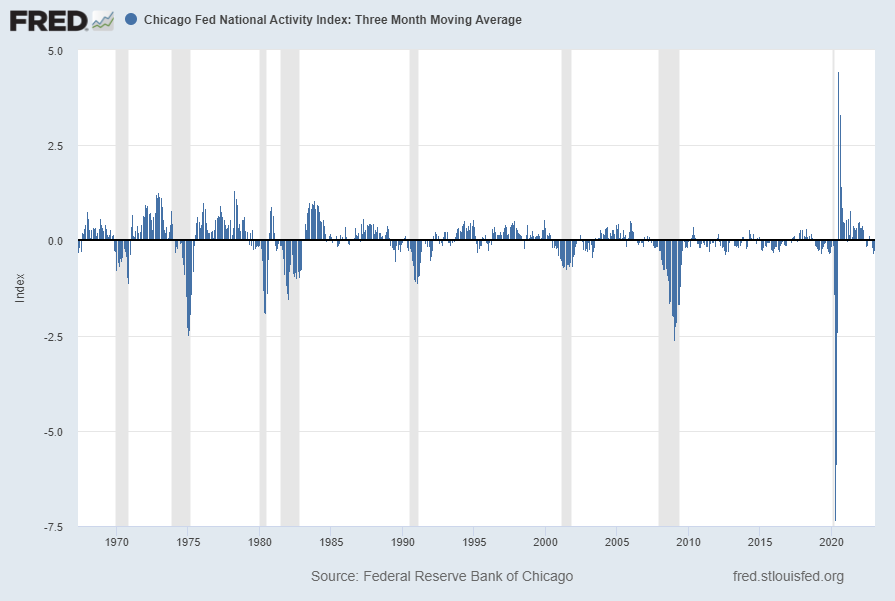

The CFNAI-MA3, with a current reading of -.26:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed February 23, 2023:

https://fred.stlouisfed.org/series/CFNAIMA3

–

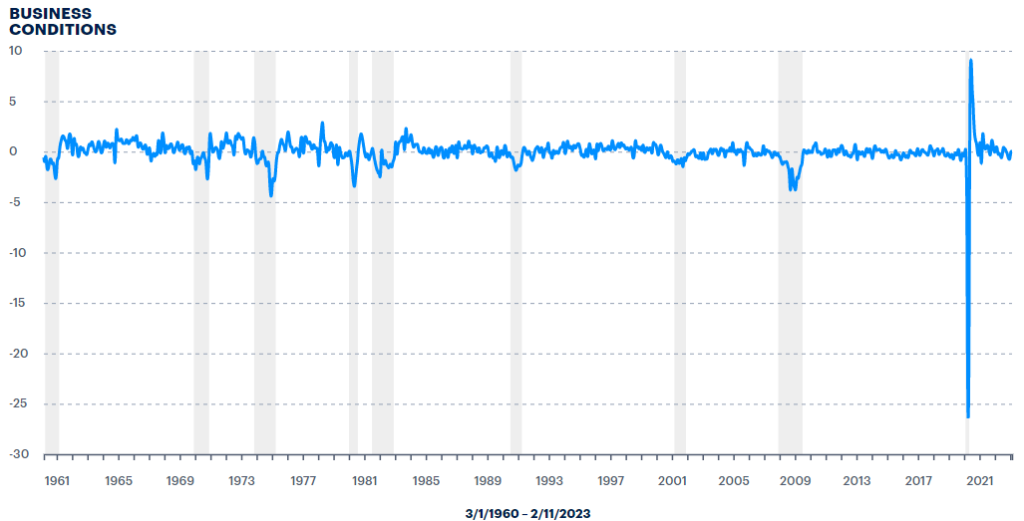

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index

The ADS Index as of February 16, 2023, reflecting data from March 1, 1960 through February 11, 2023, with last value .0316398:

–

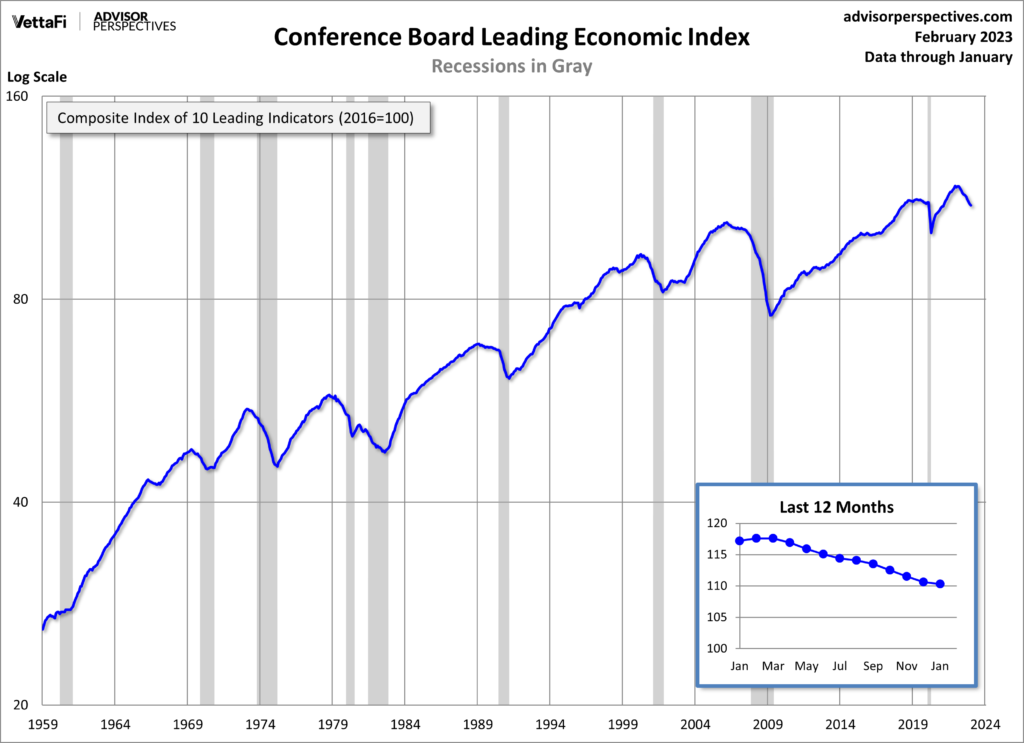

The Conference Board Leading Economic Index (LEI), Coincident Economic Index (CEI), and Lagging Economic Index (LAG):

As per the February 17, 2023 Conference Board press release the LEI was 110.3 in January, the CEI was 109.5 in January, and the LAG was 118.5 in January.

An excerpt from the release:

“The US LEI remained on a downward trajectory, but its rate of decline moderated slightly in January,” said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. “Among the leading indicators, deteriorating manufacturing new orders, consumers’ expectations of business conditions, and credit conditions more than offset strengths in labor markets and stock prices to drive the index lower in the month. The contribution of the yield spread component of the LEI also turned negative in the last two months, which is often a signal of recession to come. While the LEI continues to signal recession in the near term, indicators related to the labor market—including employment and personal income—remain robust so far. Nonetheless, The Conference Board still expects high inflation, rising interest rates, and contracting consumer spending to tip the US economy into recession in 2023.”

Here is a chart of the LEI from the Advisor Perspectives’ Conference Board Leading Economic Index (LEI) update of February 17, 2023:

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 3987.70 as this post is written

No comments:

Post a Comment