The following is an update of various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

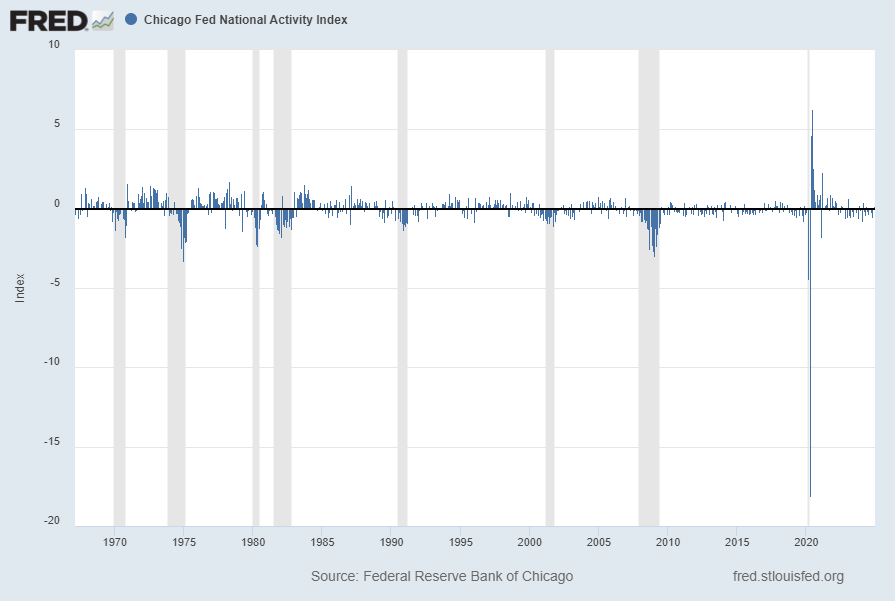

The January 2025 Chicago Fed National Activity Index (CFNAI) updated as of January 27, 2025:

The CFNAI, with a current reading of .15:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index [CFNAI], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed January 27, 2025:

https://fred.stlouisfed.org/series/CFNAI

The CFNAI-MA3, with a current reading of -.13:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed January 27, 2025:

https://fred.stlouisfed.org/series/CFNAIMA3

–

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index

The ADS Index as of January 23, 2025, reflecting data from March 1, 1960 through January 18, 2025, with last value .299227:

–

The Conference Board Leading Economic Index (LEI), Coincident Economic Index (CEI), and Lagging Economic Index (LAG):

As per the January 22, 2025 Conference Board press release the LEI was 101.6 in December, the CEI was 114.1 in December, and the LAG was 118.5 in December.

An excerpt from the release:

“The Index fell slightly in December failing to sustain November’s increase,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “Low consumer confidence about future business conditions, still relatively weak manufacturing orders, an increase in initial claims for unemployment, and a decline in building permits contributed to the decline. Still, half of the 10 components of the index contributed positively in December. Moreover, the LEI’s six-month and twelve-month growth rates were less negative, signaling fewer headwinds to US economic activity ahead. Nonetheless, we expect growth momentum to remain strong to start the year and US real GDP to expand by 2.3% in 2025.”

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 6011.18 as this post is written

No comments:

Post a Comment