The following is an update of various indicators that are supposed to predict and/or depict economic activity. These indicators have been discussed in previous blog posts:

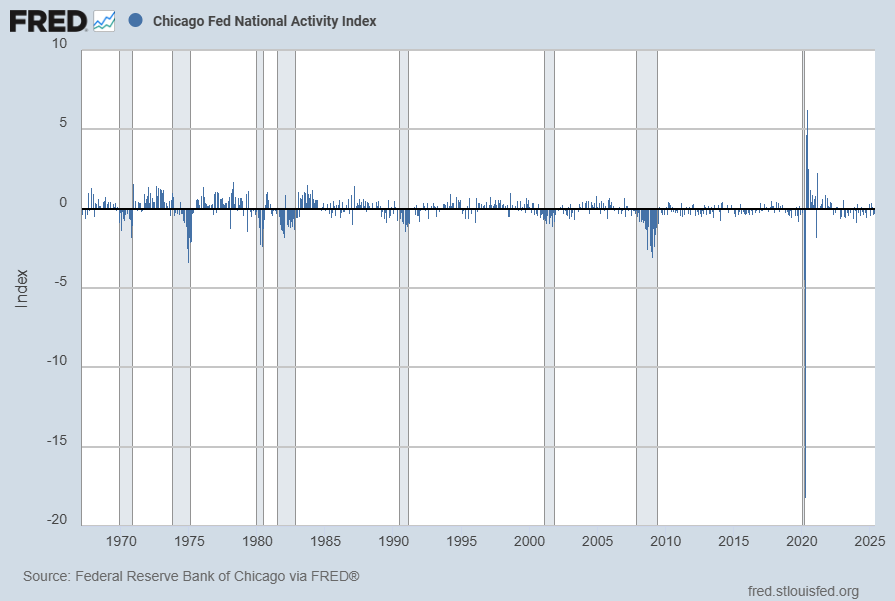

The June 2025 Chicago Fed National Activity Index (CFNAI) updated as of June 26, 2025:

The CFNAI, with a current reading of -.28:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index [CFNAI], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed June 26, 2025:

https://fred.stlouisfed.org/series/CFNAI

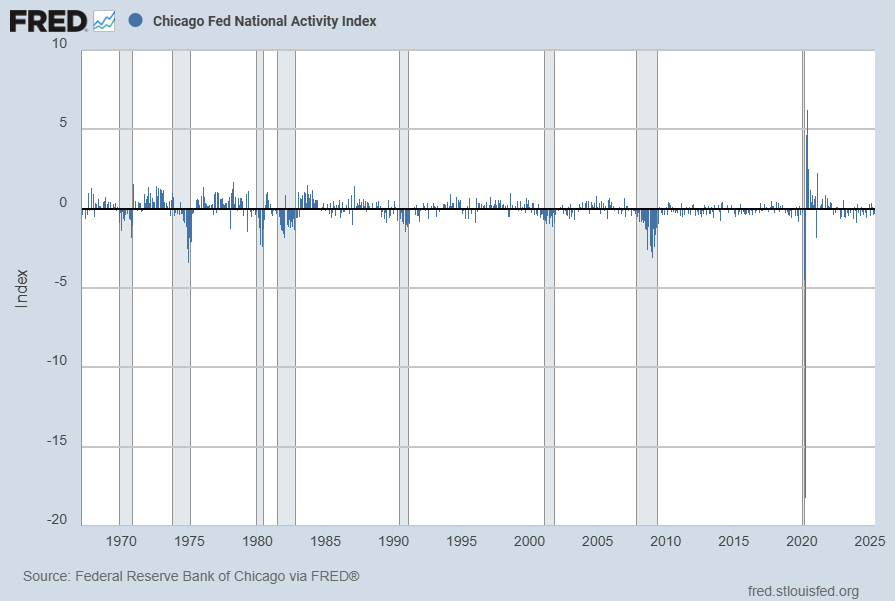

The CFNAI-MA3, with a current reading of -.16:

source: Federal Reserve Bank of Chicago, Chicago Fed National Activity Index: Three Month Moving Average [CFNAIMA3], retrieved from FRED, Federal Reserve Bank of St. Louis; accessed June 26, 2025:

https://fred.stlouisfed.org/series/CFNAIMA3

–

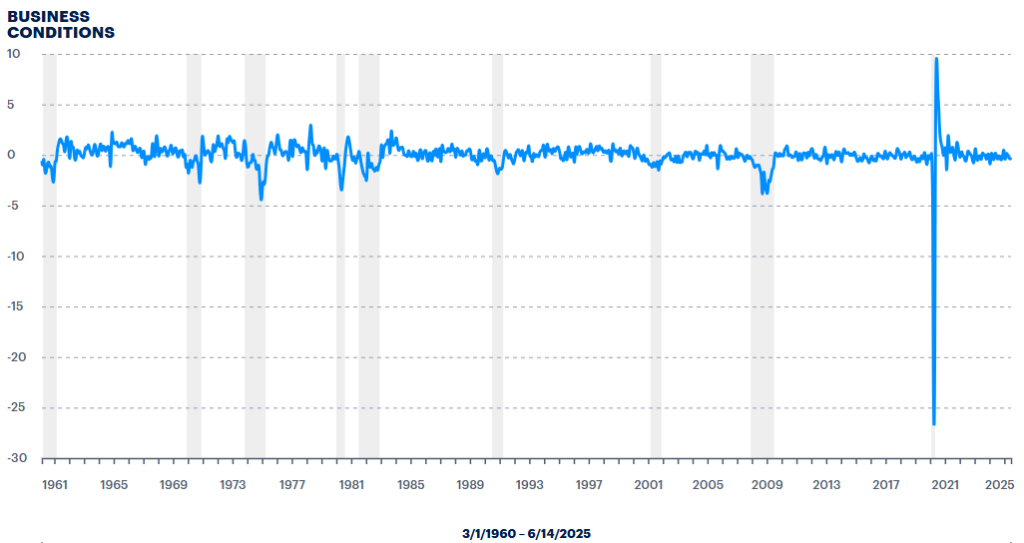

The Aruoba-Diebold-Scotti Business Conditions (ADS) Index

The ADS Index as of June 18, 2025, reflecting data from March 1, 1960 through June 14, 2025, with last value -.236785:

–

The Conference Board Leading Economic Index (LEI), Coincident Economic Index (CEI), and Lagging Economic Index (LAG):

As per the June 20, 2025 Conference Board press release the LEI was 99.0 in May, the CEI was 115.1 in May, and the LAG was 119.6 in May.

An excerpt from the release:

“The LEI for the US fell again in May, but only marginally,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “The recovery of stock prices after the April drop was the main positive contributor to the Index. However, consumers’ pessimism, persistently weak new orders in manufacturing, a second consecutive month of rising initial claims for unemployment insurance, and a decline in housing permits weighed on the Index, leading to May’s overall decline. With the substantial negatively revised drop in April and the further downtick in May, the six-month growth rate of the Index has become more negative, triggering the recession signal. The Conference Board does not anticipate recession, but we do expect a significant slowdown in economic growth in 2025 compared to 2024, with real GDP growing at 1.6% this year and persistent tariff effects potentially leading to further deceleration in 2026.”

_________

I post various indicators and indices because I believe they should be carefully monitored. However, as those familiar with this site are aware, I do not necessarily agree with what they depict or imply.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 6111.75 as this post is written

No comments:

Post a Comment