In my post of October 10 ("Near-Term Direction Of Stock Market") I stated with regard to the S&P500:

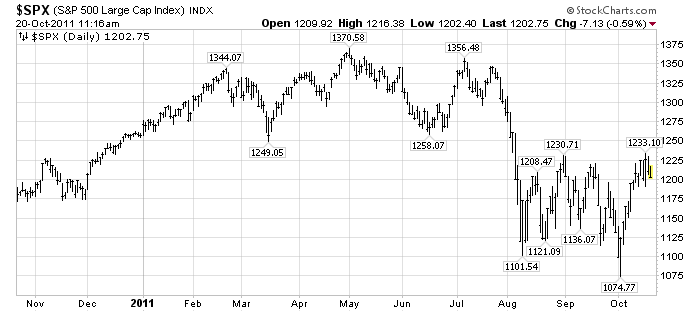

In my post of Monday, October 17 ("Danger Signs In The Stock Market, Financial System And Economy") I further highlighted a variety of building risks.The question now becomes whether that 1074.77 was a “lasting bottom,” or whether there is more near-term downside. I believe that the 1074.77 low will not be a “lasting bottom” – i.e. it will be breached to the downside in the near-term.

Near the end of that blog post I commented:

I have come to the conclusion, based on my overall analysis of the growing risk, that the next leg down in the stock market might not be "orderly." In other words, it may be a stock market crash. At this point I would assign the probability of such a stock market crash in the near-term being (at least) 50%.Of further concern is whether, and when, the above-mentioned problems might reach a point at which another (financial system) crash occurs.

Here is an updated chart of the S&P500, on a 1-year daily basis through the present, with price labels, for reference:

(click on chart to enlarge image)(chart courtesy of StockCharts.com)

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1202.83 as this post is written

No comments:

Post a Comment