Corporate earnings and earnings growth is a particularly notable subject at this time. As I wrote in the blog post of June 11, 2013 ("

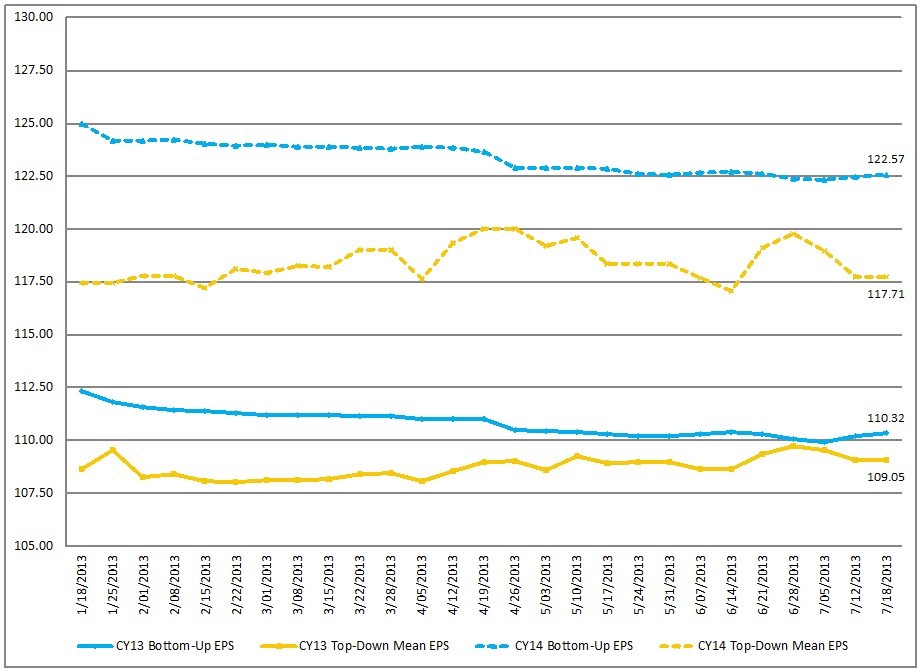

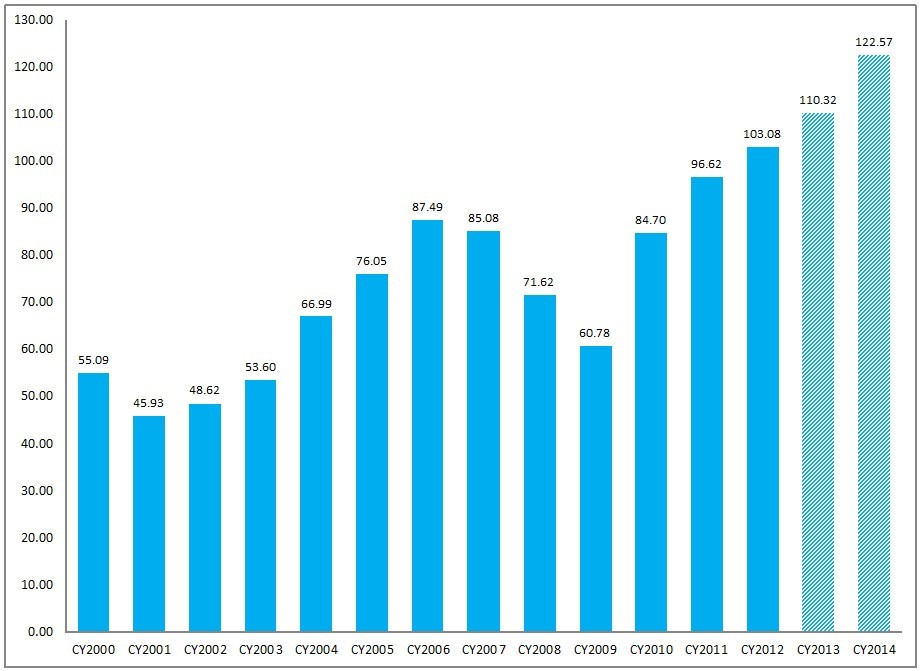

The Current High Levels Of Corporate Profitability") current various levels of profitability - including the S&P500′s operating margins, operating profits, EPS, and After-Tax Corporate Profits as a Percentage of GDP - are at or near record-high levels. Furthermore, as seen in a variety of aggregate S&P500 earnings forecasts,

S&P500 EPS growth for years 2013-2015 is projected to be fairly robust.

I believe that for a variety of reasons, on a going-forward basis earnings face a variety of "headwinds' that will prove substantial. My analyses indicate that many of these "headwinds" lack proper recognition. Here are some of the factors that I consider significant:

The threat of deflation

I've discussed the threat of deflation in a variety of recent blog posts, including the July 11, 2013 post titled "

Would Deflation Be Beneficial?" as well as the June 10, 2013 post "

The Prospect Of Deflation." While none of the recent various business surveys (or economist surveys) indicate that businesses expect oncoming deflationary conditions, whether businesses would foresee – and successfully adapt – to such deflationary conditions remains to be seen. It appears as if businesses aren't assessing and/or planning for a deflationary environment. Should deflationary conditions occur - and I believe deflationary conditions are on the horizon - the impact on businesses’ revenues and profitability would likely (depending upon the extent of the deflation as well as other factors) be pronounced. Deflationary conditions, along with likely accompanying significant declines in aggregate demand, would likely highly impact revenues and profitability.

Ongoing weak revenue growth

Persistent weak revenue growth - and even revenue declines among various companies - has been an ongoing problematical characteristic since 2009. While this overall weakness in revenue growth has coincided with substantial aggregate growth in profitability, this weakness in revenue growth is cause for concern on many fronts.

Rising Interest Rates

While the recent increases in interest rates impacts companies differently depending upon many factors, from a general perspective this increase has many direct and indirect impacts on profitability. While the direct impacts include such issues as borrowing costs, perhaps the greater issue is what impact increases in interest rates will have on overall demand. While of course the overall impact of rising interest rates on profitability will depend upon the extent of the interest rate increase, even an increase in interest rates to (historically) "normal" levels would likely have a significant - if not substantial - impact on overall business profitability. A chart of 10-Year Treasury Yield, from

Doug Short's monthly update, is seen below and gives one perspective as to how low today's interest rates have fallen:

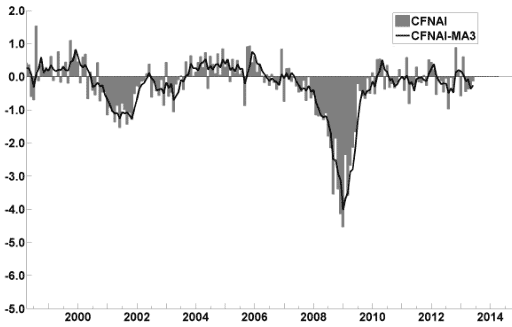

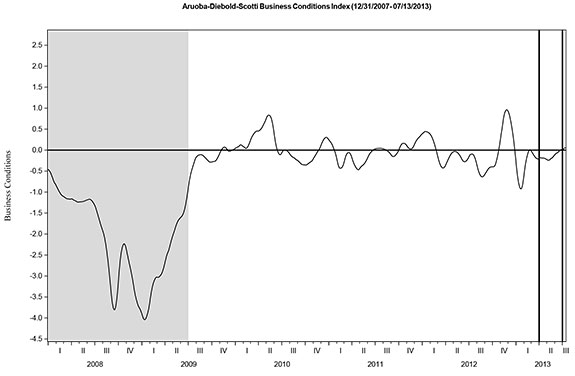

Widespread Weak(ening) Economic Growth

While

economists continue to predict 2013 GDP will come in above 2.0%, there appears to be a growing consensus that 2nd quarter GDP will be (at most) 1%. International economic growth, in many instances, is also predicted to be weak or weakening. Of course, actual GDP growth can come in above or below these forecasts, but for a variety of reasons I believe that even these GDP forecasts will prove overly optimistic.

Other factors

There are many other factors that have positively impacted profitability, some of which I mention in the above-referenced June 11 blog post. Also in that blog post, one can see how "stretched" overall profitability is to GDP from a long-term perspective. One critical question is whether such historically high levels of profitability represent a new structural era in which such high levels are sustainable, or whether such outsized profitability is anomalous and will (at minimum) mean-revert. I strongly believe that, from an all-things-considered basis, the latter will prove true, which will have an outsized negative impact on profitability.

_____

The Special Note summarizes my overall thoughts about our economic situation

SPX at 1695.05 as this post is written